Kevork Djansezian

Investment Thesis

We follow up with a timely update on Occidental Petroleum (NYSE:OXY) as there were noteworthy developments in its price action over the past month. As a result, our Sell rating on OXY has played out accordingly as the market digested its gains.

We cautioned in our previous article that the market could be setting up a deeper retracement in OXY, but the signals were still not validated. Following the steep fall in June, the bull trap (significant rejection of buying momentum) has been validated on its long-term chart.

Therefore, it raised our conviction levels of a potentially steeper fall moving ahead, as the market’s focus could have shifted from the troubles with Russia to a potential recessionary scenario. The fall also coincided with a tumble in WTI crude over the past month, as it has fallen below $100. Therefore, we believe that the market has focused on potentially weaker oil prices moving ahead, even though Occidental’s profitability is expected to remain robust.

Our valuation analysis suggests that OXY could underperform. The market rejected further buying momentum, even though OXY traded at an FCF yield of close to 20% at its recent June bull trap.

Notwithstanding, OXY’s technicals look well-oversold in the near term and close to its near-term support. Consequently, we urge investors looking to cut further exposure to wait for a possible short-term rally as the market draws in dip buyers first.

Accordingly, we revise our rating on OXY from Sell to Hold. We will reassess our ratings if a lower-high bull trap forms subsequently.

Why Did OXY Stock Dip In June?

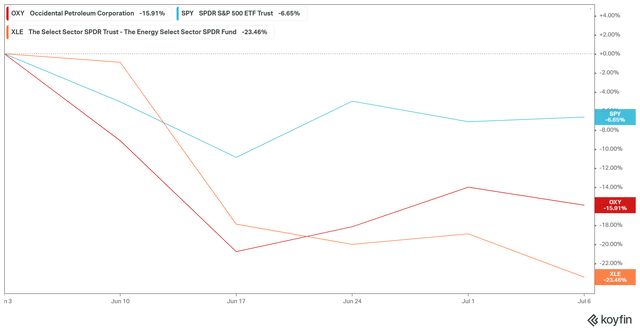

Despite trading at relative “cheap” FCF yields of close to 20% in early June, OXY underperformed the SPDR S&P 500 ETF (SPY) over the past month. As a result, OXY notched a 1M decline of 15.91%, well below the SPY’s 1M return of -6.65%.

We believe the market’s focus has already turned to a potential recessionary scenario, with price action signals warning of a possible distribution since April. Therefore, the market has likely been using the last two to three months to distribute “quietly” before forcing a steeper sell-off in June.

As a result, WTI crude has declined to below $100 as analysts battled over whether such risk-off trades in the crude market could continue. Citi analysts even suggested that oil prices could fall to $45 by the end of 2023, even though futures pricing has not yet priced in such an outcome.

Notwithstanding, WTI futures for July 2024 have moved below $74, indicating that the market continues to expect a decline moving forward.

Will Occidental Petroleum Rise Again?

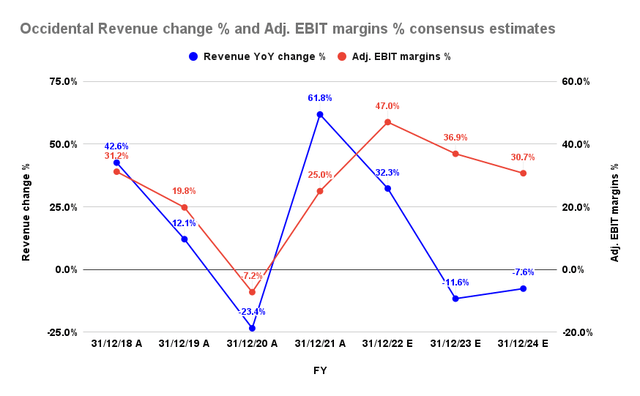

Occidental revenue change % and adjusted EBIT margins % consensus estimates (S&P Cap IQ)

Occidental has undoubtedly been receiving much love from Warren Buffett, as Berkshire (BRK.A) (BRK.B) has progressively increased its stake in OXY, and could possibly reach 20%. Therefore, it seems like Buffett has been buying the dip in OXY, despite the risk-off sentiments seen in June. As we explained in our previous article, we believe Buffett remains confident in Occidental’s long-term prospects.

Notwithstanding, the consensus estimates (generally bullish) indicate that Occidental’s revenue growth could decline in FY23 by 11.6%, with a further fall of 7.6% in FY24. However, its adjusted EBIT profitability is expected to remain robust, even though it’s projected to moderate to 30.7% by FY24.

Hence, we believe some investors could be drawn into a quandary as they parsed the potential for Occidental’s markedly falling revenue growth estimates. In contrast, Buffett’s increasing conviction (given Berkshire’s increasing stake) in OXY indicates that the Oracle of Omaha has maintained his bullish perspective of Occidental’s long-term prospects.

OXY’s Valuation Suggests It Could Underperform

| Stock | OXY |

| Current market cap | $55.4B |

| Hurdle rate (CAGR) | 5% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 20% |

| Assumed TTM FCF margin in CQ4’26 | 29% |

| Implied TTM revenue by CQ4’26 | $47.56B |

OXY reverse cash flow valuation model. Data source: S&P Cap IQ, author

OXY’s buying momentum was rejected in early June at an FCF yield of nearly 20%. Therefore, we believe that the market considered the yield too low to compensate for the risks in holding the stock. Our view is also consistent with its falling revenue outlook, which could impact its profitability.

We also used a blended TTM FCF margin of 29% (factoring in a reasonable margin of safety). As a result, we require Occidental to post a TTM revenue of $47.56B in FY26, for an implied hurdle rate of 5% (market-underperform).

Given the revised consensus estimates, we believe Occidental is unlikely to meet our revenue target. Therefore, it suggests that OXY may not even attain the hurdle rate implied in our model.

OXY’s Price Action Suggests Caution

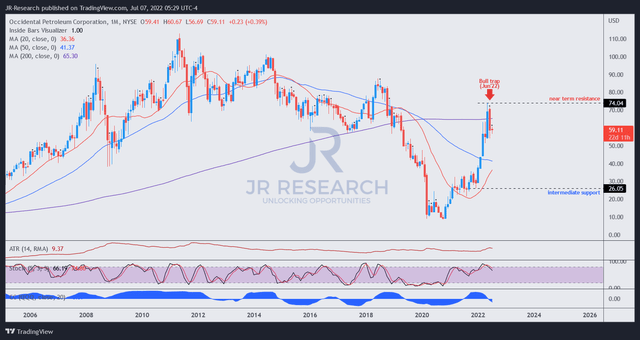

OXY price chart (monthly) (TradingView)

As seen above, the bull trap in June has been validated on its long-term chart. Therefore, it doesn’t augur well for OXY, given its rapid flush-up in 2022, which is highly unlikely to be sustainable. Therefore, OXY could be in the initial stages of a steeper fall moving ahead.

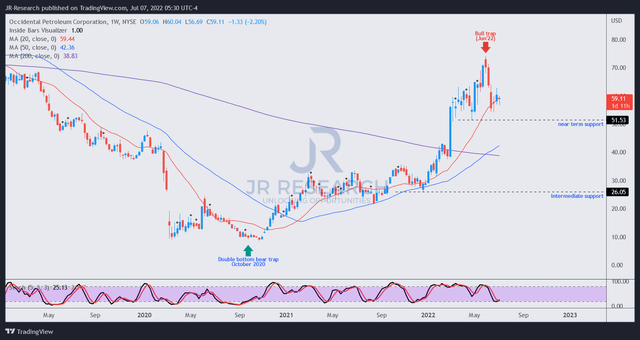

OXY price chart (weekly) (TradingView)

Poring into its weekly chart, OXY’s near-term technicals are well-oversold. Therefore, we posit a short-term rally could follow before a possible lower-high bull trap forms to stanch buying momentum.

Notwithstanding, OXY remains in a bullish bias, which the market could use to draw in more dip buyers before setting up for its eventual fall. Therefore, given its ominous price action signals, we don’t encourage investors to buy this dip.

However, we urge investors looking to layer out to wait for a potential short-term rally first.

Is OXY Stock A Buy, Sell, Or Hold?

We revise our rating on OXY from Sell to Hold.

OXY could be at a near-term bottom, given its well-oversold technicals. Therefore, investors should wait for a possible short-term rally before cutting exposure.

However, we do not encourage investors to buy the dip as Buffett did. Our valuation analysis indicates that OXY could underperform over the next four years at the current levels. Therefore, investors looking to add OXY should be patient and wait for a much deeper retracement.

Be the first to comment