Bennett Raglin/Getty Images Entertainment

Investment Thesis

Shopify (NYSE:SHOP) has created an incredible sticky platform whilst continually rolling out new products and solutions to upsell its merchants. The company has seen rapid growth since its 2015 IPO, but expects a slowdown in 2022 after two years that were nothing short of incredible.

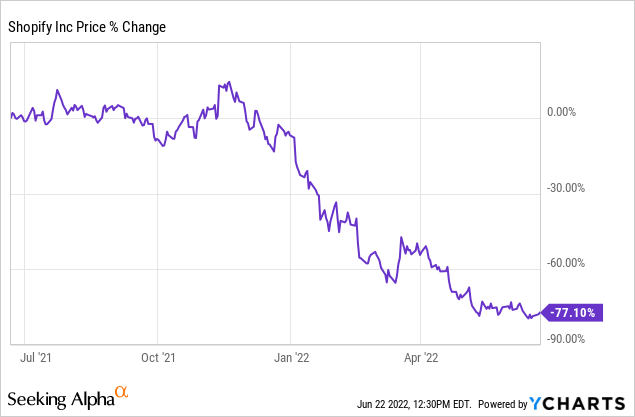

Naturally, shares reacted by falling almost 80% from their 52-week high.

In my previous article, I spoke more broadly about the market’s current sentiment towards Shopify, and why I believed that the market was acting on short-term pessimism.

But, what about the business as a whole? After running Shopify through my investing framework, I can only make one conclusion – Shopify is a high-quality business that is currently trading at far too low a price, considering the opportunity that lies ahead.

Business Overview

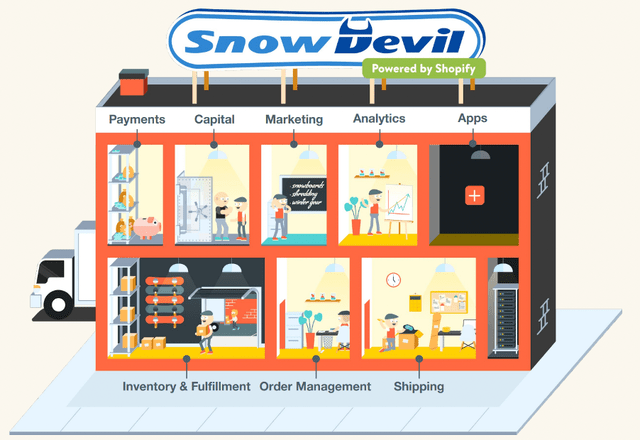

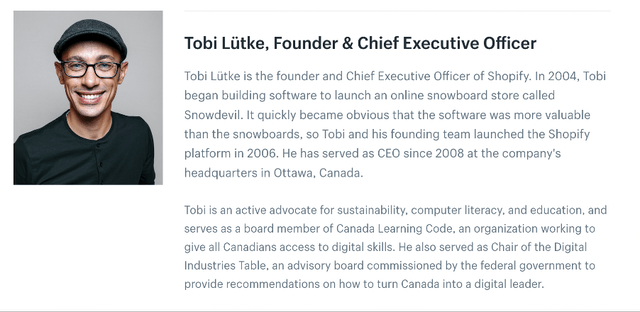

Before we get into the business itself, I want to start with Shopify’s origin story. Back in 2006, Shopify Founder and CEO Tobi Lütke decided to open an online store, but this was not Shopify. He actually wanted to open an online store called Snowdevil which sold snowboarding equipment. So, he went to see what he could use to build his online store and found that the existing solutions just weren’t good enough and didn’t cater to his needs. So, he did what any computer programmer would do – he built his own solution. A few months later, Lütke decided that this solution for creating online stores could be quite useful, and thus Shopify was born. The company still pays tribute to its roots on company presentations, with its sample Shopify store having the Snowdevil logo above it.

Shopify Q3’21 Investor Presentation

Onto the business itself – Shopify is a leading ecommerce infrastructure provider, giving businesses of any size the ability to succeed in the world of ecommerce.

The business model has two core revenue streams: Subscription Solutions and Merchant Solutions, with the former referring relating to recurring revenues generated through subscriptions to the Shopify platform, and the latter relating to additional services offered by Shopify, such as payments, accounts, fulfilment and so on.

This business model has given Shopify a solid base of high-margin, recurring revenues through its Subscription Solutions as well as with the rapidly growing, performance-based revenues from its Merchant Solutions.

Over the past decade, Shopify has grown to be the clear US leader in the world of ecommerce infrastructure providers. Having successfully moved upmarket, the company now counts the likes of Netflix, Heinz, and Gymshark as customers.

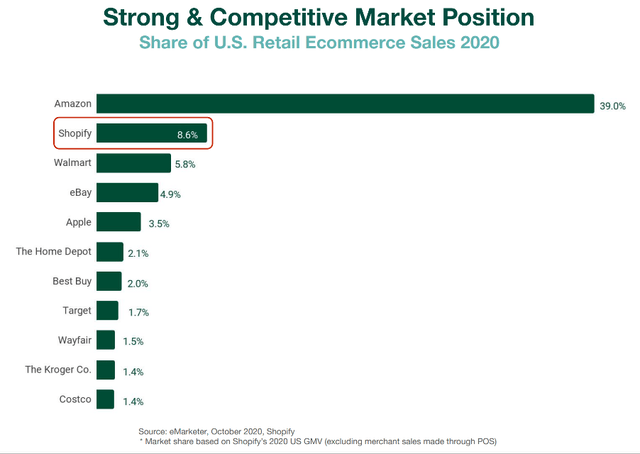

In terms of the total share of 2020 US Retail Ecommerce sales, according to eMarketer, Shopify-powered sales hold the 2nd largest share of the US retail ecommerce market, second only to the behemoth that is Amazon.

Shopify Q3’21 Investor Presentation

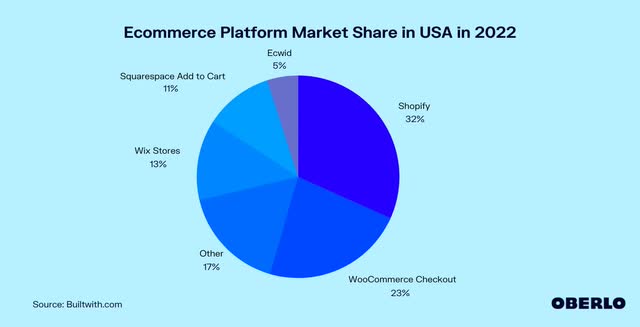

Looking at Shopify’s position against its ecommerce platform competitors, it also has the lead in the United States as it continues its rapid expansion.

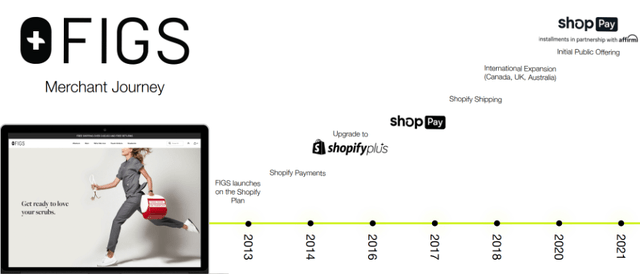

As an investor, the most impressive aspect of Shopify is its ability to continually upsell new solutions to its existing customers, as demonstrated by the rapid growth in its Merchant Solutions business. This significantly increases the lifetime value of every single customer on Shopify’s platform.

Let’s take a look at Figs (FIGS) as a recent example of a company that started out on Shopify & recently IPO’ed. They first launched on the Shopify platform in 2013 under the more basic Shopify Plan – since then, they have: added Shopify Payments, upgraded to the Shopify Plus plan, added Shop Pay, added Shopify Shipping, expanded internationally on Shopify, and offered Shop Pay Instalments. This is just one of many stories of Shopify being able to grow alongside its customers.

Shopify Q1’22 Investor Presentation

Economic Moats

With every business, I look to see if there are any durable competitive advantages (aka economic moats) that will help the company continue to thrive whilst protecting itself from competition. Thankfully, there are plenty of strong economic moats to protect Shopify, and I’ll start with its biggest one: switching costs.

The economic moat of switching costs means, unsurprisingly, that it is expensive or troublesome for customers to switch from a certain product. If a customer builds out its ecommerce website on Shopify’s platform, then it is unlikely to switch providers as it would take a lot of effort to transfer your existing website to another platform – the only benefit in doing so would be if that new provider was significantly cheaper or provided a better service for the same cost.

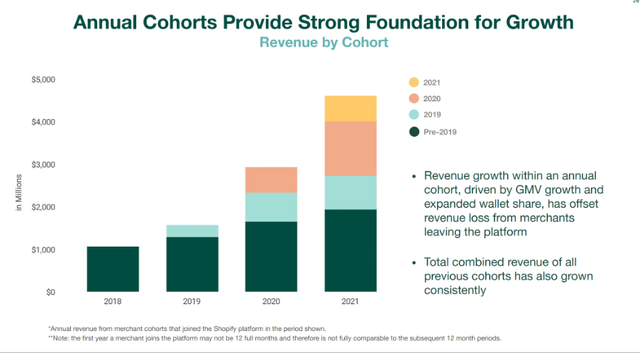

Now, imagine that a company has not only its ecommerce website on Shopify, but it also has payments, logistics, accounts, and additional features all linked to Shopify’s platform. Any switch of provider would likely lead to downtime, business disruption, and all in all, it wouldn’t be worth it unless the payoff was huge. So the switching costs result in fewer customers leaving, and the new products result in higher spend over time, so as you can see from the below chart, each Shopify cohort continues to spend more on the platform each year.

Shopify Q4’21 Investor Presentation

Whilst this is currently Shopify’s strongest moat, it also has a number of smaller economic moats that combine to create a business that is very well protected from the competition.

Speaking of competition, your first thought may be Amazon (AMZN) (it often is when it comes to ecommerce), so I’ll move onto the economic moat that is particularly effective against this giant, and that is counter positioning. Now, Amazon has been accused of exploiting small and medium sized business by optimising its own-brand products through its algorithm – or, taking it one step further and duplicating a business’s product & then going on to optimise that on its website.

The Amazon Basics Camera Bag, left, and the Everyday Sling by Peak Design (Peak Design screenshot via YouTube)

Shopify, on the other hand, has a seller-aligned business model. Through its performance-based Merchant Solutions, where Shopify takes a cut of revenue generated by its merchants, it has created a win-win situation. As a result, small and medium sized business would be much more inclined to use Shopify’s platform to sell on – albeit the dynamics are different, and it’s not a marketplace with the same reach as Amazon. But this is why I feel like any worries about Amazon encroaching on Shopify’s territory are exaggerated.

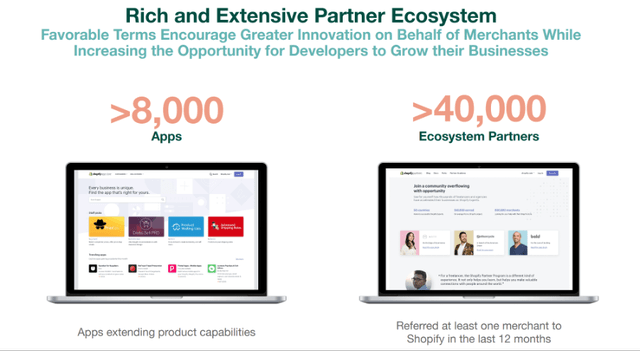

Shopify also benefits from a weak network effect, and this is mainly through its ecosystem of partner app developers, who have created more than 8,000 apps on Shopify’s store. These integrations can then be used by Shopify’s merchants on their websites. The weak network effect here is that Shopify is the largest US ecommerce platform provider, so developers will want to use Shopify’s app store to reach the most potential customers, and more potential customers will want to use Shopify as the breadth of additional apps offered increases. It also has its ecosystem partners who refer merchants to Shopify, and over 40,000 referred at least one merchant to Shopify in the last 12 months. Two weak network effects, but they are both at play.

Shopify Q4’21 Investor Presentation

I also think the current buildout of its own fulfilment network is substantially increasing the barriers to entry, whilst becoming a big differentiator against the likes of Squarespace (SQSP) and WooCommerce. The recent acquisition of Deliverr should only help to speed up this process.

Outlook

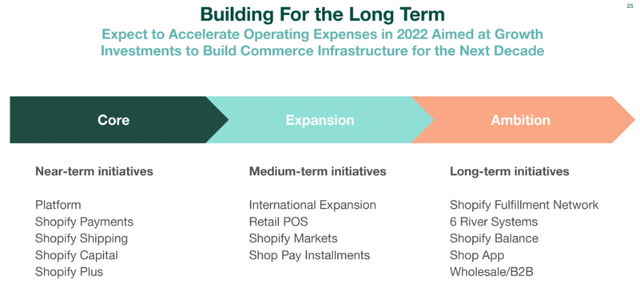

Shopify has proven itself to be capable of rolling out new solutions that merchants need, and I don’t expect this to slow down in the future. The company recently outlined their investments across the next decade, which indicates that Shopify is certainly not short of ideas.

Shopify Q4’21 Investor Presentation

In terms of the opportunity that remains, Oppenheimer released a report last year suggesting that Shopify’s global commerce TAM will reach ~$255B by 2025. To put that into perspective, Shopify saw revenues of $4,827m for the past 12 months – or, less than 2% of this forecasted TAM. Given that Shopify is a leader in this industry & should be able to take a sizeable piece of the pie, I think Shopify’s story lies firmly in the future.

It’s also not yet a company primed for profitability. It continues to be in all-out growth mode, which for me is absolutely fine considering the company it’s trying to grow into & the size of the opportunity which it is trying to capture. Most importantly, it is growing whilst being financially solid & free cash flow positive.

Management

When it comes to fast-paced, innovative companies, I always aim to find founder-led businesses where insider ownership is high, and Shopify ticks this box. Snowboard enthusiast and Shopify Founder Tobi Lükte heads up the company as CEO.

When it comes to skin in the game, this is also visible at Shopify, with Lütke holding 6.3% of Shopify shares as of March 2022. It’s worth highlighting that, back when Shopify was a $200 billion company, these shares were worth over $12 billion – so 6.3% might not sound like a lot, but it is a substantial amount of wealth that Lütke has tied to Shopify’s success.

Shopify 2021 Annual Report / Excel

I also like to have a quick look on Glassdoor to get an idea about the culture of a company, and Shopify gets some great scores from its 1,778 reviews. Any score over 4.0 is impressive, and Shopify achieves this across the board – with particularly high scores in Culture & Values and Diversity & Inclusion, which help make for a successful workplace and should help drive forward a mission-led business such as Shopify. The fact that over 80% of the staff are positive about the future for Shopify is also a great sign (this number is usually much lower), and CEO Lütke is clearly popular. All in all, this indicates that employees love working at Shopify.

Financials

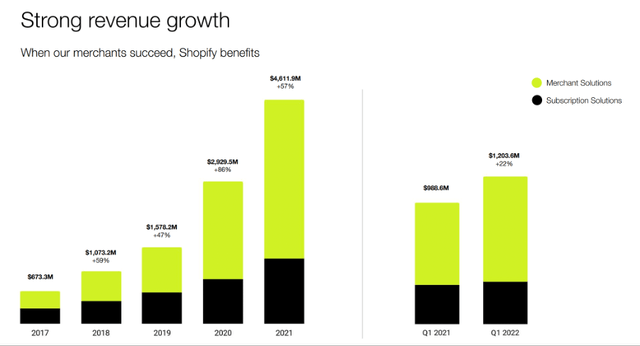

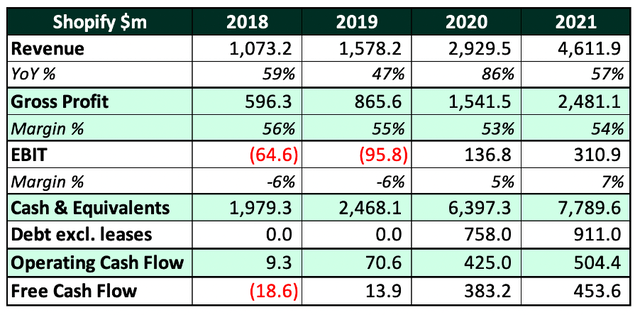

Shopify’s financials show a company that has grown rapidly, with revenues increasing at a 63% CAGR from 2018 through to 2021, with an additional pandemic boost over the past couple of years as more business went online. It also has a substantial net cash position of ~$6.9 billion, representing ~16% of the company’s total market capitalisation. It’s also free cash flow positive, despite the huge investments being made, and this FCF exploded in 2020 and 2021.

I’m going to take a moment to focus on the gross profit margins, which we can see fluctuated between 56% and 53% over the last few years. Now, with a company growing as quickly as Shopify, I would expect to see some economies of scale playing out & that gross margin improving – but, what I can in fact see is a gross margin that is slightly declining, so what’s going on?

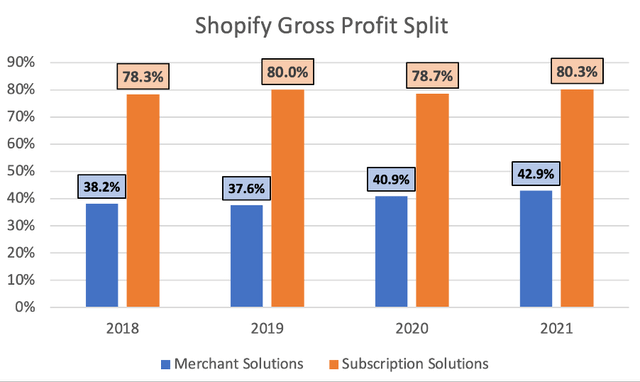

Well, take a look under the hood, and things aren’t as bad as they seem. Take a look at the below graphic, detailing the split between Subscription Solutions and Merchant Solutions.

Shopify Q1’22 Investor Presentation

Clearly, the Merchant Solutions are growing at a much quicker rate, and that’s to be expected due to Shopify’s business model. Now, it’s worth highlighting that the Subscription Solutions have considerably higher gross margins, because the costs relate mainly to infrastructure and hosting fees that get a lot lower with scale.

On the other hand, Merchant Solutions have considerably higher costs associated to them, such as payment processing and interchange fees, credit card fees, point-of-sale hardware costs, warehouse storage costs, plus everything else associated with Shopify’s capital intensive fulfilment network.

Yet, the good news is that gross profit margins are remaining stable for Subscription Solutions at ~80% and they are actually improving across Merchant Solutions. So on the surface, it doesn’t appear that gross profit margins are actually moving, but look under the hood and we see a much more positive picture.

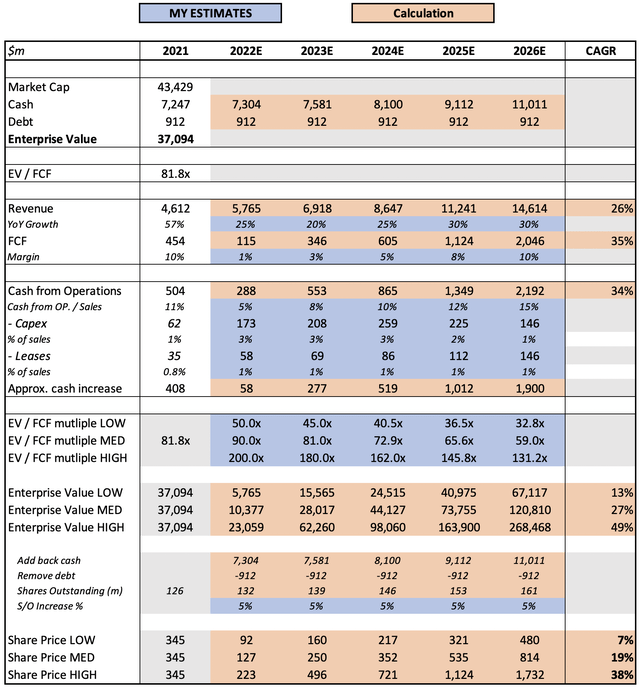

Valuation

In my previous article, I outlined the reasons behind my current valuation model for Shopify.

The only thing to have changed since is Shopify’s current market capitalisation, which has fallen slightly.

Risks

Whilst there are a lot of positives for Shopify shareholders, I can’t ignore the clear risks that face the company.

Firstly, the wider macroeconomic risk of a recession could impact Shopify more substantially, due to both its exposure to small and medium sized businesses as well as the fact that it mainly serves retail customers; arguably an industry that is more impacted by a recession than, say, enterprise software.

There is also the risk that they are taking on building out their fulfilment network; in particular, if it fails to deliver (excuse the pun), then Shopify will have spent a lot of time and money on a substantial failure.

That said, I do believe in management’s ability to roll out new solutions, as they have a track record of doing this frequently and succeeding. Furthermore, although I view the short-term impact of a recession as being quite substantial, digitalisation of businesses is a secular tailwind that should allow Shopify to continue growing in difficult times – plus, I am planning to invest in this company for the upcoming decade, so I’m not too swayed by current macroeconomic factors.

Bottom Line

There is a reason that Shopify shares have returned 270% for shareholders over the past 5 years, despite currently being down almost 80% from its 52-week high – this is a high-quality business.

There are short-term headwinds for Shopify, in particular the potential impact of a recession on smaller and medium sized businesses. But over the upcoming decades, I can see this company driving businesses of all sizes into a digital future – and at the current price, it’s just far too cheap to ignore.

Be the first to comment