stanley45

Thesis

Kayne Anderson Energy Infrastructure Fund (NYSE:KYN) is a closed end fund focused on MLP equities. The vehicle has seen a resurgence in its performance on the back of the strong rally in energy related equities this year. KYN is highly concentrated, with eight names representing more than 5% of the fund’s portfolio, and more importantly, two names accounting for more than 10% each. The fund is built with a 25% leverage ratio, hence an investor is taking significant single name risk with leverage. The fund was pummeled during the Covid crisis, experiencing a -77% drawdown. KYN is a very volatile fund with a 3-year standard deviation of 52. The fund is ultimately a concentrated macro play on a handful of MLPs, with added leverage on top. The MLP asset class is on the mend from our viewpoint. The management teams have deleveraged significantly in the past two years and are trying to set themselves up for a sustainable future. Coupled with the energy crisis in Europe, U.S. oil and gas pipelines should have a robust future. The performance, however, will not be linearly up-sloping.

In our opinion, the best way to take advantage of this structure is to wait for a -5% to -10% drawdown during a risk-off bout (for example, KYN was down more than -15% during the June risk off environment) to enter this vehicle. If you buy expecting a steady-Eddy 8.3% yield here, you are wrong. KYN is very volatile, reflecting the volatility of the MLP asset class with the added leverage on top. We expect robust overall performance for the CEF holdings in the next year, but the best way to exploit that is by buying the next risk off dip and being able to stomach volatility with this fund.

What are MLPs

KMF is a CEF that provides investors access to a lesser-known asset class, namely Master Limited Partnerships, or MLPs, from the Oil & Gas sector. MLP is a fancy way of describing a form of incorporation for a company that generally runs pipeline and processing infrastructure for the Oil & Gas sector. In a nutshell, a classic MLP is a company which owns transportation (pipelines) and storage facilities for oil and gas. Since this business has traditionally been very stable (irrespective of oil prices, the actual liquid has to be transported from the extraction site to a port or storage facility) many large corporates chose to spin off their transportation and storage arms into freestanding companies with long-term standing transportation contracts. The MLP format provided tax advantages for both the respective companies as well as investors.

Performance

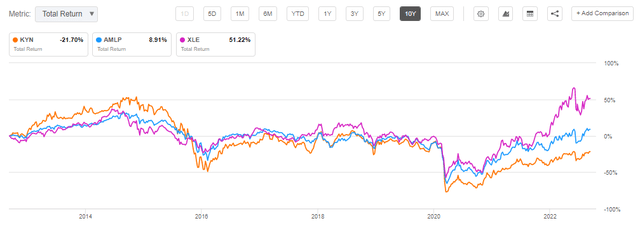

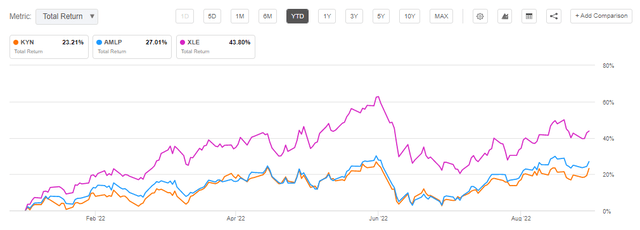

The fund is up more than 20% in 2022:

What is interesting to notice, however, is the fact that KYN does not outperform the unleveraged MLP vehicle AMLP. That is a bit of a disappointment for us, and it speaks poorly regarding KYN’s single stock selection.

On a 5-year basis, the fund still has a negative total return:

5-Year Total Return (Seeking Alpha)

We can see that KYN has not made back the Covid losses from a total return perspective (i.e., dividends are factored in) and moreover it still lags AMLP even on this time frame.

A 10-year timeframe paints a similar picture:

10-Year Total Return (Seeking Alpha)

KYN’s Holdings

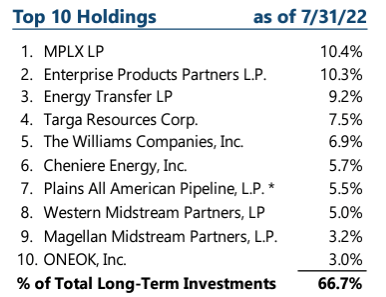

The fund is highly concentrated via its top holdings:

Top Holdings (Fund Fact Sheet)

The top ten names account for over 66% of the fund. That is a very high number. Generally, for a granular fund, an investor would not find single-name concentration exceeding 5%. Here we have names exceeding 10% of the portfolio!

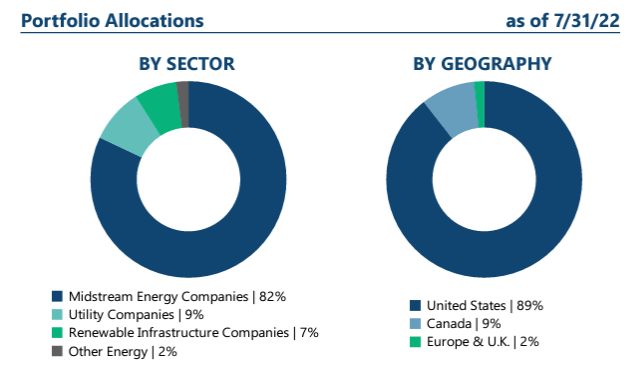

U.S. Midstream companies account for the bulk of the portfolio:

Portfolio Allocation (Fund Fact Sheet)

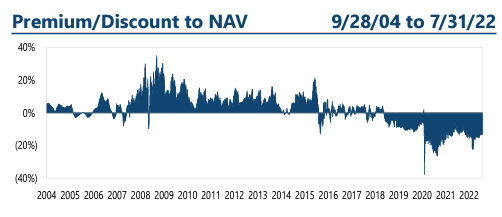

Premium / Discount to NAV

Surprisingly, prior to the Covid pandemic, the fund was trading at a consistent premium to NAV:

Premium / Discount to NAV (Fund fact sheet)

Post the significant Covid drawdown, the fund has been trading at substantial discounts to net asset value. Value destruction is not rewarded, hence the discount the market currently applies to the fund. We feel that we need to see another year or two of robust performance for the vehicle for us to start talking about seeing a premium in the fund again. Keep in mind that investors tend to flock and overpay only for funds which have posted robust results over a good amount of years in the recent past. One or two years of gains is not sufficient to command a premium. Expect a discount still for 2023.

Conclusion

KYN is a closed end fund focused on MLP equities. The vehicle has a 25% leverage ratio and takes very concentrated positions, with the top six holdings accounting for almost 50% of the fund’s portfolio. The CEF is up more than 20% this year, but still exposes a negative 5-year lookback total return. The vehicle is a cyclical play on oil & gas midstream names and is currently trading at an -11% discount to NAV. The MLP asset class is on the mend from our viewpoint. The management teams have deleveraged significantly in the past two years and are trying to set themselves up for a sustainable future. In our opinion, the best way to take advantage of this structure is to wait for a -5% to -10% drawdown during a risk-off bout (for example, KYN was down more than -15% during the June risk off environment) to enter this vehicle. Do not trade KYN as a long term buy and hold, but rather set a 1-2 year holding time-frame.

Be the first to comment