Zhanna Danilova

Author’s note: This article was released to CEF/ETF Income Laboratory members on October 11.

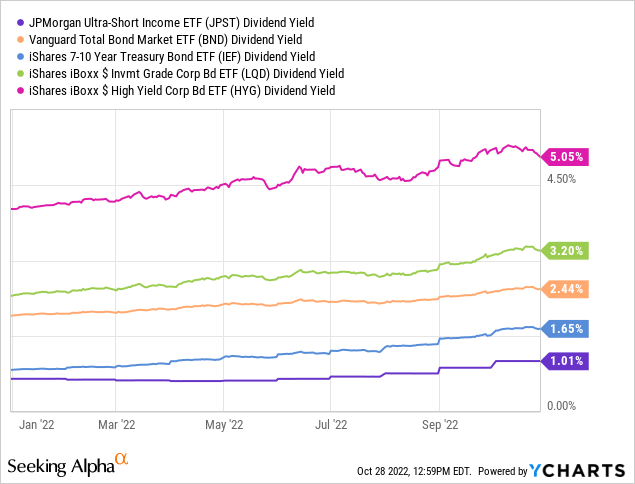

The JPMorgan Ultra-Short Income ETF (NYSEARCA:JPST) is a diversified, short-term, investment-grade fixed income ETF. JPST currently yields 2.2%, but yields should increase to around 3.2% in the coming months, a product of rising interest rates. JPST’s underlying holdings are incredibly safe and have very low volatility, and so the fund could function as an alternative to cash for investors looking for a little bit of extra income. In my opinion, JPST is a buy, but only appropriate for short-term investors looking for alternatives to cash.

JPST – Basics

- Investment Manager: JPMorgan

- Dividend Yield: 2.0%

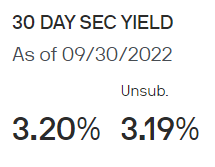

- SEC Yield/Forward Yield: 3.2%

- Expense Ratio: 0.18%

JPST – Overview

JPST is a diversified, short-term, investment-grade fixed income ETF.

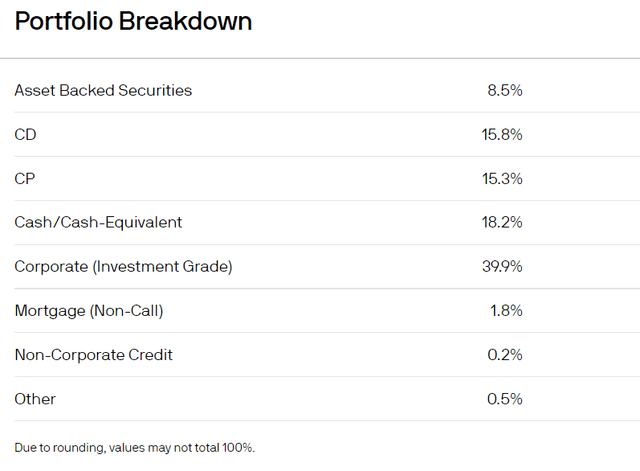

The fund invests in several short-term fixed income asset classes, focusing on corporate bonds, but with investments in CDs, commercial paper, cash, and mortgage-backed securities. Asset allocations are as follows.

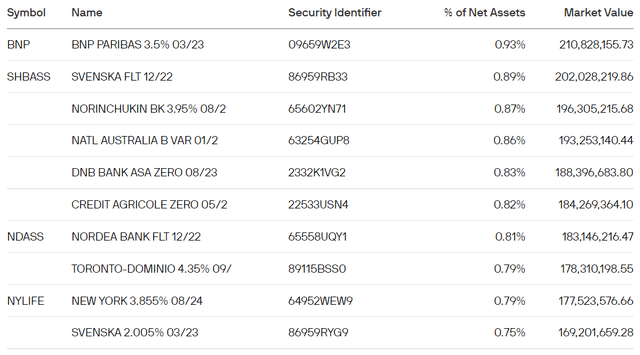

JPST invests in 617 different securities. Concentration is quite low, with the fund’s top ten holdings accounting for around 8.0% of its value. Top ten issuers accounting for around 15% of the same. Largest holdings are as follows.

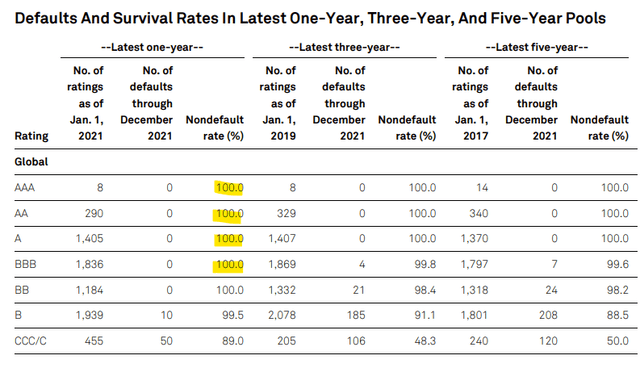

JPST’s holdings are of very good quality. Slightly over half of the fund’s holdings have a credit rating of AAA, or A-1, the equivalent rating for very short-term securities. Securities with these ratings are issued by the most credit-worthy institutions in the market, with very strong balance sheets and financials. The fund’s other holdings have credit ratings between AA and BBB, or their equivalents, which are still quite strong, although moderately less so.

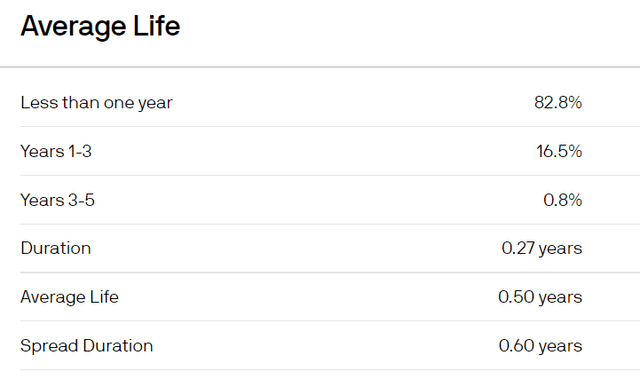

JPST focuses on short-term securities, with an average remaining maturity of 0.56 years, and duration of 0.29 years. Both figures are very low on an absolute basis and much lower than average for a bond fund.

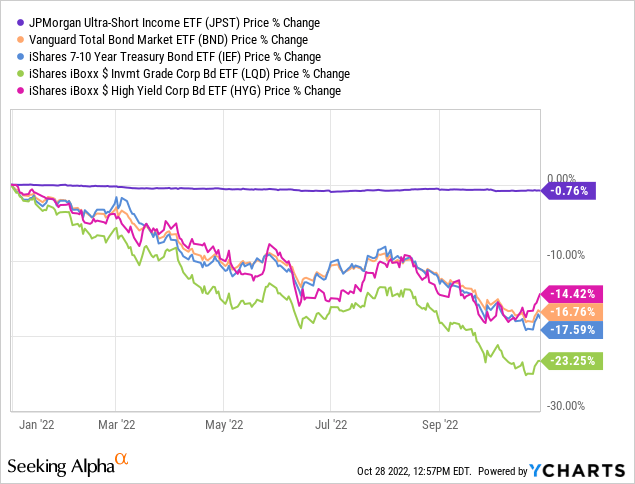

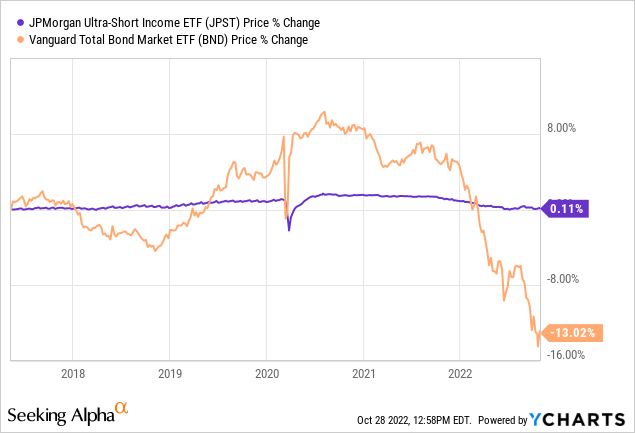

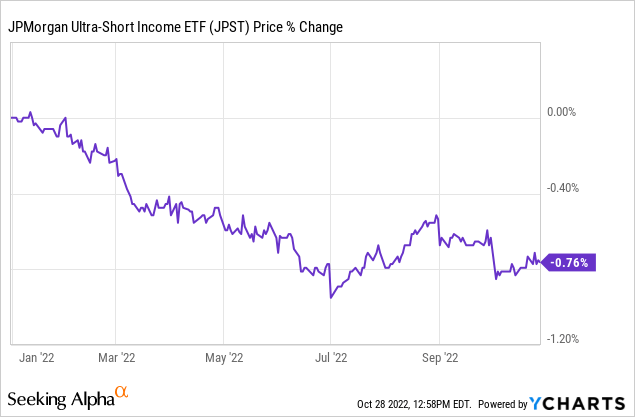

JPST’s short-term holdings have very little interest rate risk. Expect very low capital losses when interest rates increase, much lower than average for a bond fund. This has been the case YTD, as expected.

JPST’s investment-grade, short-term holdings have extremely little credit risk as well. Investment-grade securities are only issued by strong companies with solid balance sheets, and these companies rarely go bankrupt in a short amount of time. As per S&P, not a single investment-grade issuer has gone bankrupt for several years, and extremely few have done so in history. Investment-grade issuers do sometimes go bankrupt, but the process almost always takes them several years, which means short-term debt gets paid back without issue. As such, and as per S&P data, JPST’s underlying holdings have almost no credit risk, with default rates hovering around 0%.

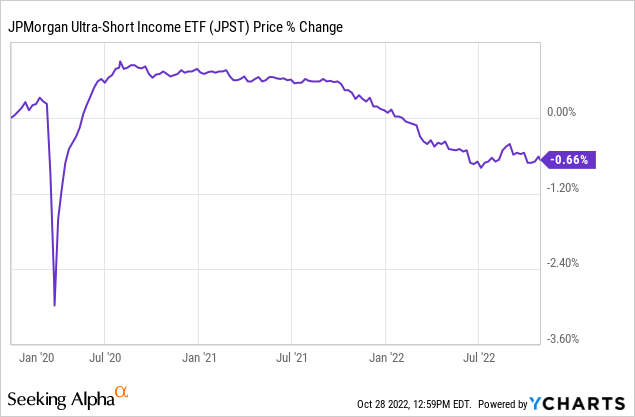

As JPST has very little credit and interest rate risk, volatility, risk, and losses during downturns are all quite low. JPST tends to trade within a very narrow price band, between $50.00 and $50.50. The fund did see some losses in early 2020, at the onset of the coronavirus pandemic, but these were quite small and short-lived. JPST’s share price is remarkably stable, especially in comparison to its peers

JPST does sometimes see small capital losses, when either interest rates increase or economic fundamentals worsen. The fund has seen capital losses of 0.80% YTD, a period of rapidly increasing rates.

The fund also saw some losses in early 2020, as economic conditions worsened and liquidity dried up. Losses reached 3.0% but very quickly stabilized around 1.0%, and the fund had completely recovered by June.

JPST’s safe, stable holdings and share price are significant benefits for the fund and its shareholders. In my opinion, and considering the above, the fund is stable enough to function as an alternative to cash for most investors.

On a more negative note, safe, stable funds tend to be relatively low-yielding ones as well, and JPST is no exception. The fund currently sports a trailing twelve-month, TTM, yield of just 1.0%, a low figure, and lower than average for a bond fund.

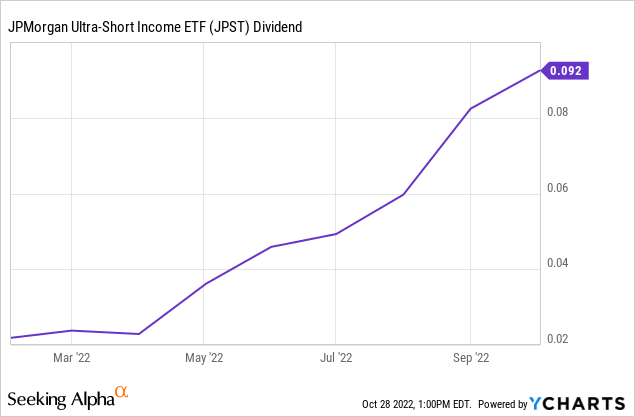

On a more positive note, the fund’s forward dividend yield is quite a bit higher than that of 1.0%, as interest rates have risen quite a lot these past few months. Annualizing the fund’s latest monthly dividend payment nets you a 2.2% forward dividend yield. JPST also sports an SEC yield, a standardized measure of short-term income, of 3.2%.

JPST

ETFs almost always distribute any and all income to investors as dividends, so JPST’s dividends should grow until the fund’s yield equals 3.2%. JPST’s dividends have been very strong YTD, as expected, but further growth seems likely.

In my opinion, JPST’s 3.2% SEC yield is much more reflective of the dividends and income investors should expect from the fund moving forward than the fund’s 1.0% TTM yield. Although it is not a strong yield, it is reasonably good for how liquid, safe, and stable the fund is, in my opinion at least.

JPST seems like it might interest investors looking for alternatives to cash. As such, thought to do a quick comparison of the fund with these and similar investments, to help investors make the best decision for their needs.

JPST – Savings Account Comparison

JPST is an incredibly liquid investment, although perhaps a tiny bit less liquid than most savings accounts.

In most cases, investors can instantaneously withdraw or transfer their cash in a savings account without issue.

In most cases, investors can instantaneously sell their investment in JPST, but withdrawing the cash to a bank account might take hours or days. Specifics vary by broker but, in most cases, JPST is liquid enough for most investors or use cases.

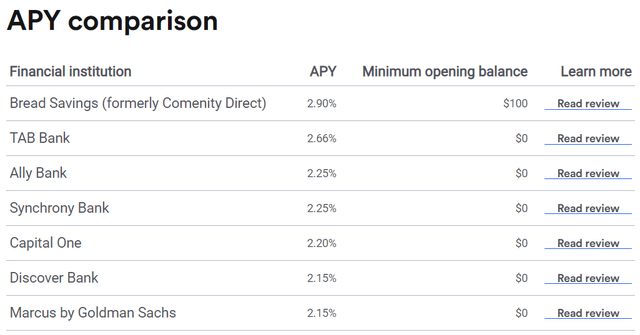

JPST yields quite a bit more than the average savings account, which currently yields 0.16%. Some banks offer stronger above-market rates, generally a commercial strategy to entice new customers. As per Bankrate, no banks offer yields higher than JPST’s 3.2% SEC yield, but several do offer yields higher than the fund’s latest monthly dividends – 2.2% annualized.

Finally, savings accounts have fixed capital and are FDIC insured, up to $250,000 per depositor, per bank. JPST’s capital is not fixed, nor is the fund insured by the government, so investors could, potentially, see capital losses, depending on economic conditions. As a reminder, JPST saw losses of 3.0% for a couple of days in early 2020, mostly recovered in a matter of weeks, and completely recovered in a matter of months. The fund has also seen capital losses of around 0.80% YTD.

JPST – 1Y CD Comparison

CDs come in several maturities. I’ll be doing a quick comparison of JPST with 1Y maturity CDs, which are about average for these assets.

JPST is quite a bit more liquid than 1Y CDs, as investors can sell and withdraw their investment in the fund in a matter of days.

JPST yields quite a bit more than the average 1Y CD, which currently yields 0.97%. On the other hand, some banks offer above-market CD rates, generally a commercial strategy to entice new customers. As per Bankrate, several banks offer rates in the 3.25%-3.75% range, higher than JPST’s forward yield.

Finally, CDs have fixed capital and are FDIC-insured, unlike JPST.

Conclusion

JPST is a diversified, short-term, investment-grade fixed income ETF. In my opinion, JPST is a buy, but only appropriate for short-term investors looking for cash alternatives.

Be the first to comment