ablokhin

It’s been a little over eight months since I wrote about J.B. Hunt Transport Services, Inc. (NASDAQ:JBHT), and since then the shares have returned a total of about 4.5% against a loss of about 13.5% for the S&P 500. I didn’t buy any shares back then, but I thought I’d review the name again to see if it makes sense to change that. I’ll decide whether or not to buy by looking at the current valuation, as well as the most recent financial results the company published. Although I didn’t buy the stock, I think I made an excellent return on deep out of the money put options, and I absolutely can’t wait to regale you with the specifics of that trade.

I know that some readers want more than they can get with mere bullet points, but may be totally put off by the idea of reading an entire 1,800-word screed by yours truly. I understand. For such people, I have created the “thesis statement” paragraph that sits near the front of each of my articles. This so-called “thesis statement” allows you, the reader, the opportunity to get the “gist” of my thinking without the need to wade through my tiresome bragging. You’re welcome. Anyway, I think the financial results for JBHT have been magnificent this year. The company is (do not forgive this pun) firing on all cylinders. The problem for me is that there’s growing evidence that trucking and logistics businesses such as this one may be hitting a soft patch, so earnings may come down. That relates to the stock valuation. If the “E” in PE drops, the shares, which currently look cheap, may not appear so in six months or a year. For that reason, I’m going to remain on the sidelines until the inevitable happens and the shares of this wonderful business go on sale. Finally, although I earned a very good risk adjusted return on the short puts that expired in August, I don’t recommend a similar trade today. I think the premia will expand further when the stock falls. At that point, I’ll sell deep out of the money puts, but not before.

Financial Snapshot

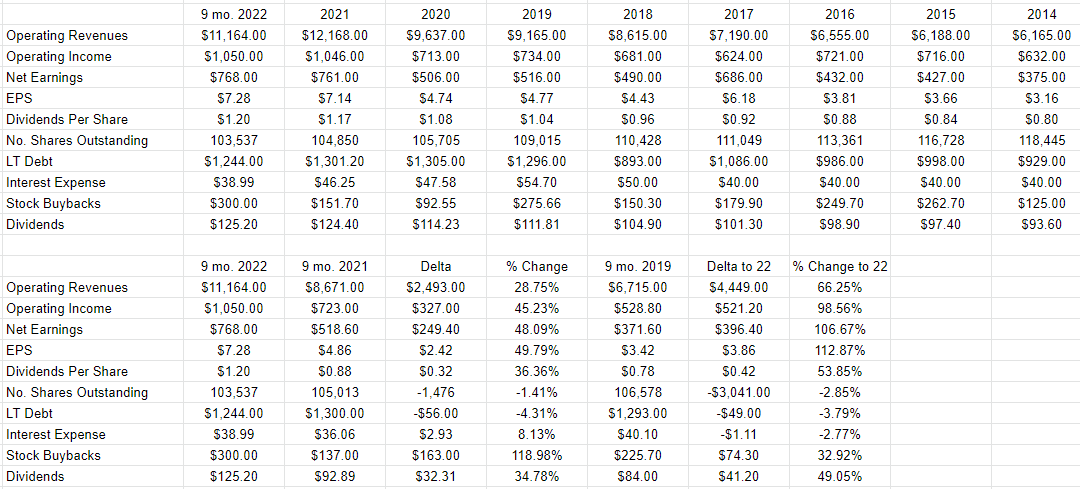

The most recent financial results have been spectacular in my view. Relative to last year, revenue, operating income, and net earnings are higher by 29%, 45%, and 48% respectively. Management has rewarded shareholders with this performance by upping the dividend dramatically to $1.20 for the first nine months of the year. At the same time, relative to last year, there are about 1.47 million (or 1.41%) fewer shares in circulation today than there were this time last year. The capital structure has also improved dramatically, with long term debt lower by about $56 million, or 4.3% when compared to the end of Q3 2021.

When I expand my point of comparison a few years, things look even better. Compared to 2019, the most recent revenue, operating income, and net earnings are higher by 66%, 98.5%, and 107% respectively. Additionally, the dividend is now about 54% higher than it was only three years ago. The capital structure has similarly improved, given that long term debt today is about $49 million lower than it was in 2019.

The financial results have been spectacular in my view, and this puts me on the horns of a dilemma. Is it reasonable to assume that the most recent financial results represent a new “normal”, or is the business going to inevitably soften.

This question is difficult, because logistics are going through some significant changes at the moment. Additionally, a compelling case can be made to suggest that trucking demand will moderate in 2023. Given these uncertainties, I’d be happy to buy into this business, but I’d want to do so at the right price, as I think it reasonable to assume that the “E” in PE, for instance, may head lower.

J.B. Hunt Financials (J.B. Hunt investor relations)

The Stock

My regulars know that I consider the business and the stock to be distinctly different things. If you’re one of my new followers, first, welcome, I guess. Second, I consider the business and the stock to be distinctly different things. This is because the business generates revenue by selling transportation, and logistics services, while the stock is a bit of virtual paper that gets traded around based on a host of factors having little to do with the business. The company’s decision to buy some shares, for instance, may drive the stock higher in price. The stock price may go up and down depending on the demand for “stocks” as an asset class. There’s no way to prove it definitively, but I think a reasonable case could be made to suggest that the shares of J.B. Hunt would be even higher today had the overall market not dropped by about 13.5%. Also, a fashionable analyst may write something about The Jones Act, for instance, and that may impact all transportation companies. Given that the financial statement valuation of the business is “backward-looking” and the stock is the crowd’s forecast about the distant future, there’s an inevitable tension between the two.

So, to sum up, the business generates revenue and net income, while the stock bounces up and down based on the crowd’s ever-changing views about the future. In my view, the only way to successfully trade stocks is to spot the discrepancies between what the crowd is assuming about a given company and subsequent results. I like to buy stocks when the crowd is particularly down in the dumps about a given stock, because those expectations are easier to beat.

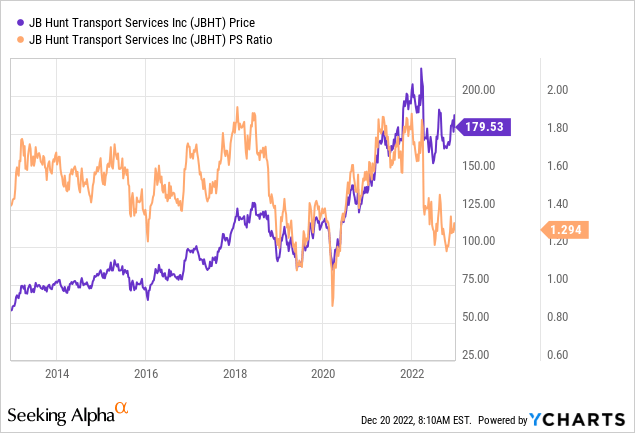

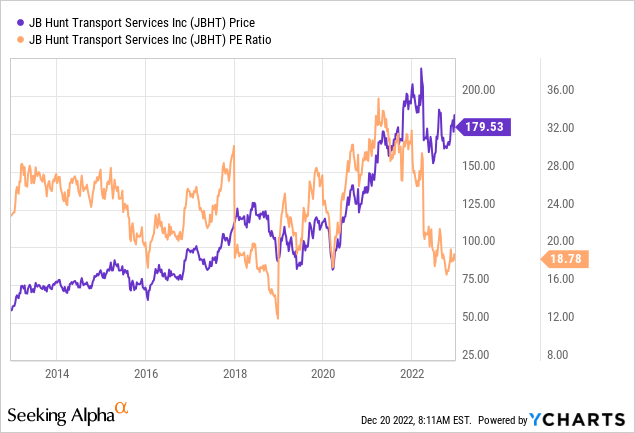

Another way of writing “down in the dumps about a given stock” is “cheap.” I like to buy cheap stocks because they tend to have more upside potential than downside. As my regulars know, I measure the cheapness of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the relationship of price to some measure of economic value, like sales, earnings, and the like. I like to see a stock trading at a discount to both its own history and the overall market. When I last reviewed J.B. Hunt, the market was paying $1.52 for $1 of sales, which was high by historical standards. Additionally, the shares were trading at a fairly hefty PE of 24.37. This valuation was “rich” in my view. A little over eight months later, and the shares are between 15% and 23% cheaper, per the following:

Source: YCharts

Source: YCharts

As these graphs seem to show, the shares are trading near the nadir of their valuations, but this may simply be an artifact of the company just coming through a great financial time. As I suggested above, the “E” in PE may be shrinking. For that reason, I want to move beyond simple ratios to examine the assumptions that underlie the current stock price.

As my regulars know, in order to try to understand what the crowd is currently “assuming” about the future of a given company, I rely on the work of Professor Stephen Penman and his book “Accounting for Value.” In this book, Penman walks investors through how they can apply the magic of high school algebra to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in this formula. In case you find Penman’s writing a bit dense, you might want to try “Expectations Investing” by Mauboussin and Rappaport. These two have also introduced the idea of using the stock price itself as a source of information, and then infer what the market is currently “expecting” about the future.

Anyway, applying this approach to J.B. Hunt at the moment suggests the market is assuming that this company will now grow profits at a rate of about 6.1% from here. In my view, that is a very optimistic forecast, even for a company as great as this one. Given the above, I’m going to remain on the sidelines for now.

Options Update

In my previous missive on this name, I wrote that I had previously sold five August J.B. Hunt puts with a strike of $125 for $0.55 each. Since the shares dropped in price between the time I published the article before last and the most recent one, the premia on these expanded to $1.75. Since I was still happy with that strike price, I sold five more at that price. These 10 puts expired on the third Friday of August, obviously, and that netted me a total of $1150 in put premia. In my view, this represents a great risk adjusted return. I earned a fairly decent return for being willing to sell very deep out of the money put options. I didn’t earn any upside from the stock, but I think I earned a much better risk adjusted return.

While I normally like to repeat success, I can’t in this case. I am firmly of the view that the earnings will moderate from current levels, and I think that will put pressure on the stock price. While the current August put with a strike of $125 seems attractively priced at $2.95, I’m of the view that the premia will expand as the stock drops. For that reason, I would recommend remaining on the sidelines until the inevitable drop in price.

Be the first to comment