roman023/iStock via Getty Images

Thesis

On August 11 the Delaware Ivy High Income Opportunities Fund (NYSE:IVH) announced that its Board of Trustees approved the reorganization of the fund into Aberdeen Income Credit Strategies Fund (ACP). As per the announcement:

It is currently expected that the Reorganization will be completed in the first quarter of 2023 subject to (I) approval of the Reorganization by the Acquired Fund shareholders, (II) approval by Acquiring Fund shareholders of the issuance of shares of the Acquiring Fund, and (III) the satisfaction of customary closing conditions.

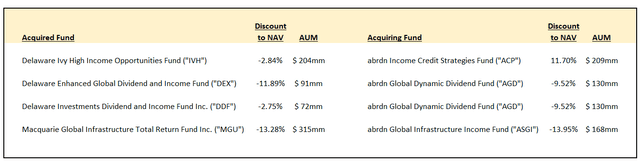

In fact, a number of closed-end funds (“CEFs”) from the Delaware Management Company are being taken over by Aberdeen:

If we look at the above table, we will notice that most of the Delaware Management Company CEFs are fairly small and they are all trading at discounts to net asset value. In fact this is a systemic problem with this asset manager, where external parties have been successful in arbitraging this negative market view of the asset manager. To that end we have seen a successful proxy fight by Saba Capital Management, L.P., a hedge fund, that has forced a Delaware fund to start purchasing shares trading at a discount:

Saba Capital Management, L.P. and certain associated parties (collectively “Saba” or “we”) today announced that it has reached an agreement with Delaware Investments National Municipal Income Fund (NYSE: VFL) (the “Fund”).

Under the terms of the agreement, the Fund will commence a significant cash tender offer for up to 50% of the Fund’s outstanding shares of common stock at a price per share equal to 99% of the Fund’s net asset value (“NAV”) per share (the “Tender Offer”). The Fund will repurchase shares tendered and accepted in the Tender Offer in exchange for cash. In exchange for the Tender Offer, Saba agreed to certain customary standstill provisions.

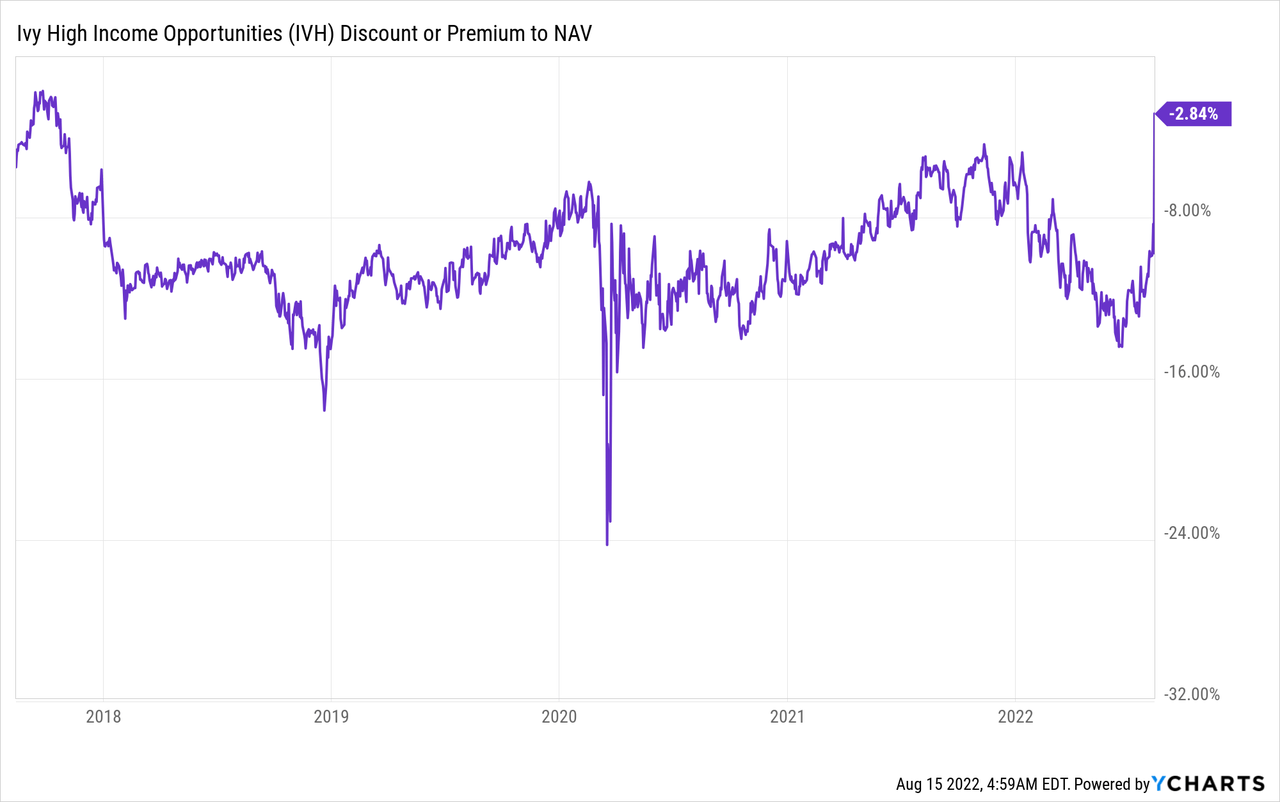

In term of IVH and the implications for its shareholders, we generally see this move as a positive. IVH has changed managers very recently, with Delaware / Macquarie announcing the completion of its acquisition of Waddell & Reed Financial and IVH in April 2021. Rather than being merged into a platform highly regarded by the market, IVH was moved to an asset manager that has seen constant discounts in the market for its CEFs. To that end, the discount to NAV for IVH persisted after the acquisition:

We can see from the above graph that the market is viewing positively the ACP merge announcement with a very sharp tightening of the discount to NAV. The obstacle left is for both funds shareholders to approve the merger. It is clear that IVH shareholders benefit substantially, and we believe ACP shareholders will benefit as well. Higher AUM are always positive for a fund because it will give them more leeway regarding primary allocations, cheaper cost of funds and more preeminence in the market. ACP will basically double its AUM if the IVH merger goes through.

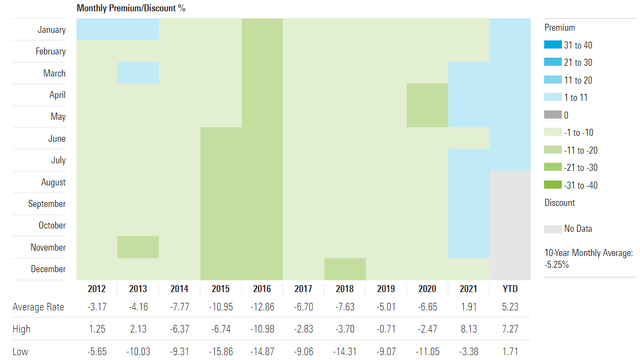

ACP on the other hand has most recently traded at premiums to NAV:

ACP Premium / Discount to NAV (Morningstar)

While ACP has only seen premiums starting in 2021, its historic discount to NAV is much lower than the one observed in IVH (roughly -5% for ACP versus -10% for IVH).

Delaware Management Company and Aberdeen are aware of the synergies as per their press release:

The combination of the merging funds will help ensure the viability of the Funds, increasing scale, liquidity and marketability changes that may lead to a tighter discount or a premium to NAV over time. Following the Reorganizations, shareholders of each Acquiring Fund will experience an increase in the assets under management and a reduction in their Fund’s total expense ratios. There are no proposed changes to the current objectives or policies of the Acquiring Funds as a result of these Reorganizations, including the Funds’ monthly distribution policies. Individually, each Board believes that the Reorganizations are in the best interest of their Fund’s shareholders recognizing the strategic objective of creating scale for the benefit of shareholders.

Ultimately we do not know if we have seen the widest in credit spreads for the year, so another leg down in credit conditions might still occur. However we think the merger will go through and that it is a positive for the IVH shareholders which will see themselves migrated to a platform that usually traded at a premium to net asset value. A year from now, when we can say that fundamentally the market will have already priced in a recession, we feel the merger will have gone through and IVH (then ACP) will see a premium to NAV for its shares.

Collateral Composition

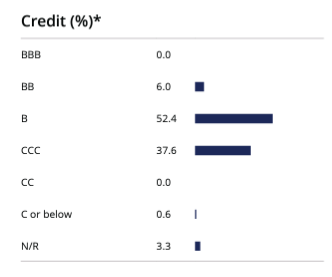

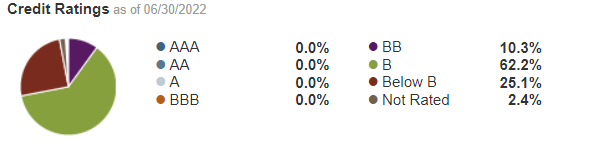

Both IVH and ACP are high yield CEFs that focus on the riskiest pieces of debt:

ACP Portfolio (Fund Fact Sheet) IVH Portfolio (Schwab)

As per the acquisition statement the current funds’ objectives will not change and we see similar collateral compositions here.

Conclusion

A number of CEFs from the Delaware Management Company are proposed to be acquired by Aberdeen funds. IVH is to be merged into ACP if approved. Both are high yield CEFs that focus on the riskiest pieces of the capital structure (single “B” and “CCC” credits). The market reacted immediately with the IVH discount to NAV narrowing to a -2.84% level, unseen in almost five years. ACP, on the other hand, is currently trading with a 11.7% premium to NAV. We believe the merger is going to go through and it will represent a positive for IVH shareholders. Expect lower cost of funds, synergies and better liquidity. The best way to trade this announcement now is to wait for another risk-off bout when the discount to NAV for IVH will widen again and start accumulating shares with the view that once merged, IVH will trade at a premium to NAV as the new ACP and from a fundamental standpoint higher recessionary default rates will already be priced in the credit spreads.

Be the first to comment