Lemon_tm/iStock via Getty Images

Lantheus Holdings (NASDAQ:LNTH) had an extraordinarily productive 2021, which is evident in the company’s fourth-quarter and full-year earnings. Lantheus worked hard to make headway on the company’s strategy in order to accelerate growth, and expand their pipeline. Moreover, the company expanded their product portfolio with the company’s prostate cancer franchise launching PYLARIFY, which pulled in over $35M in Q4. Overall, Lantheus finished 2021 with a strong beat on EPS and reported $425.2M for their full-year 2021 revenue. The company expects 2022 to be a record year and has set their revenue guidance at 685M – $710M, which dwarfs the Street’s projection of $481.73M. These developments have triggered a huge move in the share price, which is now up over 100% over the past three months and has been one of our top performers in my Seeking Alpha Marketplace Service, Compounding Healthcare.

I still am extremely bullish on LNTH both in the near term and long term. However, I am struggling to formulate a battle plan for my LNTH position. On one hand, the company’s growth and fundamentals are calling for me to start loading the position on dips. On the other hand, the chart’s technicals are enticing me to take a more active approach and trade the ticker as a momentum play. I believe I am not the only one that is stuck in this lovely dilemma. As a result, I am going to attempt to hammer out a game plan for managing LNTH as it gathers momentum and the company begins a new period of growth.

I intend to review the company’s recent earnings and will highlight some key updates for investors. In addition, I take a look at the charts to see if we can extract any vital information from the technicals. Finally, I attempt to formulate my plan for my LNTH position.

Breakout Earnings

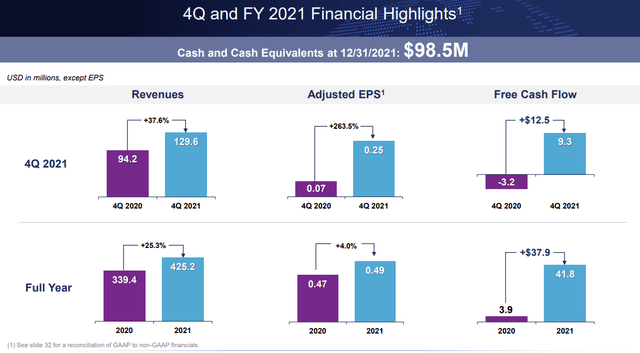

The company’s Q4 and full-year financials have generated an abrupt change their fundamental outlook. Q4 revenue came in at $129.6M, which is a 37.6% increase over Q3. Full-year 2021 revenue was $425.2M, which was up 25.3%. The company’s precision diagnostics segment pulled in $87M in Q4, with DEFINITY accounting for $59.3M. DEFINITY recorded $232.8M of net sales in 2021, up 18.8% over 2020. TechneLite had a strong 2021 pulling in $91.3M, which was up 7.5% year-over-year.

Lantheus Q4 Financial Highlights (Lantheus)

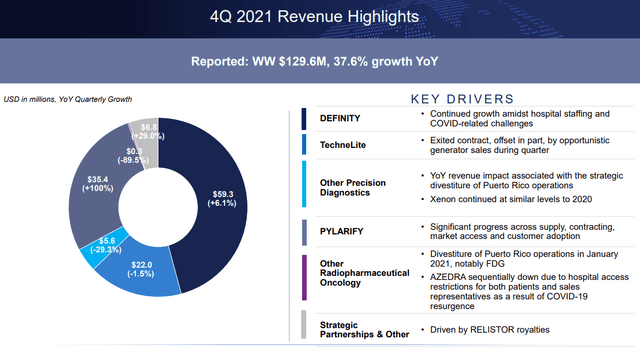

Radiopharmaceutical oncology contributed $35.7M of sales in Q4, which surged 1,300% from Q4 of 2020. PYLARIFY accounts for nearly all of the revenue. AZEDRA still appears to battle COVID-19 headwinds.

Lantheus Q4 Revenue Highlights (Lantheus)

Lantheus strategic partnerships are generating significant revenue. For Q4, the company reported $6.8M from their strategic partnerships, which is up 29% from Q4 of 2020 thanks to the RELISTOR royalty stream.

Operating expenses did surge in Q4 attributable to Lantheus pumping capital into PYLARIFY and DEFINITY sales and marketing activities.

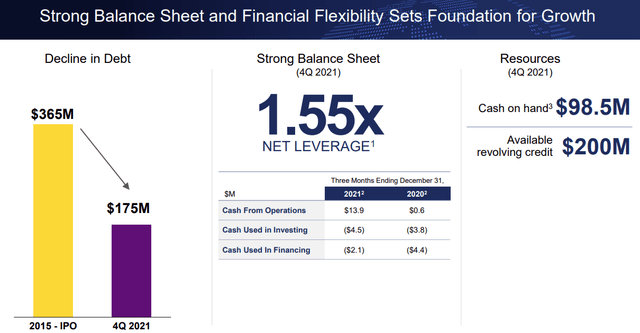

The company finished Q4 with $98.5M in cash and cash equivalents net of restricted cash. In addition, Lantheus still has $200M available in revolving credit.

Lantheus Balance Sheet (Lantheus)

To recap, 2021’s highlights include the successful launch of PYLARIFY and another year of market leadership for DEFINITY. Lantheus was able to differentiate their revenue stream and finished 2021 with just about $100M in cash. Lantheus executed their strategy to fast-track growth, expand the company’s portfolio, and position Lantheus as a leader in their markets.

Key Updates

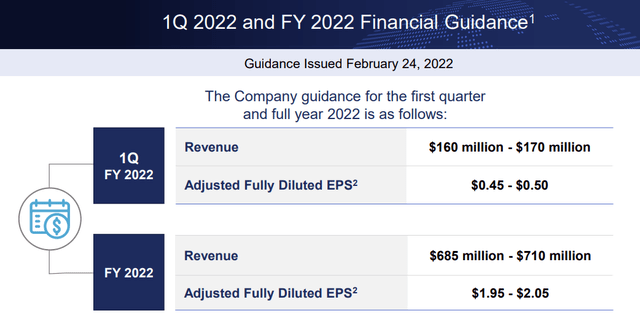

In 2021, Lantheus made progress across all the company’s major business drivers that have already established momentum going into 2022. For the first quarter, Lantheus expects net revenue to be between $160M-$170M, with PYLARIFY accounting for $70M to $80M. Lantheus expects their fully diluted adjusted earnings per share to be between $0.45 and $0.50. For the full year 2022, Lantheus forecasts PYLARIFY to be in a range of $300M to $325M and their full-year revenue to be $685M-$710M, which would be roughly 60% and 65% increase over 2021. Keep in mind that these numbers don’t include the $24M from the PSMA-617 settlement agreement with Novartis (NVS).

For the full-year earnings, Lantheus expects their EPS to be in the range of $1.95 to $2.05.

Looking ahead, Lantheus is looking to further establish PYLARIFY as the PSMA PET imaging agent of choice for prostate cancer; preserve their market leadership with the company microbubble franchise; execute strategic transactions in line with the company portfolio objectives, and deliver on the company’s financial objectives. All of which should translate into strong growth and share price resilience.

Taking A Look At The Charts

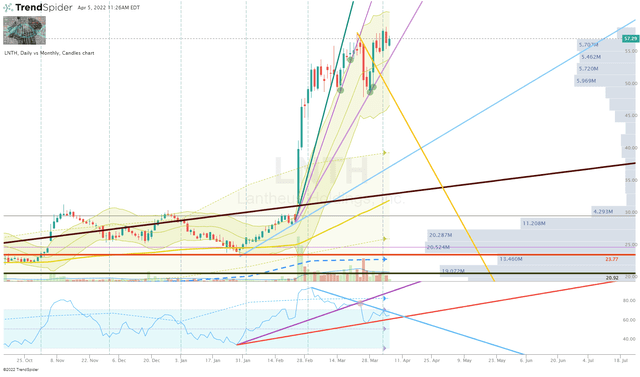

A quick glance at the Daily Chart shows LNTH is holding strong following the impressive earnings and encouraging guidance. We can see a couple of uptrend rays coming that were spawned from the initial move back in February. I don’t see any strong indications of an imminent sell-off.

LNTH Daily Chart (Trendspider)

We can see pennant formation forming on the Daily RSI, which could trigger a strong pull-back if it breaks down, however, a breakout to the upside could easily lead to a continuation. If I had to pick, I would expect LNTH to eventually make another leg higher in the coming weeks.

My Plan

Admittedly, I have already sold a large portion of my LNTH position in order to book profits and transition it to a “house money” position. Indeed, I wish I still had a full position but I had already placed some sell orders well ahead of the earnings report. Yes, I can’t really complain about cashing out of a big winner, but now I am stuck making a decision to either average up, sell some more to book more profits, or simply hold for the time being.

Considering the points made above and the stock performance over the last month, I think it is safe to say I should not sell any more of my position at this point time. Clearly, the company is off to a strong start with PYLARIFY and is still seeing steady growth and their legacy business. So, now I need to determine if I am going to buy or hold my remaining LNTH shares.

I believe it is safe to say that Lantheus has plenty of growth potential and is worthy of investment. However, we need to determine if the share price has overshot the company’s near-term revenue estimates, which could force me to sit on my hands.

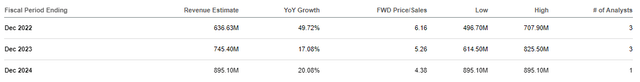

Looking at the Street’s revenue estimates, we can see they expect Lantheus to report strong growth in the coming years. However, we can also see LNTH is currently trading at a 6x forward price-to-sales for 2022. Considering the sector’s median price-to-sales is 5x, we can say LNTH is slightly overvalued for the Street’s revenue projections for this year.

LNTH Analyst Revenue Estimates (Seeking Alpha)

Indeed, one typically has to pay a premium for a growth stock, but I am looking for growth at a reasonable price “GARP”. So, I am hoping to get a shot at LNTH for slightly less than its fair value, despite it having substantial growth potential. This might be difficult to achieve for most stocks going through an aggressive growth period, however, LNTH is underfollowed, so we might have an opportunity to grab it at a GARP price. If we use the Street’s 2022 estimate of $636.63M and the industry’s average price-to-sales multiple of 5, we get a target price of roughly $47. Considering, we are trading around $58 per share, I am going to have to be patient and will have to wait for the market to provide a chance to get GARP buy on a pullback.

Without a doubt, it is possible we will never see LNTH below $47 for the remainder of this year, so I might have to contemplate adding to LNTH at a premium valuation. In this case, I would have to switch to my momentum playbook where I will look to perform some scalp trades on breakouts and sell after trend breaks until I have an opportunity at a GARP buy. Yes, this is a bit risky and requires a lot of devotion to executing this strategy, but it can be lucrative when a stock is filled with bullish momentum.

So what’s the Plan?

Personally, I am going to pick the “be patient and wait for a GARP buy opportunity”. The market is experiencing elevated levels of volatility, so it is possible the market could bring LNTH down to $47 at some point. Therefore, I am going to set a small buy order in the $47 area and will continue to accumulate under the $47 mark.

Long-term, I will follow a similar strategy for the next three years in anticipation Lantheus will report strong double-digit growth both in revenue and earnings. As a result, LNTH will stay in the Compounding Healthcare Bioreactor Portfolio for the foreseeable future.

Be the first to comment