mikulas1

Investment Thesis

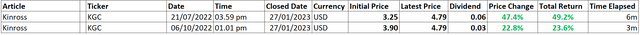

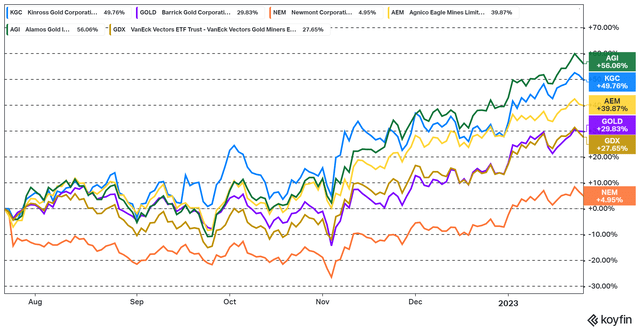

Kinross Gold (NYSE:KGC) was very out of favor during 2022 following the divestment of the Russian assets for relatively little money and a couple of quarters with sub-par operating performance. The valuation had at that point gotten extremely depressed, I consequently added Kinross to the portfolio, and wrote a couple of articles on the company during the second half of 2022.

While my holding period is usually around 1-3 years, I recently divested my holdings in Kinross for more attractive risk-rewards elsewhere in the industry. If you invested at the same time as my articles were published, you would have up until today made a healthy return in a relatively short period of time.

Figure 1 – Source: My Article Returns

We can see that Kinross has since the publication of the first article outperformed many peers in the industry, which has together with the lowered production guidance for 2023 led to less of a bargain price for the stock. It now appears more to be priced in-line with other gold producers.

Valuation

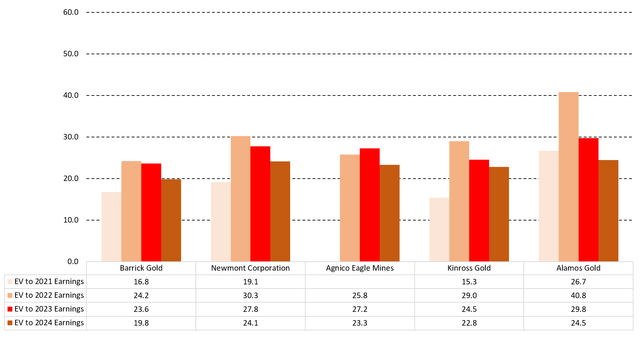

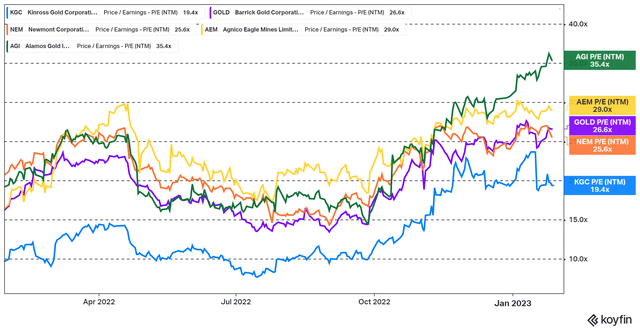

In the below chart from Koyfin, we can see the forward-looking price to earnings ratio for a select number of gold miners.

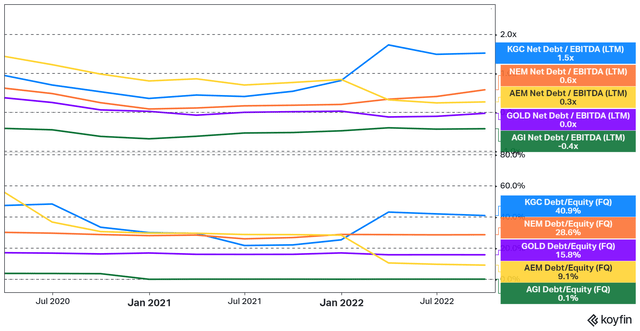

Where the valuation has increased for all of them. However, Kinross still looks to be cheaper than the peers. A small part of that can possibly be explained by operating in slightly riskier jurisdictions than some of the peers, even after divesting the Russian assets. Most of it is likely because Kinross has more leverage compared to the peers. Both the debt to equity and net debt to EBITDA ratios are substantially higher for Kinross than the peers.

So, if we instead of using the market cap turn to the enterprise value and look at the next few years earnings. We can in the in the chart below see that Kinross might be slightly cheaper than most peers on 2023 earnings, but very similar if we look at 2024 projected earnings.

Figure 5 – Source: Estimates from Koyfin & Other Data from Quarterly Reports

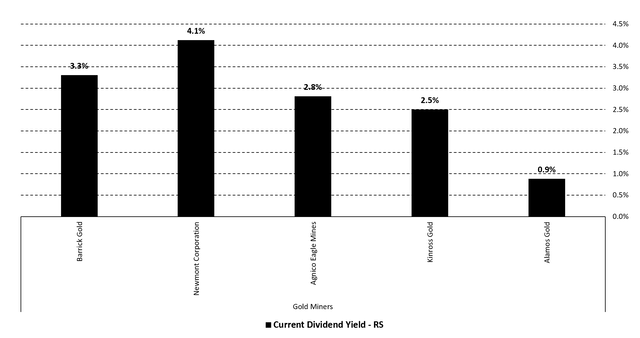

This does not mean that Kinross is a bad investment at this level, just that the risk-reward based on the valuation is not as favorable as it was during part of 2022. Kinross still has an aggressive buyback program in place, which is set to use 75% of excess cash (FCF – interest & dividends) in 2023 and 2024 for buybacks. That has the potential to be a very good tailwind for the stock price going forward. The dividend yield is otherwise slightly below most of the selected peers.

Figure 6 – Source: Data from Seeing Alpha

Conclusion

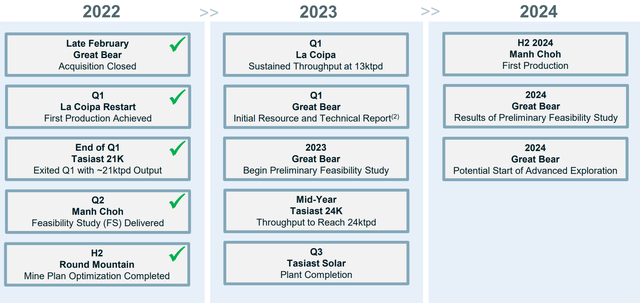

Kinross has a few interesting catalysts over the next few years, where I am most interested in the initial resource and technical report on Great Bear, due to be released in this quarter. This asset has the potential to deliver a very large amount of value for Kinross, if it turns out to be as good of an asset as many suspects. It is important to keep in mind though, that we are talking about an asset, which is likely 5+ years from production. So, it can take quite a while for the company to realize that value in the form of cash flows and earnings.

Figure 7 – Source: Kinross January 2023 Presentation

I like Kinross as a company and think the buyback strategy is something many peers, especially those with lower leverage ratios, should copy. However, the strong returns lately together with a lowering of forward production estimates makes it less of a compelling buy today. There are many other precious metals miners, that are still trading with more depressed valuations, which is where I like to invest even if the quality of some of those companies is slightly lower.

If you like this article and is interested in more frequent analysis of my holding companies, real-time notifications on portfolio changes, together with macro and industry analysis. I would encourage you to have a look at my marketplace service, Off The Beaten Path.

I primarily invest in turnarounds in natural resource industries, where I have a typical holding period of 1-3 years. Focusing on value offers good downside protection and can still provide great upside participation. My portfolio generated a return of 81% during 2020, 39% in 2021, and -8% in 2022.

Be the first to comment