JHVEPhoto/iStock Editorial via Getty Images

There is nowhere to hide in this market. It is not just speculative assets that are down. The S&P has fallen into bear market territory year-to-date. The Nasdaq has bled more than 30%. Even the relatively “safe” Dow Jones Index is down 16% with only 8 stocks in it up minimally or just about flat. And who knows how long that is going to last with the sell-offs gaining steam!

Johnson & Johnson (NYSE:JNJ) is one of those rare names that has withstood the onslaught as the stock is flat year-to-date. How does the stock look here as a safe haven and as a long-term holding from here? Let’s find out.

Short to Medium Term

Valuation

JNJ should continue being a relatively safe holding in this market, as suggested by its low beta of 0.66. With a yield of 2.62% and a forward PE of 16.50, the stock offers moderate income at an attractive valuation. Sure, inflation is running into double digits and the 2.62% yield pales in comparison, but JNJ’s dividend growth pedigree is well known, with a streak of 59 consecutive increases. As much as it may pain the readers here, inflation is more transitory in nature than JNJ’s dividends.

Covered Calls

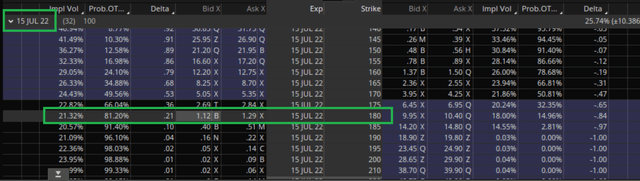

If you have 100 shares or more, writing covered calls against your JNJ holdings may be something you may want to consider. This strategy will allow you to milk additional income from your shares while agreeing to sell it at a higher price on a future date. As an example, the chain shown below means that you agree to sell 100 shares of JNJ for $180 should the stock go above $180 by July 15th. For this agreement, you get $112 in premium for every contract (100 shares) you sell. If you get “called away”, you net a total return of about 6.50% in this: the upside to $180 plus the $1.12 premium collected. If you don’t get called away (that is, JNJ stays below $180 by the expiration date), you simply retain the $112 and all your shares. This additional income adds up over time. Covered calls work well in bear markets like this as share prices tend to be under pressure and bounces get sold quickly.

Think or Swim JNJ (Think or Swim JNJ)

Selling Cash Secured Puts

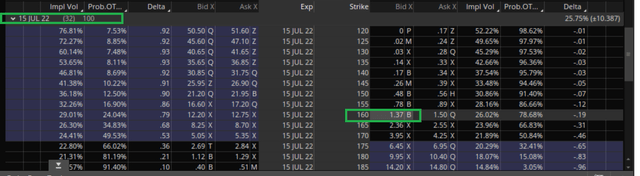

If you like JNJ here but are not sure the price has fallen enough, selling cash-secured puts may be the best strategy for you. In this example below, you are agreeing to buy 100 shares of JNJ at $160 should it fall below $160 by July 15th. For this agreement, you are getting $137 in premium per contract (100 shares). The strike price of $160 represents nearly 6% below the current market price. Selling puts works better in up-trending markets if your intention is to capture the premium but never called (forced to buy at expiration).

Think or swim JNJ (Think or swim JNJ)

Please keep in mind that both option chains above are just examples and not necessarily the best returns after comparing all the possible chains. Please review this article for the basics of covered calls and selling cash secured puts.

To sign off the short to medium-term section, please bear in mind that no stock is immune to sell-offs. Until a week or so ago, another favorite of ours, Altria Group (MO) held up exceptionally well and then came a downgrade that has since pushed the stock to being flat YTD.

Long Term

There is nothing new to be mentioned about this company. This is a profitable juggernaut that will likely continue making billions in profits. It is as guaranteed as anything gets in the stock market. JNJ’s upcoming split into two entities in 2023 is on track and has generally been well received.

In spite of increasing dividends for 59 consecutive years, JNJ’s payout ratio is sitting well below 50% based on forward earnings estimate. That is just mind-boggling to think as it underscores three critical factors:

- JNJ’s earnings prowess

- JNJ’s operational efficiencies

- the fact that as dividends go up each year, the stock price slowly creeps up without much fanfare. This is evidenced by the fact that the average yield has generally been below 3%

Factors like low beta and moderate growth go both ways. Things improving for the economy and the market is not a question of “if” but “when”. It may be months at least, if not years. Crypto will run hard someday. Concept tech stocks will run hard someday. The problem is going to be that they may be so low when they start the runs that current investors may never see their original investments back. But run, they will. JNJ is unlikely to be such a runner in any type of market. But it is also unlikely to ever see a 50% haircut like the high flyers have. And therein lies its safety.

Conclusion

As much as we all want it all, we cannot have it all. The safety net afforded by JNJ comes with a slower capital appreciation potential when things turn around. However, we are glad to have JNJ in our portfolio irrespective of the market condition. What about you? What are your thoughts on this stock? Please leave your comments below.

Be the first to comment