Thomas Barwick/DigitalVision via Getty Images

The iShares MSCI Global Agriculture Producers ETF (NYSEARCA:VEGI) is an investment product that provides access to 145 odd developed and emerging market producers of fertilizers, agricultural chemicals, and farm machinery, Companies involved in packaged goods and meats are also included in VEGI’s tracking index to the extent that they derive the majority of their total revenue from agricultural commodity production. Conversely, finished goods manufacturers that rely on agri-commodities as raw materials are excluded from the index. Also consider that even though this appears to be a globally focused product, a substantial portion of the fund (57%) is oriented towards US-based stocks.

The top stock in the ETF with relatively high weight is Deere & Co (DE) which accounts for 19% of the total portfolio (the next largest stock-Nutrien’s weight is not even half as large as Deere & Co.); As noted in The Lead-Lag Report, DE recently delivered a solid Q4, with results coming in ahead of expectations. Crucially the company is also looking to leverage the elevated pricing environment, which should help it expand its margins. All in all, we saw DE lift its FY bottom line guidance.

Should you be considering VEGI?

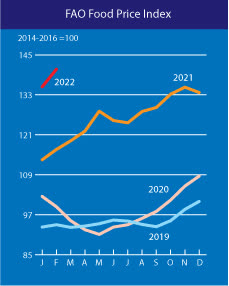

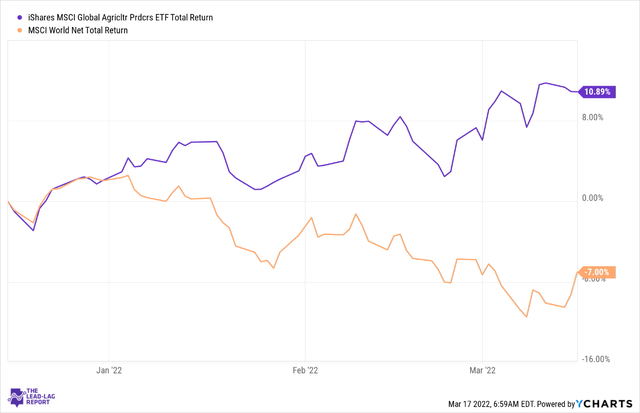

Over the last three months, when global risk aversion has been particularly pronounced, VEGI has delivered solid double-digit returns of 11% even as the MSCI World Index has seen its net total returns fall by 7%. Clearly, this ETF has the wind in its sails, even as the Global FAO Food Price Index hit record highs of 140.7%.

FAO

It’s easy to get overwhelmed with what’s happening in the agricultural markets around the world, as it isn’t just a one-month phenomenon, but something that has been brewing for a while now. What’s catapulted agricultural prices to a different level is the speed and ferocity of the Russia/Ukraine crisis that has caught a lot of stakeholders off-guard. Both nations play a crucial role in agricultural markets; for instance, both nations jointly account for 33% of global wheat exports. Then with barley, you’re looking at an aggregate contribution of 25%, in the corn market, Ukraine is the 4th largest exporter whilst Russia is the 7th largest exporter. Also consider that both nations, particularly Russia play a massive role in the global fertilizer markets, with the likes of potash, ammonia, etc. This too has weighed heavily in driving up agri prices.

I also want to reiterate that typically, food prices rise in a slow and steady manner, enabling food producers to be well-positioned to make pricing adjustments to keep pace with inflation, but in recent weeks, it has been anything but slow and steady leaving producers with very little elbow room to make pricing adjustments. What I’m trying to reiterate is that don’t underestimate the “shock factor” in the current pricing premium of agricultural products which can often prove to be fleeting rather than long-standing.

Clearly, the ongoing crisis isn’t ideal, but as mentioned in The Lead-Lag Report, we could see a resolution to this issue soon enough. This could quickly extinguish some of the recent largesse we’ve seen with agricultural prices as we may see a potential boomerang downward slide.

There’s a precedence of something like this happening before; think back to late 2015, when food inflation in the US was creeping up to 4% on account of issues such as the avian flu and drought-like conditions. In a year’s time the situation had reversed as the supply/demand conditions normalized. I’m not suggesting that we see the exact situation play out, but I do believe that currently steep pricing conditions in the agricultural markets look unsustainable and investors would do well not to be short-sighted and get carried away with the near-term euphoria.

Summing up

The agricultural markets are currently on fire and I can see the temptation to latch on to this bandwagon but do also note that P/E valuations here are not overly cheap with the ETF trading at 16x P/E. Conversely, if you consider a more diversified natural resources option such as the SPDR S&P Global Natural Resources ETF (which offers you exposure to not just the agricultural markets but the energy, metals, and mining markets as well) you can pick it up at a 25% discount as it’s trading at only 12x P/E.

Anticipate Crashes, Corrections, And Bear Markets

Anticipate Crashes, Corrections, And Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Be the first to comment