Justin Sullivan/Getty Images News

Introduction

In an article published on May 15, I was neutral on KB Home (NYSE:KBH), one of America’s largest homebuilders. In this article, I will update my call based on new housing developments and the company’s way of dealing with what appear to be increasing headwinds. The problem is that despite high pricing, cracks are appearing as the market is not as tight as investors may have hoped. As a result, we could see increasing pressure on prices while orders remain subdued due to the fact that people’s ability to spend is constrained by high prices and weakening economic growth. The good news is KB Home shares are adjusting to this, providing investors with chances to buy a homebuilder with a decent valuation for a situation where the Fed is forced to pivot, which I expect to be somewhere early next year.

So, let’s dive into it!

Weakness In Housing

A part of my takeaway on May 15 is quoted below:

This housing market is extremely tough to trade. On the one hand, we have homebuilders that do very well due to pricing power and under-serviced markets in some areas. On the other hand, we have a situation where high prices, higher rates, and weaker economic growth pressure demand.

The last sentence is key as that’s pretty much what we’re still dealing with, just at a faster pace.

Starting with a key report, the NAHB published a report with the title “Housing Starts Weaken in July as Market Slowdown Continues”.

The report came out shortly after the monthly NAHB Housing Market Index was released, which showed a steep decline in industry confidence.

TradingView (NAHB Housing Sentiment)

According to the NAHB:

A sharp decline in single-family home construction is another indicator that the housing slowdown is showing no signs of abating, as rising construction costs, elevated mortgage rates, and supply chain disruptions continue to act as a drag on the market.

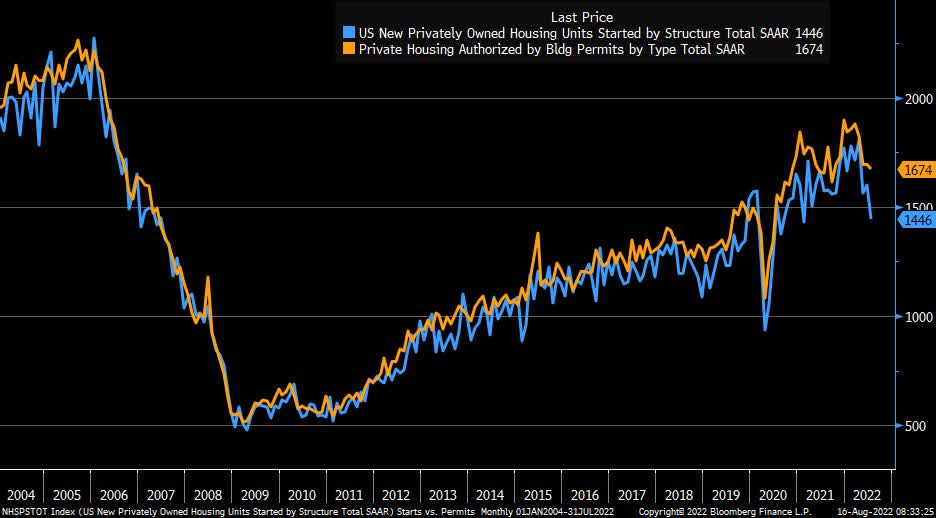

Bloomberg

Housing starts fell 9.6% to an adjusted annual rate of 1.45 million units in July.

Moreover:

The July reading of 1.45 million starts is the number of housing units builders would begin if development kept this pace for the next 12 months. Within this overall number, single-family starts decreased 10.1% to a 916,000 seasonally adjusted annual rate and are down 2.1% on a year-to-date basis. This is the lowest reading for single-family home building since June 2020.

Allow me to share one more quote:

A housing recession is underway with builder sentiment falling for eight consecutive months while the pace of single-family home building has declined for the last five months,” said NAHB Chief Economist Robert Dietz. “However, multifamily construction remains very strong given the solid demand for rental housing.

Essentially, we’re now dealing with a housing crisis at the same time when demand for affordable housing is high. That’s a very tricky environment for investors, builders, potential buyers, banks, and other parties.

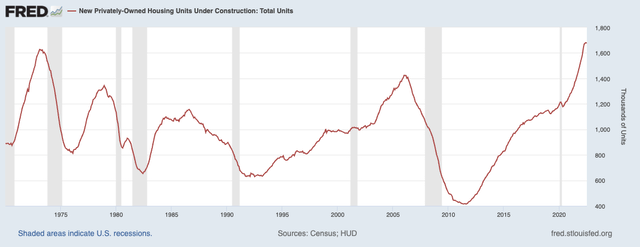

One of the problems that I discussed in my prior KBH article is supply. This problem is getting worse (from the point of view of someone wanting higher home prices).

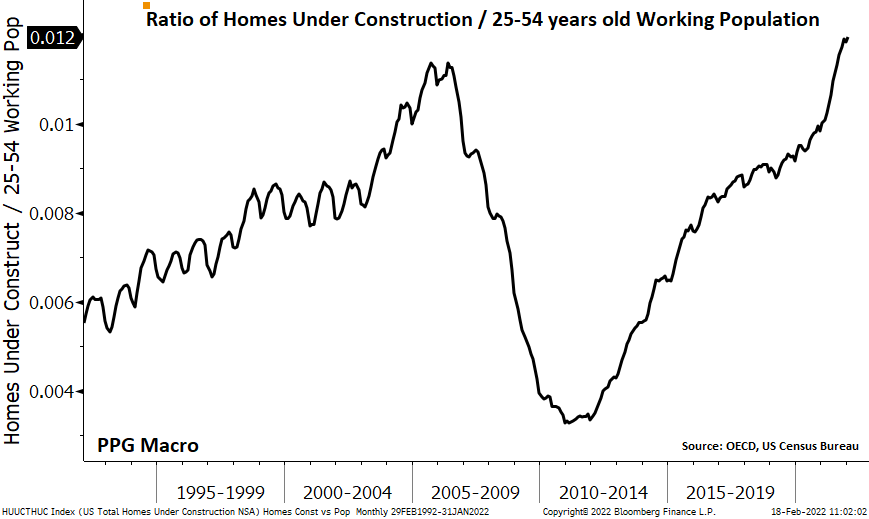

Homebuilders have stepped up their game with a record number of homes under construction – at least going back to the 1970s.

In this case, we need to be aware that the population is now much larger than back in the 1970s. As PPG Macro shows, the ratio between homes under construction and the working population is also above pre-Great Financial Crisis levels.

Bloomberg (Via PPG Macro)

As a result, this is now starting to pressure prices as more supply is hitting limited demand – after all, prices are still elevated.

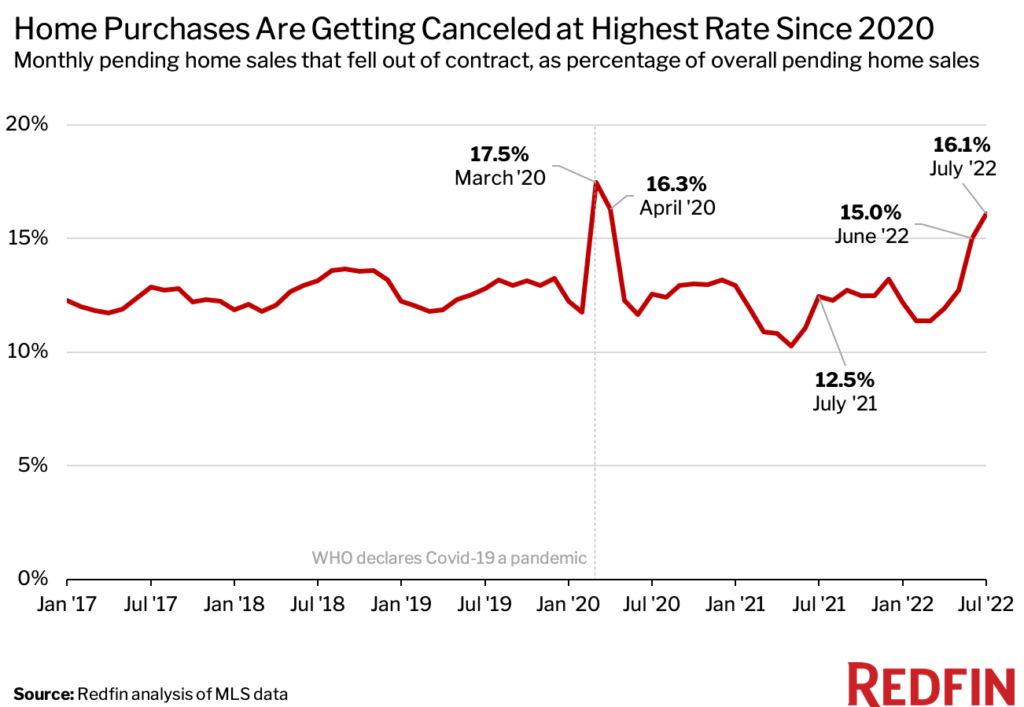

For that, let me show you some numbers from Redfin starting with the fact that 16.1% of home purchase deals are getting canceled. That’s the highest rate since March of 2020 when people didn’t know how bad the pandemic would get. Jacksonville, Florida, led the country with a cancellation rate of 29%.

Redfin

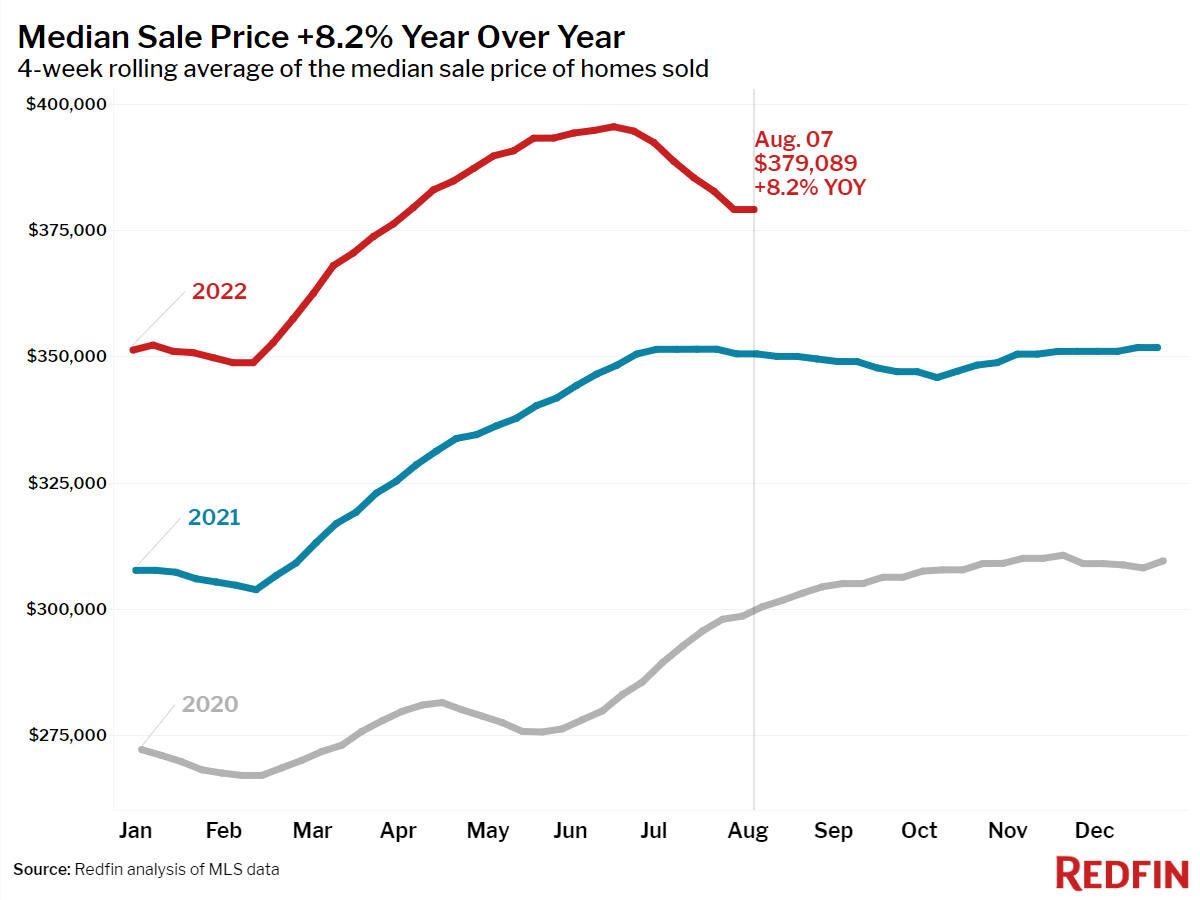

We’re now in a stage where bad fundamentals start to slowly impact prices. For example, in August, the median sales price in the US was roughly $380 thousand. That’s up 8.2% compared to 2021 (still very elevated), but down from almost $400 thousand at the start of this summer.

Redfin

It’s hard for prices to stay up as the average mortgage payment is now $2,300. That’s with a rate of 5.22% and down from $2,500 earlier this year. Yet, it is still more than $500 above 2021 levels and roughly $800 above 2020 levels.

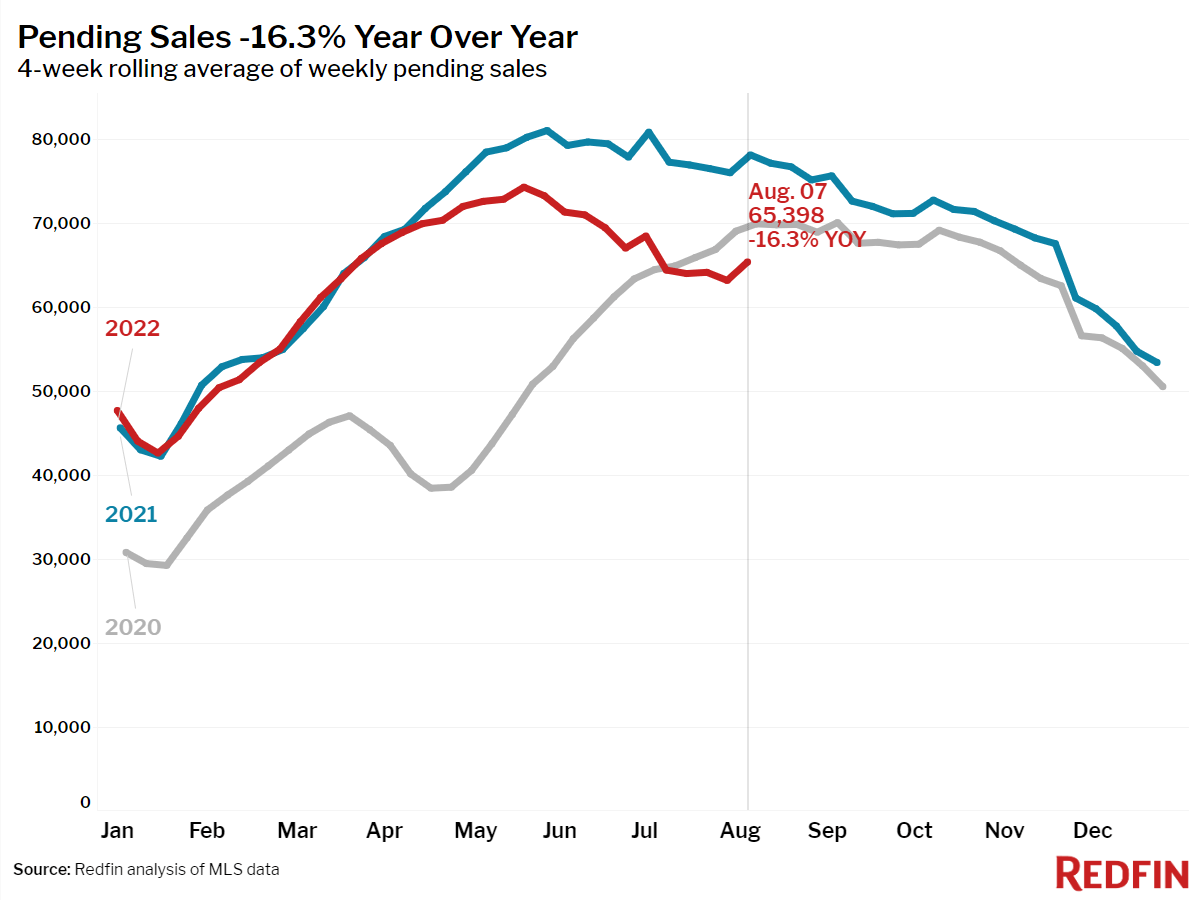

Hence, pending home sales are down 16.3% year-to-date, falling below 2021 and 2020 levels.

Redfin

So, to go back to what PPG Macro said:

In conclusion, financial conditions have already tightened significantly. The will get worse, presenting a very challenging environment for risk assets and demand. One should start thinking of investment grade (is BBB- really IG?) between 150 and 200 basis points. Lower housing prices and a recessionary environment in the latter part of the year, raising interesting questions about where bond yields will be.

Now, the question is, what does this mean for KB Home?

KB Home – Waiting For An Entry

Headquartered in Los Angeles, California, KB Home is America’s 9th-largest stock-listed homebuilder.

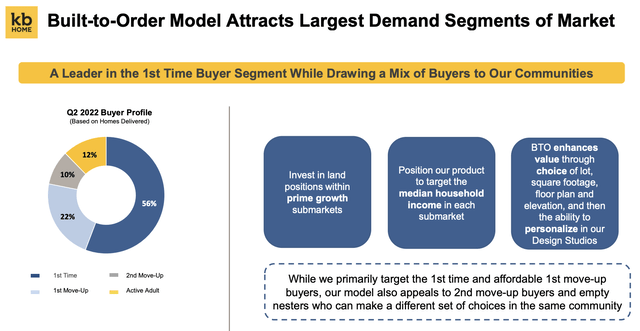

The company has a built-to-order business model, which means that it is well-aligned with demand. This way, the company minimizes inventory and protects margins, which is not something companies with speculative inventory can compete with. At least not in a market where headwinds are mounting. At that point, the smaller the inventory, the better.

On top of that, the company services the markets that need the most supply: starters and median-income housing.

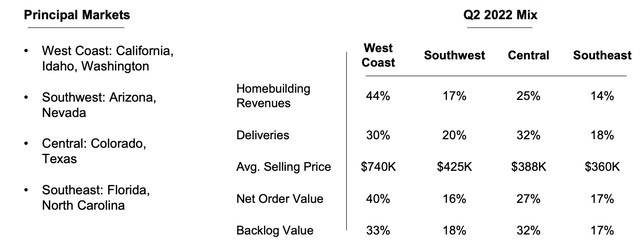

The company is well-diversified when it comes to deliveries as it has no selling region accounting for more than 32% of deliveries. However, due to high pricing differences, the West Coast generates 44% of total revenues.

With all of that said, the company is encountering some of the issues we discussed in the first part of this article. In its second quarter, the company was able to receive a 4% higher net new order value of $2.12 billion. This is based on 3,914 units. That’s down 9% compared to the prior-year quarter.

The backlog of orders rose by 43% to $6.1 billion, which is also due to a 1% decline in deliveries as supply chains remain challenging. Yet, the company delivered 200 more homes than the midpoint of its own guidance. This is what the company had to say with regard to supply chain problems:

[…] we are seeing mixed dynamics with the availability of some materials such as paint, plumbing products, interior doors, and door hardware improving sequentially. Other materials such as engineered wood products, cabinets, insulation, and concrete continue to be difficult to obtain that have stabilized. And the third group of products including heating and cooling materials and electrical equipment appliances and windows remain challenged.

Moreover, and with regard to lower housing starts:

We’d expect supply constraints will prevent us from returning to our historical build times in the short term, but we believe the actions we have taken in simplifying our SKUs, adding trade partners and suppliers, and communicating real-time with suppliers about future needs have helped to stabilize our build times. And with housing starts across the industry down 14% as reported last week, we expect the overall pace of starts in our markets to lessen, providing some expected relief to build times which will help us to return to our historical build times longer term.

With regard to demand, the company mentioned that new orders were flat. Yet, net new orders were down because of canceled homes, which I briefly highlighted in the first part of this article as well.

The company mentioned a single-digit cancellation rate and 6.2 net orders per community, which aligned the monthly absorption rate with the start of production. In other words, we’re seeing that supply and demand are now much more balanced.

What’s interesting is that buyers have good credit scores. The average loan-to-value ratio held steady at 85% with the average cash down payment being $75,000. Almost every single buyer is using fixed-rate products with an average FICO score of 734.

Moreover, the company is increasingly targeting wealthier buyers who have specific wishes, which fits the built-to-order model. The average household income of buyers in 2Q22 was $125 thousand.

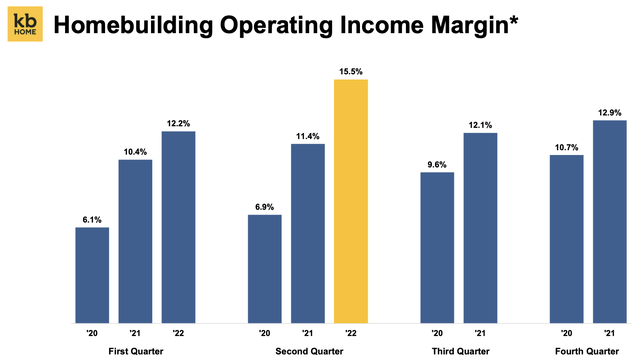

It’s also noteworthy how well KBH is managing prices and costs. The company reported a 410 basis points improvement in its operating ratio due to meaningful improvements in both its housing gross profit margin and SG&A expenses. Its 3Q22 operating margin is expected to be 16.9% adjusted for inventory-related charges.

With that said, here’s what to make of the valuation.

Valuation

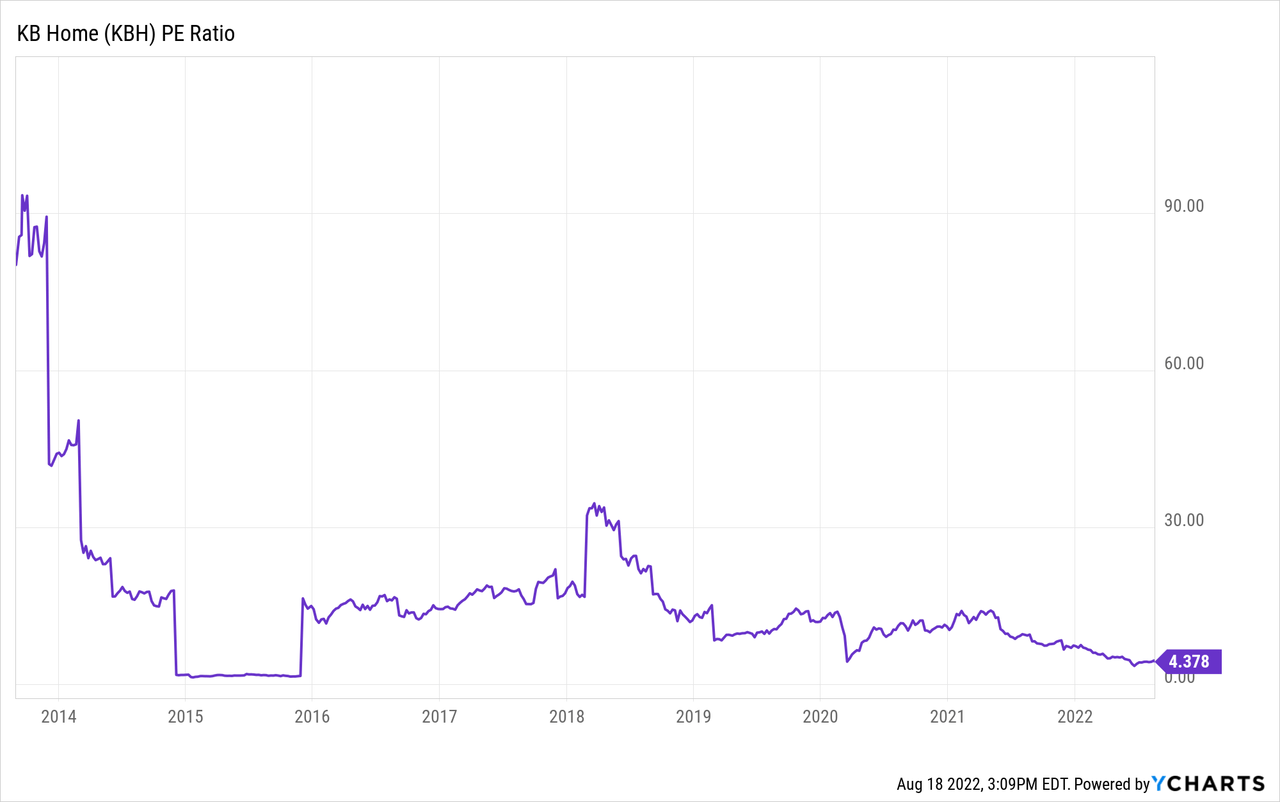

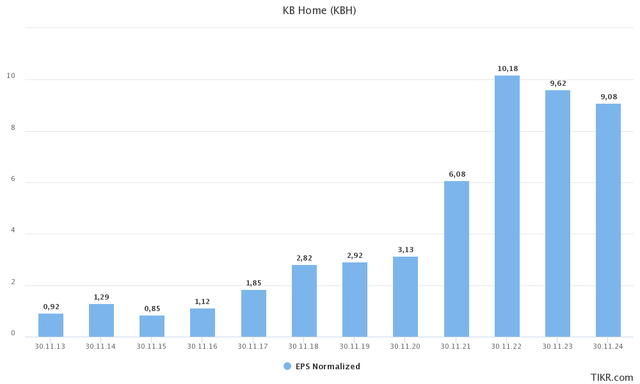

KB Home is trading at 3.1x 2022E normalized earnings. That’s wild because it’s well below any valuation in recent years. However, 2022 is a year that will be an outlier. Yet, analysts do not expect normalization to occur anytime soon. Pricing is offsetting lower net orders while the company’s massive backlog supports high revenue in the years ahead – assuming cancellation rates do not explode.

Even when using 2024E EPS, the valuation is 3.5x earnings.

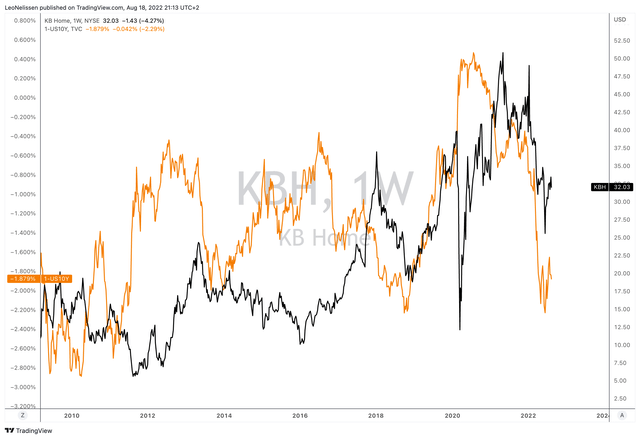

This brings up the question if investors are blind or if they simply don’t believe these estimates. I am going with the second option as KBH has basically become a rate-play.

Higher (expected) rates will continue to pressure KBH shares. Lower expected rates will cause the stock to take off.

The chart below shows the KBH share price and the inverted 10-year government bond yield. In 2019, when rates weakened due to lower global growth, KBH more than doubled. I expect that to happen again, but not in 2022. The Fed is eager to get inflation under control and that will more than certainly mean a funds rate of at least 3.5%. The Fed knows it has to weaken economic demand as it cannot impact supply. At least not directly.

TradingView (Black = KBH, Orange = 1-US10Y Yield)

So, I expect that KBH continues to hover between $35 and $25 until next year when we will likely encounter an event where the Fed is forced to refrain from further hikes.

Hence, if you want to buy KBH, make it a long-term investment and aim to buy it as close to the lower bound of this range as possible. That sounds obvious, but I think investors should refrain from chasing any homebuilding rallies for the time being.

Takeaway

In this article, I discussed my view on the housing market, which continues to be tricky for investors. While demand has been strong, we’re now encountering a situation where supply is rising due to high orders and easing supply chains. On the demand side, weakness is occurring due to high prices and higher rates on top of general economic weakness.

While this does not mean we’re on the verge of a full-blown housing crisis, it does put pressure on prices and future building activity.

Investors are currently pricing this in.

KBH is doing well so far as it is seeing a steep increase in margins, a strong backlog of orders, and the high credit quality of its buyers.

Hence I believe that KBH is a good long-term investment as investors have priced in a big part of the (expected) upcoming weakness in the housing market.

However, investors need to buy as low as possible given the risks and the fact that I believe that the trigger to cause a quick rally won’t happen until 2023 when the Fed will likely be forced to pivot.

(Dis)agree? Let me know in the comments!

Be the first to comment