JHVEPhoto

The Kraft Heinz Company (NASDAQ:KHC) is currently on the radar of an increasing number of bullish investors going by its three month return of +14%. The stock is currently back above its 200D SMA of $38.82.

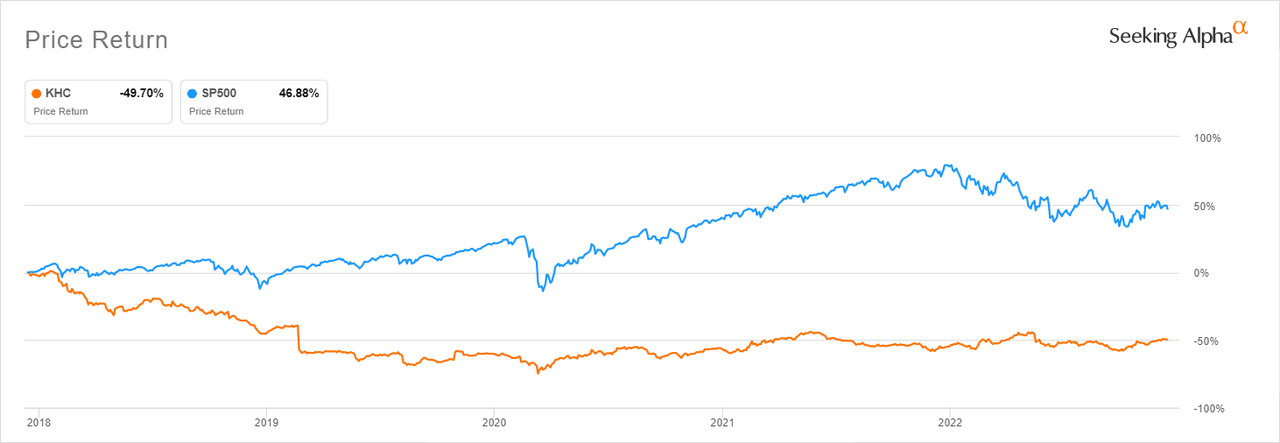

This strong momentum could be the start of a longer term recovery for the stock, which has performed terribly over the past five years, losing as much as half of its value vs the S&P500’s 50% return over this period.

KHC has halved in five years vs S&P’s 50% return (Seeking Alpha)

With this poor historical performance in mind, the increasingly strong momentum that KHC is garnering merits a closer look. Could KHC be finally turning the corner or is this recent rally a false start that you should ignore? To answer this question, we first need to understand why the stock has halved over the past five years.

A troubled marriage

KHC is the result of a 2015 merger between Kraft and Heinz that was backed by Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) and Brazilian private equity firm 3G Capital.

The $63 billion mega merger was at the time marketed as a great deal for shareholders as it was expected to expand the global reach of the combined business, reduce costs and deliver juicy returns. Anyone who is familiar with the story, however, knows this didn’t come to pass.

The merger sadly morphed into a troubled marriage where the children – in this case, shareholders – paid the price. The aggressive cost cutting that was supposed to improve efficiencies and boost returns worked for a short while. During this brief episode, the company hiked quarterly dividends to a high of $0.625 per share in 2018. It had previously paid $0.5750 in 2015. However, the skewed focus on cost cutting led to other problems, including poor sales performance, weak earnings , expensive asset impairments and ballooning debt. Amid this pressure, the company eventually cut the dividend to $0.40 in 2018 and has paid this quarterly dividend ever since. The stock obviously sank in the wake of this disappointing turn of events.

It has also not helped the situation that the last three years have been marked by unprecedented shocks. There’s been covid, supply chain disruption, the Ukraine Russia war, inflation, interest rate hikes and heightened market volatility.

These factors have in my opinion contributed to KHC’s atrocious performance in recent years. However, past performance is no indicator of future performance and the stock’s current rally could be worth looking into.

A second chance

A troubled company with unsustainable debt loads can get a fresh new start — basically hit the reset button and get a second chance – if it cleans up its balance sheet.

This is precisely what KHC has done in recent years. It cut its total debt from $31.43 billion in December 2018 to $20.23 billion in the last reported period. KHC has been able to pay down its debt by divesting non-strategic assets, which is a positive move as it ensures the management gives its undivided attention to the assets and operations that are driving shareholder value.

KHC has also been able to increase its pricing in recent quarters amid the runaway inflation experienced globally, indicating that its brands are gaining preference in the market.

The consumer staples company noted in its Q3 earnings release that it expects 2022 organic sales growth of a high-single-digit percentage increase. KHC also raised the lower end of its expected full- year adjusted EBITDA range to be $5.9B to $6.0B vs. $5.8B to $6.0B prior.

This stronger guidance suggests that the company is headed in the right direction from an operational standpoint. Sentiment is generally positive among analysts as the stock has seen 12 up revisions vs 3 down for revenue and 11 up revisions vs 6 down for EPS in the last 90 days. Inflation also appears to be cooling going by the recent CPI print so it is likely that the issue of cost pushes will subside in Fiscal 2023. This could lead to better margins.

The prospect of improved operating performance amid reducing debt could lead to more stable cash flows for KHC in future. This increases the possibility of much needed growth in dividend payouts, which is what KHC needs to convince investors it has truly turned the corner.

Start accumulating

While the most reliable sign of a turnaround will be an actual dividend increase, investors looking to bet on a turnaround can start accumulating now to maximize returns. The downside risk appears limited given the steps the business has taken to reduce debt.

The current yield of 3.98% is also reasonable for a consumer staple business and should provide some support since a dip in the share price could lead to buying pressure from investors chasing high but safe yield. The dividend is safe and it’s not likely to be cut further considering it wasn’t cut during Covid and the balance sheet is actually improving relative to where it was in 2018.

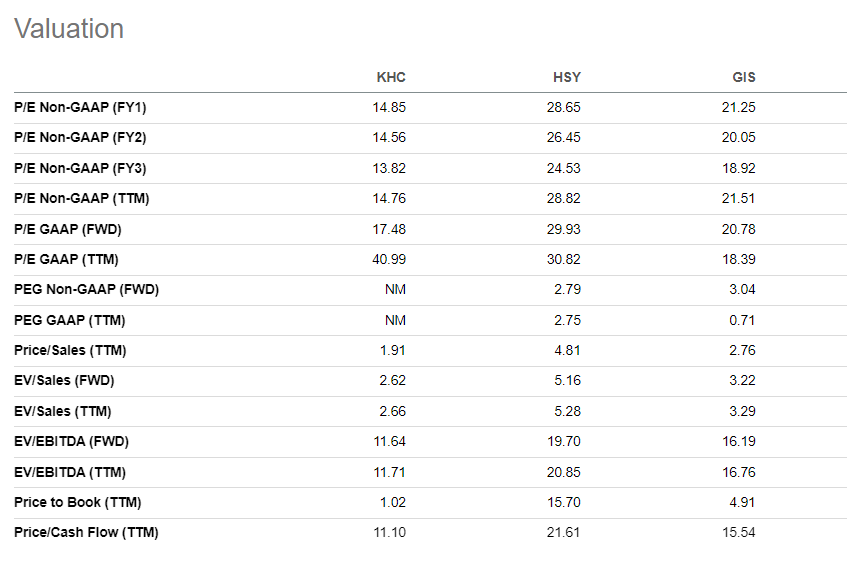

KHC is also undervalued compared with peers such as General Mills (GIS) and The Hershey Company (HSY), which both trade at multiples that are almost double KHC’s. This relative undervaluation limits the downside risk and increases the upside potential as KHC will have more room to run when market conditions favor multiple expansion in the consumer staples space.

KHC valuation vs peers (Seeking Alpha)

Conclusion

Investors typically buy consumer staples stocks like KHC because of the consistent and stable dividends they pay in different economic and market environments. KHC’s current dividend has room to grow if the company continues reducing debt, maintains its pricing power, and improves its earnings over time. I believe it is doing these things and making good use of second chances. The risk of buying the stock at current valuations and with the current dividend yield is justified as it could in the long-term deliver both income growth and capital gains.

Be the first to comment