JHVEPhoto/iStock Editorial via Getty Images

My regular reader-victims know that one of my many odious personal habits is a tendency toward being a bit of a braggart. I mention this upfront, because if you haven’t read my stuff yet, it may be a bit startling when you first encounter it. In my experience, the vast majority of Seeking Alpha contributors want you to pay attention to our successes, while politely ignoring our failures. I’m more overt about it. With that out of the way, please don’t pay too much attention to my work on nVent Electric (NYSE:NVT), and instead feast your eyes on my analysis of The Kraft Heinz Co. (KHC). Way back in January 2018, I recommended investors avoid the name and the shares remain about 43% lower today. I then changed my tune on the company and turned bullish, and the shares are about 50% higher. But wait, there’s more. I generated an additional 7.4% from selling puts on this name. In all seriousness, if you haven’t looked at how put and call options can help enhance your returns while lowering your risk, I recommend you do so. These are very powerful instruments, and you should use every tool available to you to make as much of a risk adjusted return as you can.

With all that out of the way, it’s time to review my Kraft Heinz position again. In my experience, it’s always been easier to decide to buy a stock, and has been much more challenging letting a stock go. I need to tackle that question today. I’ll do so by reviewing the financial history here, and by looking at the stock as a thing distinct from the underlying business. In addition, me being me, I’ll offer an options trade.

For those who can’t abide the idea of reading through an entire article by yours truly, I offer my summary in this paragraph. If you don’t want spoilers, I’d skip this paragraph. If you’re still here, I’m assuming you’re open to me giving you the highlights. I don’t want to hear any complaints later about me “spoiling the surprise.” I think the dividend is well covered, but I don’t see much of a catalyst for growth here. The stock is neither cheap nor expensive, and I’m quite happy with my adjusted cost base, so I’ll neither sell nor buy more. That said, I think there is an opportunity to make a small amount of money from selling the put options I describe below. As my regular readers know, I consider short puts to be a “win-win” trade.

Financial Update – A Cash Cow

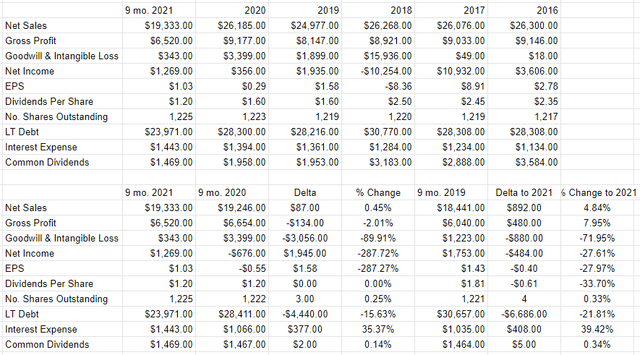

A quick review of the long-term financial history here indicates that revenue growth at Kraft Heinz could be reasonably characterised as “sclerotic.” In 2020, it was down slightly from 2016. Below the top line, not much else was very interesting, except for the large goodwill and intangible loss that I’ve written about in my earlier missives on this name. In fact, the only noteworthy thing to have happened is a large reduction in the dividend, starting in 2019.

Turning to more recent results, we see that revenue was basically flat during the first nine months of 2021 relative to the same period in 2020, and net income was much higher, simply because the tangible impairments went from $3.4 billion to ~$343 million. The capital structure improved nicely, though interest expenses were a little bit higher. Since 2020 was such a unique year, I also compared the first nine months of 2021 to the same period in 2019, and found results that are similar. I’ve characterised this company as a “cash cow”, and I stand by that characterisation.

For that reason, I think we need to focus in more closely on the cash generating capacity of this thing. From the investor’s point of view, that “cash” is manifest in the dividend, so I think dividend sustainability (or not) sets the price for this investment, so I want to focus on two questions. First, how sustainable is the dividend? Second, what’s the likelihood that it’ll be raised?

Dividend – Reasonably Sustainable

As my regular readers know, I’m as much of a fan of accrual accounting as a reasonably sane-ish person can be. When it comes to looking at the sustainability of dividends, though, I need to put my beloved accrual accounting aside, and focus entirely on cash. I think the most relevant questions that come up when looking at dividends relate to liquidity and solvency issues. I ask questions like “what are the size and timings of the company’s future contractual obligations?” “How much cash and short term investments does the company currently have on the balance sheet?” “How much net cash does the company generate on an annual basis?” I guestimate this last one by subtracting cash from investing from cash from operations for a “typical” year. It’s not precise, but it’s good enough for me. As I’m going through the exercise, I have the following question in mind: “by what amount will cash from operations have to decline to imperil the dividend?” If the answer to that question is “a lot”, the dividend is more safe. If it’s “a little”, we have a problem.

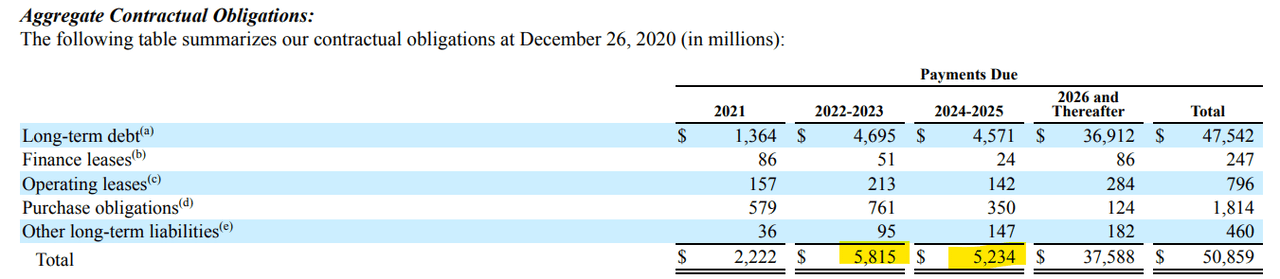

First, the obligations. I’ve gone through the effort of clipping the size and timing of the company’s future obligations for your enjoyment and edification, dear readers. Note that this is current as of late December 2020, so the relevant period starts at the highlighted column. Unfortunately, we don’t have figures broken down by year, so I make an assumption that the obligations are spread out over the period evenly. So, the company has obligations of $5.8 billion over 2022 to 2023, so I assume an annual obligation of ~$2.907 billion per year. It drops to $2.617 billion in each of 2024 and 2025.

The size and timing of Kraft Heinz’ Contractual Obligations

Against these obligations, the company has cash on the most recent balance sheet of ~$2.27 billion. In addition, the company has generated an average of ~$3.685 billion in cash from operations over the past three years. Cash used in investing activity is unique in this case, in that cash from investing activities has been net positive in four of the past six years given the sales of receivables or businesses. I’d note that cash for investing has cost an average of $737 million over the longer time span. Thus, my (admittedly crude) measure suggests an average delta of ~$2.95 billion to the good. All of this suggests to me that the dividend is reasonably well covered, and business would have to absolutely tank to imperil the dividend. Thus, I’d be very comfortable adding to my position here at the right price.

Kraft Heinz Financial History Kraft Heinz Investor Relations

The Stock

I’ve written it before, and I’ll write it again. A well covered dividend is a necessary, but not sufficient, precondition to make for a “good” investment. This is because an investor’s return is largely a function of the price paid for the stock. The more you pay, the lower will be your subsequent returns, and the lower your purchase price, the better your returns. I can use Kraft Heinz share price history itself to demonstrate this fact. An investor who bought these shares when I recommended avoiding them all the way back on January 22, 2018 (always shoehorning in a way to brag) is down significantly. The person who bought on St. Patrick’s Day of 2020 is up about 56%. The most relevant cause of this 100%+ swing in returns is the price paid. For that reason, I’m absolutely paranoid about not overpaying for a stock. In point of fact, I make it a rule to only ever buy a stock when it is “cheap.”

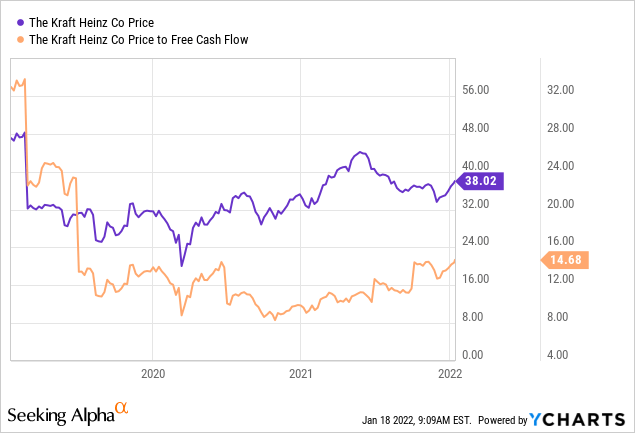

The people who read my stuff regularly for some reason know that I measure the cheapness (or not) of a stock in a couple of ways, ranging from the simple to the more complex. On the simple side, I look at the relationship between price and some measure of economic value, like earnings, sales, book value, etc. On this basis, I want to see the stock trading at a discount to both the overall market, and its own history. To refresh your collective memories, dear readers, I decided to eschew the shares originally in large measure because it was not worth paying 37 times free cash flow for. I subsequently turned aggressively bullish on this name when the stock hit a price to free cash flow ratio of ~12.10, and added when this ratio climbed to 12.98. It’s now about 21.3% more expensive than it was when I changed tunes, per the following:

My gut reaction here is that I’m not inclined to add when the shares are noticeably above the price that produced such great returns for me in the past.

In addition to the relationships between “price” and “value”, I like to try to understand what the market is assuming about a given company’s future. In order to do this, I turn to the work of Professor Stephen Penman and his great book “Accounting for Value.” In this work, Penman walks investors through how they can isolate the “g” (growth) variable in a standard finance formula to work out what the market must be thinking about a given company’s future. Applying this approach to Warrior Met Coal (NYSE:HCC) at the moment suggests the market is assuming a long-term growth rate of ~-5%, which is nicely pessimistic in my view. The fact that some of my preferred valuation measures are sending mixed signals here suggests to me that it’s best to take no action. I’ll neither buy more, nor sell the shares I own.

Options As Alternative

As my regulars know, it’s frequently the case that I don’t want to buy a company at a given price, but would love to buy it at a more attractive price. At the risk of repeating myself (a risk I’m always willing to take), this is because the price paid for a stream of future cash flows largely determines the outcome of the investment. Price drives future returns. I’m not comfortable buying Kraft Heinz at current prices, but I’d be happy to buy it at $27.50 per share to pick a price totally at random. I can either wait for the shares to drop to that level (BORING!) or I can generate some money by selling some puts that correspond with that strike price. As you may recall from reading my other articles, I consider short puts to be a “win-win” trade. If the shares remain above the strike price, I’ll simply collect the premium, which isn’t a problem. If the shares drop in price, I’ll be “forced” to buy a great business at a price I already determined was a good one.

In terms of specifics, I like the July puts with a strike of $27.50. These are currently bid at $.35. I consider this return reasonable for a very attractive entry price. If the shares remain above $27.5 over the several months, I’ll simply add this premium to the pile I’ve already earned here. If the shares drop, I’ll be obliged to buy, but will do so at a price significantly better than what’s available today. Some may complain that $.35 is a paltry return (~1.3% for six months). That’s fair, but I’d make two points in response. First, the premium isn’t the entirety of the transaction. If I’m exercised at this price, I’ll be locking in a 5.8% dividend yield, which I think is remarkably good. Second, most investors forget how stressful this activity can be. If something causes the shares drop to $27.5, there’s a strong chance that I’ll talk myself out of buying. There’ll be all manner of reasons to avoid the name, so I won’t lock in. This is why the vast majority of investors have a hard time buying after market corrections. I consider this a “win-win” trade in spite of the fact that it’s not the greatest premium I’ve ever made.

I hope you’re excited about the prospects of a “win-win” trade, because it’s time to engage in my sadistic tendency to spoil the mood by writing about risk. The reality is that every investment comes with risk, and short puts are no exception. We do our best to navigate the world by exchanging one pair of risk-reward trade-offs for another. For example, holding cash presents the risk of erosion of purchasing power via inflation and the reward of preserving capital at times of extreme volatility. The risks of share ownership should be obvious to readers on this forum.

I think the risks of put options are very similar to those associated with a long stock position. If the shares drop in price, the stockholder loses money, and the short put writer may be obliged to buy the stock. Thus, both long stock and short put investors typically want to see higher stock prices.

Puts are distinct from stocks in that some put writers don’t want to actually buy the stock – they simply want to collect premia. Such investors care more about maximizing their income and will be less discriminating about which stock they sell puts on. These people don’t want to own the underlying security. I like my sleep far too much to play short puts in this way. I’m only willing to sell puts on companies I’m willing to buy at prices I’m willing to pay. For that reason, being exercised isn’t the hardship for me that it might be for many other put writers. My advice is that if you are considering this strategy yourself, you would be wise to only ever write puts on companies you’d be happy to own.

In my view, put writers take on risk, but they take on less risk (sometimes significantly less risk) than stock buyers in a critical way. Short put writers generate income simply for taking on the obligation to buy a business that they like at a price that they find attractive. This circumstance is objectively better than simply taking the prevailing market price. This is why I consider the risks of selling puts on a given day to be far lower than the risks associated with simply buying the stock on that day.

I’ll conclude this rather long discussion of risks by looking again at the specifics of the trade I’m recommending. If Kraft Heinz shares remain above $27.50 over the next six months, investors will simply pocket the premium and move on. If the shares fall in price, investors will be obliged to buy, but will do so at a price about 27% below the current level. Both outcomes are very acceptable in my view, so I consider this trade to be the definition of “risk reducing.” It’s eccentric to end a discussion of risk with an explanation for why these instruments reduce risk. This’ll be neither the first, nor the last time my writing’s called “eccentric.”

Conclusion

I think Kraft Heinz is in many ways a wonderful business, but I’m not expecting much growth from it. For that reason, I think the dividend is the most relevant factor here. It’s quite sustainable, but the shares aren’t worth the price they’re currently trading at in my view. Nor are they egregiously expensive, so I see no need to sell. I think the most reasonable course of action here would be to sell the puts described above. Best case scenario, the shares are put to me. Worst case scenario, the “whiskey acquisition fund” grows by a few hundred dollars. Both outcomes are very acceptable in my view.

Be the first to comment