MF3d/E+ via Getty Images

To say technology stocks have struggled thus far in 2022 would be one of the biggest understatements of the year. Year-to-date through June 17, 2022, the Nasdaq composite (QQQ) is down 31%. Although that is a breathtaking number, believe it or not, down 31% significantly understates the declines experienced by the average Nasdaq stock. This is because, like most indexes, the Nasdaq is market capitalization weighted, and therefore, the mega cap leaders, such as Apple Inc (AAPL), Microsoft (MSFT) and Google Inc (GOOGL) have held up better on a relative basis.

If you are a contrarian, opportunistic, and a stock picker then you are licking your chops as these type of market drawdowns can mean that so many good companies trade at valuations that are completely disconnected from their intrinsic values.

Despite one of the most challenging markets ever, behind the scenes, I have been a busy bee, in the research weeds doing my fundamental analyses and thinking beyond the current sentiment of chicken little (the sky is falling) and the pervasive mindset that the macro headwinds are too stiff to be long.

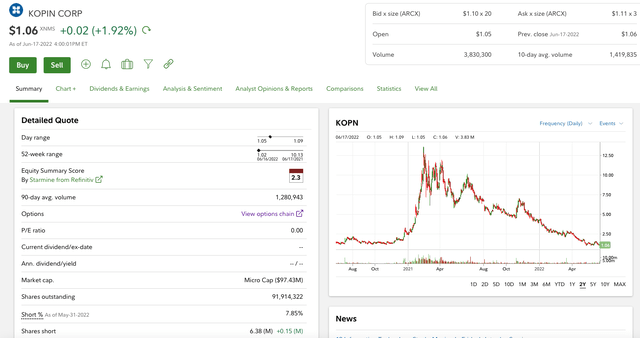

Today, I write to share an update on Kopin Corporation (NASDAQ:KOPN). Like so many technology stocks that are currently Adj. EBITDA negative, the market has completely thrown the baby out with the bathwater here by extrapolating that its Adj. EBITDA losses will go on forever. And based on those extrapolations, along with extraordinarily negative sentiment, Kopin’s stock is trading as if the company will simply run out of cash and the stock will go to zero.

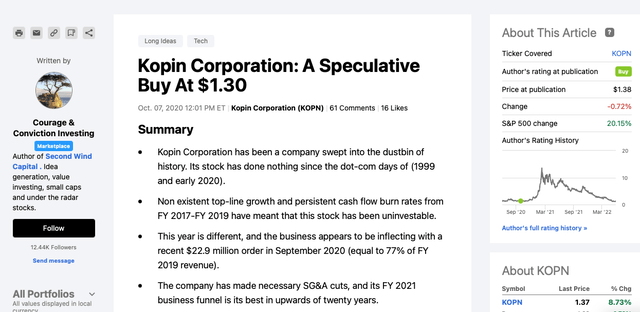

Incidentally, back in October 2020, I wrote up Kopin with shares then trading at $1.30. Lo and behold, by February 16, 2021, shares closed at $13.56. For anyone with perfect timing, that is a good old fashion ten bagger in less than six months. That said, February 2021 were the halcyon days of Nasdaq euphoria and coincided with the period when Cathie Wood was literally the Queen of Wall Street.

(Source: Seeking Alpha (October 7, 2020))

Why Kopin Is So Compelling

In today’s piece, I write to explain why the risk/ reward, at $1.06 per share (as of June 17, 2022), is dramatically skewed to the bullish side here.

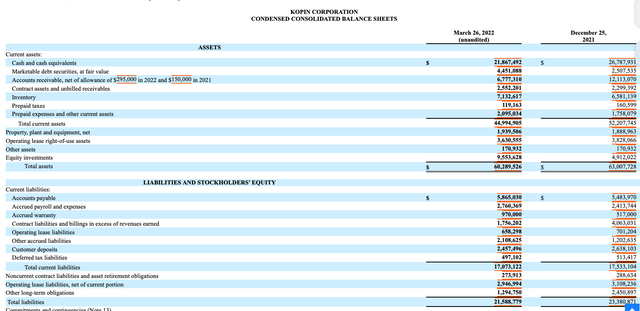

1) As of March 26, 2022, Kopin has $26.3 million in cash and no debt. The company also has $27.9 million in positive working capital.

2) The company’s cash burn rate isn’t elevated, so the company has a longer business runway than the market is pricing in.

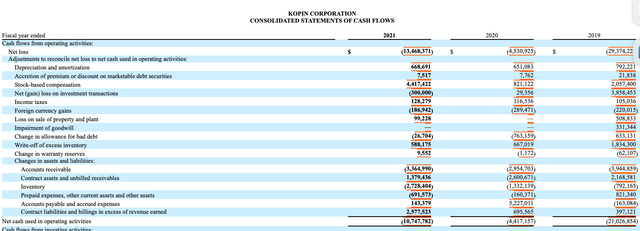

As you can see, negative operating cash flow was only $10.7 million for the full year FY 2021.

3) Kopin has a robust backlog, but hasn’t really been able to fully execute on it due to supply chain issues.

On its May 3, 2022 Q1 FY 2022 conference call, CEO, Dr. Fan, discussed Kopin’s very strong backlog.

We entered 2022 with very strong backlog of orders, and we believe 2022 will be another year of good growth. We’re excited for the growth of coping as we see a wave of growing interest in AR/VR and MR product applications. Our technology advances and current [Indiscernible] conditions are very favorable. And we believe coping is very well-positioned to capitalize it. Finally, I would like to make a comment on the equity gain in Q1. As some of you know, coping is very strong in IPs with over 2,000 — with over 200 patents and patent applications providing display optics and module assemblies.

And subsequently to the end of Q1 FY 2022, the company got a follow on $4.8 million order for the F-35 joint fighter program.

Moreover, on the May 3, 2022 conference call, CFO, Richard Sneider, noted that a number of its purchase orders, won during Q4 FY 2021, should ship during FY 2022. In other words, a lot of the backlog should turn during FY 2022.

We did indicate that we had a $19.8 million quarter PO in December. In November, we had a 2.3 and then there was another million something for another those were all in November, December. So you can assume that’s all shipping this year and possibly into the beginning of next year. But the bulk of it will be this year.

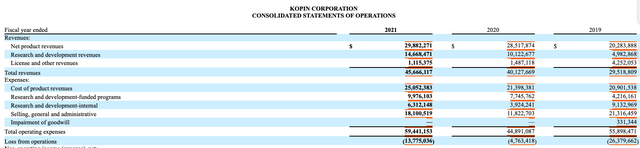

For perspective, in FY 2021, Kopin did $30 million in net product revenue, so again, its FY 2022 backlog is strong. The only caveat is securing access to enough low-end semiconductors is required to build its finished products.

Qualitative Nuances

1) Kopin owns an extensive IP portfolio.

At $1.06 per share, you are essentially paying next to nothing for Kopin’s patent portfolio. Given this extraordinarily low valuation, I highly doubt Dr. Fan wants to sell the company at this juncture, but equity investors can take advantage of the current market malaise. And I would argue that this patent portfolio is a valuable-hidden asset that the market is completely overlooking and underappreciating. This is what happens during severe bear markets. The market essentially losses its ability to accurately value businesses.

As some of you know, coping is very strong in IPs with over 2,000 — with over 200 patents and patent applications providing display optics and module assemblies.

One of the IP monetization strategy is to license some of our IPs to startup companies. As — and as a copy, as a part of a conversation, we often receive equities in the startups. We’ve completed a few of those transactions and our goal is to do more. Some of the early transactions are not going to a more mature stages. We’re actually very excited with this IP business model.

(Source: Kopin’s May 3, 2022 – Q1 FY 2022 Conference Call)

As discussed on the call, the company licenses those patents to startups, and some of those startups are reaching the mid-cycle of their growth phase. RealWear is a good example of this. Incidentally, in early June 2022, Ford (F) ordered 3,000 of RealWear’s Head Mounted Tablets.

So, if any of these companies are successful, Kopin gets to triple dip. This means they can earn royalties if/ when the startups successfully bring a commercial product to market, can generate revenue by selling its components/ displays to them, and they get equity, like a venture capitalist firm.

Here is how Dr. Fan described it on the conference call.

I’m glad you mentioned it. Those are the companies that we license and they in fact, pay equities in. I don’t want to go a lot to buy into it obviously, some of them are already making progress and so [Indiscernible] equity gain. And I think that that would continue. The one that will form three, four, five years ago is just like a VC situation. Some of them become mature stage now, and you’re going to have a series of hopefully monetizes in [Indiscernible] like VC, we’re going get things come back and with some significant equity gain. But remember our goal is more than the equity gain. We’ll tip in three ways. We have royalty and we also sell them components plus equity grant gain.so this way [Indiscernible] this is [Indiscernible] very good.

So I think this is the one area that’s not well known by the shareholders. We have several ways to make money for the shareholders. Once we do sell products, [Indiscernible] our products not only just selling display now. We can do more and more into assemblies in the Amex vehicles, [Indiscernible] the full system. And you can [Indiscernible] how many [Indiscernible] going to be. And they’re with IP models.

(Source: Kopin’s May 3, 2022 – Q1 FY 2022 Conference Call)

Also, to jog readers’ memories, back on January 3, 2022, RealWear selected Kopin’s microdisplays for one of its products.

2) Light At The End Of The Tunnel (With A Caveat)

Both Dr. Fan and Richard talked extensively about how the semiconductor shortages for very mundane and low technology chips has delayed fulfilling orders. Moreover, Dr. Fan explains that a lot of Kopin’s business is in defense, and you can’t simply swap out one chip for another as it has to be approved by its end customers, so think businesses like the Department of Defensive or defensive contractors. Therefore, given the extensive testing required, by both Kopin, the DoD, or defense contractors, this has been problematic.

However, and for perspective, during FY 2021, Kopin’s CFO has been conservative and honest about its supply chain challenges, yet he was guardedly optimistic on the May 3, 2022 call. Optimistic that Kopin has enough vendor commitments to fulfill its strong backlog, and optimistic that there are signs that the global supply chain cluster is improving.

Well, we have commitments from vendors, which would indicate that we’re in good shape for the rest of the year. But we’re just putting up the caveat there that I think given the situation, I think, it’s unrealistic to think that we’re out of the woods. We do see — we talk to people in the industry, they do see light at the end of the tunnel. And they — but we just want to make sure that we get a couple of more quarters under our belt before anyone starts declaring that we’re out of the woods.

(Source: Kopin’s May 3, 2022 – Q1 FY 2022 Conference Call)

Dr. Fan discussed very low tech microcontroller is the linchpin.

Yeah. I think as you well know, a lot of supply chain problem is agonizing, because automobile industry is affected by that too. What you’re missing is a microcontroller, which is a very low tech product. It’s made by everybody in the whole world; Taiwan, Korea, and China, Japan. But they’re short. And once they’re short, you can’t even a car too. Everybody that set the buyer of microcontroller, not advanced IC. Is it really maintain ICs? So for us, it just about the automobile, you can’t find an IC that’s put in the there. You got to get your customers the proven and date of compliances so you slowdown things. But it’s not fundamental. It’s not that IC cannot get it anywhere. It is very common IC.

(Source: Kopin’s May 3, 2022 – Q1 FY 2022 Conference Call)

3) AR/VR And The Meta Verse

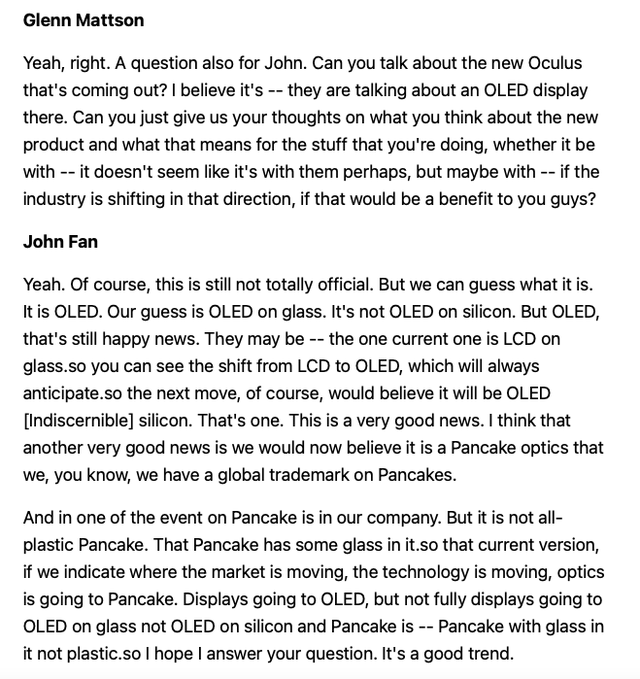

Dr. Fan discussed how Kopin is well positioned to take advantage of the increased interest in AR/ VR and the Meta verse. Secondly, he discussed how industry is moving toward OLED. Kopin’s technology is OLED on silicon, not on glass, but the move back to OLED is a step in the right direction.

Kopin’s Q1 FY 2022 Conference Call

(Source: Kopin’s May 3, 2022 – Q1 FY 2022 Conference Call)

4) Kopin Is Working With Two Foundry Partners On Micro Displays

Exhibit A

Under our model, we either sell finished OLED displays to our customers, working with our OLED foundry partners or we sell a [Indiscernible] wafers to our OLED OEM partners who complete the micro displays for sale to their own customer base. This business model provides us a lot of visibility to meet customer demands without incurring the major fixed capital investment associated with our lead deposition process. We continue to work on design wins with other new customers. Regarding to our research and development programs. We continue to make excellent progress on our customer funded defense development programs, which include armored vehicle targeting systems, rotary wing aircraft, pilot helmets, and additional weapon sight programs.

(Source: Kopin’s May 3, 2022 – Q1 FY 2022 Conference Call)

Exhibit B

Micro OLED, as you all know, some people always consider their ultimate display, which it is true. It became — we developed and producing a cost effective way. It’s hard to solve everything that we wanted to do AR/VR and MR. We work with a Chinese company, Monochrome Micro OLED and we work with Japan’s company to do full color Micro – LEDs. And both of them are very super high advanced Micro – LEDs. And a large customer funded so this is a customer funded activities, and the progress is good. I think China was, again because there’s a lot buying in China, [Indiscernible] as a few weeks. Otherwise, you might already have something, [Indiscernible] to announcer for this quarter. In general, things are going well and some lockdown has slowed down some of the things, but we’re still making good progress.

(Source: Kopin’s May 3, 2022 – Q1 FY 2022 Conference Call)

Putting It All Together

Over the past three months, if I had a dollar for the number of times I have read in print or been told technology companies don’t have current positive Adj. EBITDA are worthless, then I would be a wealthy man. That elementary observation is now so widely held that it should be more than priced into so many of these technology stocks, given the crazy rout that has taken place throughout the technology stock landscape. Moreover, not surprisingly, the baby seems to get thrown out with the bath water when it comes to small caps and micro-caps, as these stocks are often owned by a diffuse group of holders. Far too often, these holders have been conditioned by this bear market to be overly focused on short term price movements, super sensitive to unrealized short term losses as much less interested in investing in businesses, with the understanding precisely timing the bottom is nearly impossible.

As for Kopin, you have a company has $26 million in cash, a relatively low cash burn rate, a robust IP portfolio, one of its highest backlogs in its history, as well as the intermediate term excitement / possibility on the AR/ VR Meta verse frontiers.

At $1.06 per share, we are talking about a company with only a $98 million market capitalization (there are only 92 million shares outstanding).

I would argue Kopin shares are ridiculously mispriced and offer compelling value investors an attractive risk/ reward setup. That said, you have to be willing to own this stock for a period of time (at least 12 months or until the market wakes up) and wait for the sentiment to improve (this isn’t a stock to waste your time timing it for $0.10 to $0.20 moves). Also, this is relatively higher risk as the balance sheet is healthy, but certainly not robust. Therefore, when you size this, size it in the context of other higher beta names within your portfolio.

Be the first to comment