Pgiam/iStock via Getty Images

Investment Thesis

Bonds have performed poorly since the start of the year due to a spontaneous and aggressive monetary policy recalibration. Despite the policymakers’ recent efforts to tackle this problem, inflation remains a persistent issue, which suggests further tightening is expected over the next couple of months. I believe tightening financial conditions while the economy shows signs of slowing down will ultimately have negative repercussions on high-yield corporate bonds. In other words, the odds of a recession are increasing while at the same time, credit metrics for junk bond issuers are likely to deteriorate over the next couple of months. As a result, engaging in yield chasing today is an unwise strategy in my opinion that discards the elevated odds of an economic downturn and how that could bring the junk corporate credit market to a level much lower than where it is today.

Strategy Details

The iShares iBoxx $ High Yield Corporate Bond ETF (NYSEARCA:HYG) tracks the performance of the Markit iBoxx USD Liquid High Yield Index. The fund invests in a basket of US dollar-denominated, high-yield corporate bonds.

If you want to learn more about this strategy, please click here.

Portfolio Characteristics

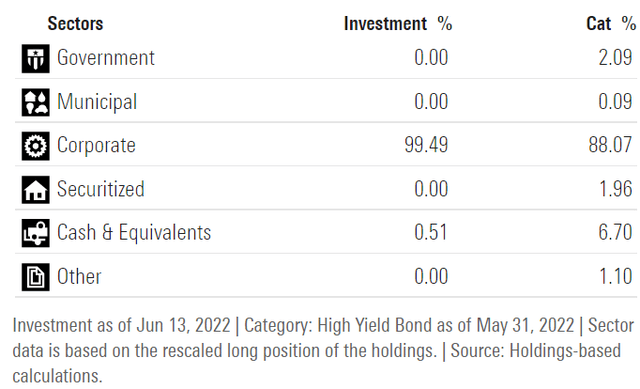

The fund invests exclusively in US corporate bonds. Corporate bonds are generally seen as riskier than government bonds, since governments can always print more money in order to service their debt.

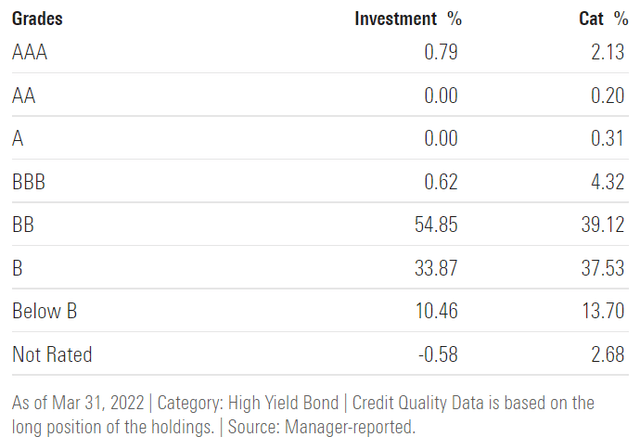

~55% of issuers are rated BB, which is a credit rating just below investment grade. This is a speculative rating, and it is generally assigned to companies facing financial uncertainties and/or who are vulnerable to adverse economic conditions. ~44% of assets are rated B and below. These securities carry high default risk. Finally, less than 1% is assigned to BBB-rated bonds, which is in line with the strategy’s goal of investing primarily in corporate junk bonds.

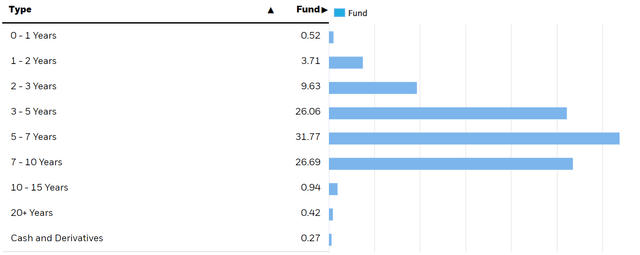

According to Morningstar, the portfolio’s average maturity is ~5 years. However, over 28% of constituents have maturity of more than 7 years, which doesn’t surprise me since the portfolio is trying to maximize the yield.

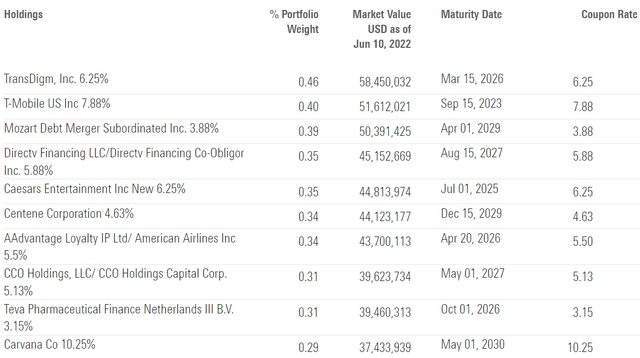

The fund is currently invested in 1,261 different bonds. The top ten holdings account for ~4% of the portfolio, with no single issuer weighing more than 1%. All in all, HYG is very well-diversified across issuers.

Based on data from Morningstar, the fund has an effective duration of ~3.9, meaning that for each 1% increase in interest rates, the portfolio’s NAV is expected to decrease by 3.9%.

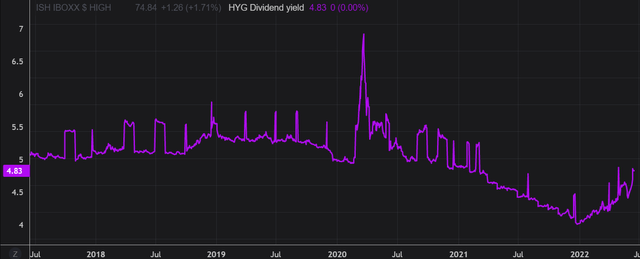

HYG has a ~5% TTM dividend yield, which is one of the reasons why this fund is popular among income investors. However, when we put things into perspective, investors shouldn’t forget that HYG’s yield could go much higher in case of an economic downturn.

Recession Risks Make High-Yield Bonds Unattractive

Given the recent selloff in bonds, income investors are now wondering if it’s a good time to purchase HYG. I don’t think that bonds generally offer an appealing risk-reward investment for the time being. As the Fed is trying to normalize monetary policy, inflation remains the main factor that stands out as meaningfully diverging compared to the pre-pandemic era and doesn’t bode well with its dual mandate of price stability and employment. On top of that, slaying inflation has now become a politically motivated decision, as suggested by the recent meeting between Powell and Biden, the president’s mediocre approval rate, and the unambiguous message coming from the White House regarding inflation.

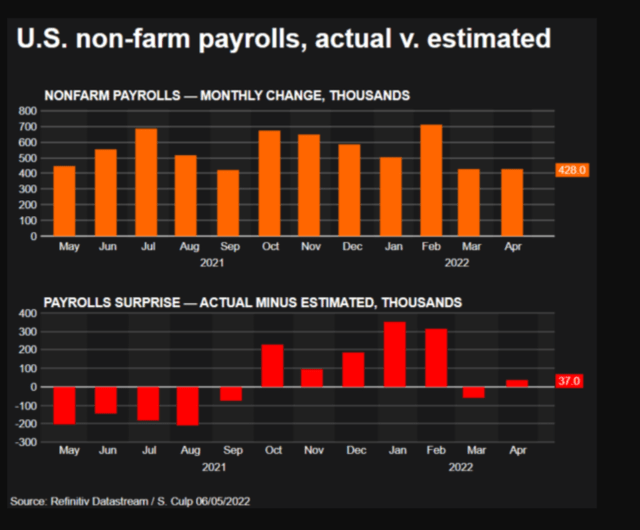

Rising the interest rate is the main tool employed by the Fed to answer the inflation problem, and I believe they will do so until we start to see demand cooling off. This argument is supported by the record low unemployment numbers, which suggest one of the Fed’s mandates is achieved, leaving plenty of room to put up a fight for the second one. But by trying to tackle the inflation problem, I believe the Fed is likely to create an even bigger issue in the form of a recession. This doesn’t bode well with junk bonds which generally come under a lot of pressure when financial conditions tighten and the economic situation deteriorates.

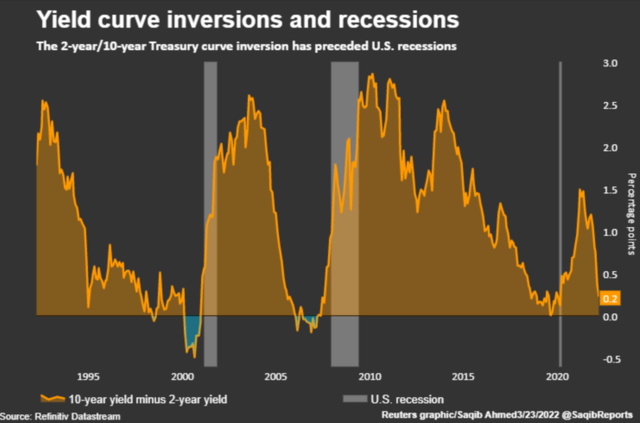

Speaking of declining economic growth, the credit market has been a good recession indicator in the past. The two recent yield curve inversions aren’t signaling anything good for the economy, in my opinion. The front end of the yield curve steepening aggressively brings a new risk to high yield issuers, which could quickly run into trouble when refinancing some of their debt coming due in the second half of 2022 and in 2023.

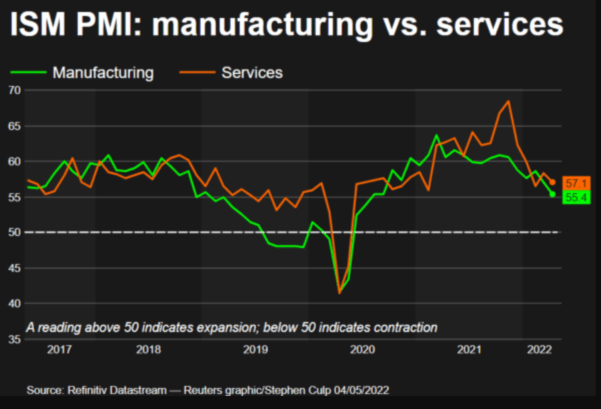

Other leading indicators are starting to paint a bleak picture of the next 12 months. The ISM PMI is in a declining trend since mid-2021, despite being above the contraction level for now. In my opinion, the economy is now extremely vulnerable to unexpected endogenous and exogenous factors that could affect it.

Refintiv Eikon

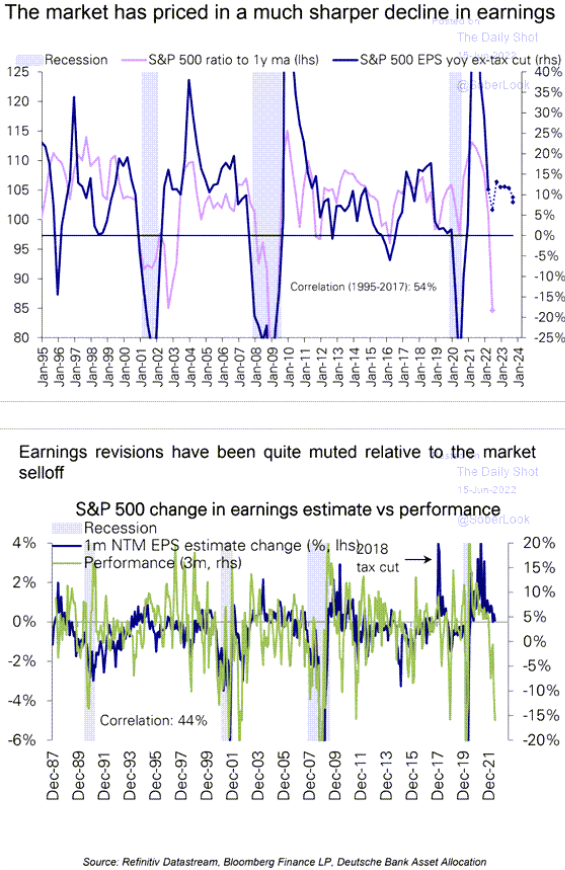

While there are clear signs of an economic slowdown, it is interesting to see that earnings revisions have been muted relative to the market sell-off. In other words, most analysts are still bullish on earnings growth for the next two to three years and haven’t properly adjusted their estimates to account for a downturn in the economy. I believe earnings contraction is likely to be the main factor leading the next leg down in equities and in high yield credit. Lower earnings/sales will ultimately lead to a deterioration in credit metrics.

Refintiv Eikon

The US high yield option-adjusted spreads are still at a modest level relative to 2008 and 2020, which is another argument that makes me believe we haven’t yet reached maximum pain in high-yield corporate bonds. I wouldn’t, therefore, exclude another drop in junk bond prices over the next couple of months.

Key Takeaways

Bonds have performed poorly since the beginning of the year as a result of a sudden and aggressive monetary policy rebalancing. Despite policymakers’ recent efforts to address this matter, inflation remains a persistent issue, implying that further tightening is likely in the coming months. Tightening financial conditions while the economy shows signs of slowing will, in my opinion, have a negative impact on high-yield corporate bonds. As a result, engaging in yield chasing today, in my opinion, is an imprudent strategy that ignores the elevated odds of an economic downturn and how that could bring the junk corporate credit market to a much lower level than it is today.

Be the first to comment