yongyuan/E+ via Getty Images

Doing Well Without Extraordinary Gains

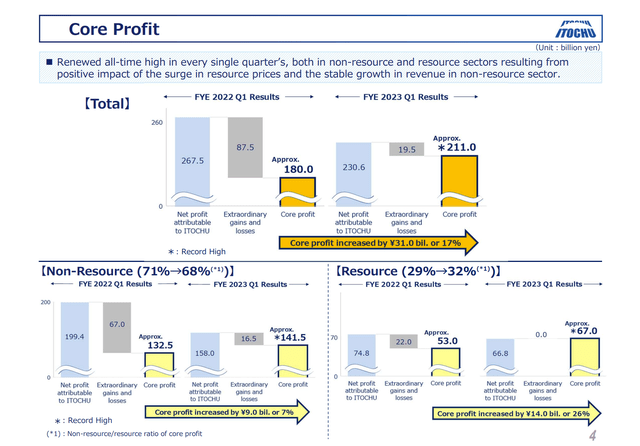

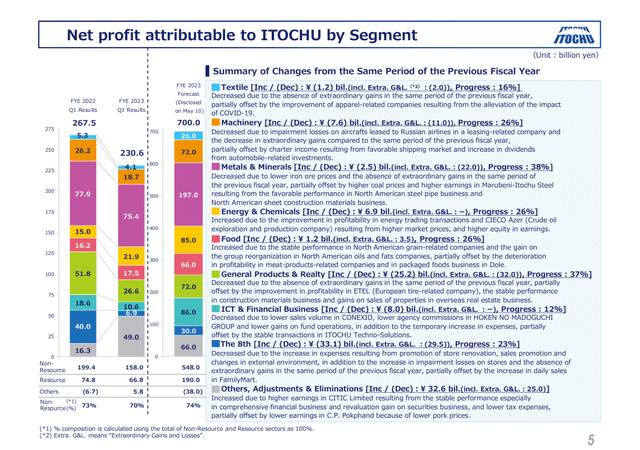

ITOCHU Corp. (OTCPK:ITOCY) (OTCPK:ITOCF) earned a profit of ¥230.6 billion in fiscal 1Q 2023. While this was a strong result, delivering 1/3 of the annual plan of ¥700 billion, the headline number was 14% below 1Q 2022 results. A closer look shows however that Itochu had significant one-time gains last year from asset sales. The company sold a pulp and paper business in Brazil and a stake in Taiwan FamilyMart, compared to no major sales this year. Backing out these extraordinary items, Itochu delivered a record quarterly profit.

Itochu 1Q 2023 Earnings Slides

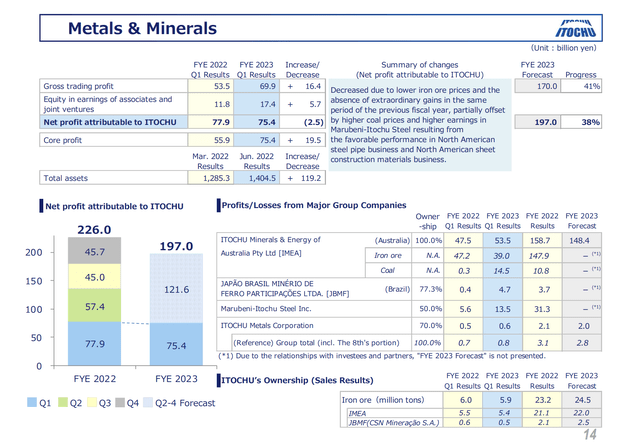

While I expected the non-resource businesses to lead the company at the start of the year, the Metals & Minerals and Energy & Chemicals segments continued to do well in the quarter. Compared to Mitsui (OTCPK:MITSY) (OTCPK:MITSF), which I covered earlier this week, Itochu’s Metals & Minerals segment did better because of its higher percentage of coal relative to iron ore. Itochu also had excellent results in its steel business, which is included in Metals & Minerals and not a separate segment as at is at Mitsui. Itochu also performed better in Energy, where it did not have the drag from LNG trading and hedging that Mitsui had.

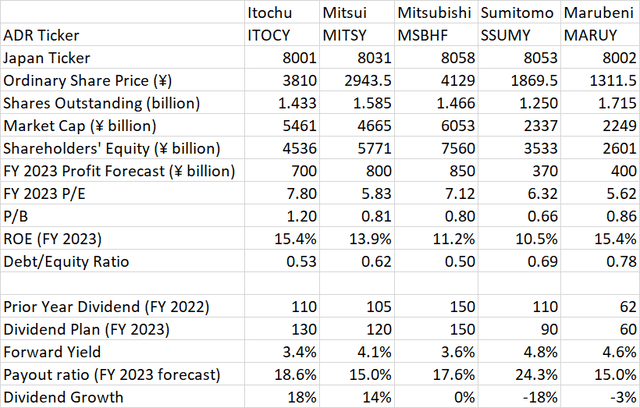

Itochu improved its debt/equity ratio slightly this quarter, with equity up 8% to ¥4.54 trillion and net debt up 4.7% to ¥2.39 trillion. However, Mitsubishi (OTCPK:MSBHF) surpassed Itochu this quarter, getting its debt/equity ratio down to 0.50 compared to Itochu’s 0.53. Japan’s interest rates are projected to remain low, unlike the rest of the world, but Itochu’s financial position should benefit it if rates rise.

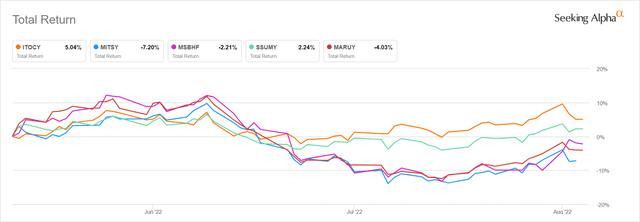

Itochu ADRs have been the best performing of the 5 major Japanese trading companies since they released the FY 2023 plan in May. This is a reversal compared to the 3 months leading up to May when Itochu performed the worst. The ordinary shares in Tokyo performed similarly as the Yen weakened only slightly during this period overall.

Despite this outperformance and valuation premiums compared to peers, Itochu is still a good stock to own for the long term due to its dividend growth, low debt, and higher return on equity.

Upside for FY 2023

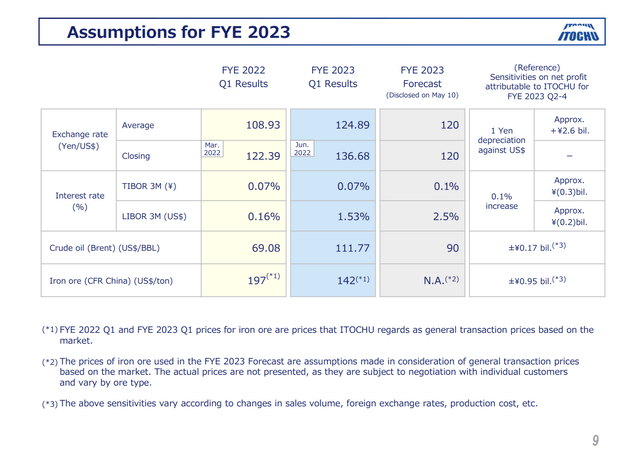

Itochu did not update its FY 2023 forecast, and neither did any of its peer trading companies. This is probably out of conservatism and uncertainty about commodity prices given that only one quarter is in the books. Still, it’s worth looking at commodity prices to see if future quarters might bring any revisions. Although Itochu is not as commodity focused as some of its peers, commodity prices are still important as we see from the sensitivity analysis chart in the earnings slides. With many commodities priced in US dollars, the exchange rate is also important.

Itochu 1Q 2023 Earnings Slides

Let’s look at these to estimate the upside or downside to the forecast.

Exchange Rate

The Yen has been weaker than plan so far this year. While it had been strengthening as of late, the July US Employment Report was strong and caused interest rates to spike, driving the US dollar back up. Meanwhile, Japan does not seem interested in raising rates. The current exchange rate of ¥135/USD looks reasonable for the rest of the year.

(135-120)*¥2.6 billion = ¥39 billion upside

Crude Oil

Brent averaged $111.77 in the first fiscal quarter. It is currently trading around $95, with futures pricing suggesting it will fall to $89 by March 2023. That averages out to about $97 for the fiscal year.

(97-90)*¥0.17 billion = ¥1 billion upside

Iron Ore

This one is difficult to estimate because the company does not disclose its forecast basis. If we look at history, it was trading around $135/ton at the time the FY 2023 forecast was made. It is now trading around $112 with the forecast flat to slightly down for the rest of the year.

(112-135)*¥0.95 billion = -¥22 billion downside

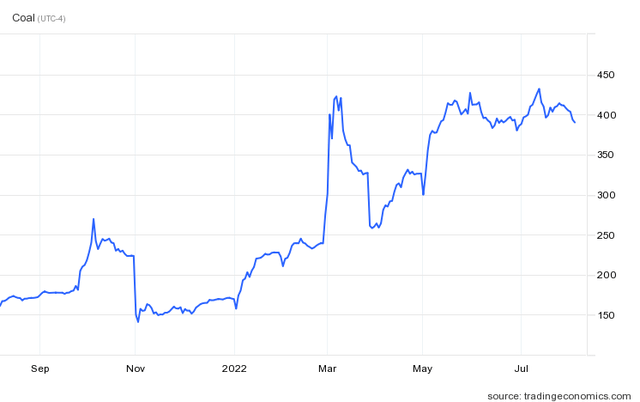

Coal

Itochu does not provide a sensitivity amount or a forecast but it is worth making an estimate because of how much the commodity has increased. The price has almost doubled since the start of the year.

We see from the segment results slide that Itochu’s Australian coal business earned ¥14.5 billion in 1Q 2023 compared to ¥0.3 billion in 1Q 2022. If we annualize this difference and subtract full year 2022 actuals, Itochu could make around ¥46 billion more this year.

Itochu 1Q 2023 Earnings Slides Supplement

Adding these up, we see ¥64 billion of potential upside in the resource businesses from commodity pricing.

Looking at the non-resource businesses, we see that the Machinery segment was on plan but would have been nicely ahead of plan if not for a write-off of the Russian aircraft leasing business. General Products and Realty is ahead of plan due to the European tire business as well as construction materials. On the other hand, the ICT and Financial segment is below plan. The 8th Company is also a bit behind plan as remodeling and promotion costs at FamilyMart are still more than offsetting sales gains.

Itochu 1Q 2023 Earnings Slides

Finally, the company still has a ¥30 billion loss buffer that it built in at the start of the year. This has not been released yet despite the overall results coming in ahead of plan in 1Q.

Adding up all these impacts, I see around ¥100 billion upside that could be added into the full year forecast in future quarters. That would not quite top the FY 2022 actual record of ¥820.3 billion but it’s not bad for a year where some commodity prices appear to be peaking.

Valuation

Comparing Itochu to the other major trading companies, it has the highest P/E at 7.8 times the FY 2023 earnings estimate. It also has the highest price/book ratio at 1.20. While these look like cheap valuations on an absolute basis, they are premium numbers relative to Itochu’s Japanese peers. These premiums are warranted however, given Itochu’s quality. Itochu reduced their debt/equity ratio to 0.53 which is now the second lowest of the five companies. Itochu has the highest expected return on equity this year, tied with Marubeni (OTCPK:MARUY) (OTCPK:MARUF).

Author Spreadsheet (Data source: Company earnings releases)

Capital Management

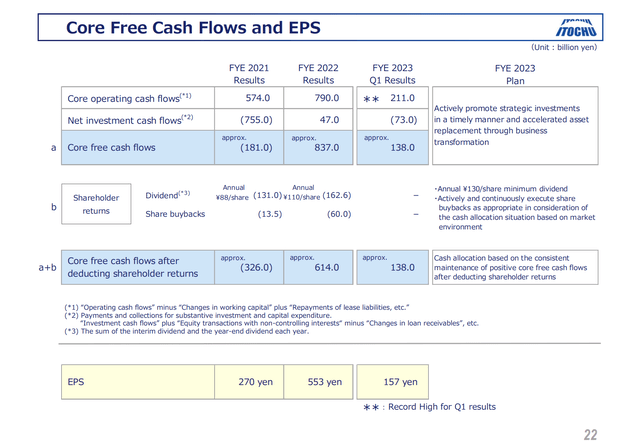

Itochu had record core operating cash flows in the quarter. The main thing keeping free cash flow from being a record was that the company did not have the large cash inflows from asset sales that they had last year. Still, with ¥138 billion core free cash flow after just one quarter, they should easily be able to cover the full year dividend of ¥130 per share or ¥186 billion total.

Itochu 1Q 2023 Earnings Slides

The dividend forecast for FY 2023 remains ¥130 per share. At 3.4%, this is the lowest yield of the five trading companies but that should not be a negative. Note that dividend growth is the highest of the five. There is upside to the dividend forecast given the low payout ratio of 18.2% and possible earnings upside. The company indicated they are targeting a payout ratio of 30% by FY 2024. Itochu has not done significant buybacks yet this year although they had not done them in 1Q 2022 either.

Conclusion

Itochu delivered record core profit in 1Q 2023, missing last year’s reported profit record only because of the absence of a gain on asset sales. Shares have held up well vs. peers since the FY 2023 plan was rolled out in May. Looking ahead, there is potential for upward revisions to the profit and dividend forecasts in future quarterly releases. The stock is worth its higher multiple because of its low debt, high return on equity, and dividend growth capability.

Be the first to comment