Sundry Photography

Realty Income (NYSE:O) is a very popular dividend stock due to being a high-quality REIT as evidenced by consistently growing dividend payments. But amidst the rising interest rate environment, is the stock still a buy, or even worth still holding? That is not such an easy question to answer. With corporate bond yields now trading at comparable rates, the yield spread may not look sufficient to some. I discuss what needs to happen in the market to justify holding the stock and why the stock may need to be sold if those factors do not happen. While I continue to rate the stock a buy, the valuation is clearly on the upper end of any fair value range.

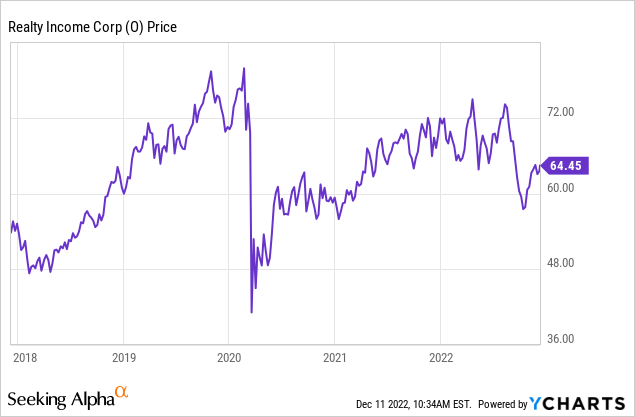

O Stock Price

O has been a strong stock performer over the past few years, but it remains below pre-pandemic highs.

I last covered O in August where I rated it a buy after strong earnings results. The stock has fallen double-digits since then, but corporate bond yields have risen 100 bps as well – this stock continues to be no slam dunk at current prices.

O Stock Key Metrics

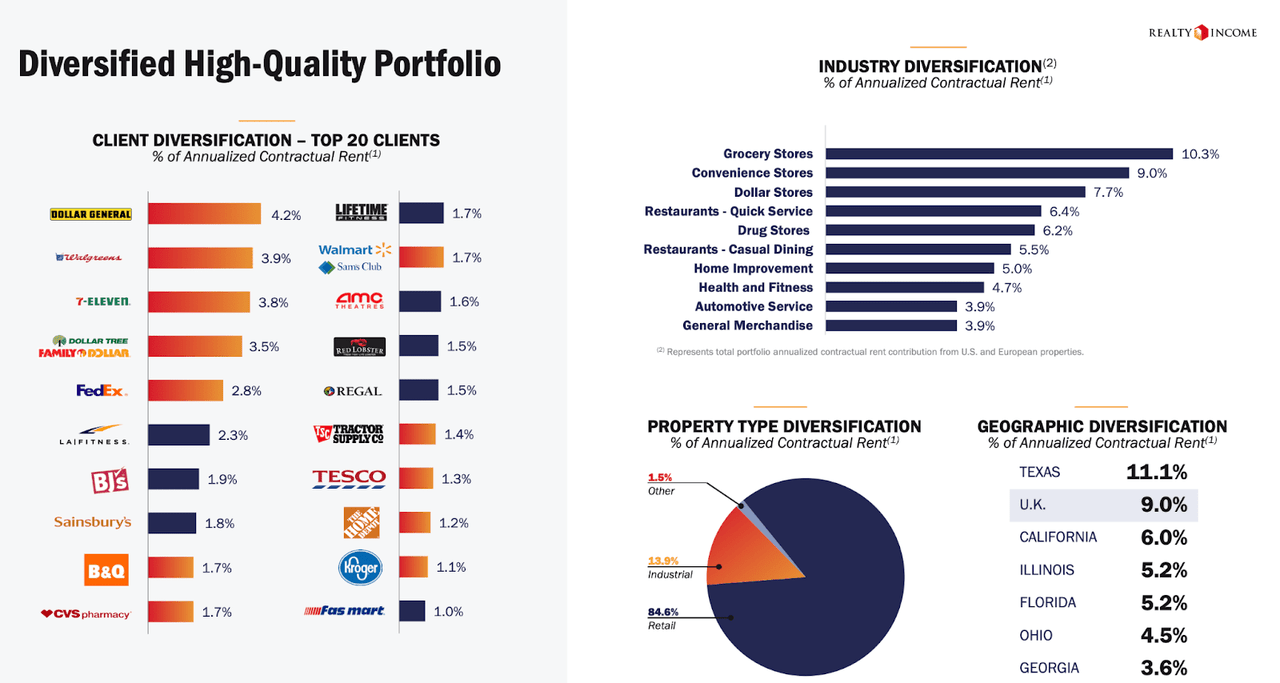

O maintains a high-quality net lease portfolio diversified across high credit tenants. O demonstrated its superior portfolio quality through some outperformance amidst the pandemic (although admittedly substantially all public net lease REITs passed with flying colors). O has targeted economically stable industries with most resistant to e-commerce threats.

2022 Q3 Presentation

In the latest quarter, O increased AFFO by 7.7% to $0.98 per share. That accelerated growth was boosted by its acquisition of Vereit. O continued to make progress at its movie theater tenants, collecting 85% of contracted rent in the quarter. Cineworld, which had commenced Chapter 11 proceedings in September, did not pay rent that month but O noted that it had collected all contracted rent from theater tenants in the month of October.

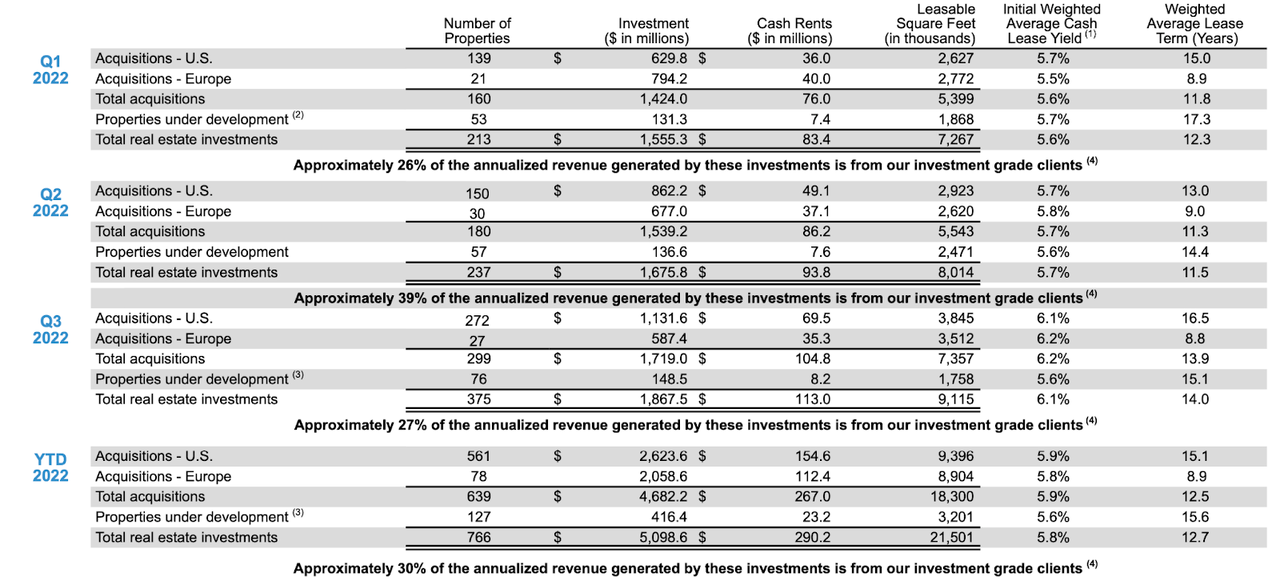

O remains best-in-class in executing on its acquisition pipeline. O has acquired $5.1 billion year to date at an average 5.8% cap rate. O had greatly accelerated its acquisition pipeline in 2021 when it acquired $6 billion of properties (previously it had been acquiring properties at around a $2 billion run-rate) but it appears that it is committed to sustaining an elevated pipeline.

2022 Q3 Presentation

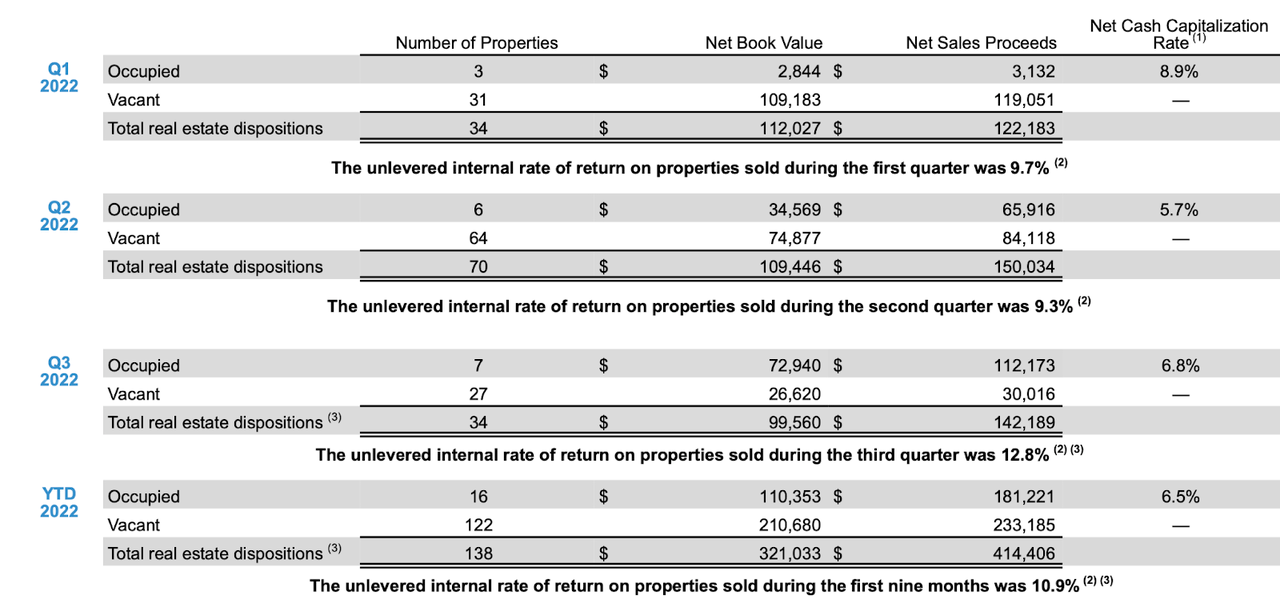

Dispositions have remained low in relation to acquisitions, with total dispositions totaling only 6% of acquisitions. I view a low amount of dispositions as being indicative of higher credit underwriting standards, as typically dispositions are composed of vacant properties.

2022 Q3 Presentation

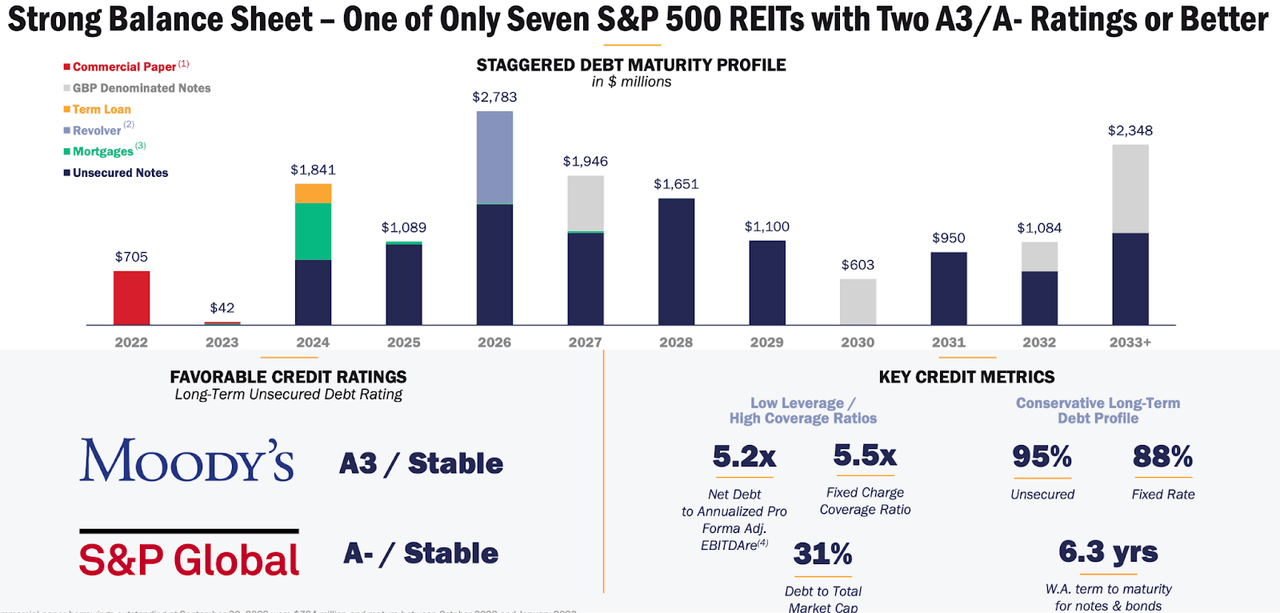

O has maintained a best-in-class balance sheet rated A-, making it one of only 7 REITs in the S&P 500 with such a distinction. Debt to EBITDA stood at just 5.2x, giving it room to issue debt if needed to fund its acquisition pipeline.

2022 Q3 Presentation

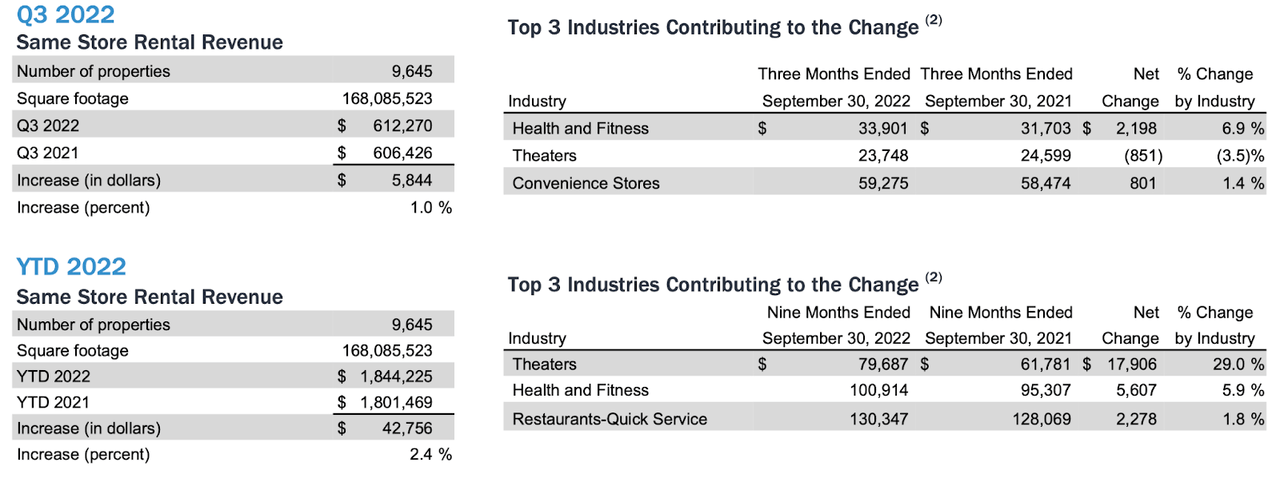

Besides external acquisitions, O has also shown consistent growth through same store rental revenue growth. O has generated 2.4% in same store rent growth year to date, largely due to improvement in theater rent collection. Investors should expect the 1% of the latest quarter to be more representative of forward results.

2022 Q3 Presentation

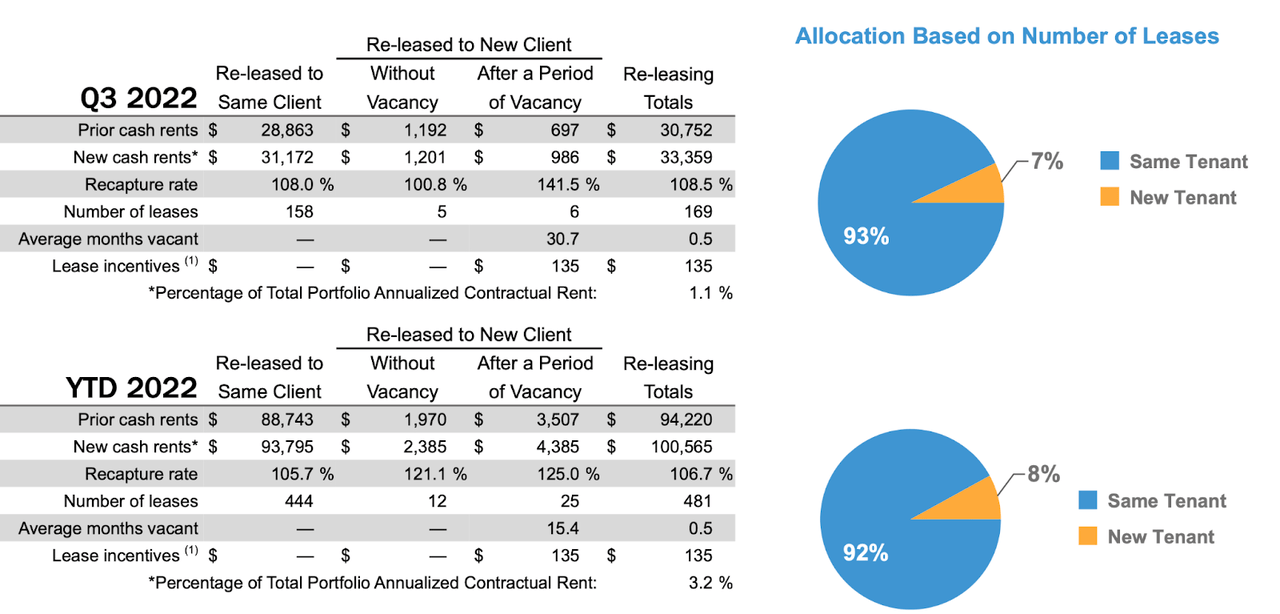

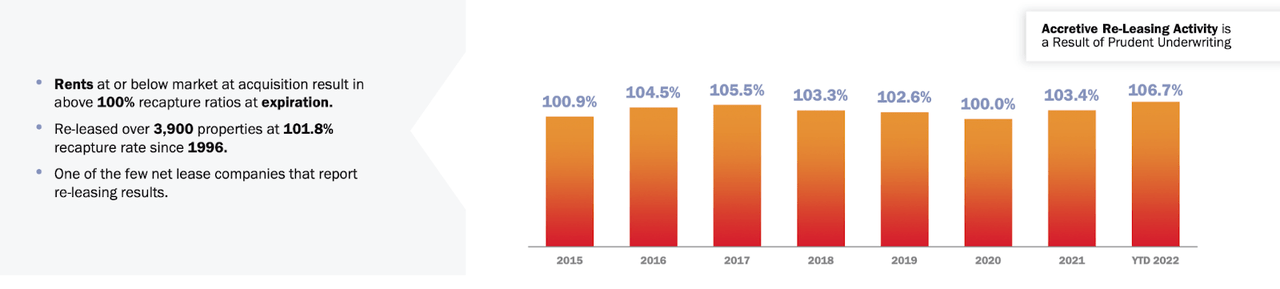

One unusual phenomenon has been solid re-leasing spreads. O was able to recapture 106.5% of expiring rents in the latest quarter and has been sustaining a similar rate year to date.

2022 Q3 Presentation

The strength is so significant that O is now even disclosing the strong re-leasing spreads as being differentiator relative to peers.

2022 Q3 Presentation

Traditionally, NNN REITs do not typically get strong re-leasing spreads, but it is possible that O has been able to drive strong spreads due to its acquisition cap rates being lower than peers.

On the conference call, O noted that 22 of its Cineworld theater properties are on cash basis accounting and account for 40% of its total exposure to the tenant. Management did state that they believe their Cineworld assets represent among the stronger assets in the tenant’s portfolio, but that is difficult to quantify. Management did also note that they “have received reverse inquiries from multifamily and industrial developers exploring opportunities on these sites.” Given the commentary, I suspect that the NNN REIT sector (and the entire retail REIT sector, for that matter) may face a rationalization of movie theater locations over the coming years as movie theaters finally face the consequences of a post-pandemic world.

Is O Stock A Buy, Sell, or Hold?

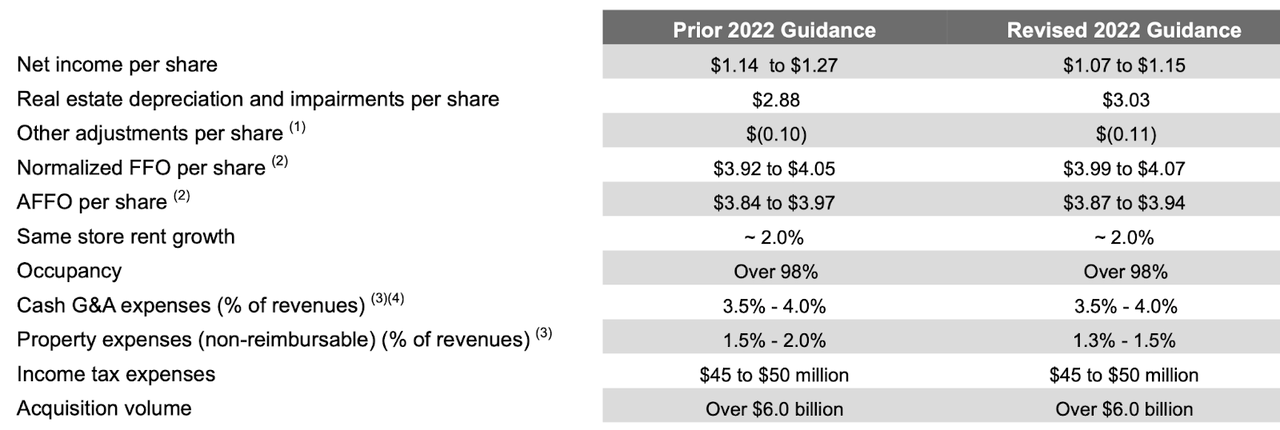

Looking forward, O has increased guidance to see up to $3.97 in AFFO per share, driven by 2% same store rent growth and over $6 billion in acquisition volume.

2022 Q3 Presentation

Yet even based on that guidance, the stock is still trading at 16x FFO and at a 4.6% dividend yield. That valuation might not look that cheap considering that the company is expected to grow at a 2% to 3% clip moving forward. Some readers might contest that there should still be more accretion from the Vereit acquisition. While that may be true, recall that much of the synergies were expected to come from refinancing debt at lower interest rates. The rising interest rate environment may have spoiled that party.

That 2% to 3% growth outlook looks reasonable considering that O was growing at around that rate prior to the Vereit acquisition. This is now a $40 billion company. Even if O is able to sustain its $6 billion acquisition run-rate moving forward, the low yield spreads may limit the potential growth.

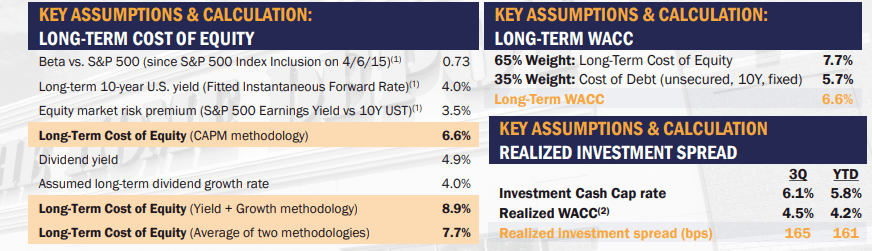

O has been able to maintain a reasonable weighted average cost of capital (‘WACC’) thus far this year and generate a 161 bps investment spread.

2022 Q3 Presentation

Yet with the stock trading where it is today and debt rates higher, I expect WACC to be far higher moving forward. O estimates it to be around 6.6% currently. I previously mentioned that O has been acquiring properties at a 5.8% cap rate thus far this year. Clearly it would not make sense to raise capital at a 6.6% cost to acquire properties at a 5.8% cap rate. Even if we assume that cap rates expand to 7% (a huge jump from 5.8% and likely too optimistic), then the investment spread would only be 40 bps. That might lead to 1.4% in FFO growth. Together with the 1% annual lease escalators, we arrive at 2.4% in projected growth, in-line with consensus estimates. While O can theoretically reduce its cost of capital by not issuing equity and instead only issuing debt, I note that such a strategy has limitations as O cannot let its leverage ratio rise too high.

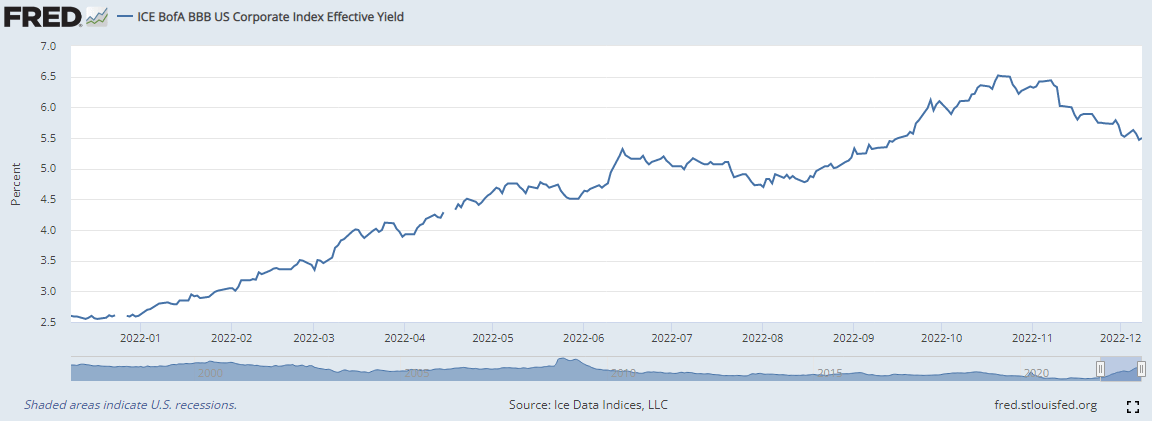

Is a 4.6% dividend yield with 2% to 3% growth worth owning in this environment? That’s hard to answer. Corporate bond yields have increased rapidly over the past year – AAA rates on average are around 4.8% and BBB rates are around 5.5%.

Fred.stlouisfed.org

That 5.5% rate is higher than the 4.6% yield at O. It is hard to argue that 2% to 3% growth is enough to offset that differential. One can make a clear argument that O is not offering enough of a risk premium relative to corporate bonds.

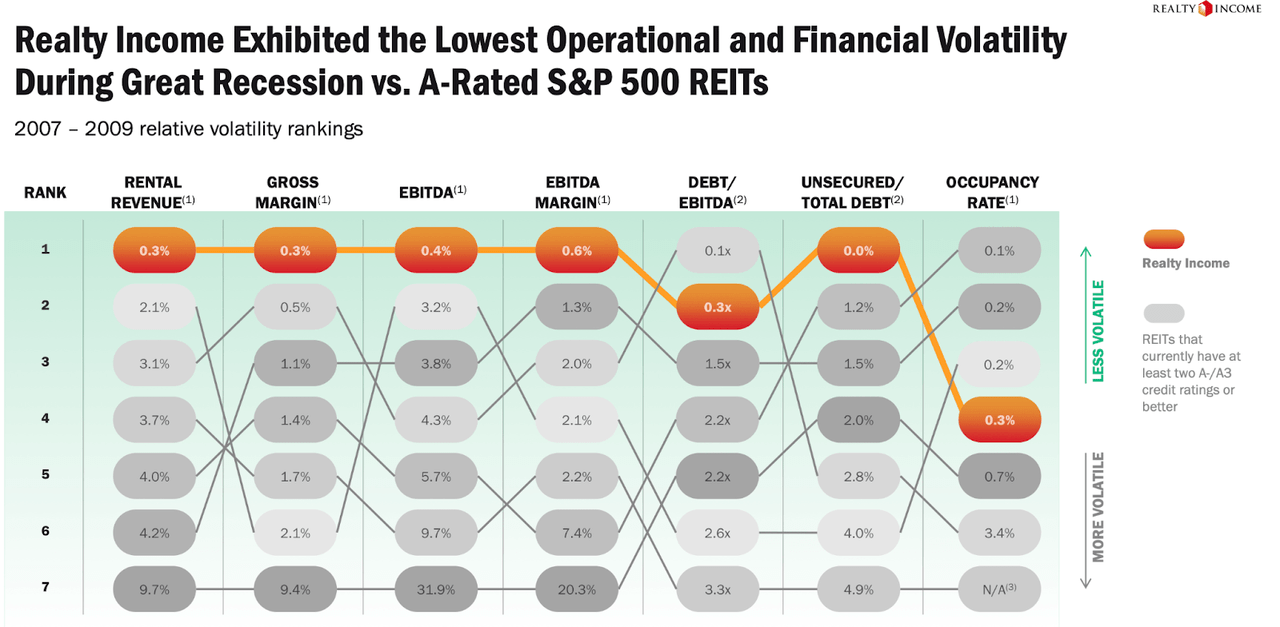

But here’s the other side of that argument. O has proven itself to be rock-solid even in the face of economic disaster. O was one of the top performers financially during the Great Financial Crisis.

2022 Q3 Presentation

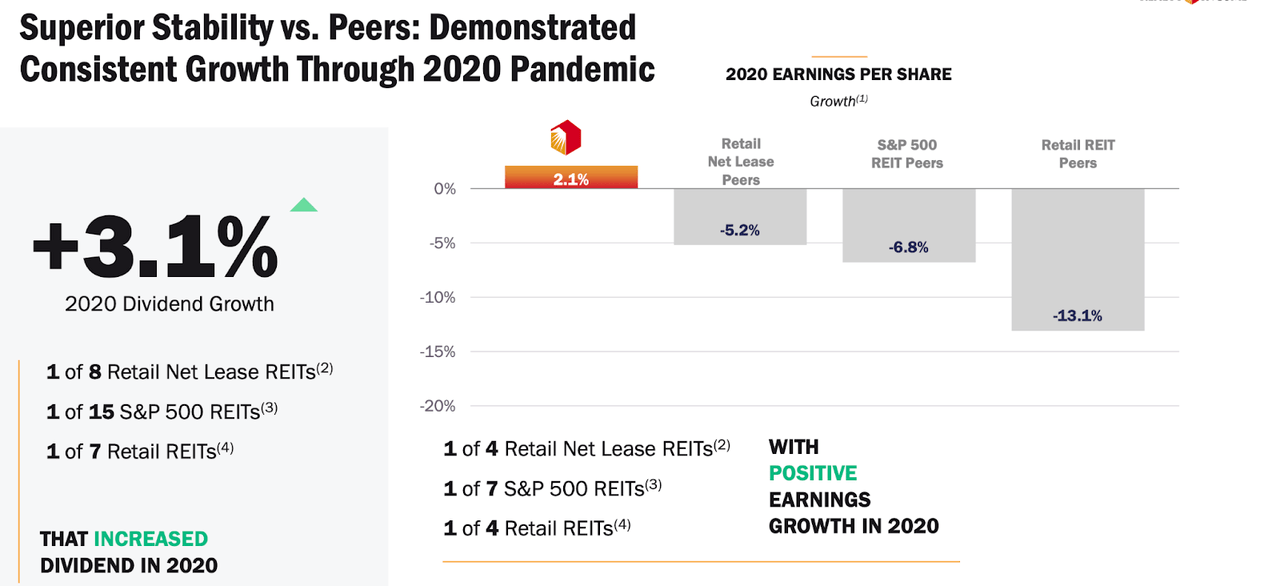

O was one of the few REITs able to grow both cash flows and dividends during the pandemic.

2022 Q3 Presentation

Viewed in this lens, I could see many investors choosing to invest in O as a “bond-replacement” kind of investment. In some sense, one can make the argument that O’s net leases to tenants like Home Depot (HD) are just as strong as their corporate bonds, which may explain why O continues to trade at comparable yields to corporate bonds. Thus, perhaps one shouldn’t focus so much on why there isn’t much of a risk premium between O and corporate bond yields, as there aren’t many scenarios where O is doing poorly and corporate bonds are doing well.

But of course, with the valuation so high, there remains great risk here. Perhaps O might continue to show strong rent collection and some cash flow growth. But the stock price might see great valuation compression as not all investors may share the same views just outlined above. If O were to trade at a 6.5% yield – representing a 100 bps risk premium to BBB corporate bonds, then the stock would trade at $46 per share, representing 28% potential downside. It has been many years since O consistently traded at such a high dividend yield, but I note that O was trading at around a 100-125 bps risk premium to BBB-rated corporate bonds at the beginning of the year. While I rate O a buy, I caution that it is at the high end of its fair value range and that investors might do well to search for greater discounts at NNN REIT peers, or perhaps even venture the brave waters in sifting through the rubble of the crash in growth stocks.

Be the first to comment