Justin Paget/DigitalVision via Getty Images

JinkoSolar (NYSE:JKS) is a huge solar panel manufacturer. The company works highly integrated and continuously innovates on its products. The solar panel production industry is highly competitive with slim margins. By surviving several boom and bust phases, JinkoSolar became one of the market leaders. The consolidated industry became more interesting to invest in.

JinkoSolar recently unlocked cheap capital with its Chinese IPO.

It’s the first company to deliver 100GW of solar modules globally. Jinko produced one out of every ten solar modules installed globally.

Consider this an update of my previous work about JinkoSolar.

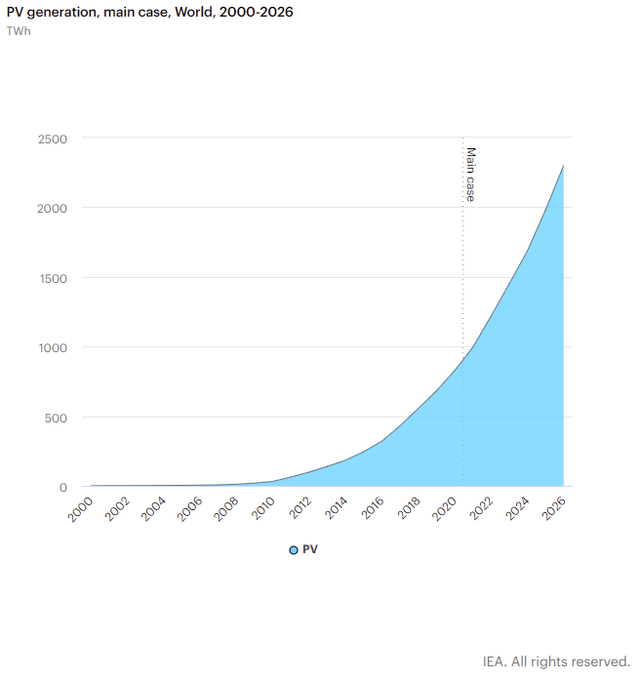

Robust Growth Projections

JinkoSolar profits from the secular growth trend in solar energy production. The cost of solar generation is highly competitive with fossil fuels. Solar gets more support by the need for many countries to become energy independent.

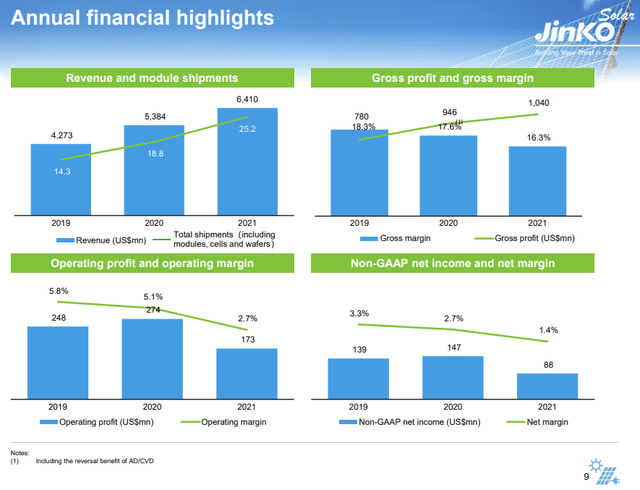

JinkoSolar posted impressive Q4 results with 73.9% revenue growth and swinging from a $57.8M loss to a $37.9M profit. The company had an impressive sprint in Q4. Full-year revenue grew 16.2% to $6.4B.

The company guides for significant growth in 2022. Shipments increase to 35 GW – 40 GW or 39% – 59%. It provides fewer details on expected margins since it aligns with the Chinese outlook. In Q1, the margins will probably be slightly lower with improvement during 2022 as more polysilicon capacity comes online in the second half-year.

The capacity growth suggests ~49% revenue growth at equal ASPs. This increase aligns with the analyst consensus estimate of 46% growth. Jinko mostly beats analyst estimates.

Capacity growth should remain impressive over the next couple of years. Demand for solar should increase further, and cost price is expected to reduce further. The lower future ASPs mean the company will grow slower than the market expansion in GW.

Margins Under Pressure

JKS Investor Presentation (Seeking Alpha)

Margins were decent despite supply chain and transportation cost challenges. Jinko managed to keep positive net margins. A normalization of gross margin and the fast revenue growth could put a turbo on future net profits.

The company switches between module shipments and component shipments when profitable. The strong integration increased its flexibility.

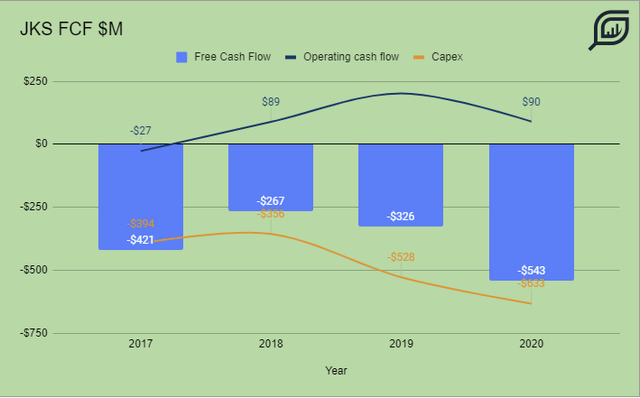

Free Cash Flow

Jinko only provides cash flow in its yearly 20-F, so it’s slow to track free cash flow. The company produced negative free cash flows during the most recent years.

The operating cash flow trended positively but not enough to offset the high CapEx requirements. There are two reasons for the high CapEx: manufacturing expansion and innovation. JinkoSolar innovates its solar panels continuously to achieve better performance. The fast sector growth supports the expansion of the company. Positive free cash flows could be a couple of years away. The cash need isn’t a problem if the company finds enough funding. It expects to spend $1.8B – $1.9B on CapEx in 2022, up from $1.3B in 2021.

Chinese IPO

JinkoSolar listed its operating subsidiary Jiangxi Jinko on the Shanghai Stock Exchange. It raised RMB10 Billion ($1.56 Billion) to support its further growth. The subsidiary’s share price doubled after the IPO at RMB5 and now trades around RMB11. It still holds 58.62% of the subsidiary with a current value of RMB67.7B or $10.63B.

There is a huge valuation gap between these shares and the ADR shares. The Chinese subsidiary has about four times the market cap of the U.S. ADSs. It sounds like an enormous arbitrage opportunity, but it’s impossible. The gap can only be closed if Chinese companies receive much higher valuations in the U.S. Jinko could also exit the U.S. stock market but hasn’t made any indication it wants to do so. An exit would probably still happen at a lower valuation than the Chinese listing.

According to the preliminary results of Jiangxi Jinko, it had RMB 40.48B in revenue in 2021. It’s 99% of total JinkoSolar revenue.

Balance Sheet

It had $2.55B net debt at the year-end with a leverage of 3.5x Net debt/EBITDA. The continuous expansion of production capacity and innovation in new products has high capital requirements.

The company’s balance sheet improves drastically with the $1.56B from the listing of Jiangxi Jinko. Jinko will probably raise more cash through Jiangxi Jinko.

Valuation

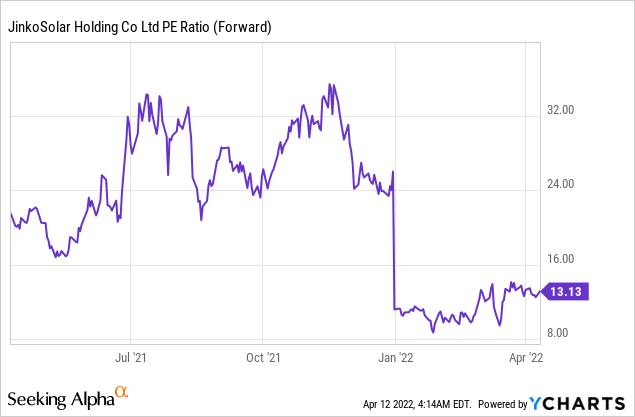

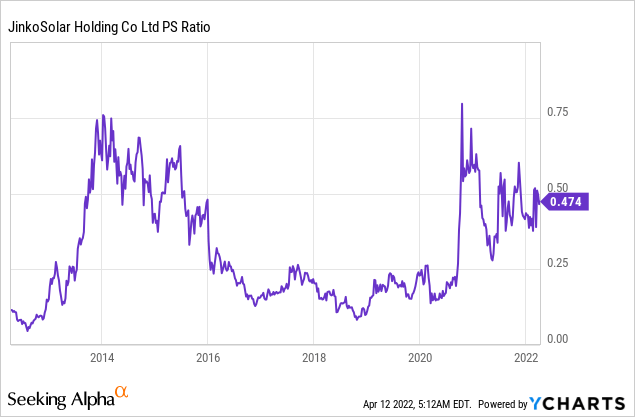

The company trades at a TTM PS ratio of 0.38 and a TTM PE ratio of 27.7. The recent IPO diluted shareholders but at a valuation far above the ADS. The dilution from the IPO isn’t included in these metrics yet.

The valuation looks good on estimates for 2022. Adjusting for the Chinese IPO, the forward PS ratio is 0.42. The forward PE is 13.5. Inexpensive for a company with such vigorous growth. It’s noteworthy that JKS was valued at low PS ratios before:

Revenue growth was flat between 2017 and 2019, and the tin margins didn’t help either. The situation is different today with robust growth. As we advance, a PS ratio of around 0.5 should be achievable. The revenue growth points to a significant share price upside in 2022.

Risks

Chinese stocks in the U.S. market remain under fire. The SEC demands more information that China doesn’t want to provide. JinkoSolar isn’t affected by the Chinese tech regulation.

Although it doesn’t supply the U.S. from China, it faces potential solar tariffs in the U.S. market. Attacks on other Asian manufacturing countries have remained unsuccessful so far.

Razor tin margins are a given in the solar panel manufacturing industry. The slightest change in costs makes the difference between substantial profits or losses.

Conclusion

Jinko profits from the fast-growing industry. It invests heavily in more capacity and is a fully integrated solar panel producer. The high CapEx makes positive free cash flows unlikely soon.

It carries a China discount like most Chinese ADS in the U.S. The Chinese IPO shows that the company is valued four times higher in its home market. There is no arbitrage possible, and for now, it signaled the Chinese cash from the IPO will be used for investments. The vast difference in valuation won’t disappear soon. The IPO is still attractive as it dilutes shareholders less than in the U.S. market.

JinkoSolar is cheaply valued for its growth. Even if the valuation remains equal, the share price should increase as JKS increases its revenues.

Be the first to comment