vittaya25

Editor’s note: This article is meant to introduce Ahan Vashi’s Marketplace service, The Quantamental Investor.

Today, I am pleased to announce the official launch of my SA marketplace service – The Quantamental Investor, a unique shared intelligence platform designed to help you build and run a robust investing operation that can meet (and exceed) your long-term financial goals. If you are a public equity investor, TQI is suitable for you.

Introduction To The Quantamental Investor

The Quantamental Investor is a premium marketplace service that can help you generate wealth sustainably through robust portfolio strategies that suit your unique investing goals and risk tolerance levels across different stages of the investor lifecycle. At TQI, you’ll receive my proprietary investment framework, intelligent model portfolios, software tools, exclusive research, community intelligence, and direct access to me.

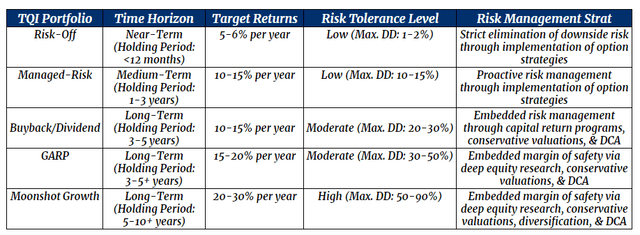

For your perusal, here’s a brief overview of our investment mandates, i.e., model portfolios –

Each of these five model portfolios comes with thoroughly vetted investment ideas, embedded risk management, and specialized financial engineering for alpha generation. TQI’s model portfolios are underpinned by our proprietary Quantamental Analysis [QA] process and valuation methodology, which means each of our investment ideas is fine-combed using a mix of fundamental, quantitative, and technical data analysis.

If you are interested in learning more about TQI’s Quantamental Analysis process, valuation methodology, and investment allocation strategies, please refer to the following notes:

| Date | Research Note | Exemplifies | Suggestion | Outcome | |||

| July 7th 2022 | As AMD Stock Dips, Is It A Buy, Sell, Or Hold? |

TQI’s Quantamental Analysis process, valuation methodology, and risk management strat for our GARP and Buyback-Dividend portfolios |

Strong buy for long-term investors, with the expectation of a quick bounce up from $73 (technical call) | AMD’s stock bounced up from our recommended buy level of $73 to $104 in quick order. The stock has retreated since to the $80s and is once again a strong buy. | |||

| July 11th 2022 | Is Meta Platforms Stock A Buy During The Dip? If You Want To Buy The Next Apple, Then Yes | Strong buy with a DCA plan for long-term investors in the $160s, skip for short-term investors due to weak quantitative and technical data | The stock has been flat for over a month and remains firmly within our buy/accumulation range. | ||||

| May 16th 2022 | Hims & Hers: Improving Fundamentals + Declining Price = A Generational Buy | The kind of investment ideas we provide at TQI’s Moonshot Growth portfolio | Strong buy for long-term investors | The stock is up +84% from our recommendation in just 4 months. | |||

| July 18th 2022 | Upstart: An Opportunity Of A Lifetime Or A Tragic Mistake? | TQI’s proactive risk management through option-based hedging strats | Strong buy with a DCA plan for long-term investors, skip for short-term investors | We effectively cut our $78 cost basis on UPST by $25 in just three months and made an additional $24 in cash (per share) | |||

Now that we have covered TQI’s research and valuation processes, I want to share our key differentiator.

TQI’s secret sauce is the utilization of applied financial engineering in equity markets, and this is how we manage risk proactively and generate alpha within our investing operations.

Here’s a simple example of how financial engineering works in the investing world:

Over the last ten years, Apple (AAPL), Microsoft (MSFT), and Domino’s (DPZ) have generated price returns of ~600%, ~700%, and ~1200%, respectively. During this period, S&P 500 has generated price returns of ~170%. Clearly, all three of these stocks have outperformed the market by a mile. Are you wondering how a commodity pizza chain managed to outperform two revolutionary technology companies that recorded stellar outperformance themselves? Was there a common thread between these stocks?

Well, here’s the commonality between Apple, Microsoft, and Dominos:

- Low starting valuations (in 2012: 10-15x P/FCF),

- Steady revenue [and free cash flow] growth (~10% CAGR), and most importantly,

- Massive capital return programs.

At the heart of their outperformance lies financial engineering performed by executives of these companies in the form of stock buybacks. Simply put, asset prices are a function of supply and demand, and stock buybacks reduce supply. Due to scarcity, stock prices go higher and so do the trading multiples. Of course, there’s a lot more nuance attached to individual businesses, but these are the type of setups we look for at TQI within our GARP and Buyback-Dividend portfolios.

Stock buybacks and dividends are just one form of applied financial engineering, and there is a lot more investors could do on their own using the numerous exotic financial derivative instruments available in the market. I like to call it – “DIY Financial Engineering” – and this is what serves as the foundation for TQI’s Managed-Risk and Risk-Off portfolios, where we buy stocks at a discount using options and manage risk proactively using options-based hedging strategies.

If you are worried about the complexities of implementing financial engineering in your investing operations, don’t; because TQI’s model portfolios have got you covered. And with our approach, there’s no algorithmic black box for building these advanced strategies; we just follow common sense and the immutable laws of money [and that’s all you need to make money in the stock market anyways].

Hey Ahan, The Quantamental Investor Sounds Fantastic, But Why Do I Need This Service?

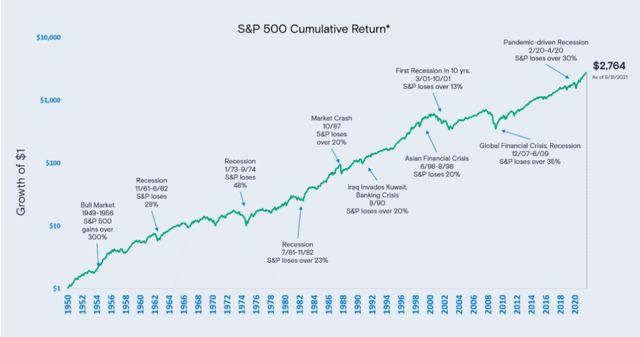

Over the last 70 years, the stock market has generated annual returns of roughly ~12% per year, which means every dollar invested in the S&P 500 index has grown to 2,764 dollars. As you can see in the graph below, the trajectory of these returns is far from linear, as stocks go up and down (a lot); however, buying a diversified basket of stocks and holding them long enough [i.e., passive index investing] seems like a decent playbook for investors.

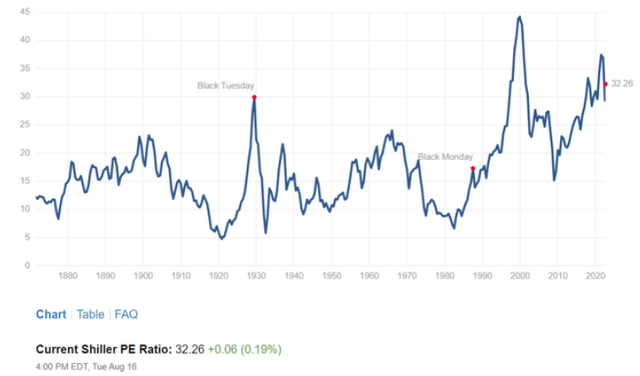

While I am an ardent proponent of the “Buy and Hold” philosophy, historically-high equity valuations in a challenging macroeconomic environment [stagflation – low to no economic growth, multi-decade high inflation] coupled with an unprecedented quantitative tightening [liquidity withdrawal] by the Fed could portend an economic recession and yet another lost decade for equity markets (like the one we saw at the beginning of the 21st century).

With major indices – QQQ and SPY – heavily tilted towards (pricey) mega-cap tech stocks like Apple and Microsoft, the likelihood of passive index investing generating double-digit CAGR returns from current levels over the next five years is quite low. However, history tells us that a period of heightened volatility in the stock market is a good time to buy.

Asset prices evolve according to random walk, i.e., the stock market is unpredictable. I don’t know, you don’t know, and nobody else knows where the market is headed over the next week, month, quarter, or even a year. Timing the market is simply impossible and a futile exercise! We could use all the technical, quantitative, and fundamental data in the world, but the probability of nailing the exact bottom on the stock market (or even a single stock) is approximately zero (unless, of course, we were to get lucky).

Volatility is a double-edged sword, and while this ongoing bear market is an opportune moment for long-term investors to take new long positions, it is also an opportunity to lose a lot of money quickly. If corporate earnings contract in the coming months and the Fed continues to tighten its monetary policy by raising interest rates, trading multiples in equity markets could easily contract by another ~30-50%+ from here. Being selective, contrarian, and right during bear markets could result in outsized returns; however, the potential range of negative outcomes is scary.

Do investors really need to sit through massive paper losses to make the most of this ongoing market volatility? That’s just a rhetorical question; sitting through such massive losses is simply unacceptable.

Solution: Active Investing With Proactive Risk Management.

“The Quantamental Investor” offers a better way to invest in this uncertain environment, i.e., to upgrade your investing operations.

Here are the 3 things ‘The Quantamental Investor’ can help you with:

- Devising a robust portfolio strategy that suits your unique investing goals and risk tolerance levels,

- Building robust, highly-concentrated portfolios with clearly defined goals to make the most of ongoing market volatility, and

-

Alleviating stress by limiting downside risk with embedded risk management and specialized financial engineering.

What You’ll Get As A Member:

At The Quantamental Investor, we will make investing simple, fun, and profitable for you. Our marketplace service provides all the foundational building blocks that you’ll need to build and run a robust investing operation that can meet (and exceed) your long-term financial goals.

- TQI’s IDFO framework – A robust investing framework for building, re-building, and/or enhancing your investing operation.

- TQI’s Model Portfolios – Tailored portfolio strategies that meet your needs across different investor lifecycle stages. Each of our five model portfolios comes with thoroughly vetted investment ideas, embedded risk management, and specialized financial engineering for alpha generation. Our intelligent, real-time portfolios will help you eliminate emotions from the investment decision-making process.

- TQI’s Exclusive Research – While I’ll continue to share some investment ideas on the free site in eternity, my best investment ideas, deep-dive analysis, and portfolio & risk management strategies will be reserved exclusively for TQI members.

- TQI’s Software Tools – A TQI membership also grants you exclusive access to our purpose-built software tools, including TQI Investor Lifecycle Curve Builder, TQI Investor Suitability Test, and TQI Valuation Model.

- TQI’s Community Chat – The power of community investing lies in shared intelligence, and here at TQI, you will get access to valuable investing insights, ideas, experiences, and research from our members. And you can share yours too.

Building and running an investing operation is time-consuming and hard. After all, an investor needs to put in several hours of work to thoroughly research an investment idea. And then there’s the added burden of knitting these ideas into a robust portfolio strategy that suits an individual’s investment goals and risk tolerance levels. If you would like to build, re-build, or enhance your investing operation, and run it with maximal efficiency and minimal effort, then “The Quantamental Investor” is just the resource you need.

A Little About Myself

My name is Ahan Vashi, and I am the Co-Founder & Chief Financial Engineer at The Quantamental Investment Group. I started my investing journey in public equity markets nine years ago, and my love and passion for investing have grown exponentially ever since, so much so that I chose to make investing my profession. In essence, TQI’s Quantamental investing approach is the amalgamation of my formal education in Quantitative Finance & Engineering and my professional experiences as an investor, an equity researcher, and a private equity analyst.

Over the last couple of years, I served as the Head of Equity Research at the growth-oriented SA marketplace service – Beating The Market. Before that, I worked as an Associate Fellow with Jacmel Growth Partners, a middle-market private equity firm in New York. My resume also includes a stint at Capgemini as a software engineer (I still code). With regards to academia, I hold a Master of Quantitative Finance degree from Rutgers Business School and a Bachelor of Technology degree in Electronics and Communication Engineering. Additionally, I am currently pursuing the CFA certification (Level 2 candidate).

Final Thoughts

Making money with your job or business is hard enough, and so, making your money make money for you [i.e., investing] must be simple, fun, and profitable. While you will always be the one calling the shots, i.e., making the investment (buy/sell/hold) decisions for your investing operation, TQI is here to help you every step of the way.

The first 50 subscribers will automatically lock in a special, highly-discounted lifetime price of $399 per year / $49 per month. Once these foundational member slots are filled, our regular membership price will move to $899 per year / $99 per month.

For a limited period only, I am also offering a two-week free trial. And this means you can try my marketplace service risk-free and see if it works for you before ever paying a dime. You may choose to cancel the service at any time during the trial period, and if you do so, you will never be charged. However, if you do decide to stay on at TQI after your free trial [and I am very confident that you will stay with us for a long, long-time], you will be charged according to the plan you selected at the time of signing up.

Are you ready to elevate your investing operations?

Sign up today to start building, re-building, or enhancing your investing operations with The Quantamental Investor.

If you’re reading this via Seeking Alpha’s mobile app, to try this service right now go to seekingalpha.com and enter The Quantamental Investor in the site search to visit my Marketplace Service checkout page.

Be the first to comment