NicoElNino

Intro

Recent elevated volatility in iShares U.S. Real Estate ETF (NYSEARCA:IYR) means that this fund has lost almost 29% of its value since the turn of the year which equates to roughly $33 a share. Increasing interest rates, as well as a bearish trend in mortgage applications overall, seem to be the primary reasons for the collapse of real estate investment trusts in 2022. Due to the significant spike in inflation in recent months which has corresponded with a sharp tightening cycle by the Fed, the real estate sector is having a hard time of it and there seems to be no clear end in sight. Suffice it to say, given the significant retracement in the fund price as well as the dividend on offer, it will be interesting to see if buyers begin to step in here once more once we get a firm bottom in the S&P 500 index.

We state this because experienced investors or strong hands many times step in in times of maximum pessimism. Sentiment remains very bearish as there may seem to be no end to the cost of living crisis in the US. Sustained inflation obviously affects one’s disposable income and the market has been pricing in this trend to continue for some time now.

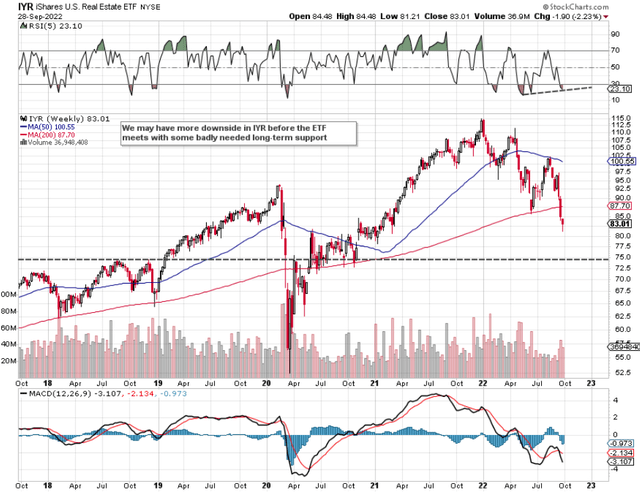

However, if we go to the technical chart, we can see that shares of IYR have some pretty significant support beneath (At approximately the $75 level) if indeed the present carnage continues for some time to come yet. Furthermore, bullish divergences are beginning to make themselves known on the RSI momentum indicator which may mean a turnaround is in the offing.

IYR Technical Chart (Stockcharts.com)

Furthermore, the Bank of England’s decision yesterday to step in to try and stabilize its bond market immediately softened its bond yields not only in the UK but also in the US. Although this looks counterintuitive from a bond perspective, more interventions may indeed help the real estate sector due to them being inflationary in nature. Suffice it to say, the global economy has never been as connected as it is now which definitely leaves the door open for Jerome Powell to “intervene” in US markets once more. This is what the bears need to take into account. Although a sharp recession could indeed be very painful, if the interventionalists reverse course and begin easing once more, markets will begin to price in immediately the ramifications of these very same assets being priced in cheaper dollars.

As a result of the significant down move, implied volatility has spiked to approximately 30% in the November cycle with historical volatility coming in under the 20% mark. The large divergence suits option sellers so here are two options strategies investors can use to reduce risk in a long investment in IYR.

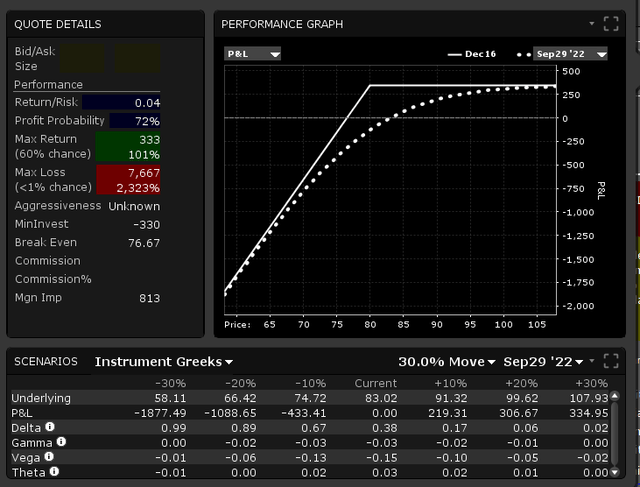

Sell Puts

Implied volatility in this year’s December cycle is actually above 30% so selling something like the $80 December put for $3.50 per contract is a sound strategy for the following two reasons. The first reason is that this play immediately reduces one’s cost basis to $76.50 (Almost 8% below IYR’s prevailing share price). The second reason is longer dated options have higher vega which means one can get “more bang for their buck” by selling more long-dated options. This essentially means that any contraction in volatility will be more beneficial for more long-dated options. This is really apparent with at-the-money options which have the highest vega of all.

Put Option Sale in IYR (Interactive Brokers)

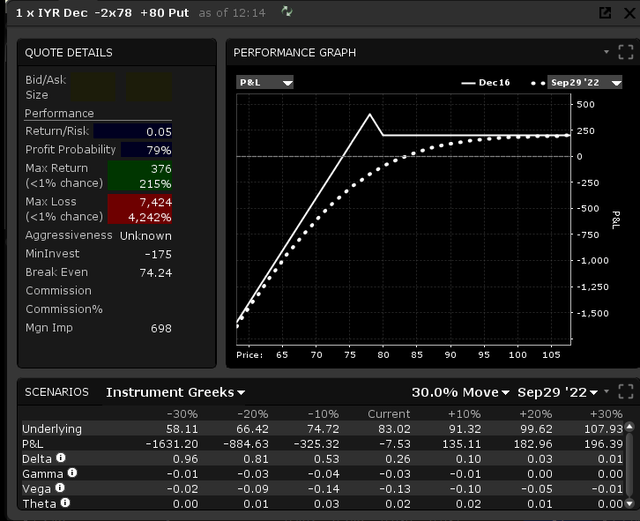

Sell Ratio Spreads

If one wants a higher probability of profit trade, then one could sell a put ratio spread which means one is essentially selling more out of the money puts over their corresponding calls. (Buy 1, Sell 2 Or Buy 4, Sell 8 put contracts, etc.). Below, we have depicted a simple one-for-two where although less credit is collected on the front end, the profit potential due to the embedded long put spread is larger than the sale of the naked put. Furthermore, as we can see below, the probability of profit now comes in close to 80% and the breakeven is a good $2.25 per share lower in IYR ($74.24).

Ratio Spread Setup In IYR (Interactive Brokers)

Conclusion

IYR has had a rough time in 2022 thus far. Now trading at an extreme though, traders and investors alike will be looking to spot a bottom here in the not-too-distant future. The fund’s high levels of implied volatility enable traders to reduce cost-basis significantly due to the richness of those puts. We look forward to continued coverage.

Be the first to comment