da-kuk/E+ via Getty Images

We’re prepared to be as forceful as needed and I’m really going to let those words speak for themselves. – Bank of Canada Governor Tiff Macklem

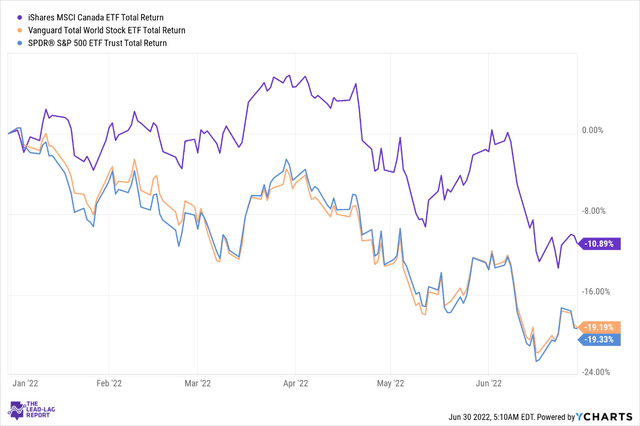

The iShares MSCI Canada ETF (NYSEARCA:EWC), an ETF that covers 88 Canadian-based stocks, hasn’t made any money this year. However, if you look at things with a broader lens, I’d say the performance hasn’t been too shabby. Canadian equities have traditionally been perceived to be a high-beta terrain, and for much of 2022 when risk-off conditions have been quite elevated, you would have thought that this ETF would bleed significantly. However, so far in 2022, it is only down by 10% and has outperformed U.S. stocks and global stocks by almost 2x.

Despite this recent outperformance, forward valuations remain compelling too; the product currently trade at a forward P/E of 12.6x, which represents a ~30% discount to U.S. equities and a 14% discount to global stocks. In light of these attractive valuations, is EWC something you should gravitate to at this juncture? Well, I think there are a lot of other macro factors to consider before you decide to take the plunge.

Canadian macros

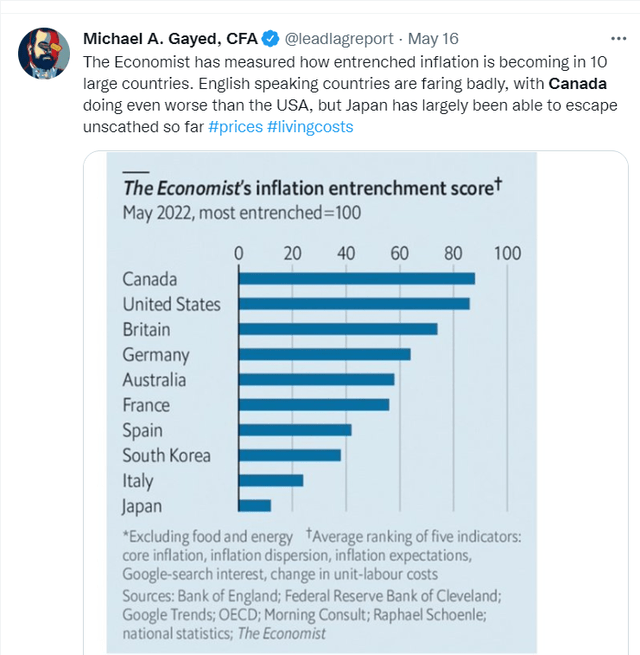

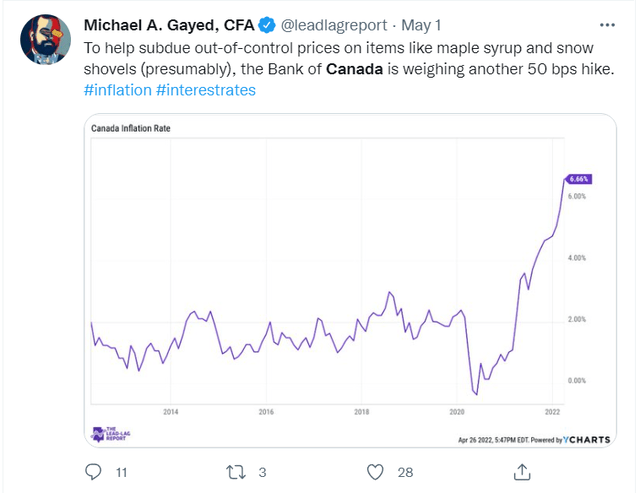

I’m sure by now most readers are sick to death of hearing the word “inflation,” as it has been paraded around by all and sundry, all throughout the year. Forgive me for bringing that term up again, but it’s not something that can be easily cast away when viewing a country like Canada; inflation has not only grown to its highest point in 40 years (and above street estimates), but as noted in The Lead-Lag Report, it also appears to be a lot more stickier in Canada than all the other major nations around the world.

Under difficult conditions such as this, Canadian consumer confidence dropped to its lowest reading outside of the last two economic crises (it has been on a declining trajectory for nine straight weeks now).

Unsurprisingly the Canadian central bank has been forced to react quite decisively. In May it was assumed that they would only resort to one 50bps hike of the overnight rate in June but it looks like they will have to do a lot more with another 75bps hike expected in the July meeting. The policy rate is currently at 1.5% and there are growing expectations that this could hit 3.5% levels by the end of the year.

It’d be curious to see what the ongoing aggressive pivot will do for the prospects of the Canadian dollar. So far in June, the USD/CAD pair has appreciated by over 3%, but as I’ve noted in The Lead-Lag Report, the U.S. Fed runs the risk of not ensuring a soft landing by excessive tightening. I also think that in the U.S., the scales are gradually shifting from the inflation narrative to that of recession risk. If you’ve been following my commentary for the last few months, you’ll note that I’ve been talking up the prospect of long-term deflationary conditions for a while now. In the next few weeks if we begin to see various KPIs point to higher recession risk, the U.S. Fed may well have to pivot back towards resorting to dovish strategies which may hamper the prospects of the dollar and boost the CAD.

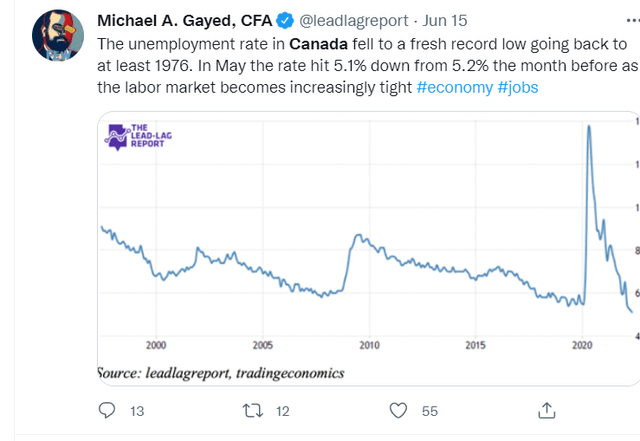

I also think that some degree of tightening would be good for the Canadian economy as important components of the economy look overheated. Take for instance, the labor market there that has become very tight. As observed in The Lead-Lag Report, unemployment conditions haven’t been this low in 46 years.

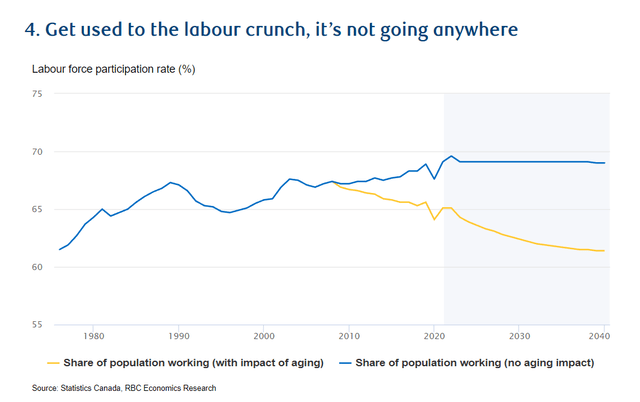

A recent report by RBC also suggests that this tightness is unlikely to be overcome too quickly as a higher proportion of worker retirements looks set to drive the labor force participation rate to structurally lower levels.

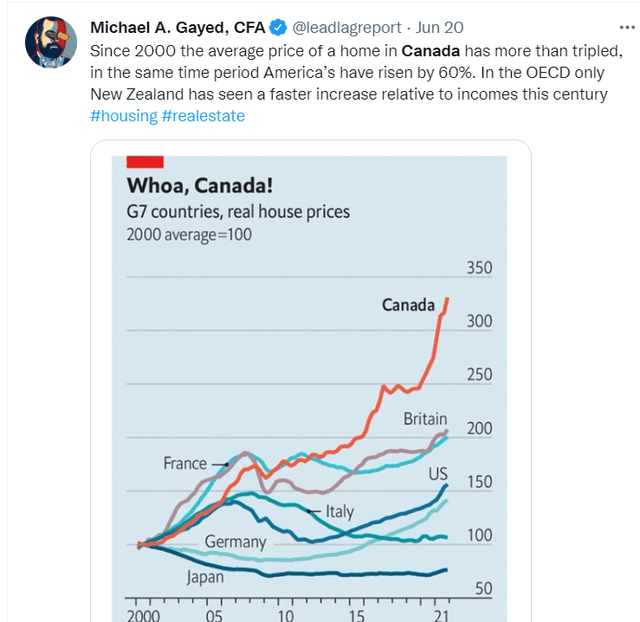

Then there’s the Canadian housing market, of course, which fills me with great trepidation. I recently shared an infographic on the timeline of The Lead-Lag Report which showed how real home prices in Canada had grown at a much heftier pace than any of the other G7 nations. What is also rather worrying is that the house prices look enormously stretched relative to income levels. This could give Canadians a false sense of security with regards to their net worth; as we’ve seen previously, housing remains very sensitive to a shift in monetary policy conditions, and I do wonder if we will see a drastic erosion in home prices if the Canadian central bank tightens too aggressively. For now, Fitch believes that housing prices could correct by 10% in 2022 whereas TD bank feels that drop could be even more pronounced by next year (19%). Incidentally last month, national home sales had fallen by 22% on an annual basis.

A significant correction in housing could be troublesome for EWC, as banks account for the largest share of this portfolio at 37%, and most of Canada’s top banks have heightened exposure to the housing market.

Conclusion

As noted in The Lead-Lag Report, in the short-term, conditions look ripe for a melt-up rally. Two of my inter-market signals still continue to signal risk-on. EWC’s valuations remain rather conducive and could attract investors who are looking for high-beta options to play a potential melt-up scenario, but do not dismiss the long-term risks that I’ve highlighted in this article. Tread cautiously.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Be the first to comment