imaginima

The iShares Global Energy ETF (NYSEARCA:IXC) continues to outperform the broader market, rising by 160% versus the MSCI World in total return terms over the past two years. Despite this extreme outperformance, the IXC still trades at a 58% discount to the MSCI world in terms of its P/E ratio. Investors must be anticipating a major decline in oil prices or rise in costs in order to justify such a large discount. While profits have likely peaked for the sector, there is still room for further outperformance for the IXC.

The IXC ETF

IXC tracks the performance of the S&P Global Energy Sector index and charges an expense fee of 0.4%, higher than its rival ETF the XLE, which tracks the Energy Select Sector SPDR Fund. In terms of country exposure, XLE is 100% focused on the U.S., while IXC has 60% of its assets in U.S. stocks and the rest spread across Canada, Europe, and the rest of the world. As a result, IXC is much more diversified, with the top 10 holdings accounting for 61% of the index versus 77% in the case of XLE. The combined weighting of Exxon (XOM) and Chevron (CVX) in IXC is 28% versus 42% in XLE. The outperformance of XOM over recent months has helped the XLE outperform the IXC, but the valuation differential is heavily in the latter’s favor. The IXC also has a slightly higher dividend yield at 3.3% versus XLE’s 3.0%. This differential should be expected to widen as the yield on the IXC’s underlying index is 4.3% versus 3.4% for the XLE.

Valuations Remain Incredibly Cheap

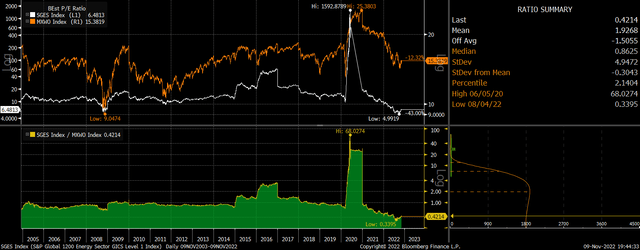

The IXC’s valuations remain highly attractive relative to their own history and the overall market despite the recent rally. The price to free cash flow ratio is just 7.7x and the forward ratio is even lower at 5.3%. The P/E ratio paints a similarly positive picture, with the trailing ratio at 8.5x and the forward at just 6.5x. This is incredibly low for a sector that has a near monopoly on the most important economic input on the planet, as well as a proven track record of outperformance during periods of elevated inflation. It is also particularly impressive considering that the MSCI world trades at a forward PE ratio of 16.5x.

IXC Vs SPX P/E Ratio (Bloomberg)

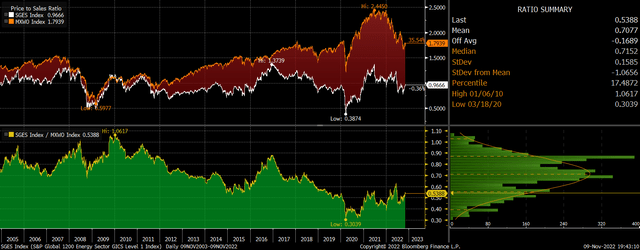

The 25% decline in oil prices seen since June will begin to feed through into lower earnings and earnings expectations over the coming months, and profit margins are likely to come down from their all-time highs. However, there are also serious headwinds facing profit margins on the MSCI world, and the price-to-sales ratio is almost double that of the IXC.

IXC Vs SPX P/S Ratio (Bloomberg)

Fears Of Long-Term Profit Declines Are Overblown

This valuation discount can only be justified if investors are anticipating a steep decline in earnings and cash flows beyond the next 12 months. It appears that investors remain cautious on the ability of global oil majors to stave off the impact of policies to phase out fossil fuels. This is surprising as one of the key lessons this past year has taught us is the importance of fossil fuels in maintaining economic stability. The transition away from fossil fuels is increasingly being revealed to be merely a shift in the production of fossil fuels away from the end user and towards the manufacture and mining of the resources needed to produce renewable energy.

Global oil consumption remains near its all-time highs seen before Covid despite a huge increase in prices and continued lockdowns holding back travel in China. It is difficult to see prices declining dramatically unless we see a major crash in the global economy. Even if this were to occur, policymakers would inevitably respond with more money printing and spending, keeping the price of scarce resources elevated. While costs are set to rise over the long term as new oil discoveries become increasingly expensive, the inelastic nature of the product will continue to allow oil majors to pass on rising costs to consumers.

Summary

The energy sector has outperformed the market considerably over the past two years, yet there is still room for further gains as valuations remain incredibly attractive relative to their own history and the broader market. Fears of a long-term decline in oil sector profitability are overblown, and the valuation differential between the IXC and the MSCI World is likely to continue to narrow.

Be the first to comment