andresr

When it comes to the furniture market, you might think that every company is more or less the same. But some have a particular niche in which they operate that helps to distinguish them from the competition. A great example of this can be seen by looking at Kimball International (NASDAQ:KBAL), an Omni channel commercial furnishings company that focuses on providing products and services to various workplaces, healthcare facilities, and even the hospitality markets. Historically speaking, the financial trajectory of the company has been rather mixed. Most of this pain, however, was driven by the COVID-19 pandemic. Fast forward to today though, and the fundamental picture for the enterprise is looking up. Shares are incredibly cheap on an absolute basis but are probably closer to being fairly valued relative to similar firms. Given the performance improvements the company has experienced, combined with the fact that shares have fallen considerably in recent months, I do think now is a good time to increase my rating on it from a ‘hold’ to a ‘buy’.

A tough time

Back in January of this year, I wrote an article discussing the investment worthiness of Kimball International. In that article, I talked about how cheap shares of the company were, even concluding that the company may have some upside potential for investors moving forward. My sentiment on that front was compounded by the fact that sales growth had been encouraging over the prior few quarters and the backlog for the company had been growing. But because of the inconsistency of the firm’s bottom line and the struggles that it dealt with during the pandemic, I felt as though it wasn’t quite the right time to rate the company a ‘buy’. So instead, I rated it a ‘hold’ to reflect my view that it should generate performance that more or less would match the broader market moving forward. Fast forward to today, and the company has performed worse than I anticipated. While the S&P 500 is down by 9.2%, shares of Kimball International have dropped by roughly 20%.

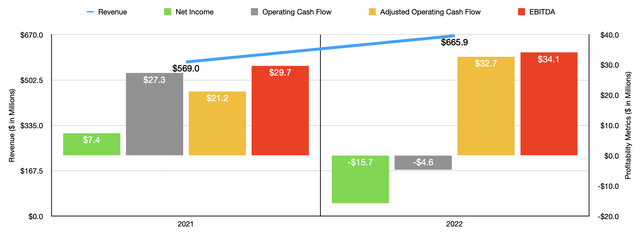

When I last wrote about the company, we only had data covering through the first quarter of its 2022 fiscal year. We now have data covering not only the rest of that year, but also the first quarter of 2023. For 2022 as a whole, it is worth noting that the company’s top line came in quite strong. Revenue went from $569 million in 2020 to $665.9 million last year. This roughly 17% increase in sales was driven largely by a 13% rise in organic net sales growth. This was driven largely by increased pricing and higher volume in two of the company’s three major end markets. Although the company continued to see year-over-year declines in the hospitality market, the healthcare market grew by 8% while workplace revenue, the largest source of sales for the firm, jumped by approximately 31%.

Although it was great to see revenue increase, bottom line results could have been better. Driven by a modest decline in the company’s gross profit margin and by a significant goodwill impairment charge, the company saw its net income fall from $7.4 million in 2020 to negative $15.7 million last year. Operating cash flow went from $27.3 million to negative $4.6 million. On an adjusted basis, however, it did improve slightly, climbing from $21.2 million to $32.7 million. And over that same window of time, EBITDA for the business also increased, rising from $29.7 million to $34.1 million.

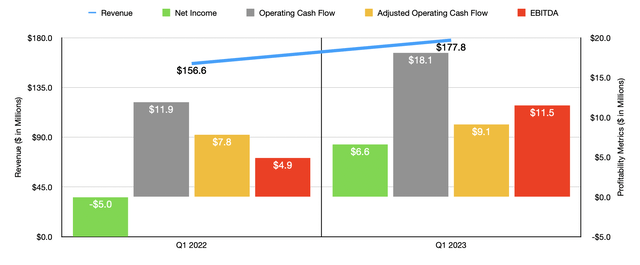

With the 2023 fiscal year now underway, it’s worth touching on how the company performed during the latest quarter. According to management, sales came in at $177.8 million. That’s 13.5% higher than the $156.6 million reported the same quarter last year. The hospitality space continues to struggle, with sales down roughly 21% year over year. However, the healthcare category for the enterprise has seen an increase in revenue of 13%, while the workplace category jumped by 22%. With this rise in revenue also came improved profitability. The company went from generating a net loss of $5 million in the first quarter of last year to generating a profit of $6.6 million the same time this year. Operating cash flow went from $11.9 million to $18.1 million. If we adjust for changes in working capital, the increase would have been more modest from $7.8 million to $9.1 million. Meanwhile, EBITDA rose nicely, climbing from $4.9 million to $11.5 million.

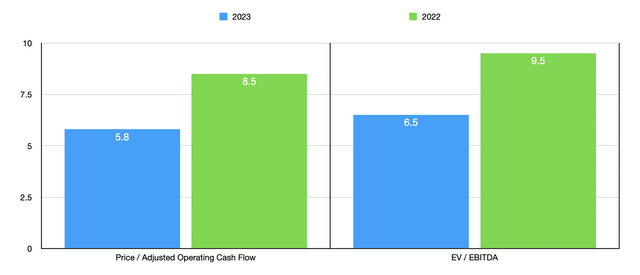

For the 2022 fiscal year in its entirety, management expects revenue to come in at between $750 million and $780 million. At the midpoint, that would translate to a year-over-year increase of 14.9%. In addition to that, EBITDA is forecasted to come in at between $48 million and $52 million. No guidance was given when it came to adjusted operating cash flow. But if we assume that it will increase at the same rate that EBITDA is forecasted to, we can expect a reading this year of $47.9 million. Based on these figures, the company is trading at a forward price to adjusted operating cash flow multiple of 5.8 and at a forward EV to EBITDA multiple of 6.5. Using the data from the 2022 fiscal year instead, these multiples would be 8.5 and 9.5, respectively. Also, as part of my analysis, I compared the company to five similar businesses. On a price to operating cash flow basis, these companies ranged from a low of 5.1 to a high of 18.3. Only one of the five was cheaper than our target. Meanwhile, using the EV to EBITDA approach, the range was between 3.8 and 14. In this scenario, three of the five were cheaper than our prospect.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Kimball International | 5.8 | 6.5 |

| NL Industries (NL) | 18.3 | 3.8 |

| Interface (TILE) | 17.4 | 6.4 |

| Virco Manufacturing Corp (VIRC) | N/A | 14.0 |

| ACCO Brands (ACCO) | 5.1 | 9.1 |

| HNI Corporation (HNI) | 16.6 | 6.2 |

Takeaway

Truth be told, I do think that economic conditions are likely to get worse before they get better. In the near term, this could lead to fewer offices, hospitality companies, and other firms, investing heavily into the furnishings space. But in the long run, shares of Kimball International are looking up, with that potential being driven by robust sales and cash flow figures. Historically speaking, Kimball International has been a bit volatile and shares are not priced all that cheap compared to similar firms. These facts have led me to still be cautious about the company moving forward. But for those who like this space and are drawn by attractively priced companies, Kimball International definitely makes sense to look into.

Be the first to comment