Nomi2626

Investment Thesis

Kinder Morgan, Inc. (NYSE:KMI) is a player in the almost oligopolistic energy infrastructure sector in the U.S. Their undeniable position as a market leader both in terms of their pipeline network reach and their total volume of natural gas, LNG, and CO2 transport makes them a hugely important company to the U.S. as a whole.

Their relatively unimpressive history from a fiscal perspective has been evolving rapidly over the past year, and the company looks to be in a position to reap huge rewards from new contracts established at the current commodity prices.

Further growth is expected due to the rapidly changing global landscape for energy sources, which should allow Kinder Morgan to further strengthen their position as a market leader.

However, growing ESG risks combined with a slightly pricey current share price means absolute objective evaluation of the companies current and future value is difficult.

Company Background

Kinder Morgan is one of the largest energy infrastructure companies in North America. They specialize in owning and operating a pipeline transportation network which is used in transferring natural gas, gasoline, crude oil, carbon dioxide ((CO2)) and other petroleum products.

Based out of Houston, Texas, the company operates over 83,000 miles (134,000km) of pipelines and over 140 control terminals. By far the largest portion of revenues is generated by their natural gas pipeline business of which 93% of earnings revolve around midstream processes.

Kinder continues to be the largest transporter of CO2 in the United States. Furthermore, this segment of their business is rapidly growing in profitability. Their focused investment into their CO2 infrastructure should allow the company to extract significant levels of value in the future.

Economic Moat – In Depth Analysis

Kinder Morgan has a truly unrivalled infrastructural advantage in the U.S. The degree of reach and complexity present in their pipelines and terminals provides a significant source of sustainable competitive advantage to the firm.

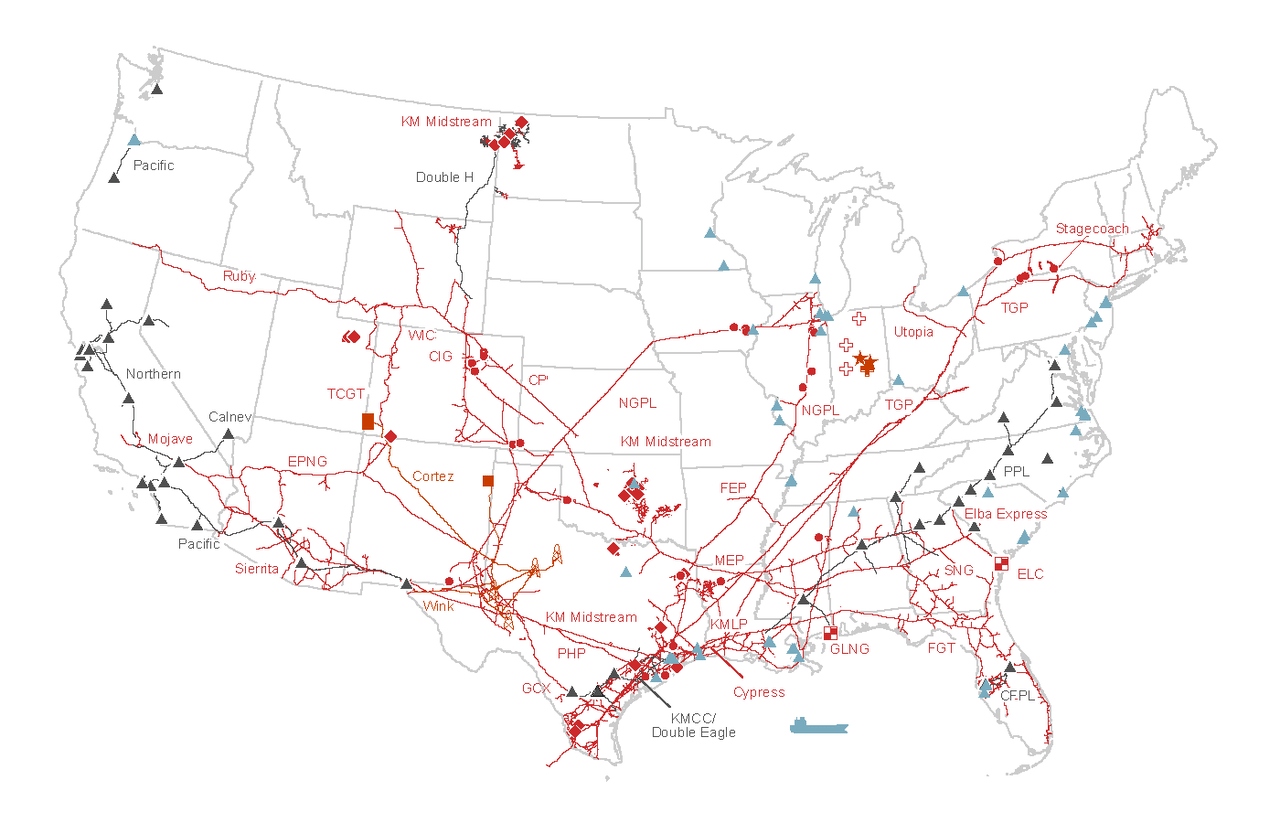

Kinder Morgan Asset Map (Kinder Morgan Website)

The U.S. relies on Kinder to provide a significant portion of natural gas transfers (approximately 40% of all natural gas transfers is handled by Kinder). This national importance to their infrastructure ensures it remains in most stakeholders’ interests to ensure Kinder Morgan continues to operate their pipelines, which in turn allows Kinder to continue extracting significant returns from the business.

By operating such a comprehensive network of natural gas pipelines, Kinder is able to ensure that key regions of supply are able to deliver their product to areas of increased demand.

Furthermore, by being the first firm to manufacture a significant portion of their interstate pipelines, Kinder is able to easily meet increased demand for natural gas volumes by adding parallel lines. This allows Kinder to decrease the costs associated with increasing supply of their pipelines while simultaneously accelerating the process of bringing such products to market.

Their established status and huge profitability allows the firm to be more elastic to demand increases. This permits Kinder to better harness potential revenue opportunities in comparison to their competitors, which further drives the depth of their economic moat.

A primary strategy of Kinder’s growth in the past 20 years has been the acquisition of third-parts assets such as El Paso Energy and Hiland. Thereafter, Kinder has consolidated these companies into their own operations structures. A majority of this serial acquiring was completed in the early 2010s, with the last five years having been relatively calm in comparison.

Kinder’s revenues are further stabilized by the type of contracts utilized in the marketplace for natural gas pipeline transfers.

Approximately 90% of Kinder’s natural gas contracts are fee-based or minimum volume agreements. Buyers are responsible for either accepting the pre-arranged levels of supply or paying a penalty fee which essentially covers the value of the lost supply. Either way, such contracts guarantee Kinder significant stability in revenues from their natural gas segment, irrespective of the prevailing macroeconomic conditions.

Their current average contract life for these natural gas agreements with customers is approximately six years. This provides investors with a good level of confidence in their ability to continue generating value into the mid-term future.

A similar situation is present in the CO2 segment, where supply contracts are also minimum-volume based with an average lifespan of 8 years. The majority of CO2 supplied by Kinder is used by third-parties in Enhanced Oil Recovery (EOR) projects.

EOR is an advanced tertiary recovery solution for oil fields and can allow between 40-60% more extraction from a given reservoir. Kinder also uses a portion of their extracted CO2 in their own EOR business, allowing them to produce over 50,000 barrels of oil per day. Much of this oil comes from their large SACROC Unit in the Permian Basin of West Texas.

The extraction of crude oil allows Kinder to engage directly in the sale and transfer of a valuable commodity. They use a long-term hedging strategy to mitigate risk and generate more stable prices from oil production to guarantee strong revenues.

Financial Situation

Kinder Morgan has been operating a profitable business for a good portion of the last 10 years. Since their serial acquisitions of third-party assets ceased, Kinder has been consistently generating EBIT margins of around 20-30% with their 5Y average resting at 27.48%.

Earnings for FY22 have been incredibly successful, with distributable cash flow (DCF) in FY22 Q3 reaching $1.1B compared to just 1.0B in Q3 FY21. This represents an excess of $492M compared to the declared dividend during the quarter.

Adjusted earnings were up to $575M for the quarter, versus just $505M in the same quarter 2021. These returns have resulted in fiscal performance exceeding their budget and well above the planned values expected by management.

No doubt, the tragic consequences of the war in Ukraine have aided U.S. natural gas and oil producers, something Executive Chairman Richard D. Kinder is well aware of.

However, it must be acknowledged that Kinder is finally benefitting from their heavy capital investments over the past decade. It is thanks to this forward thinking planning that they are now in a position to take full advantage of this relatively sudden increase in demand for U.S. natural gas and crude oil.

Earnings per share for Q3 FY22 were up to $0.25 per share, which represents an increase of 14% compared to Q3 FY21. Total net income for the first nine months of 2022 amounted to $1.88B, up 50% compared to the same period in 2021. This large spike in net income is in part attributable to a non-cash impairment charge taken in 2021.

DCF for the first nine months of 2022 was down 14% compared to 2021, primary due to nonrecurring earnings during the February 2021 winter storm. Not withstanding the impacts of storm Uri, DCF would have been up 15% compared to the previous year.

The outlook for 2022 by management now expects a 3% over-performance of budgeted DCF and net income. Adjusted EBITDA is expected to outperform budget by 5%.

Overall, Kinder Morgan has shown healthy and continued growth on their income statement so far in 2022, which has resulted in their TTM ROIC climbing to 3.98% compared to a 5Y average of 2.05%. Their TTM net margin has also increased to 13.14% up 2.48% from 2021.

Cost of Sales for Kinder has increased in the first nine-months of 2022 compared to 2021 by 60%, up from $4.5B to over $7.2B. This was primarily due to non-recurring costs associated with a litigation matter along with the rupture of a natural gas pipeline in Tennessee in July.

Kinder Morgan’s balance sheet is in outstanding condition. The firm currently (Q3 FY22) has over $69B in total assets, with total liabilities amounting to just $37.8B. Kinder has a fantastic quick ratio of 0.38 (current assets minus inventory divided by current liabilities). Their current ratio is also an attractive 0.62 (current assets divided by current liabilities). Kinder’s Debt/Equity ratio is 1.03.

Management also used a good portion of proceeds from the divestiture of a 25.5% equity interest in Elba Liquefaction Company, L.L.C. (ELC) to reduce their short-term debt and create additional capacity for share repurchasing. This has allowed the firm to repurchase 21.7 million shares year-to-date at an average price of $16.94 a share.

Considering their exceptional capital allocation and high-levels of fiscal responsibility, it is safe to say Kinder Morgan exhibits healthy financial stability and is not currently struggling with any liquidity risks whatsoever.

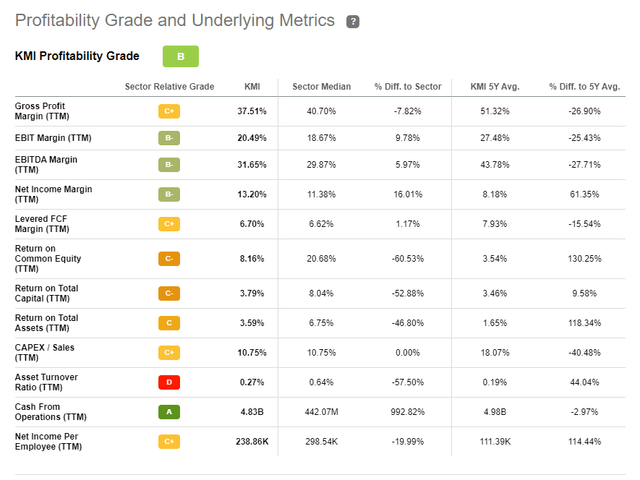

Seeking Alpha – KMI Profitability

Seeking Alpha’s Quant assigns Kinder Morgan with a profitability grade of B, which may not in itself paint the whole picture regarding the firm’s future. While current Returns on Common Equity, Total Capital and Total Assets lag the sector as a whole by around 50%, the significant levels of investment into their infrastructure over the past years have skewed these figures slightly.

Furthermore, their EBIT healthy EBIT margins combined with solid cash generation abilities suggest the company is beginning to realize the benefits from the investments. When combined with the rapidly growing earnings being experienced in their natural gas and CO2 segments, I believe their profitability is set to increase significantly into the new year.

The key drivers of these future profits moving forwards lie in the rapidly increasing price of CO2 thanks to the increasing prevalence of EOR operations in the Permian basin. This growth in demand for such tertiary oil recovery processes is due to the robust commodity prices for crude oil encouraging operators to continue extracting oil thanks to the greater profit margins available.

From a natural gas perspective, Kinder Morgan expects a significant growth in profits largely to be driven by an increase export of the commodity to Mexico. A short to mid-term increase in profits can also be expected from the rising prices for natural gas due to the global energy crisis currently taking place.

Further profitability is expected to be generated from a growing global demand for Liquid Natural Gas (LNG). Kinder Morgan is in a prime position to take advantage of a desire by most Western nations to reduce their dependance on LNG purchases from Russia due to the political concerns associated with supporting Russia during the current war with Ukraine.

Considering that Kinder handles just over 50% of all U.S. LNG exports, little doubt exists that the company would be able to extract significant value from this segment as commodity prices and demand increase.

While their current profitability can be considered as just average, the future looks like there may be a great opportunity for the firm to enter a growth stage, bringing along with it increased margins and cash flow-generation opportunities.

Valuation

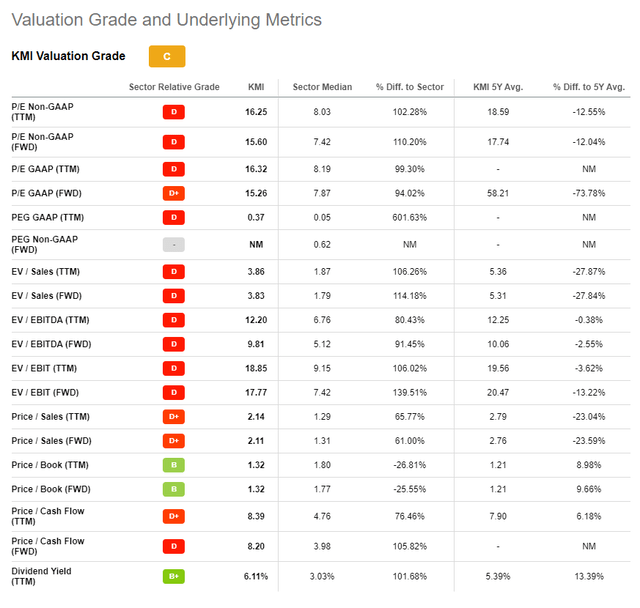

Seeking Alpha’s quant system has assigned a C Valuation rating for Kinder, which I am currently largely inclined to agree with. The FWD P/E GAAP of 15.26 is almost double that of the sector median of 7.87.

Furthermore, their FWD EV/EBITDA of 9.81 once again exceeds the sector median by over 90%. These metrics alone suggest the firm is trading at a significant overvaluation compared to their market competitors and their intrinsic value.

However, it must be noted that their FWD Price/Book value is only 1.32 and they have provided a fantastic Dividend Yield of 6.11% for the trailing twelve months. It must also be considered that their FWD ROE Growth Rate is expected to be a truly remarkable 182.67%.

These secondary metrics support the hypothesis that the firm is most likely about to enter a significant growth stage in their business.

In the short term (3-10 months) it is difficult to say exactly what the stock will do. I believe the stock price may still exhibit some bearish tendencies due to an expected market sell-off after the recent rally the stock has experienced. However, strong demand in the new year and the much-awaited Q4 and FY2022 reports should bring a boost to the share price if results are as positive as we are expecting.

In the long-term (2-4 years) I fully expect their position as a leader in the U.S. energy infrastructure industry to become even stronger. Their oligopolistic infrastructural advantages combined with the potential for significant future growth places little doubt in my mind over the almost undoubtable returns the company should be able to provide to shareholders.

However, significant responsibility lies with management to effectively manage expansion without crippling the firm with debt.

If the share price falls another $2-$5, it would in my opinion firmly place the firm in a deep-value position making it an attractive possibility for long-position, value-seeking investors.

Risks Facing Kinder Morgan

The primary risks for Kinder Morgan arise from the significant ESG risk exposure the company faces. While a majority of this risk simply exists due to the firm operating in the generally environmentally unfriendly oil and gas industry, recent pipeline spills along with increasing pressure from social groups places the firm in a difficult position.

Social and fiscal pressures on some of their projects, such as the controversial and mismanaged Trans Mountain pipeline have led Kinder to sell-of their Canadian operations entirely. While this is an extreme situation which I doubt would directly be replicated with any of the U.S. infrastructure, it does highlight the genuine risk ESG issues can pose to firms.

Significant pipeline ruptures, spills or leaks can also lead to significant fiscal penalties which Kinder Morgan would have to manage. An example of this was already seen earlier in July when a natural gas pipeline of their ruptured in Tennessee. This led to significant costs for the firm.

While not financially fatal on a non-recurring basis, an increased prevalence of such events would undoubtably harm investor sentiments along with overall operating margins.

The possibility for falling international commodity prices for LNG, natural gas, CO2 and crude oil also poses a significant risk to Kinder’s overall profitability. While the domestic U.S. contracts are almost entirely immune to these fluctuations, they still harbor a significant level of indirect exposure related to overall volumes demands.

Long-term demand for CO2 is expected to grow as oil become more and more difficult to extract from existing basins (thus demanding EOR operations and the prerequisite: CO2). However, short-term fluctuations such as those seen in 2020 due to the COVID-19 outbreak could harm profitability significantly.

Summary

Kinder Morgan has a relatively unimpressive history from an investor standpoint. However, their strong business fundamentals, strong foothold in the U.S. market combined with the capital necessary for significant growth has placed the company in an attractive position for potential investors.

While share prices continue to trade at a relative premium to the company’s current value, the promise of strong future cashflow generation could mean Kinder Morgan, Inc. stock simply will not drop much below its current levels.

As a short-term investment, I believe there is still some volatility for Kinder Morgan stock as the current market selloff continues. However, in the long term, I believe their undeniable position as a market leader places Kinder in the perfect position for a much-awaited rebound.

I will carefully be watching Kinder Morgan, Inc. stock for the next couple of months and eagerly await their Q4 and FY22 results.

Be the first to comment