JazzIRT

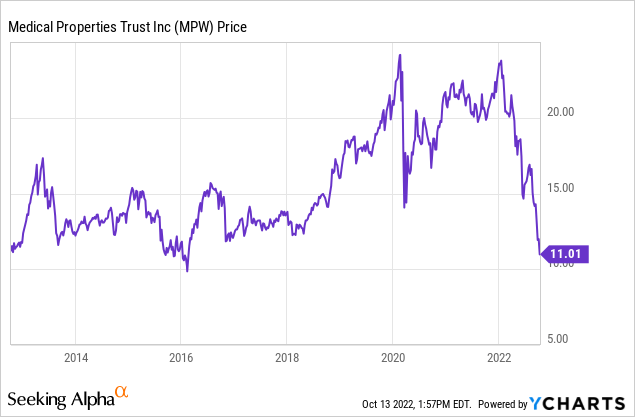

Most REITs are experiencing some weakness on account of rising interest rates, but Medical Properties Trust (NYSE:MPW) has had a particularly tough past several months. The stock is lower not just than pandemic crash prices but also lower than prices 10 years ago. The market appears to have lost confidence in the credit quality of its tenant base, as a recent bankruptcy filing highlighted the hidden risk in hospital assets. MPW also continues to invest further in its top tenant Steward Health Care in spite of already having outsized exposure to the name. Yet the stock yields nearly 11%, making it compelling relative to peers in the net lease sector.

MPW Stock Price

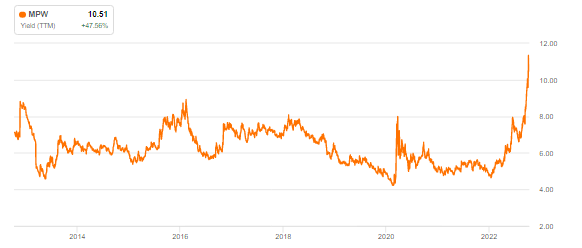

For many years heading into 2020, MPW had been a strong performer as it generated robust cash flow growth. That all changed in 2022.

I last covered MPW in April where I rated the stock buy in spite of a damning short report. The stock has since fallen 40% – not necessarily surprising considering the trend in sentiment but clearly an unsatisfactory result. Double-digit yields are quite rare in the net lease REIT sector, making MPW worthy of serious consideration.

MPW Stock Key Metrics

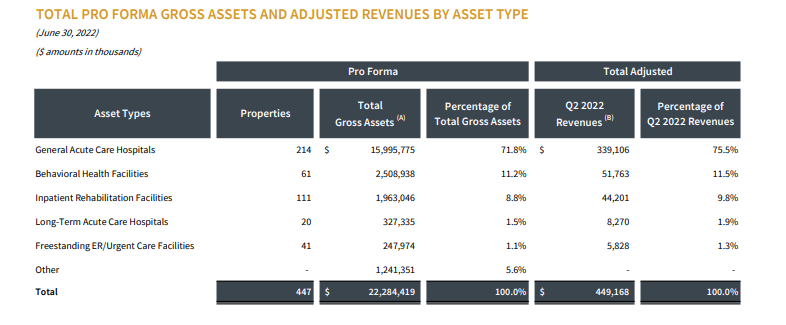

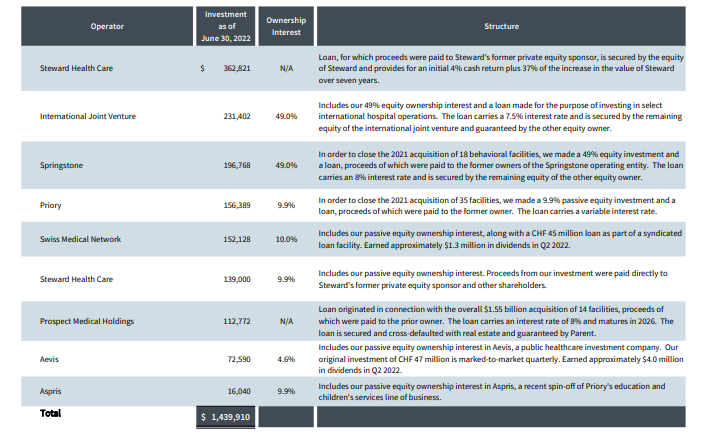

MPW is a real estate landlord of various types of medical healthcare facilities.

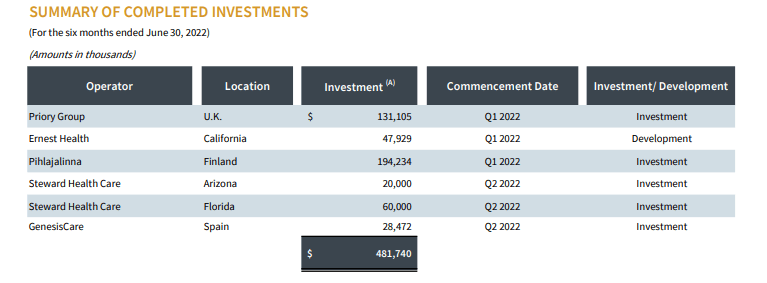

2022 Q2 Supplemental

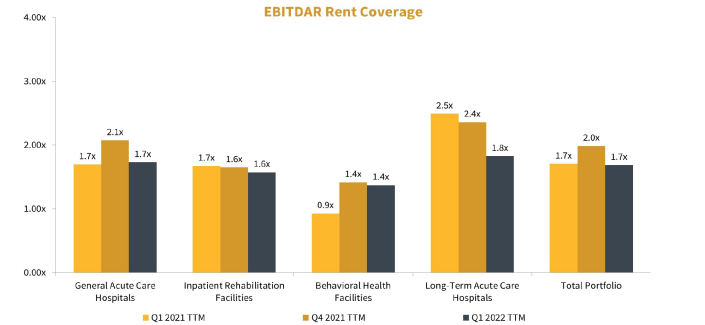

In general, such facilities are well-regarded as rent coverage is typically quite respectable.

2022 Q2 Supplemental

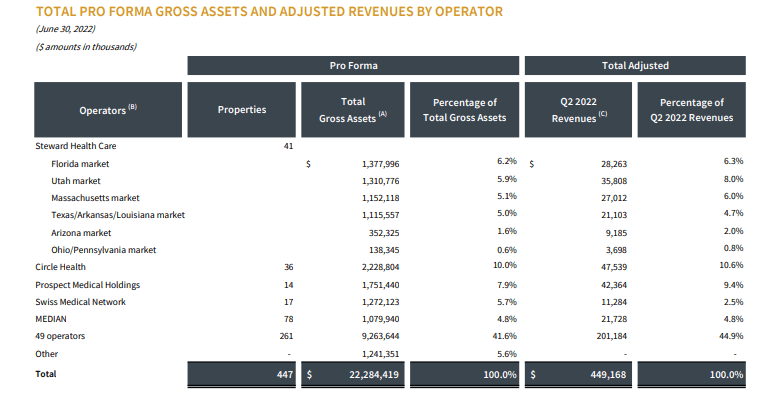

In MPW’s case, however, the stock has been heavily penalized for its outsized exposure to Steward Health Care, which makes up 27.8% of overall revenues.

2022 Q2 Supplemental

In spite of that outsized exposure, MPW has invested another $80 million into the tenant’s Arizona and Florida locations in just the first 6 months of this year.

2022 Q2 Supplemental

MPW has also committed another $169.4 million into Steward’s Texas location.

2022 Q2 Supplemental

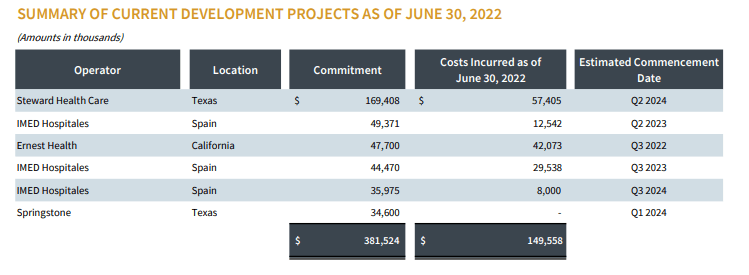

On the earnings call, management noted that the company will be extending a $150 million credit facility to Steward to assist with near term financial needs. MPW also has made other loan investments to the name as well as owning a sizable equity stake, as seen below.

2022 Q2 Supplemental

That sums up the tenant concentration risk. MPW also has an elevated leverage profile. The company states its debt to EBITDA as being 6.3x which on the surface appears reasonable relative to what is typically seen in the net lease sector. However, due to MPW having unusually high rent escalations, there is a great deal of straight-line rental revenue. Excluding $74.8 million of straight line rent in the quarter, MPW would have a 7.8x debt to EBITDA ratio. That indeed is quite high, though not necessarily yet distressed.

Management maintained their guidance for up to $1.82 in FFO per share, representing 4% year over year growth. I estimate that AFFO (FFO minus straight-line rent) may end up around $1.32 per share. The stock trades at just 8.3x that number in a world where Realty Income (O) trades at 15x FFO.

Why Has MPW’s Stock Price Been Dropping?

Up until recently, I’d say that MPW had been dropping due to rising fears regarding Steward Healthcare, but the latest plunge definitely has to do with tenant Pipeline healthcare filing for bankruptcy. It’s worth noting that Pipeline represented only a small amount of their assets.

2022 Q2 Supplemental

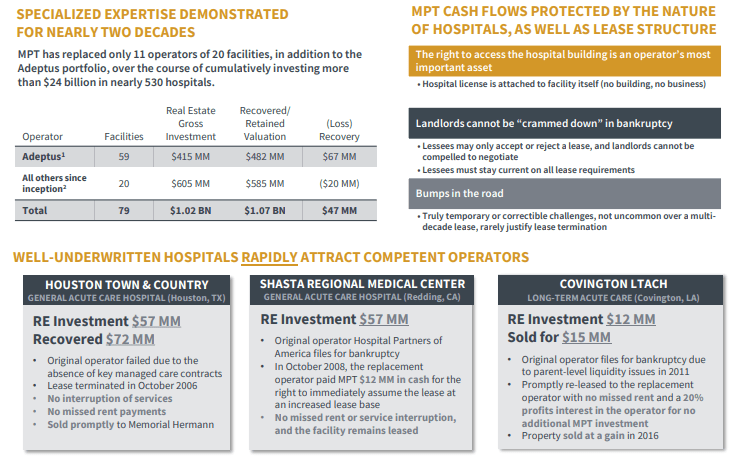

Moreover, management had just expressed confidence on the conference call regarding these assets due to their particular properties being operated “very profitably.” It is worth remembering that recovery rates in the hospital net lease sector are not so bad, as MPW notes that tenants may not be able to negotiate lease rates even in bankruptcy.

2022 Q2 Presentation

Regarding Steward, MPW sounded very confident regarding their progress on the call:

Steward operations continue to make dramatic improvements from 2020. In 2020, Steward’s unadjusted EBITDA was approximately $209 million. In 2021, based on current unaudited numbers, Steward generated an unadjusted EBITDAR of more than $450 million. This reflects a more than $240 million improvement. Based on the most recent 2 months, Steward’s internal unadjusted EBITDAR shows a run rate of more than $800 million. The Utah and Miami markets alone continue to perform very strong and made up approximately $350 million of that $800 million.

By the end of September, Steward will have paid back all of its MAP requirement, excluding the small amount associated with the hospital in Massachusetts that was hit by flood 2 years ago. The exhaustion of the payback of the MAP money in September and the termination of the Tenet management agreement will mean approximately $50 million additional cash dollars per month available to Steward.

Volumes at Steward are up 11% over the volumes in February and up more than 20% than the same time last year. And very importantly, the quality of these volumes is strong. Current labor costs at Steward are currently 9% lower than they were in January.

Management also noted in its presentation that Steward expects sustainable positive free cash flow starting as of the end of this year. Yet the company will extend a $150 million debt facility to Steward, making me wonder if all this positive talk is merely done to make that development seem more agreeable, especially considering the low interest rates on the facility? The current environment is one in which negative sentiment will significantly impact interpretation of financial developments – I do not expect sentiment to improve until Steward Health delivers on the free cash flow promise.

Is MPW Stock Undervalued?

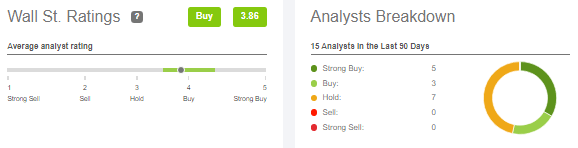

Wall Street analysts have a 3.86 buy rating on the stock.

Seeking Alpha

The undervaluation is best seen based on historic dividend yield. MPW previously traded at 8% yields heading into 2018 but had seen great multiple expansion as investors cheered the strong growth. MPW has now given up all those gains – and more.

Seeking Alpha

What Is The Long-Term Outlook For MPW Stock?

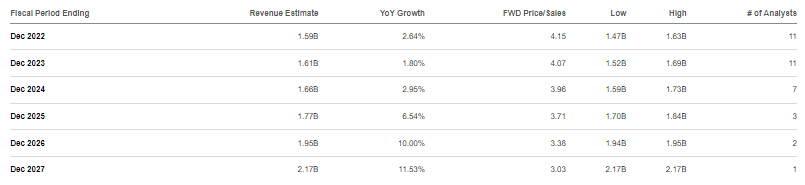

Consensus estimates call for low single-digit topline growth over the next several years.

Seeking Alpha

That in itself should be enough to justify stronger returns ahead – I could see shares re-valuing to around 15x AFFO over the long term. The company did announce a $500 million buyback authorization, but I have mixed feelings about that. Sure, a buyback would take advantage of the low valuation, but the company only has around $100 million in retained AFFO after paying the dividend. With leverage already quite high, I would not like to see an issuance of debt to fund a share buyback. On the contrary, I would anticipate more aggressive debt paydown to create more shareholder value as multiple expansion may prove more significant than financial accretion.

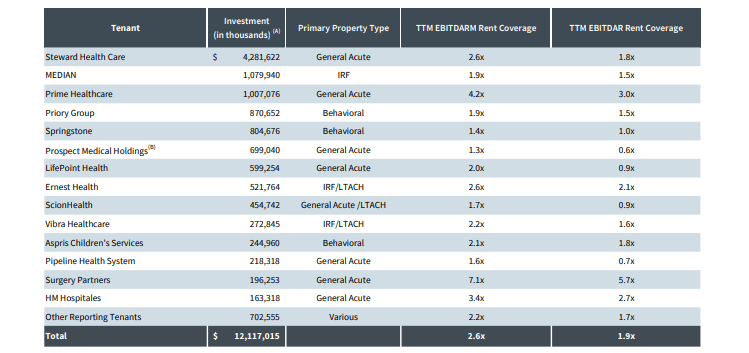

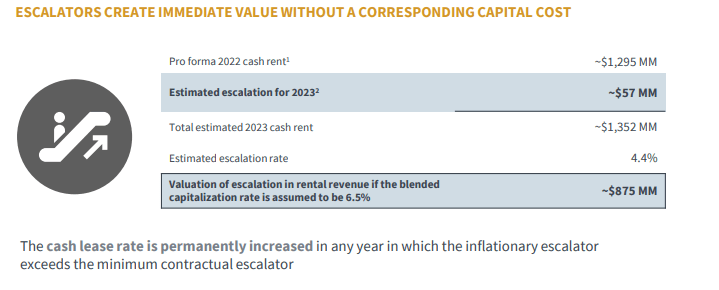

MPW has noted that due to many of its leases being tied to CPI, 2023 may see as much as 4.4% escalation.

2022 Q2 Presentation

The low stock valuation means that MPW will find it difficult to issue equity to fund external acquisitions which in turn slows down overall growth. The annual lease escalators will help drive some growth in the interim.

Is MPW Stock A Buy, Sell, or Hold?

NNN REITs have few growth levers outside of external acquisitions and with that difficulty (on account of high leverage and low equity valuations), negative sentiment is likely to persist with the stock. Perhaps MPW can eventually see a re-rating when Steward Health begins to report stronger financials, but that may take several quarters or more. In the meantime, investors might be OK with waiting as the 10.6% yield makes patience easy.

Is the stock a buy? I’d say so. It isn’t just the 10.6% yield that makes this stock appealing – it’s the fact that apocalyptic scenarios are already priced in. Let’s say that revenues decline by 25%. MPW generates a 53% AFFO margin. Assuming revenues come directly out of AFFO, AFFO would drop by 47%, but MPW would still generate $0.70 in AFFO per share. Sure, the dividend would need to be cut, but the stock would be trading at 15.7x AFFO – right around where Realty Income trades. At that point, an argument could be made for either a discount or premium, as MPW’s stronger lease escalators and acquisition cap rates can justify a premium but the higher risk of its assets may justify a discount. I find a 25% haircut on revenues to be too extreme considering the necessity of hospital real estate.

What are key risks? My long term view is bullish, but near term sentiment will likely remain negative and weigh on near term returns. The high leverage may lead to rising costs of capital though that should not be too significant unless many tenants default on their leases. That may also lead to a dividend cut – in my apocalyptic scenario above, it is realistic to expect the stock to initially trade at discounted multiples. In short, I expect significant volatility ahead even though the stock already trades at a near 11% yield.

It may not be a pretty road ahead, but I rate MPW a buy as I expect the valuation to ultimately lead to solid shareholder returns.

Be the first to comment