YinYang/iStock via Getty Images

Intro

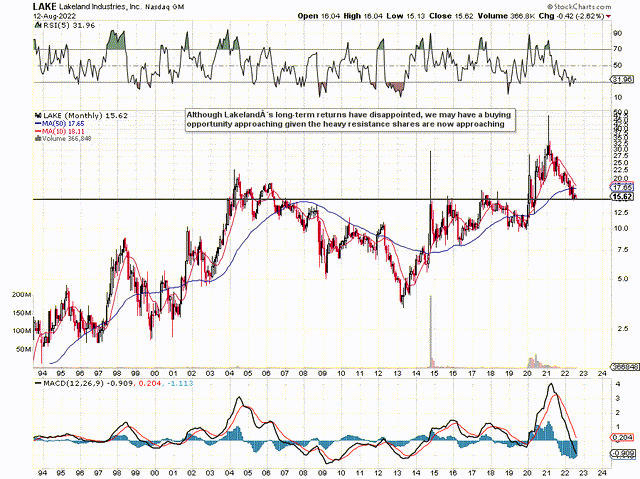

If we take a look at a long-term chart of Lakeland Industries (Industrial Protective Clothing Player), Inc. (NASDAQ:LAKE), we can see that shares have come down significantly off their February 2011 highs and now lie close to $16 a share. This means that close to 50% of the company´s market cap has been lost over the past 18 months, which is a sizable fall in earnest. In fact, shares are also down approximately 20% from their 2004 highs which means negative returns have been the order of the day here for close on two decades now in Lakeland Industries.

This does not mean in the slightest however that Lakeland is not without opportunity. Sizable gains for example have been made by investors who managed to accumulate positions close to the 2013 lows. In effect, it is all about waiting for these setups once more where the odds can be stacked in our favor considerably by looking for setups with significant upside potential but yet very limited downside risk.

Fundamental derived value investors (especially given how shares have been beaten up in recent months) will be fully aware of Lakeland’s potential for the following reasons. Although recent growth issues are self-explanatory, the company has no debt, is trading under book value, and has remained profitable during this cyclical downturn as it continues to invest through the cycle. The problem is that the bearish trend on the technical chart doesn´t seem to be taking any of this into account at present. In fact, Lakeland´s share-price action could be reacting to the unknown fundamentals in this present moment in time.

Whatever way you size it up, however, Lakeland remains a quality outfit where we will continue to wait for a long-term bottom. Here are some reasons why we will look to get long here once a hard bottom is confirmed.

Lakeland Industries Long-Term Chart (Stockcharts.com)

Profitability

Lakeland reported $0.14 in earnings per share and sales of $27.28 million in its recent first quarter for fiscal 2023. Both the top and bottom line reported numbers missed consensus estimates. Although top-line sales grew by approximately half a million sequentially, sales in Q1 came in down roughly 20% over the same period of 12 months prior. However, the company´s gross margin (40.5%) remained above that pivotal 40% mark in the quarter which once more demonstrated management’s capability of being able to reduce costs significantly in a no-growth environment. This has enabled the company as mentioned remain profitable reporting a net profit of $1.1 million or $0.14 per share in the first quarter. Suffice it to say, it is plain to see here that Lakeland’s in-house manufacturing and inventory management have been strong tailwinds of late in keeping profitability in the black.

Obviously, it will be interesting to see if management can continue to take costs out of the system in the event of a sustained no-growth environment but current trends look encouraging. We state this because everything starts with profitability and the generation of positive cash flow. For example, Lakeland is expected to fork out approximately $3 million in Capex spending this year (related to the company´s improving manufacturing facilities and growing IT infrastructure) without having to turn to external funding. This explains the actual increase in shareholder equity ($124.8 million at the end of Q1) over the past 18 months or so despite the above-mentioned capitulation in Lakeland´s share price. Suffice it to say, the longer Lakeland´s equity increases in the face of share-price declines, the more interested we will become.

Balance Sheet

Lakeland shares now trade with a book multiple of 0.96 which means shares are trading slightly under book value but in reality, this multiple is far more attractive than reported. We state this because Lakeland as mentioned has no debt, no goodwill or intangible assets to speak of, receivables remain under control ($15.5 million) and inventory continues to be managed excellently ($49.6 million). In fact, if we were to add the company´s treasury stock ($14.6 million), we would get an adjusted price-to-book ratio of 0.85.

From our standpoint (where we aim to evaluate downside risk), the balance sheet is always key due to the risk of drawdowns in asset values. However, given Lakeland´s strong current ratio where inventory remains in check, the risk of potential charges to the balance sheet remains slim given Lakeland´s low amount of liabilities. Furthermore as mentioned, assets and equity continue to grow which in the long run should result in growing sales and earnings before long.

Conclusion

Lakeland has all the hallmarks of being able to withstand this present downturn. By adding value through improving products and by undergoing sustained investment in manufacturing facilities, better sales teams, and bigger data, growth will return here once more. We look forward to continued coverage.

Be the first to comment