jumpman44/iStock via Getty Images

PepsiCo (NASDAQ:PEP) is one of those stocks where investors have grown accustomed to its predictability. The company’s impressive lineup of household brands lends itself to consistent pricing power and margin expansion. While the company is not growing nearly as fast as hyper-growth tech stocks, its consistency, and perhaps more importantly the perception of consistency, has helped the stock avoid the intense volatility seen in the tech sectors. The stock is yielding 2.7%, placing it at the low end of the past decade. The stock may only be suitable for those fearful of further market weakness and even then, the rich valuation might not offer guaranteed protection.

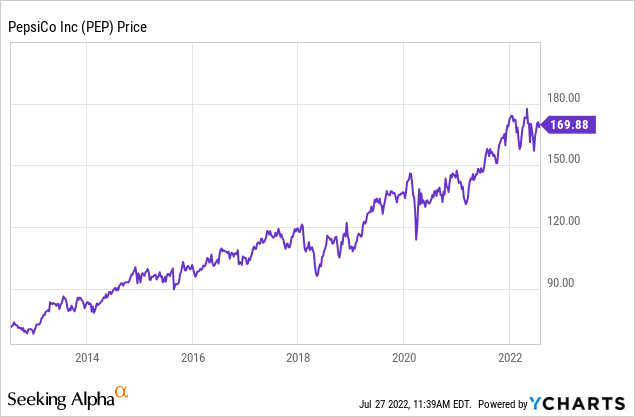

Pepsi Stock Price

PEP is not a sexy stock, but its returns are looking impressive especially to tech investors.

With the stock trading at around $170 per share, the stock is near all-time highs – seemingly oblivious to the turmoil occurring in the tech sectors.

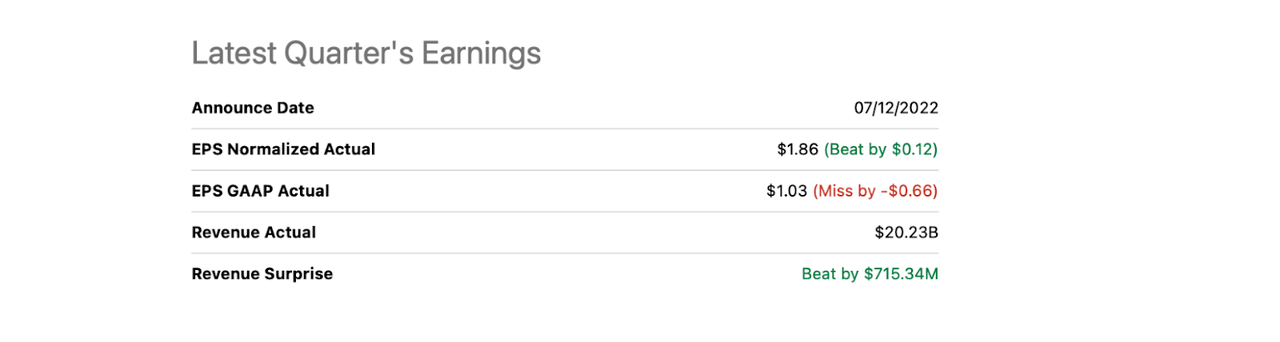

What Were Pepsi’s Expected Earnings?

When PEP reported earnings on July 12th, the company was expected to show minimal revenue growth and stagnating earnings.

Did PepsiCo Beat Earnings?

Its actual results were more upbeat, with a sizable revenue beat.

Seeking Alpha

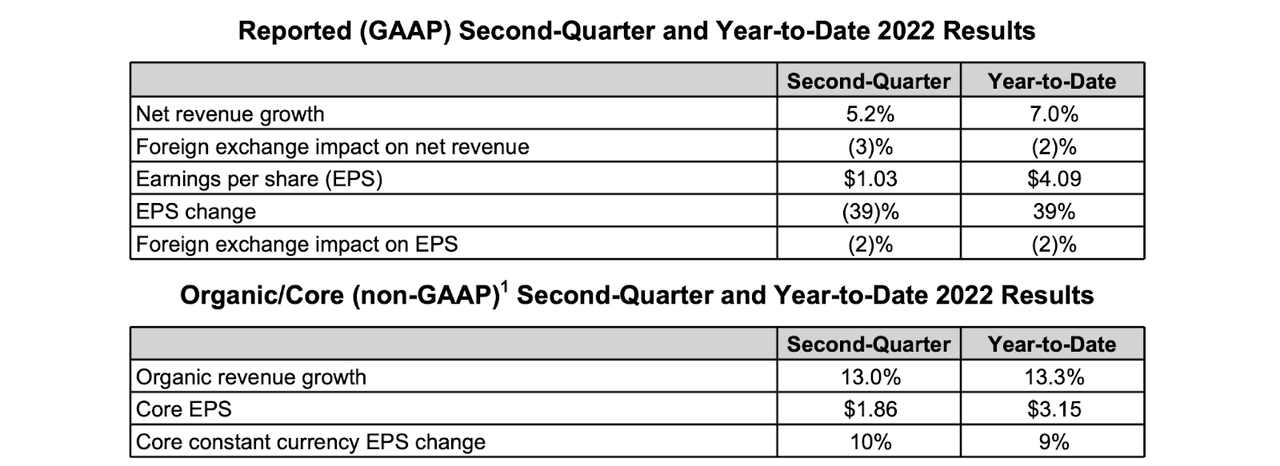

PEP Stock Key Metrics

In the quarter, PEP saw revenue grow 5.2%. GAAP earnings per share declined by 39% while “core” earnings per share grew by 10%.

2022 Q2 Press Release

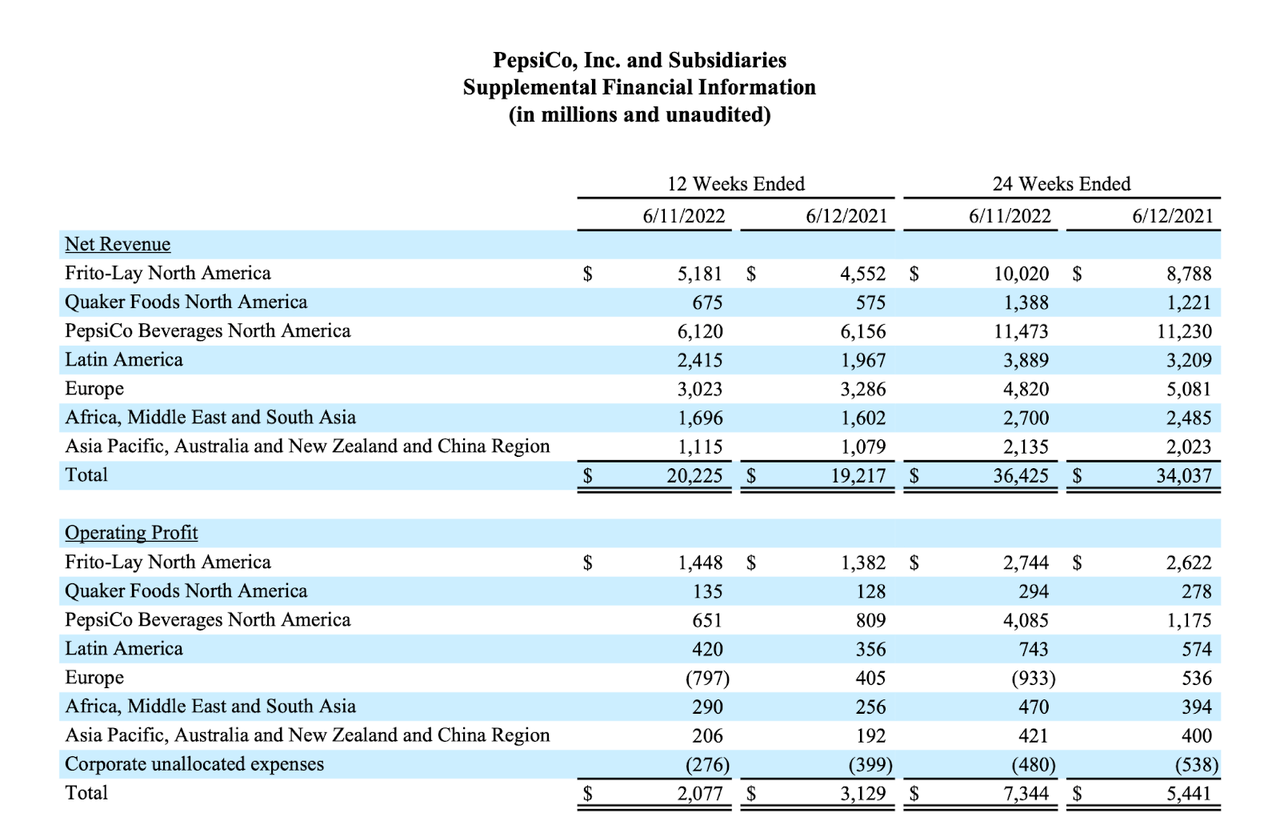

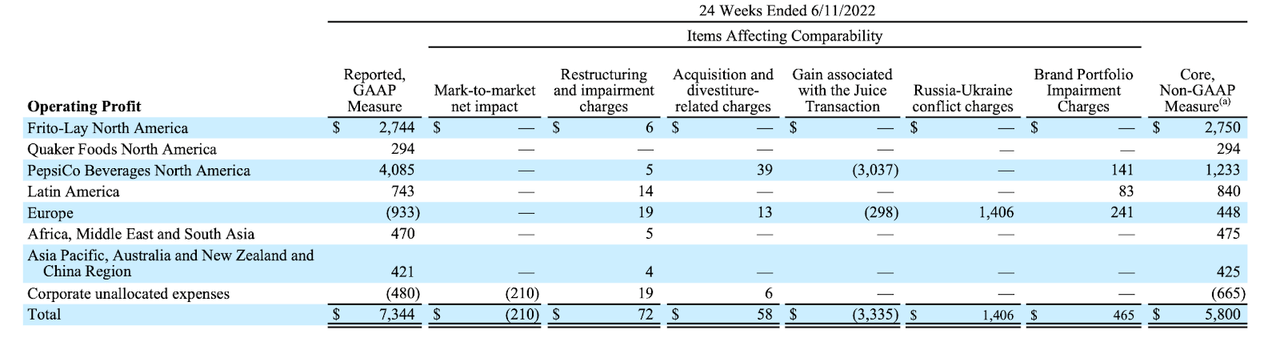

What drove the discrepancy? We can see below that the company’s European business has seen a sizable hit in operating profits whereas the PepsiCo Beverages North America business has seen an outsized gain in operating profits.

2022 Q2 Press Release

Yet both of those are excluded from core EPS. PEP had recorded a non-cash gain on its Juice transaction as well as non-cash impairment charges due to the Russia-Ukraine conflict.

2022 Q2 Press Release

After adjusting for those two non-cash line items, core EPS grew by a more predictable 10%. PEP ended the quarter with $5.4 billion of cash versus $39 billion in debt.

What To Expect After Earnings

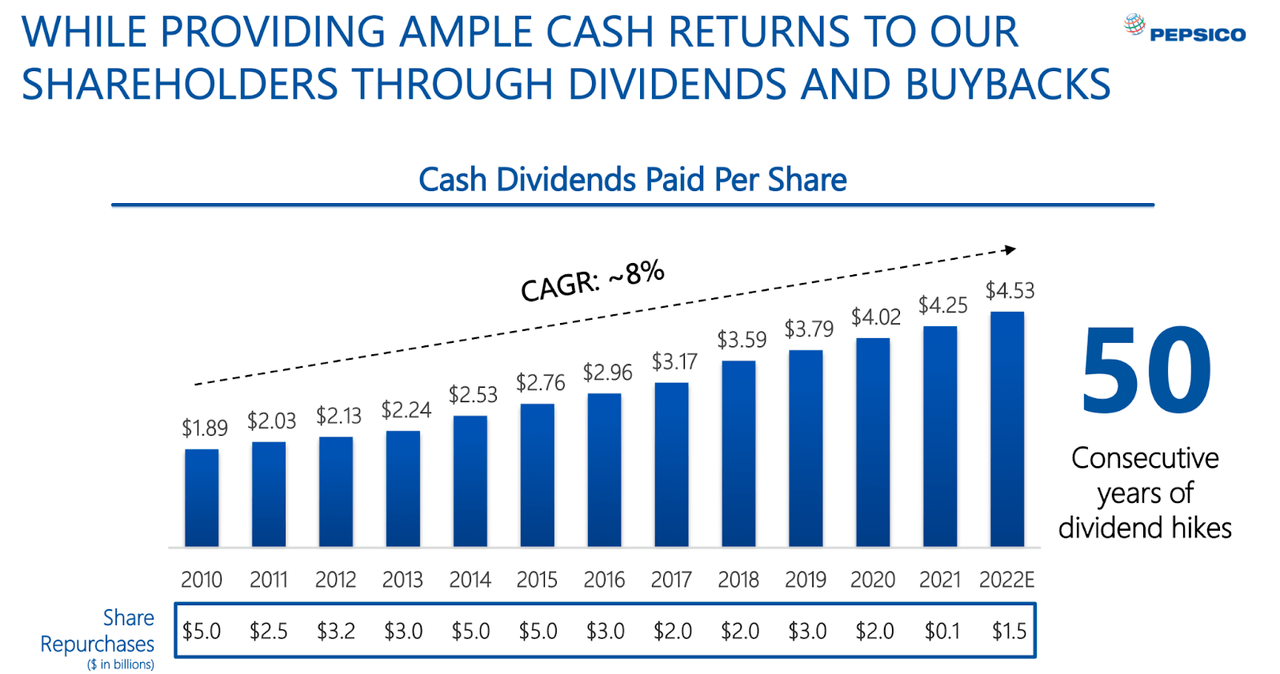

PEP has guided for full-year organic revenue to increase by 10% (prior guidance was 8%) and for its core constant currency earnings per share to increase by 8%. That latter metric may have one too many adjustments – without adjusting for constant currency, core EPS is expected to grow 6% to $6.63. The company expects to return $7.7 billion to shareholders through $6.2 billion of dividends and $1.5 billion of share repurchases.

Is PEP A Good Investment Long Term?

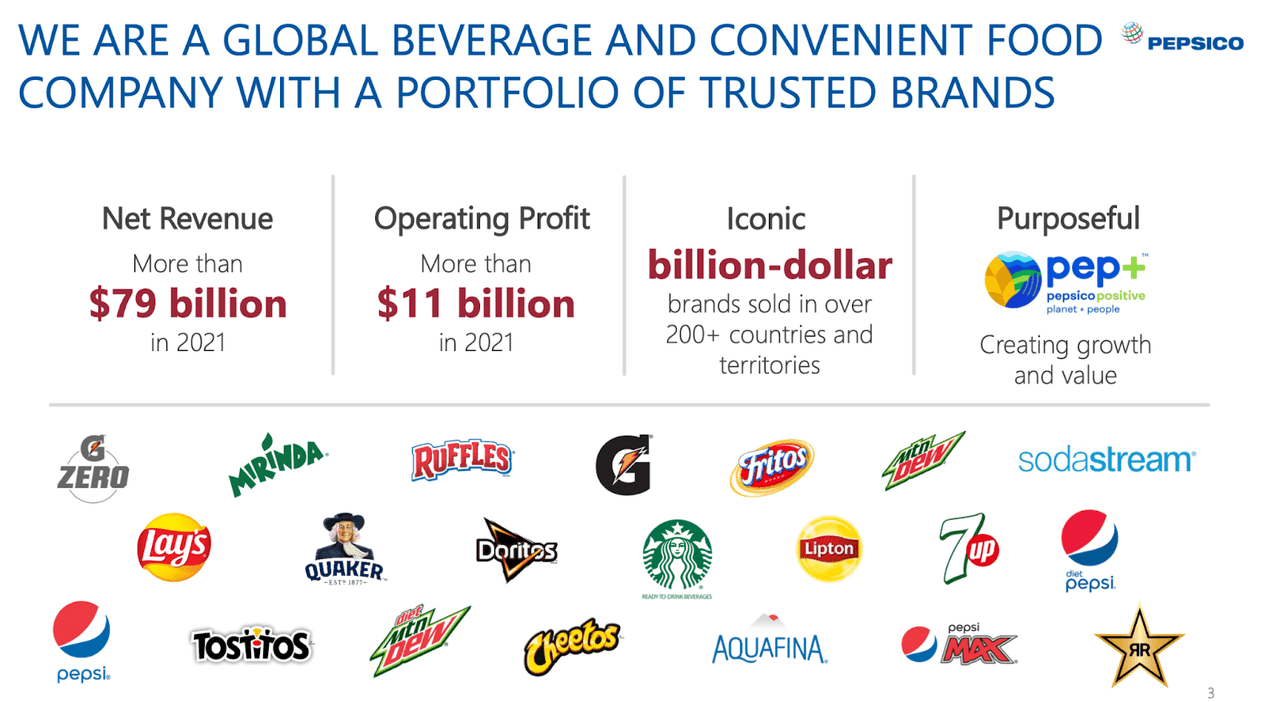

Over the decades, PEP has built an iconic lineup of household brands.

Consumer Analyst Group of New York Conference

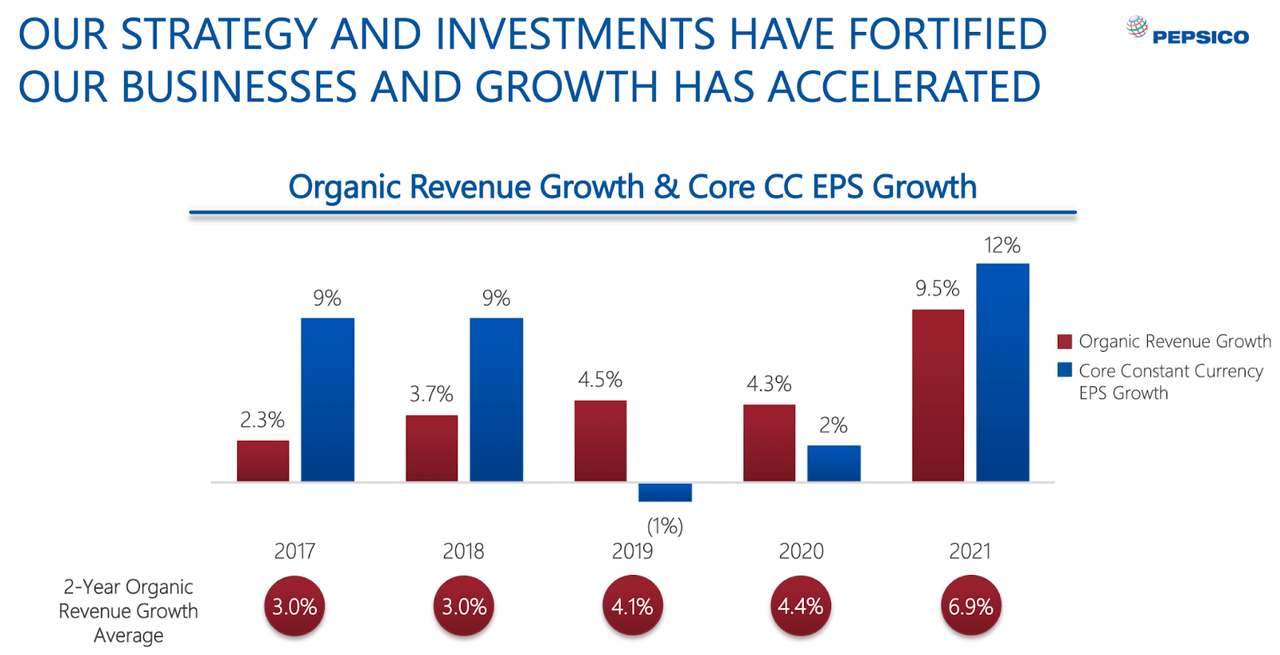

The company has been able to deliver consistent organic revenue growth which has led to even faster earnings growth.

Consumer Analyst Group of New York Conference

PEP has grown its dividend for 50 consecutive years, making the company a “Dividend King.”

Consumer Analyst Group of New York Conference

I do question the company’s decision to invest so much on share repurchases. The stock has historically traded at rich multiples and there has not been sizable growth over the past decade.

While PEP certainly has the free cash flow available for share repurchases, investors should instead consider that the company is not willing or simply does not have the ability to reinvest those cash flows at higher rates of return.

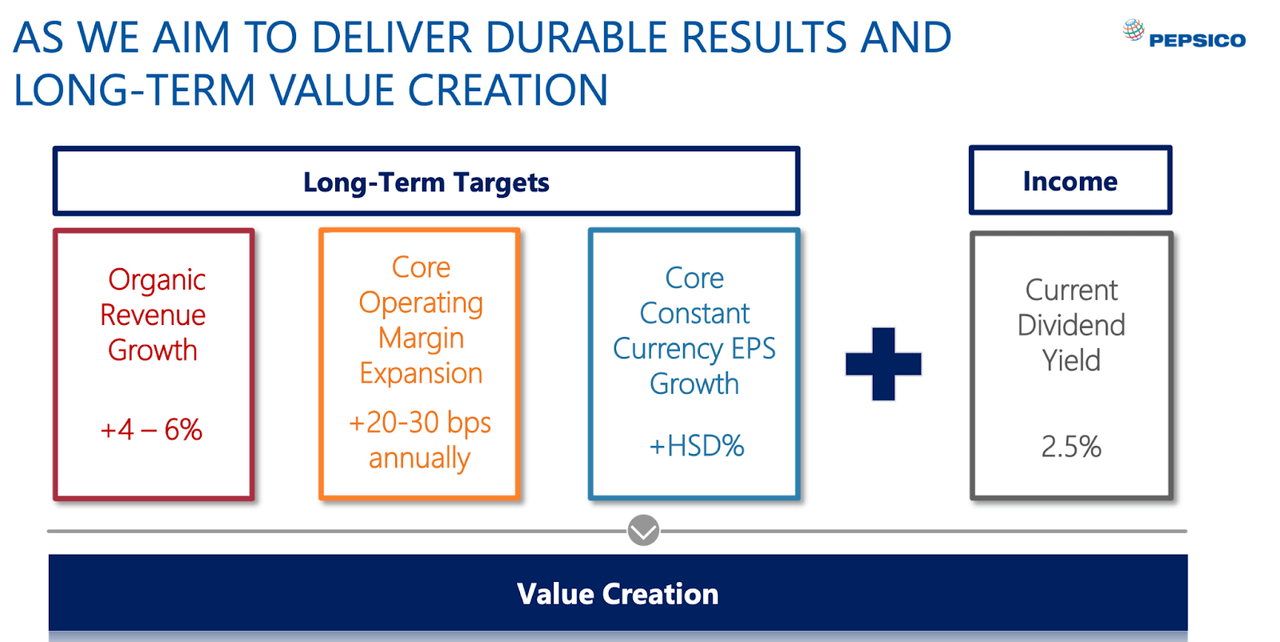

Over the long term, PEP aims to grow revenues by up to 6% annually which should lead to high single digit growth in EPS. Combined with the 2.7% dividend yield, that might lead to something close to double-digit annual returns. Such an outlook is not hard to believe considering it can be achieved through a mix of volume and pricing growth.

Consumer Analyst Group of New York Conference

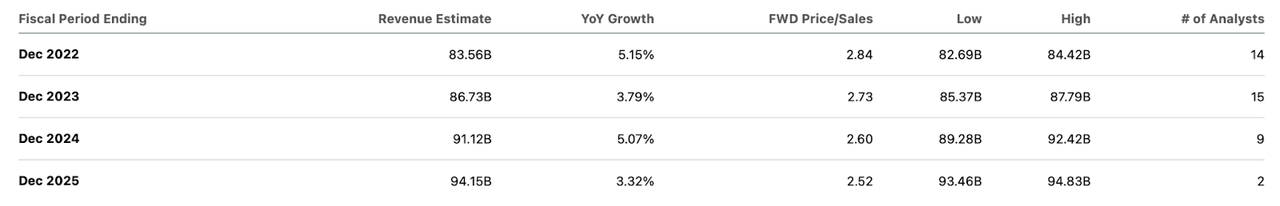

Consensus estimates seem to agree with that outlook, as analysts are expecting mid-single-digit revenue growth over the coming years.

Seeking Alpha

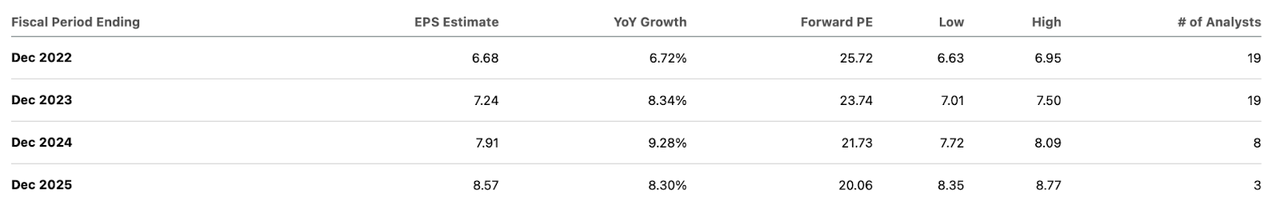

That top-line growth is expected to lead to high-single-digit earnings per share growth.

Seeking Alpha

Is PEP Stock A Buy, Sell, Or Hold?

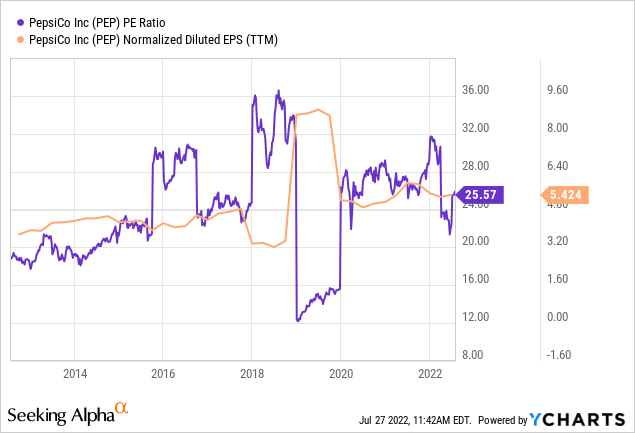

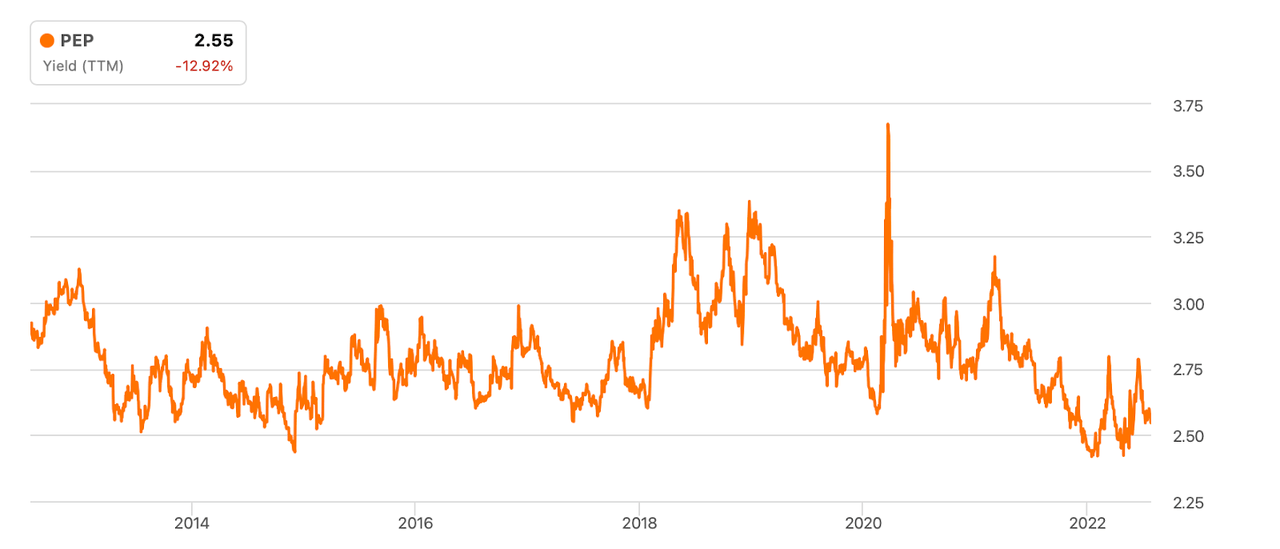

PEP offers a consistent track record and the perception of future consistency as well. But is it a buy today? We can see below that its 2.7% dividend yield places the stock at among its richest valuations over the past decade.

Seeking Alpha

I suspect that many investors use stocks like PEP largely as a market-timing mechanism, buying the stock when there is fear of market volatility. While PEP has the ability to deliver market-beating returns from here, that requires the critical assumption of stable multiples. PEP has delivered consistent results for a very long time, earning a premium multiple for a very long time, but past results may hold little value in supporting future valuations. If PEP were to show inconsistency in its growth trajectory, I would not be surprised if the stock experienced severe multiple contraction. Based on the growth profile, it would not be out of the question for the stock to trade down to around 12x to 15x earnings in such an event, representing around 50% potential downside. That suggests a risk-reward profile that is not quite favorable for investors, unless one believes that there is future market volatility ahead and that PEP can continue to move against the grain. What’s more, I have the view that this is an environment in which a risk-on strategy makes more sense, as the stocks of many high-growth companies have seen a historical valuation reset. While I can not fault anyone for buying PEP stock today, I can not recommend buying the stock at current prices – I rate the stock a hold.

Be the first to comment