With over $100bn in dry powder KKR is poised to benefit from rocky markets Berryspun/iStock via Getty Images

Investment thesis

NYSE:KKR is one of the leading alternative asset managers. It has been building a sticky asset base that generates reliable management fees. 2021 was an outstanding fundraising year for KKR which now has over $110bn to deploy in markets that suddenly offer expected returns not seen for years.

Helped by long-term locked in assets and deployment of another $42bn in fee bearing capital fee-related earnings (FRE) should be much more stable than the market gives credit for.

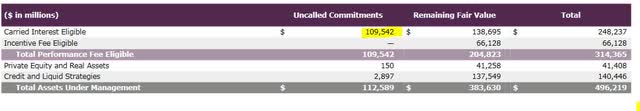

Markets currently focus on the upcoming difficult economic environment, the reduction in unrealized carry and the more challenging fundraising picture. This however gets it completely wrong when it comes to KKR. They had a bumper year for fundraising in 2021 and now sit on over $110bn of capital to deploy which is over 20% of their current AuM and even more if we exclude own investments and Global Atlantic. The majority is within the carried interest eligible part where it makes up a staggering 44% of committed and invested assets.

$109bn of dry powder to deploy for future carry (KKR Q3-2022 press release)

While it is true that they will get temporarily hurt by a lack of carry they will strongly benefit from the current difficult environment as this lays the foundation for another decade of excellent performance. I regard KKR therefore as a net beneficiary of the current environment which is misunderstood by the market.

Here is quote from their most recent conference call:

And I think to the bigger broader point, and you referenced this in your question, we were incredibly fortunate. We raised over $120 billion last year. Our large flagships have been in the market over the last couple of years before the more recent more challenged markets. So we really got a bit lucky with our timing, and that’s why we have the $113 billion of dry powder to put to work.

In an environment like this, companies still need capital. And we find private capital tends to have less competition at a time like this. Public markets are more difficult. Corporate M&A is more challenged. So we’ve got a lot of capital to put to work. Companies still need it.

In this article I will explain why I believe KKR will actually benefit from a tough 2023 and will use the following resources: KKR Q3-2022 earnings release, the Q3-2022 10-Q SEC filing, the Q3-2022 conference call as well as several presentations from the KKR investor relations page. I will explain how I value KKR and why I believe it could be one of the best investment opportunities in 2023.

Private equity and the business cycle

While many economists despise the business cycle private equity managers should love it. During recessions, when banks and public markets act in typical pro-cyclical manner in offering very little financing and public companies trade at depressed valuations, private equity can make its best deals by providing scarce financing at great conditions or taking public companies private for cheap. But as their funds are not supposed to be a permanent vehicle they also need booming and exuberant markets to which they can sell their companies later on for a much higher multiple and hopefully in a better shape. This then creates the performance for their investors that will lead to further fundraising and it also generates that famous carry, which is a cut of the gains when selling an investment at a profit.

Funnily enough, publicly listed private equity companies do behave just like all other stocks in that they get exuberant during good times as the private equity companies are able to generate high carry and successfully raise new funds to deploy. But somehow, when the market turns sours and unrealized carry evaporates, they get sold off. Now, if that company just had invested nearly all their funds at the height of the market this would be justified as those are unlikely to produce good results which might in turn hamper future fund raising. However, if they have a lot of dry powder then investors should actually welcome the bust part of the economic cycle. As this is where the seeds for outstanding future returns are planted. And without regular (out-)performance there is no business model for private equity.

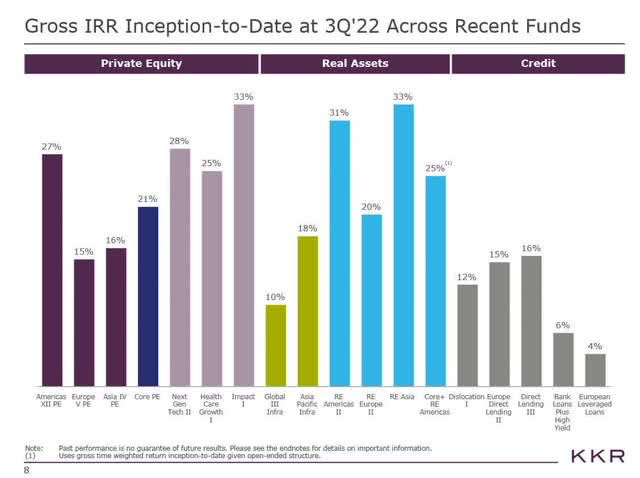

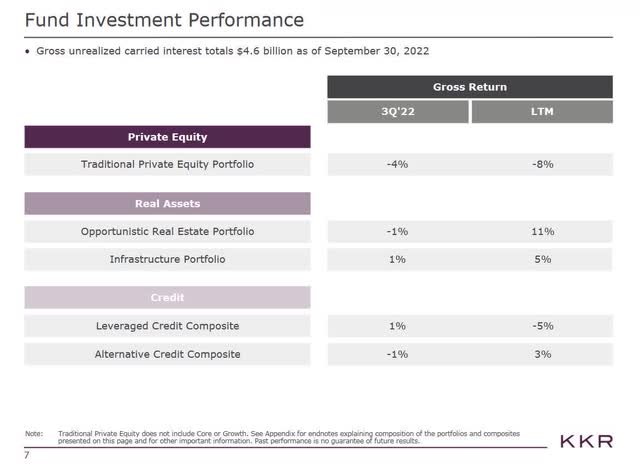

KKR’s fund performance by end of Q3-22 (KKR Q3 earnings release)

Performance is at the core of what they sell to their clients. Although more recently they branched out into infrastructure and similar assets which were more sold as a recession resistant and inflation proof alternative for regular income in a low rate environment.

Fee-related earnings

While carry gets a lot of attention with private equity managers they also earn reliable and stable asset management fees that are mostly insulated from the economic environment.

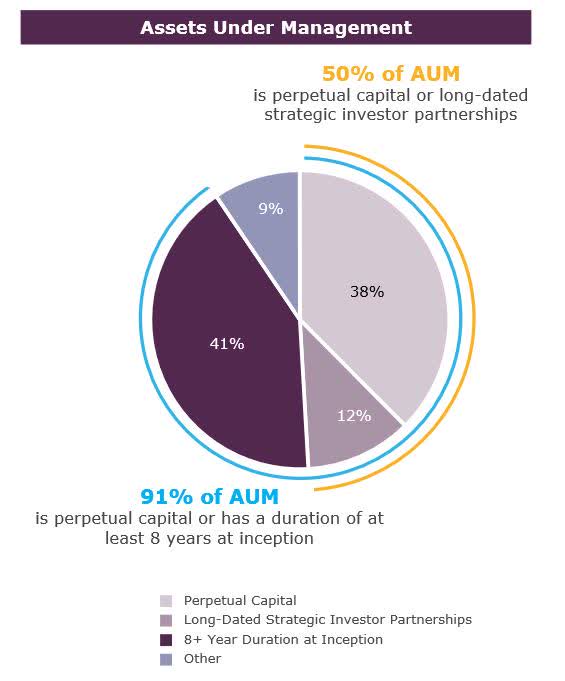

over 90% of AuM are sticky (KKR Q3 report 2022)

As one can see AuM are sticky with 91% of AuM having a perpetual character or a duration of over 8 years at inception. This is why they are less prone to outflows than traditional asset managers. Typically, management fees in private equity also get charged on committed or invested capital rather than NAV. This feature also reduces volatility of fee levels as it ignores market movements. This points to fee-related earnings as a very stable high quality earnings stream. KKR defines FREs as follows:

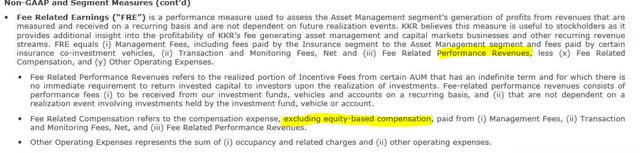

Fee-Related Earnings (“FRE”) is a performance measure used to assess the Asset Management segment’s generation of profits from revenues that are measured and received on a recurring basis and are not dependent on future realization events.

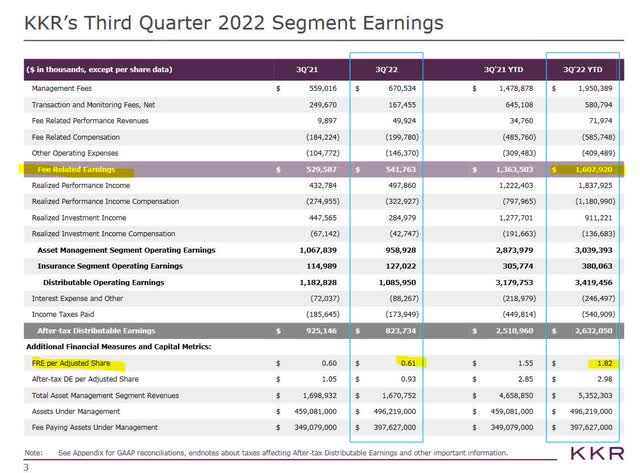

Therefore FRE is a reliable income stream that warrants a higher multiple than carry income that is reliant on realizations. As such I find FRE a valuable valuation tool as it is fairly smooth and reliable and can be modeled easily. KKR currently reports FRE for Q1-3 to be $1.82 or $2.50 for the last twelve months.

Fee related earnings Q1-3 (KKR’s Q3 presentation)

However, I am not willing to take those numbers at face value for my valuation. Because FRE as per KKR’s definition excludes stock based compensation and includes performance fees.

KKR definition of FRE (KKR Q3-2022 press release)

I do regard stock based compensation as a real expense even though it is a non-cash expense. But the cash used to buy back those shares is as real as any. On performance fees KKR’s line of thinking is that they don’t need any realization event (read: sale) to be charged. I still view them as more similar to carry than base management fees as they are much less predictable. Therefore I intend to deduct both stock based compensation as well as performance fees from KKR’s fee-related earnings to get to some proper clean management fee numbers.

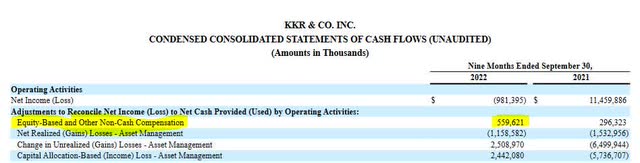

According to their Q3 report equity based and other non-cash compensation for the 9months in 2022 was $560m:

non-cash compensation (KKR Q3 filing)

This is up strongly from 2021. KKR had a reorganization earlier this year which simplified its structure plus last year they acquired Global Atlantic and this year KJRM (Japanese real estate). All of this might have distorted these numbers. Last December the new Co-CEOs received a massive incentive package:

In December, they both received packages of 7.5 million shares that can vest by the end of 2026 if they stay with the firm and KKR’s stock hits a series of performance-based targets up to $135.80 per share. That incentive plan would be worth an additional $1 billion for both of them if all of the shares vest at the top target price

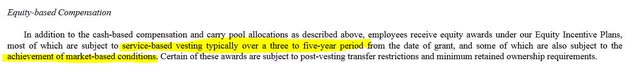

Therefore, there is no way I am ignoring this cost but it is not easy to try and figure out what an average level is. Furthermore, it is unclear how much of the $560m relates to the base management activity and how much is due to e.g. outperformance. But according to their Q3 filing most of it is service based vesting and those market based elements seem to be those like quoted above about reaching some stock price.

KKR equity based compensation (KKR Q3-2022 10-Q SEC filing)

I will deduct the $560m in full from fee-related earnings as that seems to be the most conservative way to do it as FRE gets the highest multiple.

Performance related fees seem to be $72m for Q1-3. I will deduct this in full although there is certainly some offsetting compensation element. Therefore, my adjusted FRE are only $975m vs. the $1.6bn KKR reports. Annualized, that would be about $1300m or roughly $1.49/share in FRE or with a tax rate of 17% about $1.24 in after tax FRE.

Growth profile

KKR had been very successful in growing its AuM over the past years.

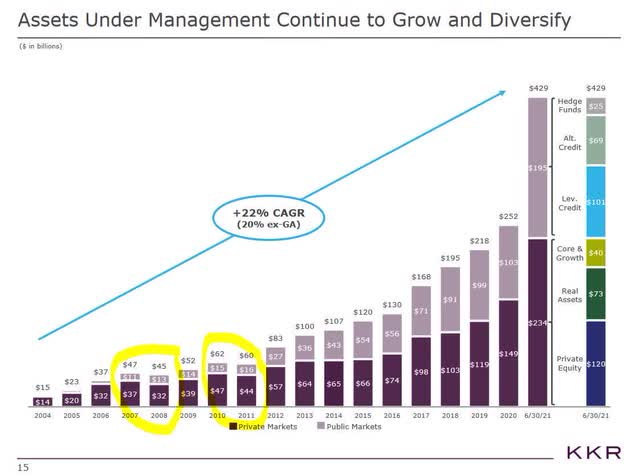

AuM growth (KKR September 2021 presentation)

2021 is distorted by the Global Atlantic acquisition that added $90bn in assets as well as being an absolutely outstanding year for fundraising. I will therefore look only at the development until 2020 for an estimate of future growth rates. From 2004 onward they grew by 19% p.a. From 2007 by nearly 14% and from 2010 by 15%. The latter numbers include the only down years 2008 and 2011. What one can see from those numbers is the resiliency of AuM. Even the great financial crisis in 2008 hardly dented the numbers and recovery in 2009 was swift. KKR has been steadily building out their franchise over the past years and believes that 50%+ of their AuM is not yet scaled. This should give them a long runway for future growth.

KKR also stated that by end of Q3 they had $42bn in AuM that was not yet paying management fees as it was waiting to be deployed but would earn around 1% once done. This means they have pretty much locked in another $420m in management fees. If they can deploy that over the next 1-2 years that alone would fuel a 15-20% growth in management fees. Which means visibility on that front is very high. If they were to deploy $25bn of that over the next year that would grow their after-tax FRE by$0.24 and get them to a run rate of $1.48 by year end. Let’s make it $1.50. And it is not like they cannot raise capital in this environment. Even in Q3 they raised another $13bn.

Valuation

I will try to value KKR by looking at four value drivers.

Firstly, FRE is the basis of my valuation. Then I add carry and performance based compensation. I do a quick and dirty insurance valuation. And finally, I look at what the investments on their balance sheet net of liabilities are worth.

I established base FRE of $1.24 and think they should grow in line with AuM. I believe that while fundraising is likely muted over the next 1-2 years, KKR should still be able to grow AuM by 15%+ p.a. as they scale up many new initiatives and deploy their dry powder. As mentioned above simply by deploying assets not yet earning management fees they should be able to grow FRE to a $1.50 run rate by end of next year. Both ARES and BAM as asset light asset managers in the alternative space currently trade at around 20x FRE (which I have not adjusted). Traditional asset managers like TROW or BLK trade around 15-20x with a lower growth profile and less sticky assets. Brookfield thinks FRE should be valued at 25-35x. I made a simple DCF with much lower growth rates (starting at 12% and then declining strongly after 3 years) but I still get to a 30x fair multiple at a 10% discount rate and a 21x multiple at 12% discount rate. At 15% the multiple drops to 14x. In the current environment I think I demand a 12-15% return and therefore see 14-21x FRE as a reasonable range. This translates into an end of 2023 value of $21 to $32 for only the fee-related earnings. And quite frankly, if they can really pull off 15%+ growth for the next decade then even $45+ seems adequate just for FRE as that would mean quadrupling their earnings power. FRE earnings alone would justify the current stock price.

Next up are performance fees (annualized $100m pretax from their Q3 disclosure) and of course carry. Historically it seems they managed to get about $1bn+ in carry per year.

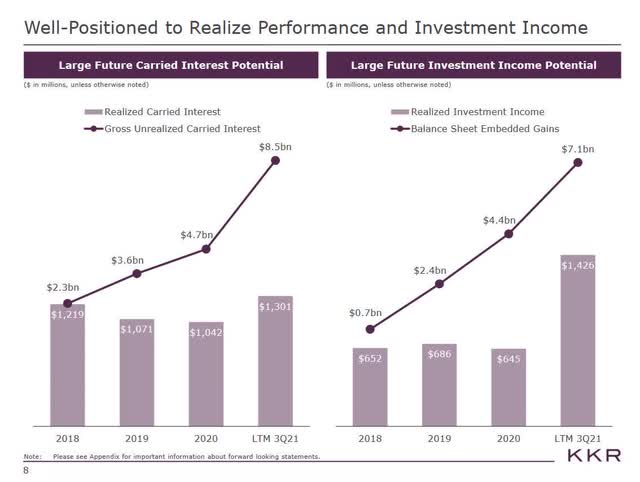

realized carry in past years (KKR presentation at Goldman Sachs December 2021)

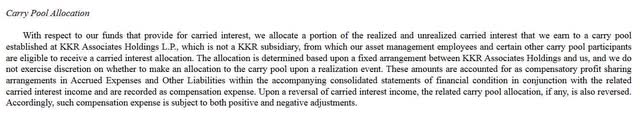

My understanding is that this realized carry is after the allocation to the carry pool for employee compensation.

Description of carry pool (Q3-2022 10-Q SEC filing)

While one can argue that these were very benign markets for exits and that ’23 and maybe ’24 are going to be less helpful when it comes to realizing carry one should also note that AuM has increased massively for KKR since 2020 and with over $100bn in dry powder I would expect them to produce sizable carry over the next decade. I believe applying an 8-10x multiple on $1bn net realized carry and performance fees for roughly $9-11/share is conservative. Given they have double the AuM they had in 2020, $20 for carry alone is not crazy either in my view.

Thirdly, there is the insurance business. KKR acquired a 60% stake in Global Atlantic for $4.7bn in 2021. During 9m/2022 insurance had operating earnings after non-controlling interests of $380m or roughly half a billion annualized. Insurance companies like MET or PRU trade around 10x earnings which puts the stake in Global Atlantic at $5bn which sounds about right given the $4.7bn purchase price nearly two years ago. That would equate to $5.75 per share.

Finally, there are the on balance sheet investments. KKR co-invests in its funds to provide alignment of interest with its investors. This puts its balance sheet at risk and requires capital but also provides returns.

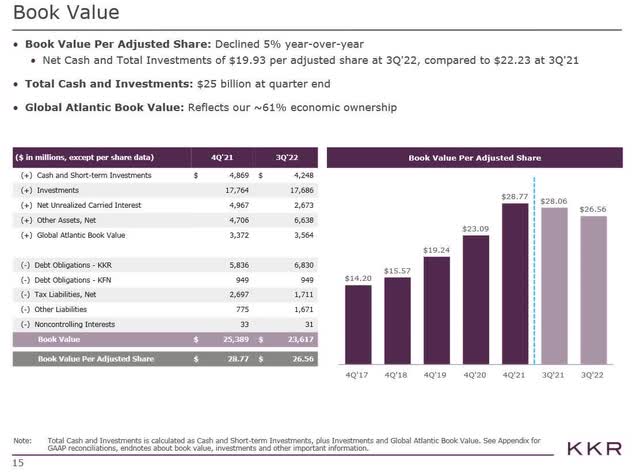

KKR balance sheet investments (KKR Q3-2022 press release)

Firstly, let me state that this is a massive simplification of KKR’s real balance sheet. The real one under GAAP is much messier as they consolidate a lot of entities not the least Global Atlantic. This is basically the deconsolidated one which looks much cleaner. To be on the safe side and avoid double counting I only take cash and investments and deduct all liabilities. Furthermore I do apply an additional 20% discount to investments as those values might not reflect at what they would trade in public markets plus they might come under stress in the coming year, especially real estate and credit. This gets me to a conservative $8/share, much less that what KKR believes it is worth.

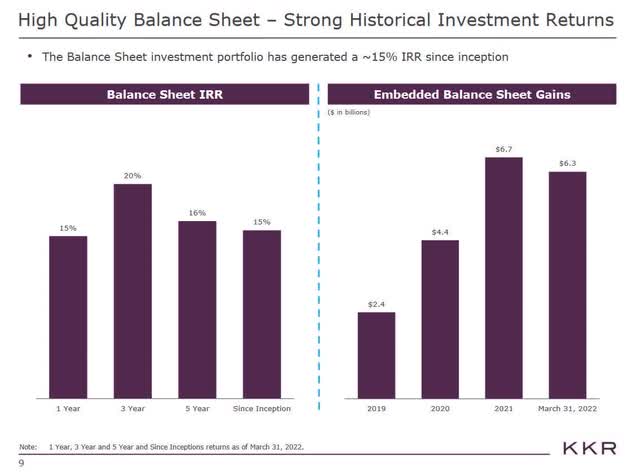

IRRs on balance sheet assets (KKR May 2022 investor presentation)

Given that KKR has historically achieved IRRs of 15% on their balance sheet assets one can once again easily opt for a higher valuation. Also, by giving at least some value to the $6.6bn “other assets, net” whatever those are. At a 50% discount they add another $4/share.

Overall, this leads me to a highly conservative low end valuation of $44 per share for year end 2023. Mind you, that is based on a very low FRE multiple due to a high 15% discount rate for that very high quality income stream and fairly low implied growth rates for FRE. All of which implies sizable future returns going forward when purchased at this level. My base case is $60-65 and my blue sky valuation is $80-85 although I do not think we will see that by end of next year but it will rather materialize through high annual returns over the decade to come. And while the latter might seem unreasonably high, KKR traded at $77 not even a year ago.

Risks

While I highlighted the opportunities above there are also obvious risks. KKR operates with a lot of leverage. Rising rates will increase those costs. According to their Q3 conference call for their own balance sheet KKR has locked in cheap leverage for a long time frame.

We have very intentionally funded ourselves with long-dated liabilities that have fixed cost of capital. The average maturity of our recourse debt is around 20 years, and it is a weighted average fixed coupon of approximately 3% after tax.

But for their investments the environment looks much worse. Many deals are financed by floating rate loans which will strongly increase the interest burden of those companies. Given that recent increases in short term rates were the strongest in half a century this certainly is nothing to sneeze at. Add in a potential upcoming recession and you have a picture where a recapitalization or even failure of some companies is likely. This will hit current investments but on the other hand also provide good investment opportunities for new capital. If we talk about a multi-year crisis then the traditionally highly levered private equity investments will face a difficult time and this could lead to much worse returns and lower fundraising than in the past.

KKR fund performance by asset class (KKR Q3-22 report)

The above slide shows that fund performance has started to deteriorate. Declines seem muted vs. public market and there has been criticism that private equity valuations are too optimistic. I guess one could argue that public markets tend to be too manic-depressive and that private markets tend to be more serene in their valuations. Still, there is no doubt a risk to the health of the underlying investments, be it highly levered companies, real estate or credit for the next years. That said, KKR was founded 1976 and has navigated challenging environments for nearly half a century now. They had their share of failures and there will no doubt be some this time around. Looking at the detail they provided on their current main funds (see “investment vehicle summary” in the appendix of their Q3 release) they have a major cushion on the fair value of their assets vs. cost for the private equity vehicles. Less so for real estate, and they seem to be under water in credit/liquid strategies which is the smallest segment (not including Global Atlantic). On the positive side there have been many strong realizations in those funds in the past to satisfy investors and dry powder makes up a large proportion of AuM waiting to be invested.

Global Atlantic might be exposed to increased surrender risk given the strong and sudden increase in rates. During the Q3 call they mentioned that 75% of the book is somewhat protected but that still leaves 25% of the book exposed to this risk.

How to trade it

By how KKR has been trading it seems clear that investors focus more on risks than opportunities right now. High uncertainty and perception as a levered investment company has led to a now very attractive valuation. I believe the current valuation already warrants a foothold investment. That said, I expect investment markets in 2023 to be challenging. I expect the Fed to go for a recession that will also impact the labor market. The Fed has already signaled that it wants to stay tight until it sees a clear improvement on the inflation front. I believe that this will put the market under pressure more than it has been this year already. Earnings estimates should continue to come down and worries about defaults in credit should increase. In this environment I would think that KKR sells off further even though I regard it as actually a positive for the company due to its massive dry powder to be deployed. This would lead to a great buying opportunity during 2023. I would hope that in the latter part of 2023 investors will realize that KKR was able to put a lot of capital to work and that FRE has been growing despite the negative environment. As investors then look forward they should become more positive on the stock and KKR should start to recover in my opinion.

Will it play out exactly like that? I don’t know, but this is my best guess. I bought some KKR but am looking forward to further increase my position at lower levels.

Summary

The current environment is challenging for many of KKR’s investments and the stock has sold off. This ignores the fact that KKR has a lot of dry powder to put to work at very high expected returns. Right now KKR is at present cheap and I believe the current price is already a good entry point. That said, I expect them to trade lower during 2023 should we get the recession the Fed seems to target. That would then be the point to size up and position oneself for a recovery in late 2023 or 2024. Assuming some normalization of the economic environment, I think KKR should then provide outsized returns for a decade to come and investors will look back at 2023 as an amazing investment opportunity in a premier asset management franchise.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment