ArthurHidden/iStock via Getty Images

Iteris, Inc. (NASDAQ:ITI), which offers software and data for mobility infrastructure, operates in a growing and innovative market. The company has already signed agreements with a large number of public agencies and private-sector enterprises in addition to signing meaningful acquisitions. Considering the guidance given until 2027, the increase in the backlog for 2023, and expected FCF, ITI appears undervalued. My discounted cash flow model indicated that Iteris, Inc. could be worth $9 per share.

Iteris

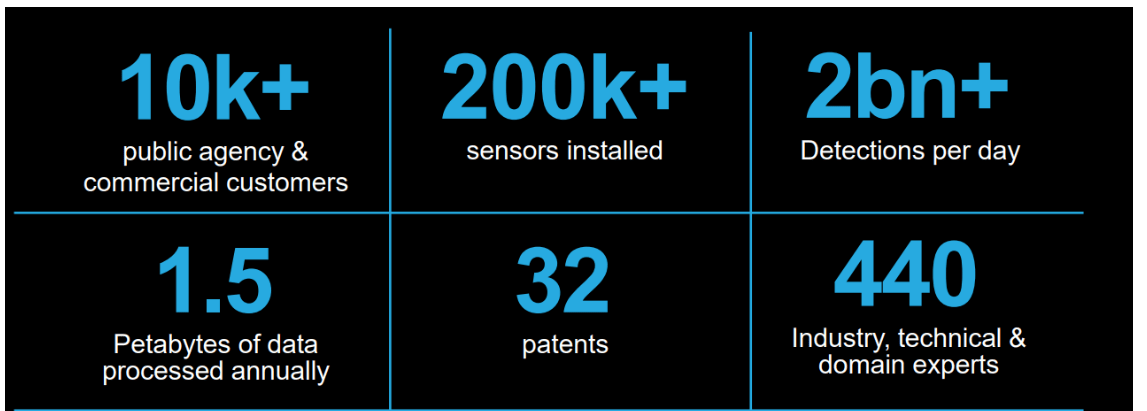

Iteris offers cloud-enabled solutions to monitor mobility infrastructure around the world. The company claims that more than 10k public agencies and private-sector enterprises are working with it.

Other figures are also quite impressive. They include 200k sensors installed, 1.5 petabytes of data accumulated per year, and 2 billion detections per day.

Source: Investor Presentation

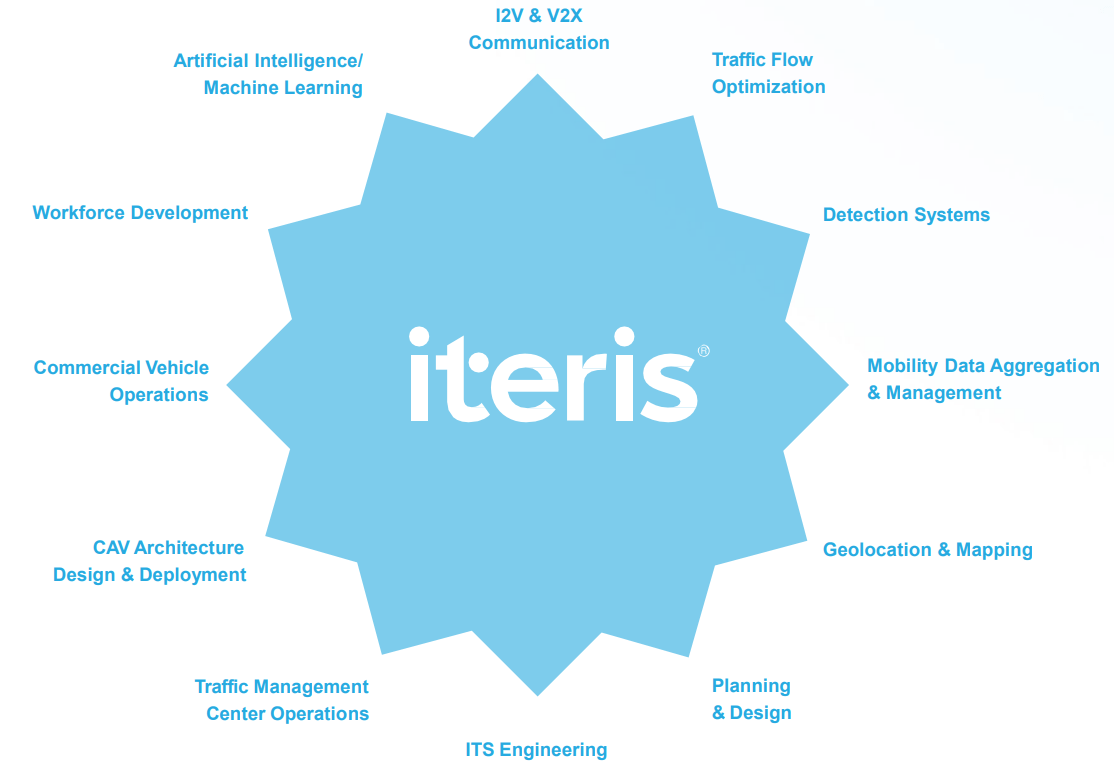

The number of applications and services that receive information from Iteris is quite overwhelming. They range from artificial intelligence tools to traffic flow optimization, geolocalization, commercial vehicle operations, and mobility data aggregation. Even without having a look at the company’s financial expectations, it is fair to say that Iteris offers innovative technologies to clients.

Source: Investor Presentation

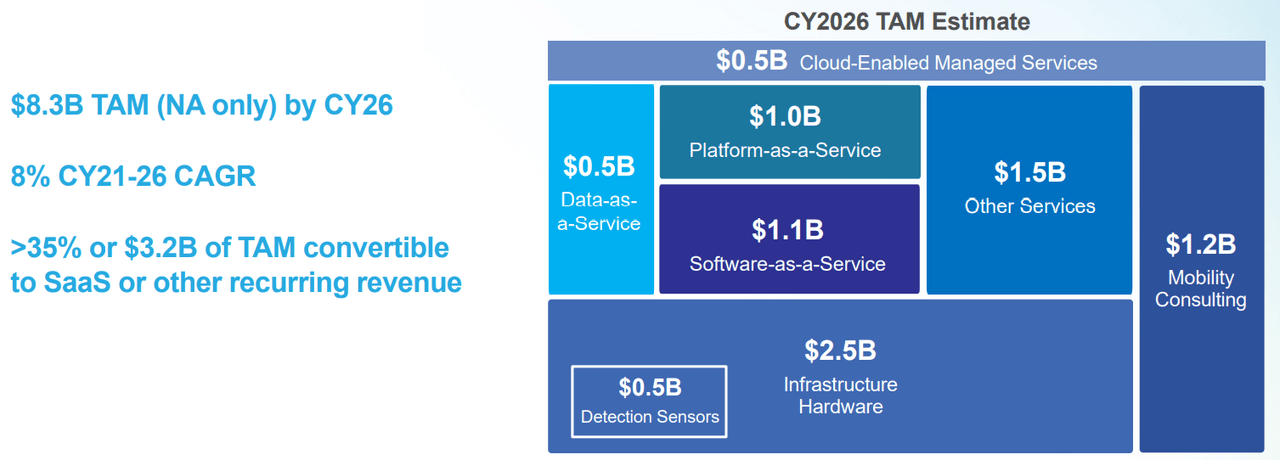

The target market estimated for the year 2026 is large, equal to close to $8.3 billion by 2026. Considering the size of the company, if Iteris controls a small part of the market, I believe that the company’s market capitalization could increase.

Source: Investor Presentation

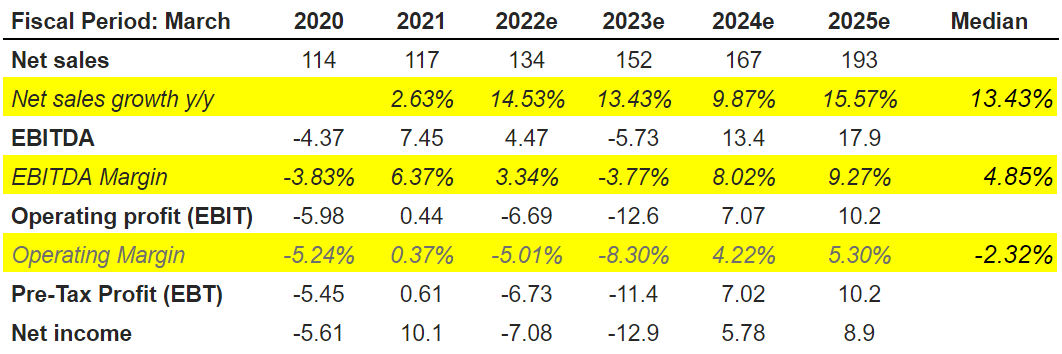

Expectations From Analysts Include Net Sales Growth Close To 13% And Growing EBITDA Margin

I believe that the expectations of analysts are quite beneficial. 2025 net sales are expected to be close to $193 million with a net sales growth of 15.57%. 2025 EBITDA will likely be close to $17.9 million with an EBITDA margin of 9.27%. Operating profit would be close to $10.2 million with an operating margin of 5.30%. Finally, pre-tax profit would stand at $10.2 million, and net income would be close to $8.9 million.

Source: Marketscreener.com

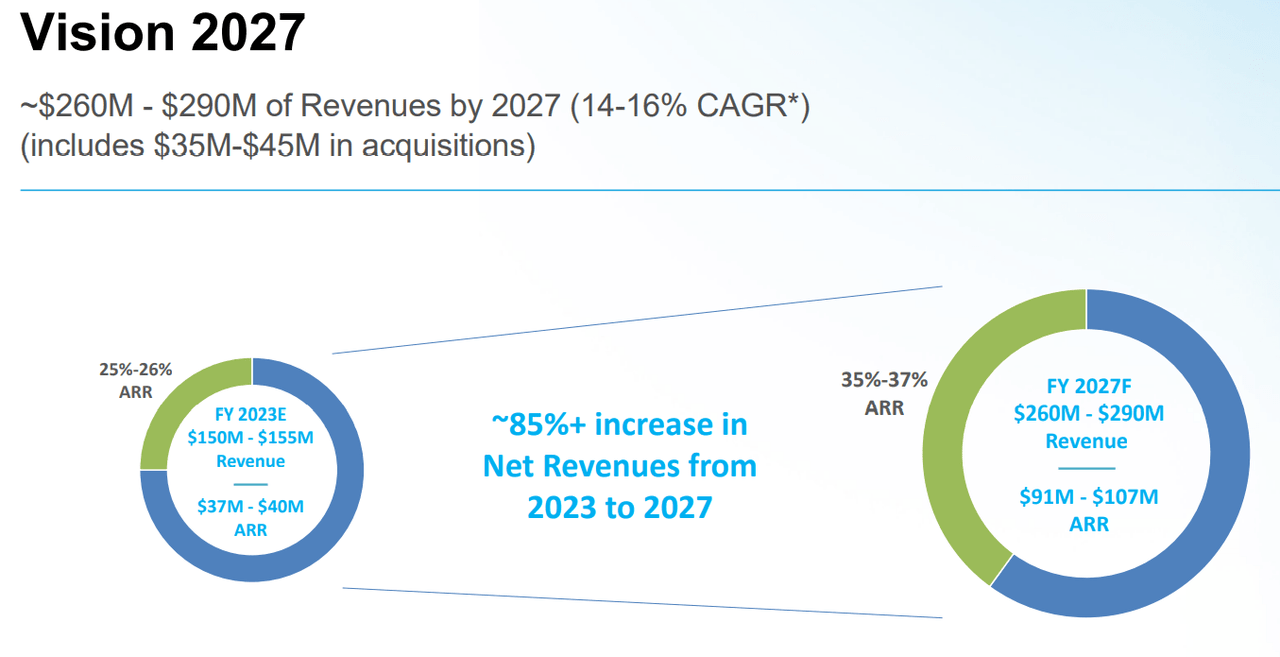

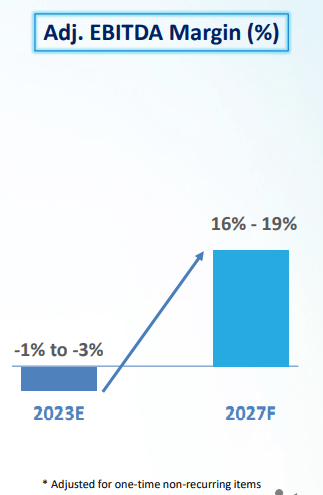

Expectations from management are also quite impressive. The company believes that Iteris could deliver close to 85% increase in net revenue from 2023 to 2027. Besides, the adjusted EBITDA margin would grow from -1% in 2023 to around 16%-19% in 2027.

Source: Investor Presentation Source: Investor Presentation

Stable Balance Sheet And No Financial Debt

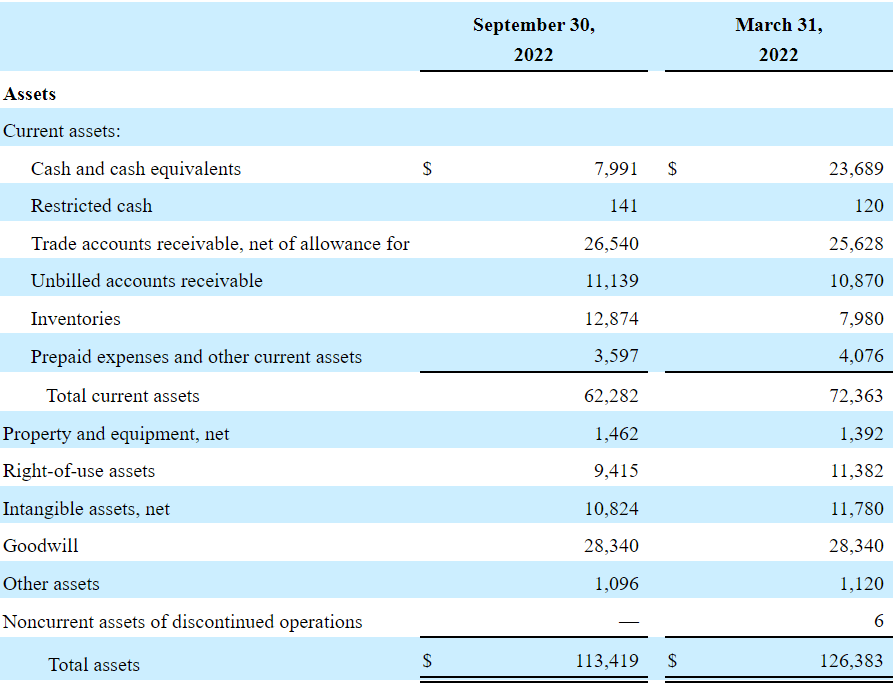

As of September 30, 2022, cash and cash equivalents stand at $7.991 million with trade accounts receivable of $26.540 million and unbilled accounts of $11.139 million. Total current assets stand at $62.282 million, close to 1.7x-2x the total amount of current liabilities. I wouldn’t expect any liquidity crisis anytime soon.

Iteris also reports right of use assets worth $9.415 million, intangible assets of $10.824 million together with goodwill worth $28.340 million, and total assets of $113.419 million. The asset/liability ratio stands at more than 2x. I believe that the balance sheet appears in good health.

Source: 10-Q

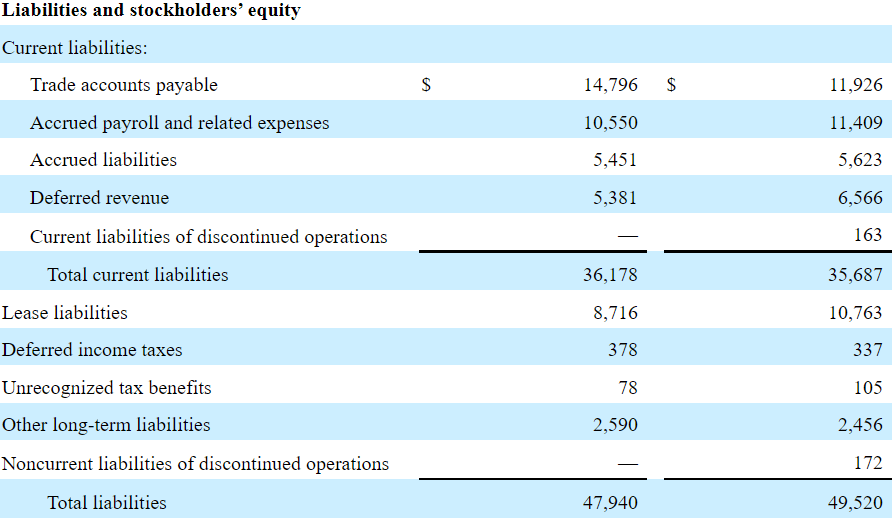

Iteris also reports trade accounts payable worth $14,796 million, in addition to an accrued payroll of $10 million and total current liabilities of $36.178 million. Without net debt, Iteris reports a lease liability of $8.716 million and total liabilities worth $47.940 million.

Source: 10-Q

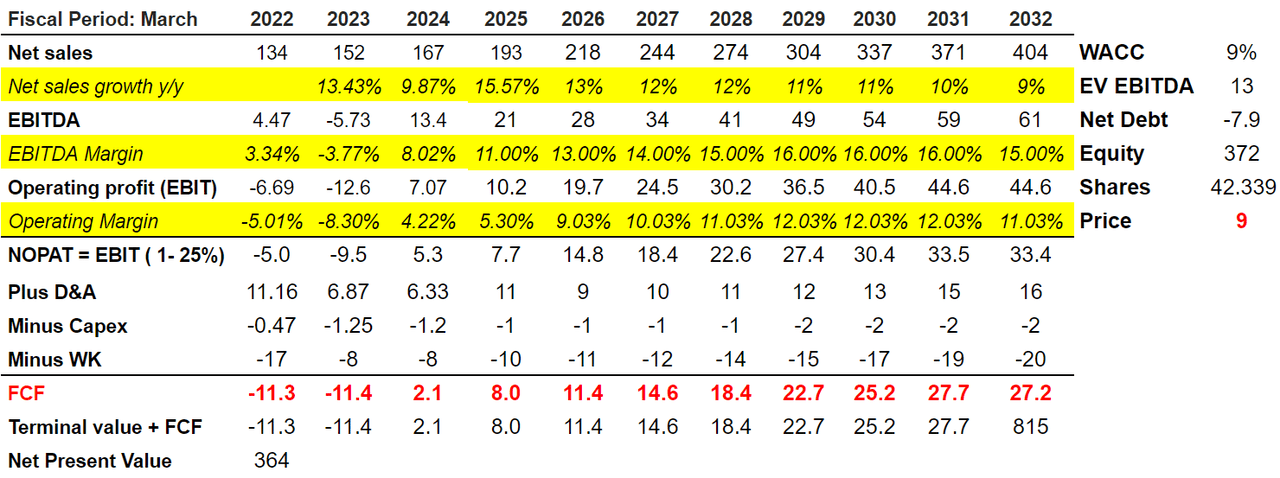

Base Case Scenario With Some Numbers From Iteris’ Guidance Implied A Valuation Of $9 Per Share

Under normal circumstances, I believe that the company’s inorganic growth strategies will likely bring revenue growth. The acquisitions I identified appear to make a lot of sense. Take for instance the transaction of TrafficCast Business, which now allows Iteris to sell traffic and mobility data to insurance companies and automotive OEMs among other clients. If the company systems are successfully integrated with those from TrafficCast, revenue will likely trend north.

With the acquisition of the TrafficCast Business on December 7, 2020, we now sell traffic and mobility data and software through a direct sales model to commercial enterprises, such as media companies involved in providing real-time traffic data and traffic incident data to insurance companies, automotive OEMs and the traveling public. Source: 10-k

I also believe that Iteris’ investments in new product development activities will bring new streams of revenue. The company invests a considerable amount of money in research and development, and every year more money is allocated to these matters. More products will likely enhance revenue generation.

Our product development activities are mostly conducted at our facility in Santa Ana, California, as well as our facilities in Madison, Wisconsin and Oakland, California. Our research and development costs and expenses were approximately $7.4 million for Fiscal 2022, $5.1 million for Fiscal 2021, and $4.3 million for Fiscal 2020. We expect to continue to pursue various product development programs and incur research and development expenditures for the Company in future periods. Source: 10-k

Finally, I am quite optimistic about the future figures considering the recent words from management. The second part of the fiscal year 2023 is expected to be better thanks to the redesigned circuit boards. Let’s note that sales growth and EBITDA margins are expected to increase in 2023.

Indeed, we anticipate sustained above market revenue growth through the second half of fiscal 2023, because the availability of our redesigned circuit boards will enable us to accelerate the conversion rate of our record total ending backlog.

Based on these combined factors, we forecast year over year revenue growth of approximately 20% and sequential improvements in profitability through the second half, enabling us to exit the fiscal year at approximately 10% adjusted EBITDA margins. Source: Press Release

By 2032, I expect net sales of $404 million with a net sales growth of 9%. 2032 EBITDA would stand at $61 million with an EBITDA margin of 15%, operating profit of $44 million, and an operating margin of 11%.

If we also assume 2032 D&A of $16 million and 2032 capex of -$2 million, 2032 FCF would be close to $27 million. With a WACC of 9%, an EV/Ebitda of 13x, and net debt of -$7.9 million, equity would stand at $372 million. Finally, with a share count of 42.339, the fair price would be close to $9.

Source: Arie’s Work

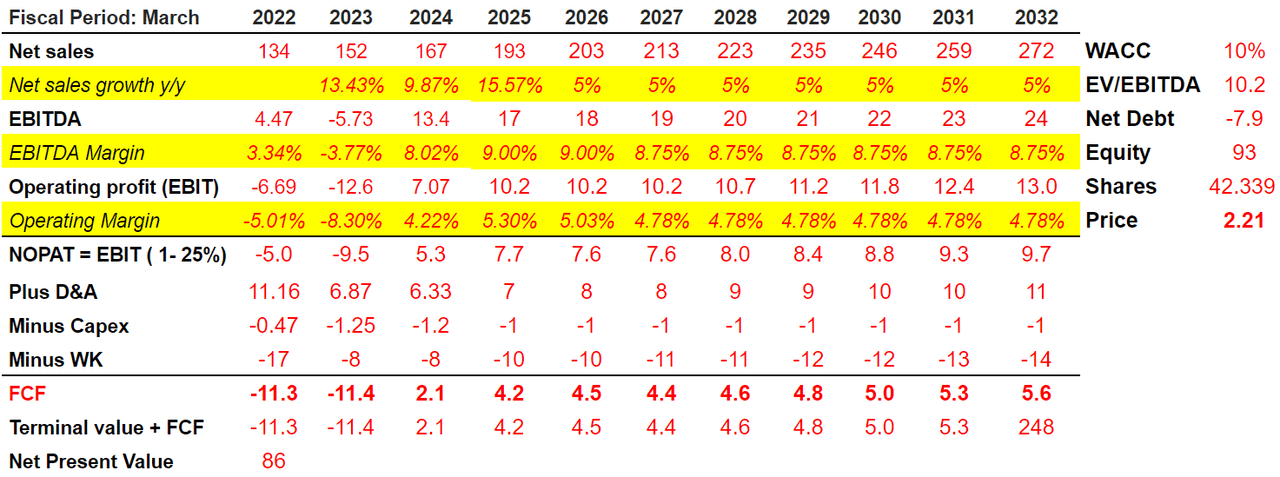

My Bearish Case Scenario Would Imply A Valuation Of $2.21 Per Share

Under traumatic circumstances, Iteris may suffer from lack of supply of certain specialized parts and components. If Iteris has to pay a bit more for these parts, or suppliers decide to sell to competitors, the company may suffer production stoppages. As a result, Iteris’ revenue may decline, or the free cash flow margin would decline.

Our products require specialized parts which have become more difficult to source. In some cases, we have had to purchase such parts from third-party brokers at substantially higher prices. Additionally, to mitigate for component shortages, we have begun to increase inventory levels and may continue to do so for an extended period. In the event demand doesn’t materialize, we may need to hold excess inventory for several quarters. Source: 10-k

I also believe that Iteris’ exposure to public-sector customers could represent a problem in the near future. Local government funding may lower, which would lower the company’s future revenue. As a result, Iteris’ fair valuation would decline.

Currently, over 90% of our revenue is attributable to public-sector customers. Therefore, most of our revenue is dependent upon state and local government funding, and to a lesser extent federal governmental funding. In some cases, this funding is appropriated annually through the respective legislative process. Source: 10-k

Finally, I wouldn’t discard errors or mistakes in the software or services offered by Iteris. I wouldn’t be talking about losing certain customers. The company’s brand may lose some value, which may create a decline in the company’s stock price.

Despite testing and quality control, we cannot be certain that errors will not be found in our software after its release. Any faults or errors in our existing products or in any new products may cause delays in product introduction and shipments, require design modifications, or harm customer relationships or our reputation, any of which could adversely affect our business and competitive position. Source: 10-k

Under this case scenario, I assumed 2032 net sales of $272 million with a net sales growth of 5%. With 2032 EBITDA of $24 million and an EBITDA margin of 8.75%, I obtained operating profit of $13 million and an operating margin of 4.78%.

My results would include 2032 NOPAT of $9.75 million, with a D&A of $11.5 million and capex of $1.5 million. 2032 FCF would stand at $5.65 million, which implied, with a WACC of 10.5% and an EV/EBITDA of 10x, equity of $93.5 million and a fair price of $2.21 per share.

Source: Arie’s Work

My Takeaway

Iteris is targeting an innovative and growing market, which is expected to be worth $8.3 billion by 2027. The company is also expecting double digit growth and double-digit EBITDA margin. I also believe that future interest from private companies in Iteris’ artificial intelligence tools, traffic flow optimization, and mobility data aggregation will likely enhance future sales growth. Under conservative financial figures, my DCF model suggests that the fair price could be close to $9 per share. In my view, the risks are small considering the business opportunities for Iteris.

Be the first to comment