Matthew Lloyd/Getty Images News

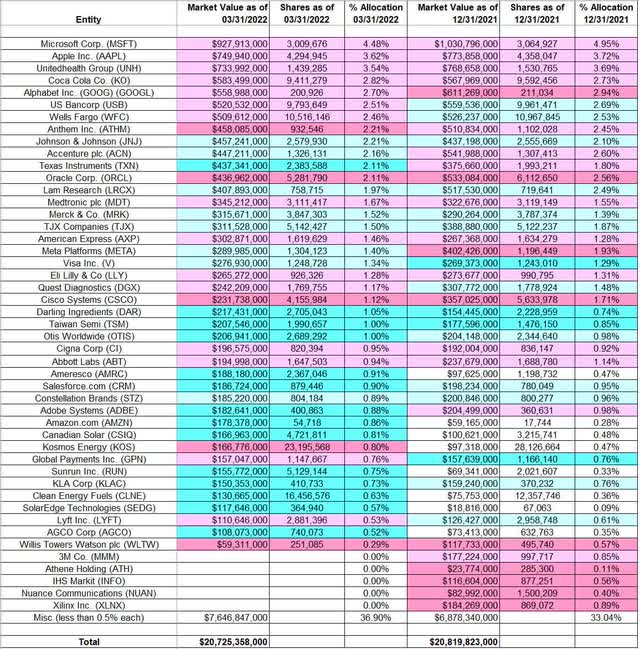

This article is part of a series that provides an ongoing analysis of the changes made to GMO’s 13F stock portfolio on a quarterly basis. It is based on GMO’s regulatory 13F Form filed on 5/13/2022. Jeremy Grantham’s 13F portfolio value decreased marginally from $20.82B to $20.73B this quarter. The portfolio is diversified with recent 13F reports showing well over 500 different positions although most of them are very small.

There are 42 securities that are significantly large (more than 0.5% of the portfolio each) and they are the focus of this article. The largest five stakes are Microsoft Corporation, Apple, UnitedHealth, Coca-Cola, and Alphabet. They add up to ~17% of the portfolio. Please visit our Tracking Jeremy Grantham’s GMO Portfolio series to get an idea of their investment philosophy and our last report for the fund’s moves during Q4 2021.

As of April 30, 2022, GMO’s 7-year asset class real return forecast is for US Large Cap asset class to have a negative 3.5% annualized return on one end and Emerging Value asset class to have a positive 6.9% annualized return at the other extreme. Most of the bond category is also forecasted to have negative annualized real returns over the next 7 years. The firm currently has ~$65B under management, a far cry from ~$120B that they had at the peak. The assets are distributed among separately managed, institutional, and mutual fund accounts. Their flagship mutual fund is GMO Benchmark-Free Allocation Fund (MUTF:GBMFX) which was incepted in 2003.

Note 1: It was reported in December 2020 that Jeremy Grantham has a ~4.8M share stake in QuantumScape (QS). The ~$12.5M investment was made 7 years ago as part of a series of bets on early-stage “green technology” companies.

Note 2: Jeremy Grantham has repeatedly said the US stock market is in a bubble since June 2020. Their Q1 2022 letter urged investors to focus on resource equities to generate strong real returns as long-term supply/demand dynamics in natural resource markets favor high and rising prices.

Stake Disposals:

3M Company (MMM), Athene Holding (ATH), IHS Markit, Nuance Communications, and Xilinx: These small (less than ~1% of the portfolio each) stakes were disposed this quarter.

Stake Increases:

Johnson & Johnson (JNJ): JNJ is a very long-term stake. In their first 13F filing in 2005, the position was at ~170K shares. The sizing peaked at around 26M shares in 2009. The stake was sold down by ~40% in 2014 at prices between $88 and $109. 2016 saw another ~50% selling at prices between $97 and $125. The ten quarters through Q2 2019 also saw minor selling almost every quarter. The pattern reversed in Q3 2019: 23% stake increase in H2 2019 at prices between $127 and $146. H1 2020 saw a ~15% trimming while the last seven quarters have seen only minor adjustments. The stock currently trades at ~$170 and the stake is at 2.21% of the portfolio.

Accenture plc (ACN): ACN became a significant part of the portfolio during the 2013-2014 timeframe when around 3.8M shares were purchased at prices between $69 and $85. The next five years had seen a combined ~50% reduction through minor selling most quarters. The two quarters through Q3 2021 saw another ~24% reduction at prices between ~$295 and ~$415. The stock currently trades at ~$275 and the stake is at 2.16% of the portfolio. Last two quarters have seen only minor adjustments.

Texas Instruments (TXN): TXN is a 2.11% of the portfolio position. The majority of the stake was purchased in Q3 & Q4 2016 at prices between $63 and $75. There was a ~20% stake increase this quarter at prices between ~$163 and ~$191. The stock currently trades at ~$150.

Lam Research (LRCX): The ~2% LRCX stake was built in Q3 2020 at prices between ~$294 and ~$385 and the stock is now well above that range at ~$420. There were minor increases in the last several quarters.

Merck & Co. (MRK): MRK is a very long-term stake. In 2014, it was sold down to a very small position at prices between $50 and $62. It was rebuilt in H1 2018 at prices between $53 and $63. Q1 2020 saw a ~20% selling at prices between ~$66 and ~$92. Last seven quarters have seen a ~30% stake increase at prices between ~$69 and ~$88. The stock currently trades at $84.62, and the stake is at 1.52% of the portfolio.

TJX Companies (TJX): TJX is a 1.50% of the portfolio position that has been in the portfolio for well over fifteen years. The position has wavered. Last major activity was a ~25% stake increase in H1 2020 at prices between ~$37 and ~$63. The stock is now at $56.62. Last several quarters have also seen minor increases.

Meta Platforms (META), previously Facebook: FB is a 1.40% of the portfolio position purchased in Q1 2018 at prices between ~$160 and ~$190. The stake had seen incremental buying since. The stock is now near the low end of their purchase price range at ~$164. Last quarter saw a ~11% trimming while this quarter saw a similar increase.

Adobe Inc. (ADBE), AGCO Corp. (AGCO), Amazon.com (AMZN), Ameresco (AMRC), Canadian Solar (CSIQ), Clean Energy Fuels (CLNE), Constellation Brands (STZ), Darling Ingredients (DAR), KLA Corp. (KLAC), Otis Worldwide (OTIS), Salesforce.com (CRM), SolarEdge Technologies (SEDG), Sunrun Inc. (RUN), Taiwan Semi (TSM), and Visa Inc. (V): These very small (less than ~1.5% of the portfolio each) stakes were increased this quarter.

Note: Although the position sizes relative to the overall portfolio is very small, it is significant that GMO has sizable ownership stakes in the following businesses: Clean Energy Fuels and Canadian Solar.

Stake Decreases:

Microsoft Corporation (MSFT): MSFT is currently the top position in the portfolio at 4.48%. It is a very long-term stake. The 2007-2008 period saw the stake built from ~5.6M shares to over 59M shares at prices between $19 and $35. The position size peaked in 2011 at ~68M shares. The next four years saw the stake sold down by ~80% at prices between $28 and $56. Recent activity follows: the three years through Q3 2020 saw a ~70% selling at prices between ~$88 and ~$232. The stock currently trades at ~$248. There was a ~9% trimming last quarter and a marginal reduction this quarter.

Apple Inc. (AAPL): AAPL is a top three 3.62% long-term stake. It was a large stake in 2005 but was sold down next year. The position was rebuilt in 2007 but was again sold down next year. Similar trading pattern continued over the next several years. The four years through 2019 saw a ~75% reduction at prices between ~$23 and ~$82. Q3 2020 saw another ~30% selling at prices between ~$91 and ~$134. The stock is now at ~$132. Last several quarters have seen only minor adjustments.

Note: The prices quoted above are adjusted for the 4-for-1 stock split last month.

UnitedHealth Group (UNH): The top three 3.54% of the portfolio stake in UNH was already a very large ~18M share position in 2005. The position size peaked in 2007 at over 20.5M shares. The five years through 2019 had seen a ~75% selling at prices between $102 and $296. The stock is now at ~$452. Last few quarters have seen minor trimming.

Coca-Cola (KO): KO is a 2.82% of the portfolio stake. The position was already a large 7M share stake in 2005. That original stake was built to 23.7M shares during the 2007-2008 timeframe at price between $20 and $32. The sizing peaked at almost 39M shares in 2012. The next five years saw the position sold down by ~90% to a ~3.7M share stake at prices between $37 and $47. Recent activity follows. Q1 2020 saw a ~75% stake increase at prices between $37.50 and $60. That was followed with a ~37% increase in Q3 2020 at prices between ~$44 and ~$51. The stock is now at $59.43. Last six quarters have seen only minor adjustments.

Alphabet Inc. (GOOGL): GOOG is a top five 2.70% position. The long-term stake was built during the 2007-2014 timeframe at low prices. The position size peaked at ~2.6M shares in 2014. Since then, the stake was reduced to ~201K shares at prices between ~$510 and ~$3014. The stock currently trades at ~$2143.

U.S. Bancorp (USB): The 2.51% USB stake was purchased in 2017 at prices between $50 and $56 and the stock currently trades at $45.41. Q1 2020 saw a ~50% stake increase at prices between ~$29 and ~$55. Last several quarters have seen only minor adjustments.

Wells Fargo (WFC): The 2.46% WFC position was purchased in Q3 2017 at prices between $49.50 and $56. Q1 2020 saw a ~25% stake increase at prices between ~$25 and ~$49. That was followed with a ~30% stake increase in Q4 2020 at prices between ~$21 and ~$30. There was a ~18% selling over the next two quarters at prices between ~$30 and ~$48. The stock is now at $38.48. Last few quarters have seen only minor adjustments.

Anthem, Inc. (ANTM): ANTM position was first purchased in 2014. The bulk of the current 2.21% portfolio stake was established in 2017 at prices between $144 and $232. There was a ~15% selling this quarter at prices between ~$428 and ~$503. The stock currently trades at ~$444.

Oracle Corporation (ORCL): The 2.11% ORCL position is a very long-term stake. The position was already at around 14M shares in 2007. The next two years saw the stake built to a much larger 62M share position at prices between $15.50 and $24.50. Next few years saw selling at higher prices and by 2017 the stake was back at 14M shares. The five quarters through Q2 2019 saw another ~45% selling at prices between $44 and $57. Q1 2020 also saw a ~18% reduction at prices between ~$40 and ~$56. Last two quarters saw another ~23% selling at prices between ~$73 and ~$104. The stock is currently at $67.72.

Medtronic plc (MDT): The very long-term 1.67% MDT stake was sold down in 2014 at prices between $56 and $76. It was built back up next year at prices between $66.50 and $80. Last six years have seen minor adjustments every quarter. The stock currently trades at ~$88.

American Express (AXP): AXP became a significant part of the portfolio during the three quarters through Q2 2016 when around 6.5M shares were purchased at prices between $59.50 and $66. Next year saw a ~50% selling at prices between $52.50 and $75. There was a ~15% selling Q1 2021 at prices between ~$114 and ~$150. Q3 2021 saw another similar reduction at prices between ~$159 and ~$178. Last quarter also saw a ~9% trimming. The stock currently trades at ~$144 and the stake is at 1.46% of the portfolio. There was marginal trimming this quarter.

Eli Lilly (LLY): LLY is a very long-term 1.28% of the portfolio position. The stake was minutely small till 2008. The following year saw a ~3.5M share purchase at prices between $30.50 and $38. The position has wavered. Recent activity follows: Q1 2019 saw the position almost sold out at prices between $107 and $116. The stake was rebuilt next quarter at prices between $111 and $129. Q1 2020 saw a ~25% reduction at prices between ~$119 and ~$147. Q4 2020 also saw a ~15% trimming. There was a ~16% selling in Q2 2021 at prices between ~$180 and ~$234. It currently trades at ~$291. Last two quarters have seen minor trimming.

Quest Diagnostics (DGX): DGX is a 1.17% of the portfolio stake purchased in Q1 2020 at prices between ~$73 and ~$116 and the stock currently trades at ~$131. Q3 2020 saw a ~22% stake increase at prices between ~$73 and ~$123. The two quarters through Q3 2021 saw another ~15% stake increase at prices between ~$127 and ~$158. Last two quarters have seen only minor adjustments.

Cisco Systems (CSCO): CSCO is a 1.12% of the portfolio very long-term stake. The position size peaked at around 37M shares in 2009. Since then, most years saw reductions and by 2019 the share count was down to 4.2M shares. Q1 2020 saw a ~35% stake increase at prices between ~$33 and ~$50. Last two quarters have seen a one-third reduction at prices between ~$53 and ~$64. The stock currently trades at $43.39.

Abbott Laboratories (ABT), Cigna (CI), Global Payments (GPN), Kosmos Energy (KOS), Lyft, Inc. (LYFT), and Willis Towers Watson (WTW): These very small (less than ~1% of the portfolio each) positions were reduced this quarter.

Note: Although the position sizes relative to the overall portfolio is very small, it is significant that GMO has sizable ownership stakes in Kosmos Energy and Gyrodyne (GYRO).

Below is a spreadsheet that shows the changes to Jeremy Grantham’s GMO Capital 13F portfolio holdings as of Q1 2022:

Jeremy Grantham – GMO Capital’s Q1 2022 13F Report Q/Q Comparison (John Vincent (author))

Be the first to comment