JHVEPhoto

Kraft Heinz Overview

We wrote about The Kraft Heinz Company (NASDAQ:KHC) at the beginning of this month when we stated that the food manufacturer was close to a firm bottom. In fact, we were lucky enough to more or less call the bottom as shares have returned over 12% since we penned that piece 18 calendar days ago. Despite the stock’s oversold conditions at the time, there was a lot to like also in the company from a fundamental basis. For one, management has done a sound job of keeping net profit margins elevated despite the fall in gross margins over the past few years. Furthermore, when one coupled the company’s profitability and positive earnings revisions with its below-average valuation (especially on the sales side), it made sense to recommend the sale of naked puts (bullish strategy) in that particular article.

We recommend the sale of the $32.50 regular November put which was trading for $1.05 at the time and had a delta of 37. That very same put due to the rise in KHC shares over the past three weeks or so is now worth $0.17 and its delta has dropped to approximately 8. Interestingly, we had implied volatility work in our favor in this setup despite the fact that KHC is announcing its next quarterly earnings on the 26th (Wednesday) of this month before the market opens. We state this because implied volatility usually rises in a stock when a binary event such as an earnings announcement approaches. Put sellers then essentially benefit when implied volatility contracts which mean our above recommendation earlier this month (sale of $32.50 puts) actually benefited from delta, vega as well as theta in the interim time period.

Assuming no big surprises in the pending third-quarter earnings numbers, we recommend remaining long KHC for the following reasons.

KHC Stock Trends To The Upside

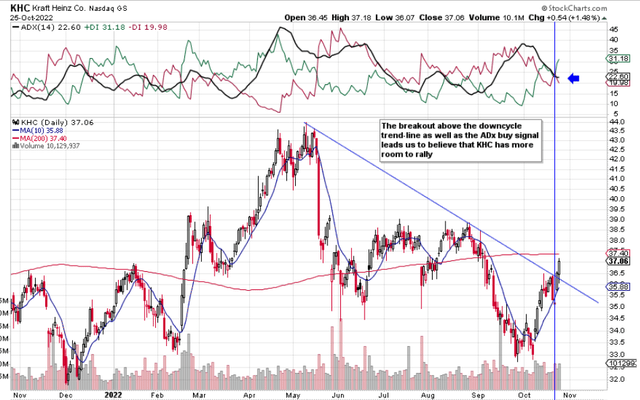

As we can see from the technical chart below, the odds are very strong now that KHC will test its 200-day moving average if not break through it in this present rally. The reason being that shares have broken through their downcycle trendline which essentially means that the pattern of lower lows has been negated for now. Probably more importantly however is the recent buy signal given on the ADX indicator. Shares last week gave a further buy signal as the Plus Directional Indicator (+DI) crossed over the Minus Directional Indicator (-DI). Furthermore, the ADX line itself remains over that pivotal 20 level which means KHC shares continue to trend to the upside (what bulls want).

Suffice it to say, what traders and investors need to take into account here is that when a trend has been established, more funds are generally put to work to increase returns (more buying volume). Could Kraft Heinz’s pending Q3 print derail the current rally? Of course, but barring a very unexpected surprise (which would be a sizable earnings miss), we see the underlying trend continuing here going forward.

KHC technical Chart (Stockcharts.com)

Earnings

Consensus is expecting an EPS normalized estimate of $0.56 on sales of $6.29 billion in the upcoming third-quarter earnings report. If these numbers are indeed exceeded, it will be the 11th straight consecutive quarter where both earnings and sales have surpassed expectations. Furthermore, General Mills, Inc. (GIS) (another player in the packaged food industry) recently announced an earnings beat for its own individual quarter as well as an increase to its full-year guidance number. Suffice it to say, here you have trends that are already taking shape in this industry which the market is fully aware of (hence the bullish technicals discussed above). Therefore, it came as no surprise when Goldman Sachs upgraded Kraft Heinz a few weeks ago as investors continue to deploy capital in this industry due to its attractive valuation and strong profitability.

Conclusion

Kraft Heinz announces its third-quarter earnings numbers on Wednesday the 26th of October before the bell. Given the company’s track record regarding its earnings as well as its bullish technicals in recent weeks, we would expect more upside in this play going forward. Bulls looking to add capital in Kraft Heinz should wait for the report’s numbers and the corresponding reaction by the market. Let’s see if we can register another beat. We look forward to continued coverage.

Be the first to comment