Juan marcos borsatto/iStock via Getty Images

GrowGeneration Corp. (NASDAQ:GRWG), once an investment favorite in the cannabis sector, has seen its stock clobbered over the past 18 months. The once high-flying hydroponics company has seen growth turn deeply negative this year as the cannabis sector faces headwinds nationwide. Isn’t the cannabis sector supposed to be a high-growth industry as more states come online for legalized sales? The issue is that GRWG is correlated not to the growth of the legal market, but the volatility of the overall cannabis market. The stock isn’t expensive here, but against that backdrop, it is hard to gain conviction in this name.

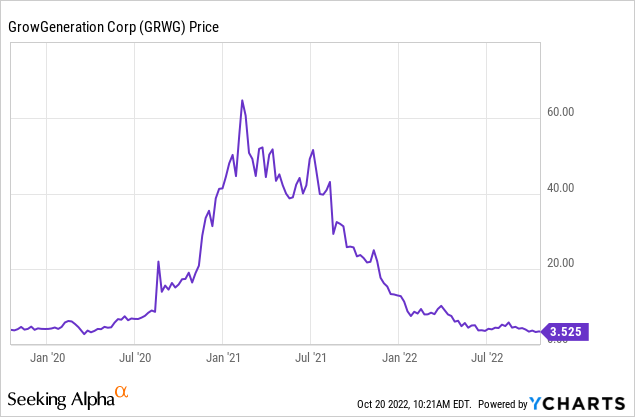

GRWG Stock Price

GRWG peaked at around $64 per share in early 2021 but has since crashed over 90% to present levels.

I first covered GRWG in August 2021, where I discussed some potential red flags. The stock fell 47% before I covered it again in October 2021, where I concluded that it was still not cheap enough relative to the U.S. cannabis operators. The stock then fell another 81%, an incredible fall from grace for what many had previously considered to be a “must-own” ancillary stock in the cannabis sector.

GRWG Stock Key Metrics

After showing triple-digit growth in 2021, GRWG saw revenues decline 44% year-over-year to $71.1 million in the latest quarter. Comparable sales declined 56.9% – GRWG was able to offset some of that decline due to new store locations. GRWG lost $8.6 million (after excluding $127.8 million in impairment expenses) and lost $2.9 million in adjusted EBITDA.

Looking forward, GRWG now expects up to $275 million of revenue and to lose up to $15 million in adjusted EBITDA for the full year. GRWG had previously guided for $340 to $400 million in revenue and $0 to $10 million in positive adjusted EBITDA as of the first quarter. Prior to that, GRWG had guided for $415 million to $445 million in revenue and $30 million to $35 million in adjusted EBITDA. Current guidance today reflects a 35% decline from 2021, and I note that is in spite of the company having spent $80.8 million on acquisitions in 2021.

On the conference call, management noted that the negative trends were “most pronounced in major markets such as California, Oklahoma, and Michigan.” That is an important detail to note – legal cannabis operators in California have struggled due to declining prices and high tax rates. GRWG’s results show that even the illicit operators are seeing declining demand.

As of the end of the 2021 year, GRWG had 23 locations in California, 8 locations in Colorado, and 7 locations in Michigan – making up over half of their store base. GRWG’s high exposure to these unlimited license states makes it highly correlated with the growth (and declines) of the overall cannabis market, inclusive of illicit sales. A note on that last point – it is entirely legal to sell hydroponics equipment to illicit cannabis operators, as GRWG has no control over what its customers do with their products after purchase. I am not trying to imply that GRWG is doing anything wrong by selling products to illicit operators – instead, the point is that we must focus on the growth of the overall market and not just the legal market.

The company did end the quarter with $65 million of net cash, but I expect that cash balance to decline this year due to operating losses.

Is GRWG Stock A Buy, Sell, Or Hold?

With the stock down over 90% from all-time highs, some investors might be searching for value here. This used to be a favorite stock to own in the cannabis sector, but that was when the company was growing at triple-digit rates. I note that even then, the growth rates were being heavily benefitted by external acquisitions and the per-share adjusted growth rates were more moderate. The stock is trading at only 1x forward sales and around 0.6x 2021 sales. That might seem like a cheap multiple, but consider that GRWG generated a slim 10.8% net margin in 2021. One could make the argument that growth and margins should improve once “normalization” of cannabis takes place in the country, at which point more and more consumers enter the space.

But when will that take place? My view is that normalization will not occur earlier than federal legalization, as many consumers might not be willing to try a product that is still considered illegal. Federal legalization might be a decade or longer away – by then, would the likes of Home Depot (HD) have already entered the sector? Moreover, it is very difficult to estimate the growth of the overall market inclusive of illicit sales, as I suspect that this growth may prove muted over the medium term.

That suggests that GRWG may be operating around peak numbers, which makes its multiple look more reasonable. If we assume that the company could achieve 15% net margins over the long term, generates 8% long-term growth and trades at a 1.5x price-to-earnings growth ratio (‘PEG ratio’), then the stock might trade at 1.8x sales, implying 80% potential upside. This is looking like the kind of stock that could deliver tremendous returns if growth returns or simply if one gets lucky on volatility.

The flip side is that it is unclear when exactly growth may return, if ever. Another risk to consider is that of cash burn – if the market weakness continues indefinitely, then the company may soon run out of cash and need to tap the capital markets for additional liquidity. Another thing to consider is that CFO Lasher stepped down in August – that is never a good look. While I rate the stock a buy, I emphasize the lack of conviction and advocate for small position sizing.

Be the first to comment