Moyo Studio/E+ via Getty Images

Any large society must have a significant amount of infrastructure in order to function appropriately. To demonstrate just how true this is, consider that the global construction industry is currently estimated to be worth $13.6 trillion based on data from 2021 and the industry is forecasted to grow to $22.4 trillion by 2028. Of course, no large player makes up a significant portion of that market. Instead, the industry has countless players, each one with a different area (or areas) of concentration. One such niche player today is JELD-WEN Holding (NYSE:JELD). Compared to the broader industry, this specialty firm is remarkably small with a market capitalization of $1.3 billion. However, the business has generally grown its profitability over time and shares are trading at levels that investors should consider quite attractive. Due to these factors, I have decided to rate the business a ‘buy’ at this time.

When one closes, another one opens

As I mentioned already, JELD-WEN focuses on producing and selling products dedicated to the construction industry. More specifically, the company sells interior and exterior building products such as windows, interior and exterior doors, and other related offerings. The company’s brands include, but are not limited to, JELD-WEN, LaCantina, VPI, Swedoor, DANA, Corinthian, and others The company produces these brands and sells them through the 137 manufacturing and distribution facilities it has spread across 19 countries. For the most part, these facilities are located throughout North America, Europe, and Australia. For context, 60% of the company’s revenue comes from the North American market. 28% is attributable to Europe, while the remaining 12% comes from Australia and parts of Asia.

At present, the largest concentration of sales for the company is made to the residential new construction market. In short, the company sells its products to a variety of players with the end market being residential infrastructure. 45% of revenue comes from this category. A further 43% of revenue comes from the repair and remodel category of end-user. That leaves the remaining 12% of revenue attributable to non-residential customers. Although the company does sell its products directly to consumers, only 18% of revenue is chalked up to that. 31% of revenue goes to retail customers, while the remaining 51% falls under the distribution category.

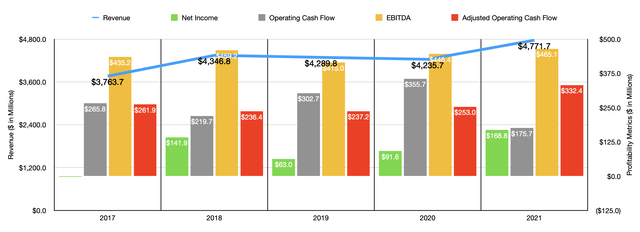

Author – SEC EDGAR Data

Over the past few years, the management team at JELD-WEN has overseen some attractive growth for the company’s top line. Despite revenue falling from 2018 through 2020, the overall trend from 2017 through 2021 was positive, with sales climbing from $3.76 billion to $4.77 billion. The biggest improvement for the company came during its 2021 fiscal year when revenue climbed, relative to the year before it, by 12.7%. The largest contributor to this with a 7% rise in pricing. This was followed up by a 3% rise in favorable volume and product mix. And foreign currency fluctuations had a positive impact to the tune of 3% to the company’s top line.

On the bottom line, things have been a bit more volatile. Net income has been all over the map in recent years, ranging from a negative $2.3 million to a positive $168.8 million. Operating cash flow has been more consistent. After falling from $265.8 million in 2017 to $219.7 million in 2018, it began a consistent incline, eventually hitting $355.7 million in 2020. But then, in 2021, cash flow plummeted to just $175.7 million. If, however, we adjust for changes in working capital, the trend from 2018 through 2021 would have been consistently positive. In 2021, this metric would have totaled $332.4 million. That represents an increase of 31.4% over the $253 million reported just one year earlier. Also, generally positive has been EBITDA. Despite declining from 2018 through 2020, the metric rose from $366.4 million in 2017 to $405.1 million last year.

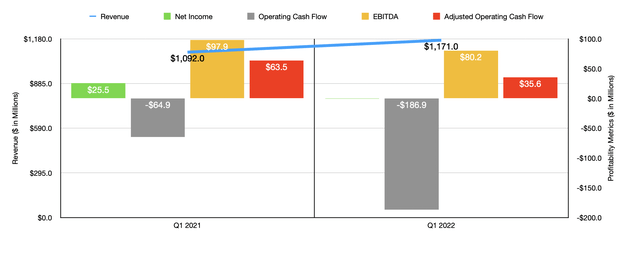

Author – SEC EDGAR Data

For the current fiscal year, things have been a bit mixed. Revenue is up, having risen from $1.09 billion in the first quarter of 2021 to $1.17 billion the same time this year. For the year as a whole, management expects revenue to be between 7% and 10% above what it was last year. At the midpoint, this would imply revenue of $5.18 billion. Meanwhile, profitability for the company has worsened. The net loss of $0.5 million seen in the latest quarter compares negatively to the $25.5 million profit experienced one year earlier. Operating cash flow went from a negative $64.9 million to a negative $186.9 million. Even if we adjust for changes in working capital, the metric would have fallen from $63.5 million to $35.6 million. And over that same window of time, EBITDA declined from $97.9 million to $80.2 million. When it comes to the 2022 fiscal year as a whole, management does think that the picture will improve. For instance, EBITDA should be between $520 million and $565 million. If we assume that operating cash flow will rise at the same rate as EBITDA, then it should come in, on an adjusted basis, at around $387.7 million. If management comes to achieve these targets, investors can expect additional share buybacks from the company this year. In 2021, management bought back 11.6 million shares, representing 11.5% of the company’s total stock outstanding. That is a massive amount by comparison to what many other firms engage in.

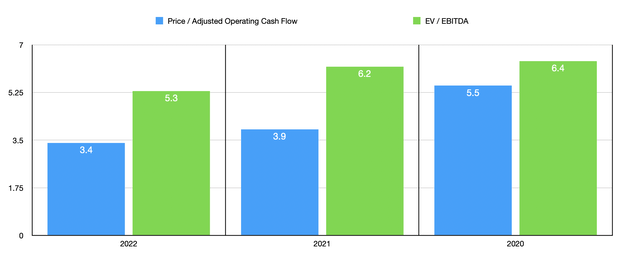

Author – SEC EDGAR Data

Using this data, it does not become hard to value the business. On a forward basis, the company is trading at a price to adjusted operating cash flow multiple of 3.4. Meanwhile, the EV to EBITDA multiple is 5.3. Investors would be right to point out that these are uncertain economic times and that the rise in interest rates and potential for a recession might dampen demand and pricing power of a firm like JELD-WEN. Because of that, I also priced the company based on 2021 results and 2020 results. Using the 2021 results, these multiples would be 3.9 and 6.2, respectively. And using the 2020 results, the multiples would be 5.5 and 6.4, respectively. Even in this case, shares look quite cheap. I also decided to price the company relative to five other firms. On a price to operating cash flow basis, these companies range from a low of 12.1 to a high of 75.3. And using the EV to EBITDA approach, the range was from 9.5 to 14.8. Using results from any of the aforementioned years, we can see that JELD-WEN is the cheapest of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| JELD-WEN Holding | 3.9 | 6.2 |

| Janus International Group (JBI) | 16.6 | 14.8 |

| Gibraltar Industries (ROCK) | 71.3 | 9.5 |

| Griffon Corporation (GFF) | 75.3 | 12.2 |

| CSW Industrials (CSWI) | 23.5 | 13.8 |

| PGT Innovations (PGTI) | 12.1 | 10.6 |

Takeaway

Based on the data provided, I will say that JELD-WEN seems to be doing a really good job. The most recent financial performance is mixed, but even if financial performance does worsen in the near term, the company looks like a cheap operator with plenty of long-term potential. Given how cheap shares are and factoring in the share buybacks management has done, I cannot help but to rate the business a solid ‘buy’ at this time.

Be the first to comment