Kar-Tr

In my last article on JOYY Inc. in November 2020 I said, the “rally could be over amid short seller report”. The stock has since fallen 70% but a recent acquisition from a U.S. hedge fund manager made me go back for another look.

Billionaire hedge owner looking for JOYY

I previously wrote a buy recommendation over two years ago in JOYY Inc. (NASDAQ:YY) and the company rallied around 70% but I slammed on the brakes over a report from a known short-seller. JOYY has since collapsed 70% but I recently read that billionaire hedge fund manager Steve Cohen had picked up a bunch of shares in this Chinese social media firm. Cohen’s fund bought 198,000 shares of YY, with an initial value of $5.3 million.

The core product for JOYY Inc. is the Bigo social media platform. Although it may not be known to U.S. investors it had 32.6M monthly active users (MAUs) in Q2 22. It was also one of the top ten apps for monetization in 2021.

Bigo live is popular for chatting, gaming, and music; while the Virtual Live feature allows users to create a 3D digital avatar for live streaming- similar to the metaverse.

Another app is the Likee app, which hosts 57.7M users and the market appetite for short-form content drives that. The company said that live streaming revenue was higher by 97.8% YoY in FY2021.

Revenues and cash position unhurt by the global slowdown

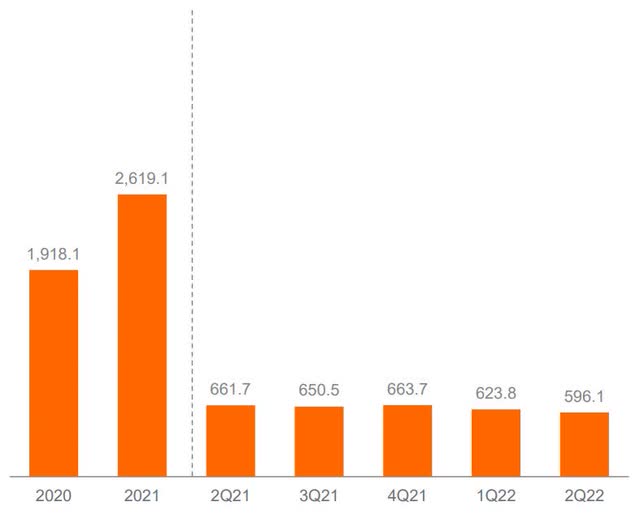

Despite a harsh global backdrop for technology companies, JOYY has seen stable revenues with its second-quarter earnings released in July.

From the second quarter of 2021, revenue of USD$66.7 million has declined to around $600 million.

Gross margins have also improved from 31.2% to almost 37% in that period. Net income from operations was US$18.7 million, compared to a net loss of US$109.3 million in the same period last year. This was due to the Bigo app turning profitable in the second quarter of 2021.

User metrics also improved in the most recent quarter with average mobile MAUs of Bigo Live up 10.6% to 32.6 million from 29.5 million in 2021.

However, there were also some headwinds in other areas with mobile MAUs of Likee down by 37.5% to 57.7 million from 92.3 million in the same period in 2021. However, like all social media firms, advertising revenue has been hit and the company slowed its spending on user acquisition.

One of the key strengths for JOYY at this moment is in its cash position. At the end of June 2022, the Company had cash and deposits of US$4,289 million.

For the third quarter of 2022, the company forecast net revenues at US$561.5 million to US$593.5 million.

Buybacks and dividends have boosted shareholder returns

Another big selling point for JOYY Inc. stock is a dividend yield of 7.85% at the current valuation. The board approved a three-year dividend in August 2020. Another was announced in the fourth quarter of that year.

With these two dividend policies, the board has declared a dividend of US$0.51 per ADS, or US$0.025 per common share, for the second quarter of 2022, which will be paid on October 6, to shareholders of record as of September 22.

The company also enacted a share buyback policy in September 2021. The company stated that it might repurchase up to US$200 in the period to September 2022. Another was set to run to November 2022 and JOYY has repurchased US$327.9 million of its shares during that period.

In the upcoming Q3 earnings, the company may make a statement on a new buyback initiative, although the stock price was 50% at the time of the previous announcements.

Valuation is dirt cheap for this cash-strong, steady earner

The real value in JOYY Inc. now comes from its valuation, which has slumped in the technology slowdown.

JOYY has a price-to-earnings ratio of 30x, but the forward P/E is only 10x. The price-to-sales ratio is also very low at 0.75x. Just for comparison with U.S. tech stocks, Twitter (TWTR) has a P/S ratio of 6.4x, while Meta (META) has a P/S ratio of 3.1x.

At the current valuation, the company has a cash position relative to $55.00 per share, based on the $4 billion cash hoard and 72 million shares outstanding. That is around 50% lower than the current market price of $26.

The Chairman and CEO said in the recent Q2 update:

“As we continue to invest in building our long-term capabilities, we firmly believe that JOYY as a company will emerge from the current uncertainties as a more focused and productive organization, and be well positioned to capture long-term growth opportunities and generate sustainable shareholder value.”

With a live streaming avatar-led platform, the metaverse is a likely destination for the company and it could get swept up in any metaverse-related bull market.

The headwind for this play comes in the form of the unaudited results for Chinese firms but Point72 Asset Management has obviously done some due diligence to see this as a safe investment. JOYY states PricewaterhouseCoopers Zhong Tian LLP as its independent auditor.

Conclusion

JOYY Inc. has slumped by 70% since I last looked at the company, but I was surprised to see the company holding up well in a tough market for social media firms. The company has steady earnings, growing margins, and a big cash position. The company turned profitable in late 2021 and now has a launchpad to go after further growth. For investors, this could be an opportunity to buy ahead of Q3 22 earnings. The company’s two buyback schemes have expired this month, although the lower price may hamper any hopes for a new effort. Despite that, the valuation is really low and investors can take advantage of a dividend yield of 7.85% and the chance of a bounce from the tech wreck lows.

Be the first to comment