Sibani Das/iStock via Getty Images

It is without a doubt that JAKKS Pacific, Inc. (NASDAQ:JAKK), a small-cap toy and consumer goods stock of $190.29 million, is successfully performing in the highly competitive toy industry. I first wrote about JAKK in May of this year. Since then, the stock price has increased by 46.96%, even with the impact of economic market uncertainty over the last few months. If we look at its year-to-date growth, the price has increased by 100.76%.

Year to Date Stock Price Growth (SeekingAlpha.com)

On top of that, JAKK has a twelve-month trailing revenue three times greater than its market cap of $190.29 million. It is soon to release its third-quarter results, and for the fans out there, this week is also the release of a tease trailer for the blockbuster of 2023, Super Mario Bros: The Movie, for which JAKK is developing already highly sought-after figures and costumes for children and adults alike. I believe that this highly undervalued stock has a lot more upside potential if we look into the toy and costume releases that ride the tails of much more prominent brands in the movie, toy, gaming and entertainment sectors. Furthermore, the stock has a one-year target estimate of $28, which is 33% lower than its current price. For this reason, I believe that investors may be interested in taking a bullish stance on this cheap company.

What is driving the numbers?

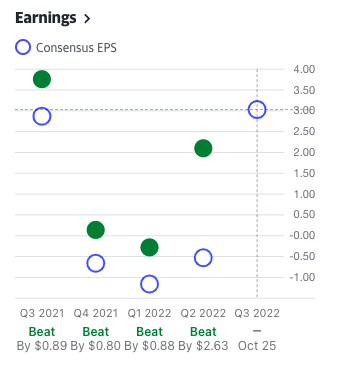

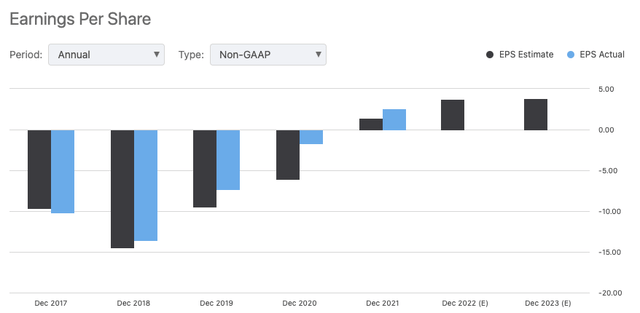

Over the last four quarters, the stock has surpassed earnings expectations. In Q2, we saw JAKK beating expectations by an impressive $2.63 at an EPS of $2.1. For the full fiscal year of 2022, there is the expectation that JAKK will have a revenue of $732.7 million, an increase of 17.95% year on year, and earnings of $4.87 per share, a rise of 88.03% year on year.

Earnings Per Share Actual versus Estimates (YahooFinance.com)

So what is leading to this solid financial performance? Firstly JAKK has a target of selling its products under an SKU of $30. More than 90% of its products are sold for under $50. The affordable pricing and the popularity of the brands that JAKK has aligned with have allowed it to surpass revenue expectations for the year. Secondly, JAKK has heavily invested in its international markets, and Q1 and Q2 saw double-digit growth numbers in these markets from the prior year. Thirdly, Disguise, the company’s costume business has produced never before seen numbers this year that have significantly boosted the company’s revenues. Lastly, the company has maintained relatively stable gross profit margins amidst increased freight costs on the cost side of the business. It has improved designs and pricing adjustments to accommodate inflation and freight charges.

Is this a one-off year, what does the future hold?

The company has had a better than expected year up until now. Fans of the stock were aware of the strong lineup of toys and consumer products off the back of several essential blockbuster movies and strategic alliances with large toy, movie, entertainment and gaming companies that allowed JAKK to produce well-loved products across its businesses, not including the underperforming outdoor activities business.

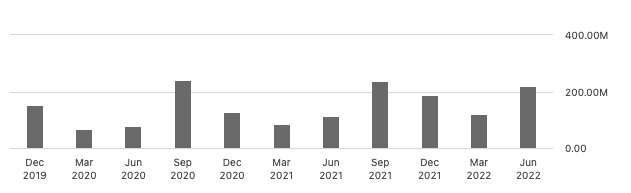

A strong indicator of continued growth for the next two quarters is the historically strong performances in the third and fourth quarters. However, analysts are wary that the high second-quarter results of this year may have cannibalised the upcoming quarter results. The graph shows that over the last two years the performance is higher in the latter part of the year.

Total Revenue by Quarter (SeekingAlpha.com)

In the long term, the company focuses on four critical criteria driving the performance forward. These are continuous innovation within the product lines, an ongoing search for new strategic licensing partnerships for short and long-term trending products and economic gains, investing in geographic expansion to meet the internationally growing demand and moving into adjacent product lines to widen the selection for customers and retailers.

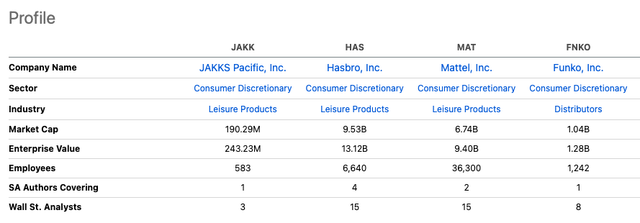

In my previous article, I looked at the relative valuation of JAKK, comparing it to a critical number of competitors in the toy industry that is much larger in size and market share, namely Hasbro, Inc (HAS), Mattel, Inc (MAT) and Funko, Inc (FNKO).

Relative Comparison Toy Industry (SeekingAlpha.com)

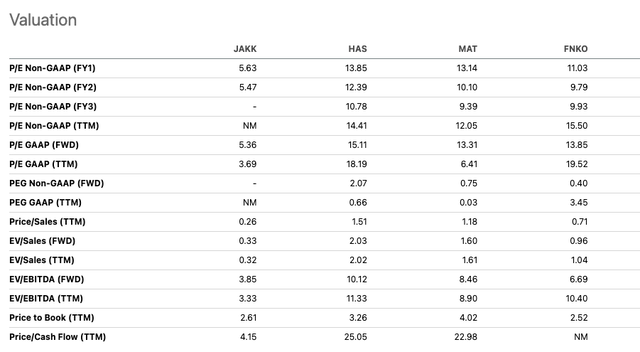

Since this article, the relative valuation for JAKK is even more attractive and indicates that it is a value stock. The low price-to-earnings ratio of 5.63, which is more than 50% under the price of its peers, tells us that the stock price is trading lower relative to its fundamental potential. The price-to-sales ratio of 0.26 is desirable for investors, indicating that you will get more than you invest for every dollar the company earns in revenue. Across the peer valuations, the numbers are more attractive than in my article in July.

Relative Valuation to Toy Industry Market Leaders (SeekingAlpha.com)

Risks

One of the risks is the economic uncertainty toy companies face. Although the toy industry has shown resilience through previous economic downturns, there is still a negative impact on the expected growth rate. This week all four toy companies saw stock prices rise and fall. On the one hand, market leader HAS announced plans to increase profit growth by 50% by 2027. However, due to the economic challenges, the company has readjusted and lowered its guidance expectations for Q3 and Q4 of 2022. It could be a telling tale and put caution to the wind for JAKK’s upcoming Q3 results.

In a slowing economic environment where competition is fierce and consumers are generally more price sensitive, although JAKK has competitive pricing, it could negatively impact the revenue and gross profit margins. Its larger peers can benefit from economies of scale, in which JAKK has less room to move. Lastly, JAKK has given its shareholders impressive returns of 81% over the last 12 months. However, investors should be cautious of the company’s performance over its long history. If we look at JAKK over five years, the total shareholder return had been a loss of 10%.

Earnings Per Share since December 2017 (SeekingAlpha.com)

Final thoughts

The big question is, how much has the economic environment impacted the upcoming Q3 results for JAKK? Nonetheless, as a very undervalued stock, there is a lot of upside potential if investor confidence increases in the stock. JAKK is recommended as a buy by analysts from Wall Street to Zacks Rating and Seeking Alpha’s Quant Rating. Although cautious of the economic uncertainty, the company has a pipeline brimming with popular and affordable products that are available across the globe. For this reason, investors may want to take a bullish stance on this company.

Be the first to comment