Bruce Bennett/Getty Images News

Consumer discretionary stocks have been making a comeback recently, following a dreadful 2022. We’re all familiar with the horrible market we’ve had this year, but as I’ve said many times since the summer, I believe the worst is behind us, and that we’re going a lot higher in 2023.

I’ve given my reasons for this line of thinking to subscribers, and we’ve positioned accordingly. When the market struggles, consumer discretionary stocks tend to get crushed. We can certainly check that box for 2022. However, when the rebound occurs, consumer discretionary is typically one of the sectors that benefits the most, along with other aggressive sectors such as technology.

Given this backdrop, I’ve been on the lookout for consumer discretionary stocks I think are going to do well into 2023 as the bear market ends (or already has ended) and we go a lot higher.

Kohl’s (NYSE:KSS) is a bit of a cross between consumer discretionary and consumer staples, in that it sells low-priced apparel and home goods that are a blend between discretionary and things people just need to live. As such, it’s not first choice when it comes to gaining aggressive exposure to what I believe will be a bull market in 2023 in consumer discretionary.

In addition, the company reported earnings yesterday and I must say, I wasn’t impressed. There’s a fair amount of bad news in here, not least of which is the CEO abruptly quitting. Following this report, I think it’s wise to take profits in KSS if you’ve got them, and look elsewhere.

Kohl’s stock resistance looms overhead

Let’s begin with the daily chart as I think it shows the bulls have a lot of work to do if this one is going to move meaningfully higher.

StockCharts

I’ve drawn in a line on the price chart at gap resistance from this past June that has never been challenged. That is at ~$35, and we’re at $31+ today, so it’s going to become an issue shortly if the stock continues to rally. We can see KSS has been consolidating for months after that gap was formed, and while it’s fine that it hasn’t made significant new lows during the consolidation, the rest of the chart looks pretty awful.

The accumulation/distribution line is terrible and continues to make new lows, even as price rises. That means investors are selling on rips rather than buying dips. The 10-day rate of change is also very near the point (+15%) where the stock has stopped and turned lower during past rallies. That doesn’t guarantee that will happen this time, but that signal has been pretty reliable.

Relative strength has been horrendous as well, as the apparel retailers index has been flying against the S&P 500 since August, while Kohl’s has vastly underperformed.

I would sum the chart up this way: Kohl’s is the worst house in a great neighborhood. In other words, the group it’s in has been absolutely outstanding, but Kohl’s is a huge underperformer within that outstanding group. We want to own stocks that are strong within strong groups; Kohl’s is not that stock.

Q3 not supportive of the bull case

You can read all about the earnings report in the link above, so I won’t go through it line by line. However, there are some things I want to note in terms of the future of Kohl’s performance.

We all know margins have been in sharp focus for retailers in particular of late, and that’s because not only are investors concerned about consumer spending habits, but there are numerous inflationary headwinds impacting profitability.

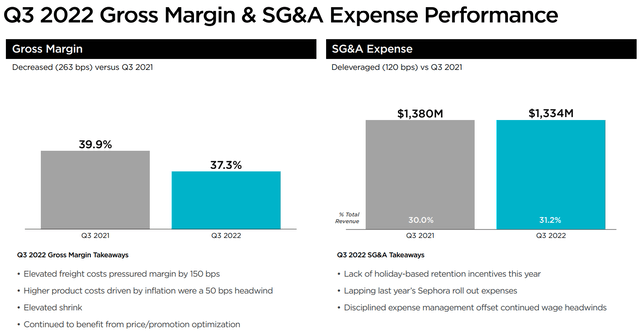

Company presentation

Kohl’s reported gross margins down 220bps this quarter, with 200bps of that coming from the combination of freight and input cost inflation. The company is working on promotion and pricing optimization, but it’s clearly quite inadequate in the face of the headwinds it is up against. Where is the bottom for margins? That’s the key question, but it certainly appears we don’t have it yet.

That’s especially true because if we look to the right, SG&A costs were flat on a dollar basis, but given revenue declined 7%, they deleveraged 120bps. That’s a bad result, and if we combine it with gross margins, we have a 340bps headwind to operating margins. That’s a huge reduction in operating profits.

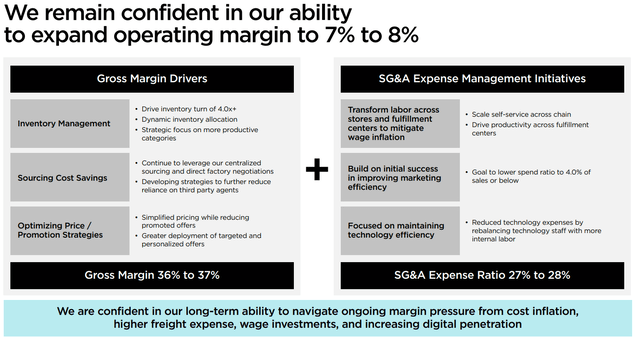

Now, Kohls’ provided an updated to its long-term goals, and they are below for reference.

Company presentation

The company sees operating margin at 7% to 8% of revenue, which includes gross margin of 36% to 37% and SG&A costs of 27% to 28%. Q3 gross margins were in the area at 37.3%, but S&GA is nowhere close. SG&A costs should be much lower as a percentage of revenue in Q4, given it is the best quarter of the year for Kohl’s in terms of sales. But it is becoming increasingly obvious that this SG&A goal is aspirational rather than realistic, in my view.

Now, the “easiest” way for a retailer to improve SG&A costs is through comparable sales gains, as that leverages down S&GA costs as a percentage of revenue, without having to cut them on a dollar basis.

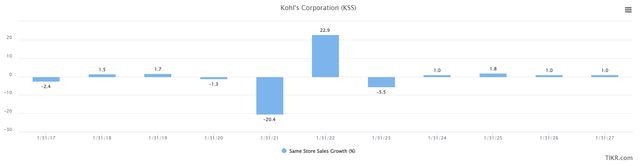

TIKR

As we can see here, pre-COVID comparable sales oscillated around the flatline, and if we look at fiscal 2023 and beyond, we’re looking at the same sort of performance. That will make it extremely difficult for Kohl’s to reach its operating margin goal, which means it either won’t reach the goal, or it will need to cut staff or take other cost saving measures. That reduces the likelihood of success, so if you’re looking for that to boost the stock, I must suggest you look elsewhere.

Concerns aplenty

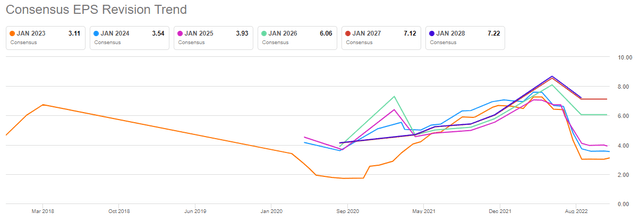

Let’s turn our attention to the company’s EPS estimates from the analyst community, which you can see below.

Seeking Alpha

EPS estimates were in the area of $7 earlier this year for fiscal 2023, and today, are less than half that level. That’s the product of weaker-than-expected revenue, as well as higher costs, which have collectively deleveraged SG&A costs and cut gross margins. You have to ask yourself if you saw evidence in Q3 of these factors abating if you’re going to buy the stock. I don’t see it, so I’m not sure why I’d want to own it.

Kohl’s has been a dividend stock for most of the recent past, so another way we can view the stock is through the dividend yield.

Seeking Alpha

Today, shares yield 5.6%, which is impressive. That is a very strong yield to say the least, so there could be some value in it for income stock investors. That’s not for me, as I prefer to trade for capital gains, but I understand there are many investors that want the income from a strong dividend. Kohl’s has that, but for how long?

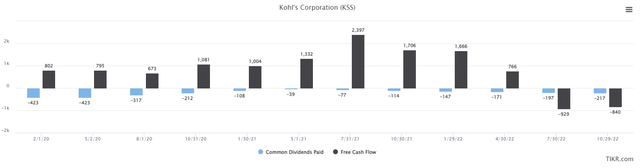

Below we have trailing-twelve-months free cash flow (in black) and the cost of the dividend (in blue), both in millions of dollars.

TIKR

FCF was once a strength of Kohl’s, but the very poor performance of 2022 has FCF highly negative. This means the company is having to finance the dividend through debt and balance sheet cash reserve reduction, rather than through the operation of the business. This sort of thing has to have an end date, so I cannot be confident the dividend can remain under present conditions. Kohl’s is $1+ billion of FCF away from just being able to afford the dividend from a FCF perspective, so the hill to climb is enormous.

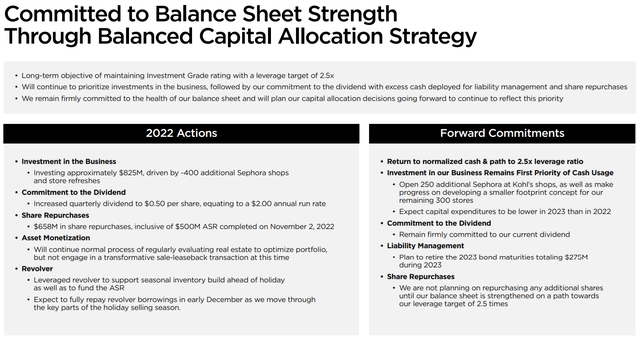

Company presentation

The company has a plan, which you can see above, but the fact is there is no evidence it is actually working just yet. Could it? Of course it could. But I’m not willing to take that leap on a management team that I don’t think deserves the benefit of the doubt, and in particular, when the CEO just quit. The management team remains committed to the dividend, but in my view, that’s imprudent.

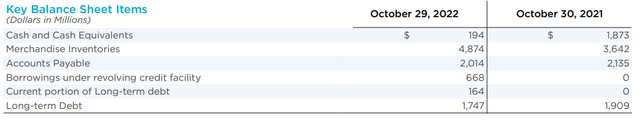

One more point before we get to the valuation is on the balance sheet, which I’ve alluded to.

Company presentation

The company’s cash position, in just the past twelve months, has gone from $1.9 billion to $0.2 billion. It’s credit facility plus long-term debt has gone from $1.9 billion to $2.6 billion. Merchandise inventories have ballooned from $3.6 billion to $4.9 billion. None of this is good. None of this is supportive of a healthy balance sheet. It reeks of a company that is stubbornly clinging to a dividend it cannot afford, and the mushrooming inventory position bodes very poorly for margins going forward.

When a retailer has too much inventory – as Kohl’s does today – either it take forever to unload it, or you have to unload it at lower prices. That crimps margins even more than they already are – as evidenced by the Q3 report – so I simply don’t understand wanting to own this stock today.

Final thoughts

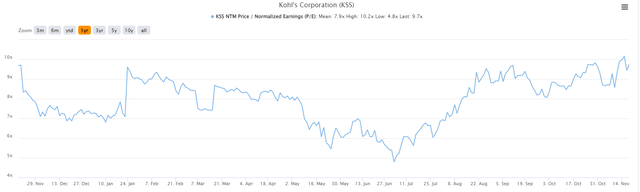

Despite all of what I believe is some substantially bad news above, this stock isn’t even cheap. Below we have the forward P/E ratio for the past year, and it’s pretty telling to me.

TIKR

Shares are ~10X forward earnings, which is about as highly valued as they’ve been in the past 12 months. The stock is flat (roughly) since the summer, but the forward P/E has skyrocketed, and that’s because earnings estimates have plunged.

This is a terrible situation for a shareholder because your share price is treading water, but is becoming more expensive all the while.

The bottom line is this: I think Kohl’s is in an untenable position with its margins, inventories, balance sheet leverage, and weak comparable sales outlook. I believe there’s a reasonable likelihood of a dividend cut, and I see the stock as way too expensive. I wouldn’t go near this, and I’m rating it a sell as a result.

Be the first to comment