littleny/iStock Editorial via Getty Images

A Defensive Stock Helping With Today’s Severe Headwinds

As a defensive stock, Keurig Dr Pepper Inc. (NASDAQ:KDP) seems to provide a hedge against the headwinds of economic uncertainty which is being triggered by the following factors.

Despite the US Federal Reserve’s July interest rate hike, the fourth consecutive hike for another 75 basis points to 2.25%-2.5%, inflation is still not improving as it should.

From the last 40-year high of 9.1% in June, the annual inflation of 8.5% in July fell more than market expectations of 8.7%. But if it weren’t for the sharp drop in gasoline costs, mainly due to lower fuel taxes, perhaps the rise in prices wouldn’t have slowed down at all.

In addition, the war in Ukraine combined with geopolitical tensions between Western countries and Russia and between the United States and China are putting further upward pressure on both fossil fuels and other commodities, leading to inflation because of higher production costs.

Therefore, the US Federal Reserve must continue its aggressive hawkish stance on interest rates, increasing the long-term risk of the economy sliding into recession or even stagflation, which would be worse.

In fact, there are already signs of an economic slowdown and after a second straight decline in gross domestic product growth, the US economy is in a technical recession. The emerging scenario hurts consumption and investment, and as a result, earnings, growth, and market valuations of listed companies will suffer from the adverse economic environment. Faced with this challenge, investors are looking for solutions that can increase the level of protection of their assets. A solution is to make more room in the portfolio for defensive stocks such as Keurig Dr Pepper Inc.

Keurig Dr Pepper and Its Strength

Headquartered in Burlington, Massachusetts, Keurig Dr Pepper is a leader in the North American beverage industry with approximately $13 billion in annual sales and more than 27,000 employees.

Even in an adverse economic cycle, consumers are unlikely to economize on KDP products as these fill a primary need or feed a consumer habit that has been consolidated over the decades. Even record inflation, like the one we are currently experiencing, doesn’t impinge this kind of sales because the company can easily pass on more expensive raw material procurement and energy costs to the end consumer. At the end of the shopping trip, the amount spent is significant, but the preference for brands from KDP (and other well-known competitors) in terms of number of items in the shopping cart has most likely not changed.

KDP’s portfolio sources revenue from well-known brands as well, such as Keurig, Dr Pepper, Green Mountain Coffee Roasters, Canada Dry, Snapple, Bai, Mott’s, CORE and The Original Donut Shop. In addition to KDP’s own brands (over 125), the US beverage company’s portfolio includes brands under license and in partnership with other companies.

KDP relies on a dense distribution network for the nationwide distribution of its hot and cold beverages throughout North America.

As a result, Keurig Dr Pepper typically has much more modest revenue growth than so-called growth companies, but in times of severe headwinds like the current one, revenue is more resilient showing muscles against heightened inflation and recession.

The company’s resilience was also shown in the second quarter of 2022 [Q2 2022].

Sequential, Year-to-Date (YTD), and Longer-Term Sales Trends

The successful recovery from the bottlenecks in the supply chain, especially in coffee and non-carbonated beverages, together with the introduction of higher prices against the high inflation, led to the following significant revenue year-over-year increases for Q2 and YTD periods (see figures in the table).

|

Item |

Q2 2022 |

Year over Year Change |

YTD |

Year over Year Change |

|

Net Sales |

$3.55 billion |

+13.5% |

$6.63 billion |

+9.9% |

Commenting on the results for the second quarter of 2022 [Q2 2022], Bob Gamgort, the US beverage company’s chairman and chief executive officer, said that the results were strong as they reflected the flexibility along with resilience of the KDP business.

The strong net sales results were credited to the CORE Hydration, Snapple, Polar Seltzer, Vita Coco, Mott’s and Hawaiian Punch brands.

Over a longer reporting period of 12 months, the portfolio continues to show a positive trend in sales, increasing from year to year.

Although at a slower pace most recently compared to its closest competitors, Coca-Cola FEMSA, S.A.B. de C.V. (OTCPK:COCSF) and Monster Beverage Corporation (MNST), KDP’s sales held up very well during the darkest period of the pandemic and at a steady pace, giving confidence in the company’s ability to weather a very challenging near-term future.

|

Item |

12 Months Jun 2020 |

YoY Change (vs 2019) |

12 Months Jun 2021 |

YoY Change (vs 2020) |

12 Months Jun 2022 |

YoY Change (vs 2021) |

|

KDP Net Sales |

$11.28 billion |

+3.87% |

$12.18 billion |

+8% |

$13.27 billion |

+8.95% |

|

MNST Net Sales |

$4.31 billion |

+7.93% |

$5.15 billion |

+19.54% |

$6.01 billion |

+16.72% |

|

COCSF Net Sales |

$8.22 billion |

-0.41% |

$9.42 billion |

-0.59% |

$10.5 billion |

+12.30% |

Q2 2022 Higher Earnings and Analyst Beat

On a pro forma basis, diluted earnings per share were $0.39 in the Q2 of 2022, representing a 2.6% year-over-year jump, and they were in line with the analysts’ average estimate.

|

Item |

Q2 2022 |

Year over Year Change |

YTD |

Year over Year Change |

|

Pro forma diluted EPS |

$0.39 |

+2.6% |

$0.72 |

+1.4% |

Strong selling prompted the CEO to express optimistic thoughts on a business model that can thrive in an evolving macro environment that is expected to be very volatile. Indeed, a resilient KDP business implies a lower need for capital investment, which becomes a significant advantage over many other companies whose access to credit has been hampered by the rise in borrowing costs due to the aggressive US FED.

As for the sustainability of the debt exposure: KDP’s current financial position is also the result of high borrowing, like many other companies, but its debt exposure ($13.3 billion as of June 30, 2022) is not an issue, as the company convincingly demonstrates with an interest coverage ratio of 6.8. that this can be handled very well. The debt compared to available liquidity of only $552 million.

Keurig Dr Pepper Inc. Calls for Higher Sales and Reaffirms Earnings Vs Analysts’ Estimates

Given the CEO’s expectations and a strong portfolio that is not afraid of future challenges, the company has raised its revenue guidance for the second half of 2022 and now forecasts steady net revenue growth in the low double digits, while maintaining guidance for mid-single-digit adjusted EPS growth.

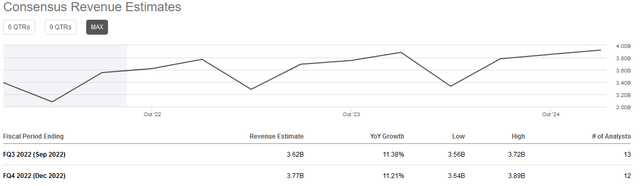

Wall Street analysts estimate that KDP’s revenue will reach $3.62 billion in the third quarter of 2022 and $3.77 billion in the fourth quarter of 2022, corresponding to a growth of 11.38% and 11.21%, respectively.

Seekingalpha KDP earnings estimates

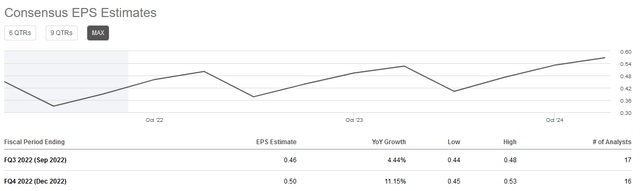

Wall Street analysts estimate that KDP’s earnings per share will increase 4.4% year on year to $0.46 in Q3 2022 and 11.15% year on year to $0.50 in Q4 2022.

Seekingalpha KDP earnings estimates

Dividend Yield: A Good Scorecard

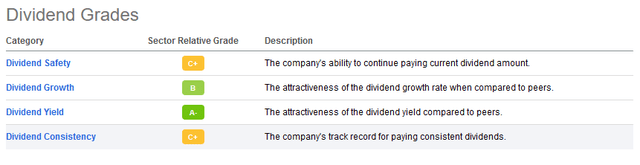

A rosy outlook for revenue and earnings complements KDP’s already good dividend scorecard.

Seekingalpha KDP dividends scorecard

Based on a payout ratio of 46.85% of earnings, Keurig Dr Pepper pays a quarterly cash dividend of $0.19 per common share, the most recent of which was paid on July 15. The payment results in a dividend yield of 1.91% versus the S&P 500’s 1.50% at the time of this writing.

Stock Valuation and Comparison with Peers

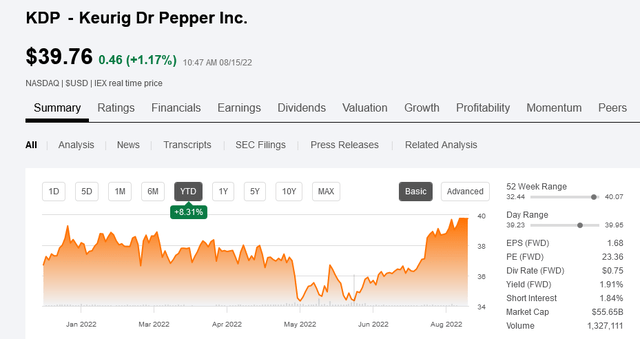

The shares of Keurig Dr Pepper Inc. are trading at $39.76 per share as of this writing, giving it a market cap of $55.65 billion. The 52-week range is between $32.44 and $40.07, while the current share price is above the 50-day moving average of $36.58 and above the 200-day moving average of $36.79.

The shares are up 8.31% year to date and have a price-adjusted earnings ratio of 24.41 and a price-to-sales ratio of 4.20.

Its peers: MNST Monster Beverage Corporation has a price-to-earnings multiple of 39.31 and a price-to-sales multiple of 7.93. Regarding Coca-Cola FEMSA, S.A.B. CV, this has a price-to-earnings ratio of 15.62 and a price-to-sales ratio of 1.24.

Conclusion

The near term is extremely uncertain as the aftermath of a war in Ukraine and geopolitical tensions between the US and Russia/China contribute to increased inflation and economic instability.

As a result, the US Federal Reserve will certainly adopt a more aggressive hawkish stance, with a high probability of a recession.

Regardless of these headwinds, Keurig Dr Pepper is likely to continue to perform well and post strong sales, as they’ve already proven it during a pandemic and despite elevated deep-rooted inflation.

The company forecasts higher sales while earnings stay flat, making the stock a good hedge for investors looking for steady growth (albeit less dynamic than so-called growth stocks) amid as many geopolitical and macroeconomic issues as we have now.

Be the first to comment