Justin Sullivan/Getty Images News

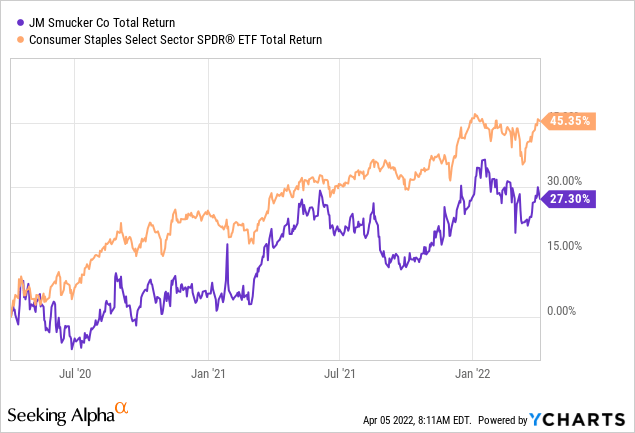

It has been a strong two year period for The J. M. Smucker Company (NYSE:SJM), which returned around 27% since the pandemic lows for the overall market.

But as the pandemic induced demand for long-shelf life foods and increased at-home consumption provided a tide that lifted all boats in that category, the tailwinds are now subsiding. Moreover, as inflation is picking up, lower margin packaged food & beverage companies are likely be hit disproportionately as they lack the comfort of high gross margins and high customer loyalty brands.

On top of all that, I still maintain my thesis that the strategic positioning of J.M. Smucker is lacklustre. Some of the company’s recent deals are already showing signs of weakness and the management remains committed to large transformative deals.

Other than that we would be looking to invest in meaningful M&A that potentially gives us a leadership position in a new and growing category or a bolt-on acquisition that helps round out one of our existing categories and those latter two comments are not new but you won’t see us entering new categories with small emerging brands.

Source: SJM Q3 2022 Results – Earnings Call Transcript

All About the Margins and Return on Capital

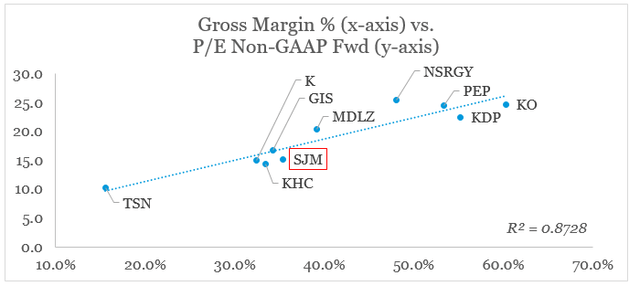

As far as large cap consumer staple companies are concerned, gross margin is by far the best measure from the income statement on their brand strength and pricing power. Operating profitability, on the other hand, depends heavily on economies of scale brought by size and discretionary management decisions relating to fixed expenses. That is why gross margins exhibit such a strong relationship with Price-to-Earnings multiples on a cross-sectional basis.

prepared by the author, using data from Seeking Alpha

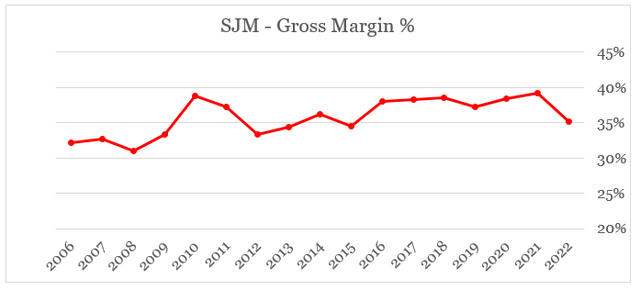

Just as SJM gross margins fell in fiscal year 2019, the pandemic came in for a rescue and provided an uplift for profitability over the next two years (see below). This trend, however, appears to be brought to an end in a rather abrupt manner during the past twelve months.

prepared by the author, using data from SEC Filings

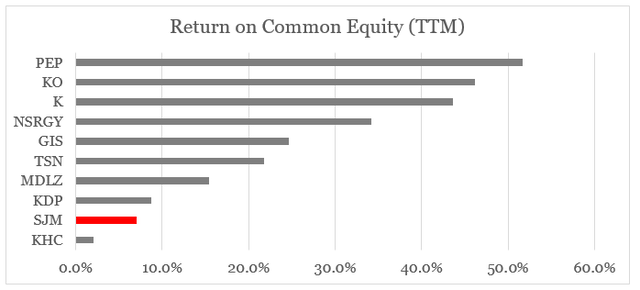

Return on Equity is also one of the lowest within the broader peer group in packaged food & beverages, although we should recognize the drawbacks of the current accounting standards which create difficulties when comparing companies that engaged in large M&A deals to those that have not.

prepared by the author, using data from Seeking Alpha

That is one of the reasons why we see Kraft Heinz (KHC), J.M. Smucker and Keurig Dr Pepper at the bottom of the graph above.

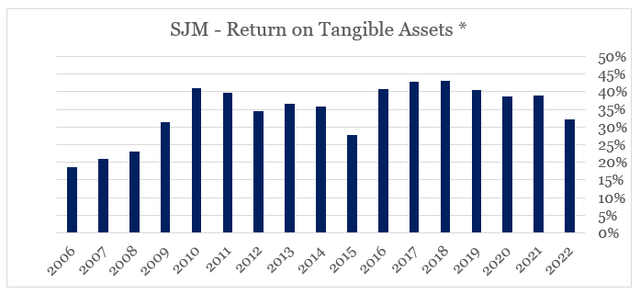

To properly account for M&A deals, I use return on tangible assets, which uses adjusted EBIT in the numerator and tangible assets in the denominator. In the graph below we could see that SJM’s return on tangible assets has been on a trend to a slow decline since fiscal year 2018.

prepared by the author, using data from SEC filings

This partially explains why the company has embarked upon an ambitious M&A program that completely transformed the company. However, such a strategy rarely creates long-term value for shareholders and the recent history in sector is abundant of ill-thought large deals that quickly turned sour.

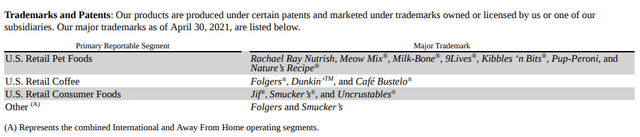

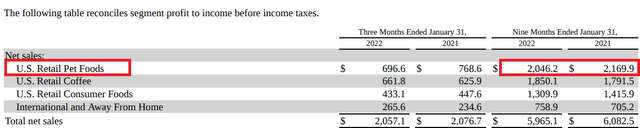

How Are New Segments Performing?

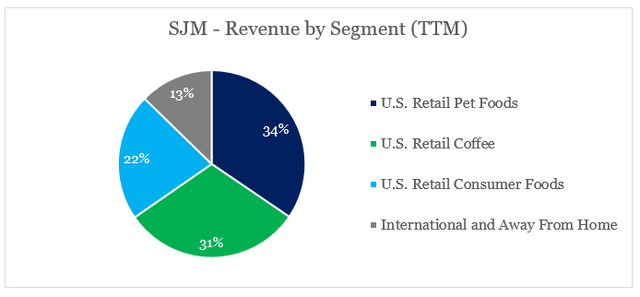

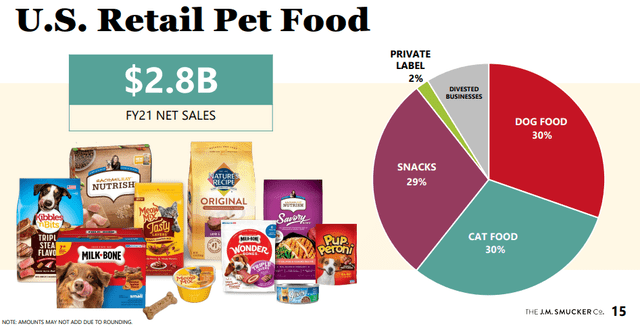

Although historically J.M. Smucker has been linked to its strong jam and peanut butter brands, the company is now first and foremost a pet food and coffee producer. During the past twelve month period, the two segments combined make roughly 65% of the company’s sales.

prepared by the author, using data from SEC Filings

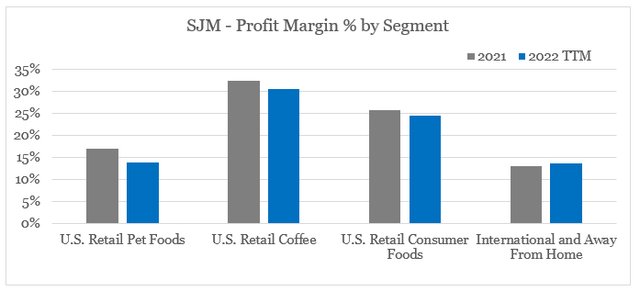

Profit margins of these two major segments fell significantly over the past twelve months when compared to fiscal year 2022, while U.S. Retail Consumer also noted a small decrease.

prepared by the author, using data from SEC Filings

When comparing J.M. Smucker legacy brand portfolio, which consists primarily of the two major brands – Jif and Smucker’s, the pet food and coffee segments look very different from a brand portfolio point of view.

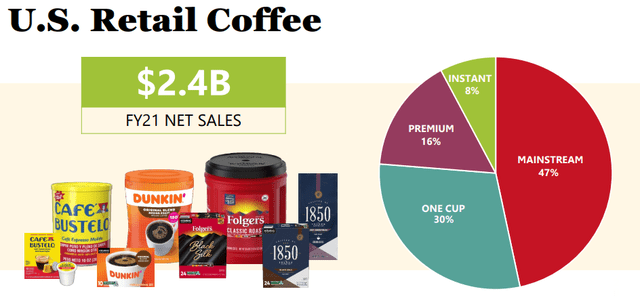

The pet food brand portfolio is highly segmented with many small brands which hold small market share within the overall pet food sector. The coffee business unit on the other hand, has a far more consolidated brand portfolio. However, SJM relies on third-party license for the Dunkin brand.

J.M. Smucker Investor Presentation

Consolidation in the coffee segment has been intensifying in recent years with Coca-Cola (KO) investing heavily behind its recently acquired Costa brand, Nestle (OTCPK:NSRGY) teaming up with Starbucks (SBUX) and the JAB Holding creating a global coffee powerhouse with JDE Peet’s and Keurig Dr Pepper (KDP).

On top of that demand headwinds in the segment will likely intensify which will hit first weaker at-home coffee brands.

Truist’s Bill Chappell believes the company’s coffee segment enjoyed “an artificial lift” over the past two years due to pandemic related changes to consumer behavior, and now he expects a decline in at-home coffee consumption as post-COVID activities pick up.

Source: Seeking Alpha

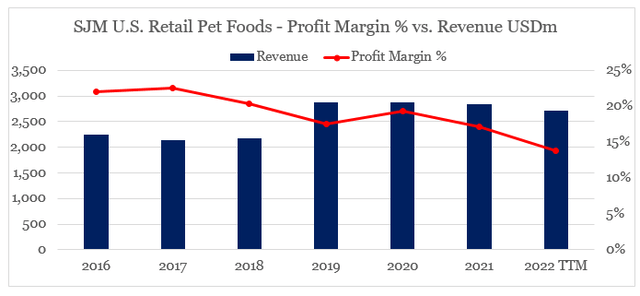

In the pet food segment, SJM is at a disadvantage to the larger well-established players too. You can read more on the company’s strategic and brand positioning in the category in my last analysis on J.M. Smucker. The risks that I covered back then seem to be playing out with the retail pet food segment already showing signs of weaknesses and asset impairments.

J.M. Smucker Investor Presentation

Not having strong brand equity of a master brand hinders the overall portfolio and requires significantly higher advertising spend to build and support all these brands. That is why, brand impairments in the recently acquired pet food business are now starting to come in.

We recognized an impairment charge of $150.4 related to the Rachael Ray Nutrish brand within the U.S. Retail Pet Foods segment, primarily driven by the re-positioning of this brand within the Pet Foods brand portfolio, which led to a decline in the current and long-term net sales expectations and the royalty rate used in the valuation analysis.

Source: J.M. Smucker 10-Q SEC Filing

Although the pet food category has been benefiting from significant tailwinds in recent years, SJM’s revenue and profit margins continue to decline.

prepared by the author, using data from SEC Filings

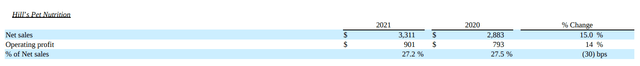

When compared to the leaders in the category, Colgate-Palmolive’s (CL) Hill’s brand grew by 15% in 2021, while margins fell by only 0.3%.

Colgate-Palmolive 10-K SEC Filing

This clearly illustrates the importance of strong brands pricing power during adverse events. While both SJM and CL pet food segments were affected by rising raw materials prices, the latter managed to offset that through price increases.

This decrease in Gross profit was primarily due to higher raw and packaging material costs (300 bps), partially offset by higher pricing and cost savings from the Company’s funding-the-growth initiatives (100 bps)

Source: Colgate-Palmolive 2021 10-K SEC Filing

In the meantime, J.M. Smucker’s pet food sales grew by only 1% during fiscal year 2021 and actually experienced lower net price realization.

The U.S. Retail Pet Foods segment net sales decreased $25.0 in 2021, inclusive of the impact of $53.6 of noncomparable net sales in the prior year related to the divested Natural Balance business. Excluding the noncomparable impact of the divested business, net sales increased $28.6, or 1 percent, primarily due to favorable volume/mix, partially offset by lower net price realization.

Source: J.M. Smucker 2021 10-K SEC Filing

During the 9-month period of fiscal year 2022, the 1% growth has already turned into a decline.

This is in stark contrast to the commentary made by Colgate-Palmolive’s management regarding their pet food segment for the past year.

Net sales for Hill’s Pet Nutrition increased 15.0% in 2021 to $3,311, driven by volume growth of 8.0%, net selling price increases of 5.5% and positive foreign exchange of 1.5%. Organic sales in Hill’s Pet Nutrition increased 13.5% in 2021. Organic sales growth was led by the United States and Europe.

Source: Colgate-Palmolive 2021 10-K SEC Filing

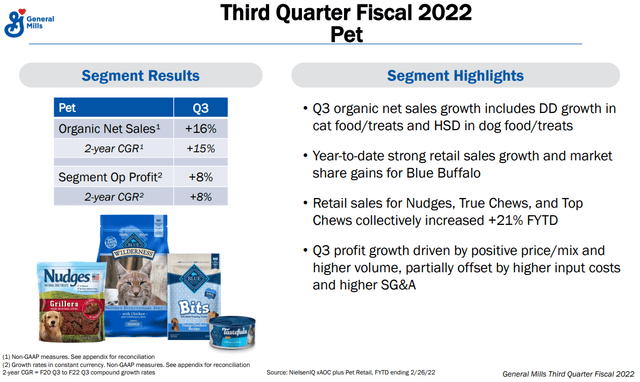

Another major competitor that also recently entered the field – General Mills (GIS) is also doing equally well to Colgate’s Hill’s brand. Organic sales are growing, while margins remain high.

General Mills Q3 2022 Earnings Presentation

Conclusion

J.M. Smucker is a company that has historically been an exceptionally strong business, driven by strong brand and leading positioning in its product segments. The current events, however, highlight the risks involved with a complete shift in strategy that involves a heavy focus on large M&A deals. Although strategic acquisitions are very important for large cap consumer staple companies, large deals rarely create shareholder value. Moreover, entering completely new product segments is a challenge on its own. In that regard, J.M. Smucker is not among the companies that I see outperforming its peers, even in the light of its recent strong share price performance.

Be the first to comment