Win McNamee/Getty Images News

Twitter (NYSE:TWTR) saw its stock soar after Tesla (TSLA) CEO Elon Musk revealed a 9.2% stake in the company. The stock had already fallen so much that even after the rally, the stock still trades far below recent highs. TWTR is a stock which has seen little love from investors during its time as a public company, leading many to be optimistic that Musk’s involvement may spur changes, though it isn’t clear if the cooperation will be amicable. In this report I discuss the potential ramifications of Musk’s involvement and analyze TWTR stock at the current valuation.

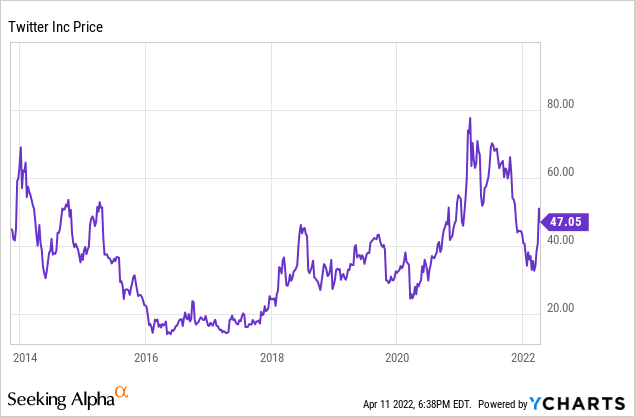

TWTR Stock Price

TWTR finished trading on Friday April 1st at just over $39 per share. Then on Monday April 4th, the stock traded up to as high as $50 per share when Elon Musk revealed his 9.2% stake.

The stock has since pulled back to trade at around $47 per share – still barely higher than it did when it came public in late 2013. I last covered the stock in August of last year and the stock has dropped 26% since then. There, I made the case that the stock offered robust forward returns while generating free cash flow. That thesis is still at play, and Musk’s entrance into the company has increased the potential of multiple expansion.

TWTR Stock Key Metrics

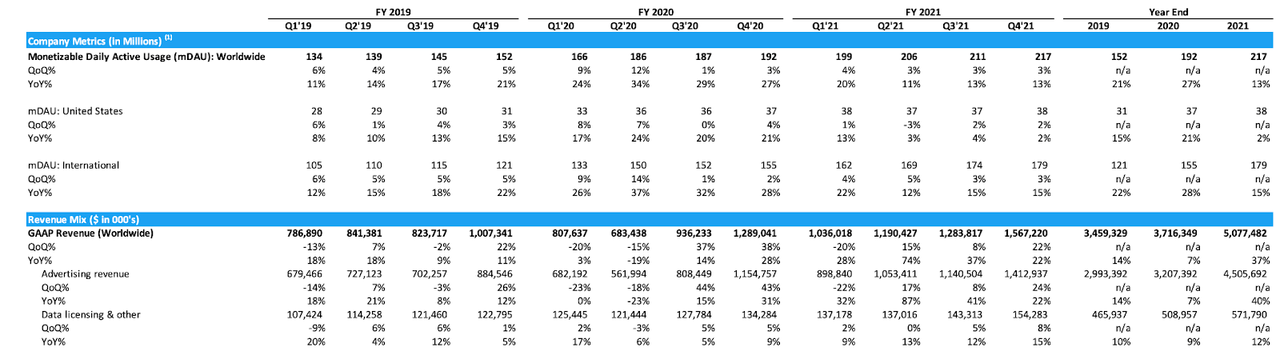

TWTR closed out 2021 with 22% revenue growth and 13% user growth in the fourth quarter. For the full year, TWTR grew revenues at 37% and users by 13%.

Twitter 2021 Q4 Selected Company Metrics and Financials

TWTR was not profitable on a GAAP basis for the year, but did generate $632 million of cash flows from operations.

Looking forward, TWTR expects to grow revenue in the low to mid 20% range next year. TWTR announced a $4 billion share repurchase program which appears to suggest that the company expects operating leverage to pick up in 2022, as I am doubtful that the company wishes to touch the $2.4 billion net cash position.

How Much Did Elon Musk Spend On Twitter Stock?

Elon Musk spent $2.64 billion to buy 73.1 million shares at $36.157 each. As of recent prices, he has already made over $700 million on his investment. This stake represents just under 1% of his total net worth (most of his net worth still stems from his 244 million share stake in TSLA).

Is Elon Musk The Biggest Shareholder Of Twitter?

The largest individual shareholder was previously Jack Dorsey, who owned 18 million shares as of 2021. Musk’s 73.1 million stake makes him the largest individual shareholder in the company. Unsurprisingly, this has caused some angst within the company, especially with regards to how Musk discloses information. Soon after revealing his stake, Musk released tweets like this one, in which he describes how his board meeting will be.

He also released a poll asking if users want an edit button.

The company later confirmed that it had already been working on an edit feature prior to Musk’s involvement, but these tweets appeared to have been a reason why Musk decided not to accept a position on the board of directors. At this point, it is unclear if Musk will seek to increase his ownership in the company to enact change forcibly. Unlike many other tech companies, TWTR does not have a dual-class share structure, meaning that Musk’s 9.2% stake represents 9.2% voting power. It is possible that Musk may increase his stake in the company then work with other activist investors to seek change. The $3.3 billion stake represents around 1% of his net worth, making it a significant though not particularly meaningful position. Does Musk want to make a profit from his investment, or does he just want to improve the app for personal use? At this point, it is too early to tell if Musk intends to stay for the long run and what his intentions are.

What Is Twitter’s Outlook Now?

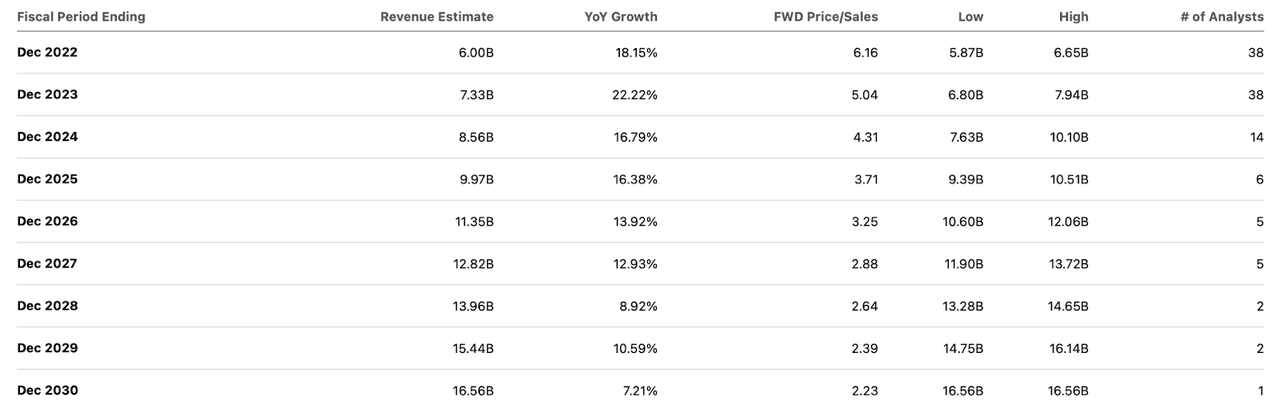

Looking forward, Wall Street analysts expect TWTR to sustain double digit growth over the next decade.

Seeking Alpha

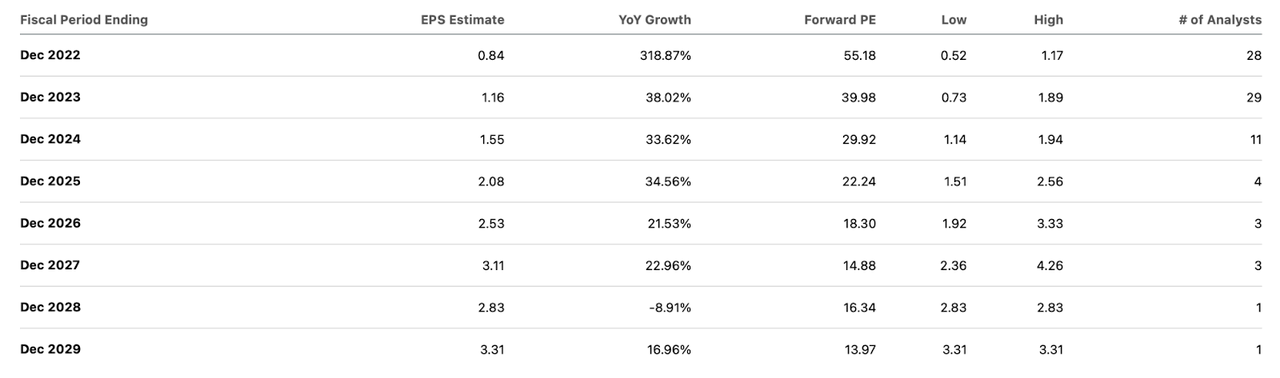

The company is expected to achieve 17% net margins by 2029, which appears conservative.

Seeking Alpha

TWTR is a platform which, at least anecdotally, has not seen much change to its functionality and feels under-monetized, with average revenue per user standing at $7.22 per monetizable user in the fourth quarter – compare that with $11.57 at Meta (FB). I note that TWTR is guiding for 315 million in monetizable DAUs by the fourth quarter of 2023 which implies that ARPU may decline by then, representing an even greater discrepancy.

Is Twitter Stock Safe?

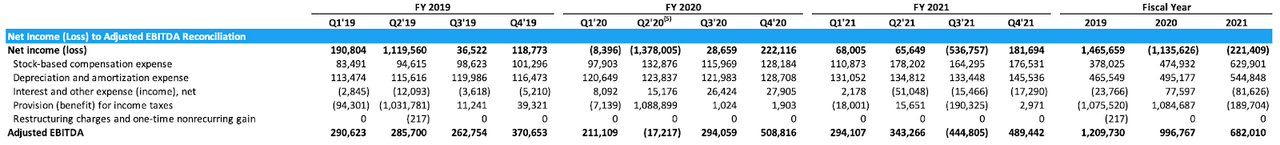

TWTR ended the year with $6.4 billion of cash versus $4.2 billion of debt. Most of the debt comes from convertible notes which carry a very low interest burden and the company is cash flow generative. We can see below that the company has generated consistent adjusted EBITDA margins over the past three years.

Twitter 2021 Q4 Selected Company Metrics and Financials

Those margins had declined modestly in 2021 due to the company investing heavily in growth, but in general this is a company with a strong balance sheet and cash flow generative position, making the stock safe from a financial solvency perspective.

Is TWTR Stock A Buy, Sell, or Hold?

From a valuation perspective, TWTR trades at only 6x sales. It trades at 55x earnings which does not look cheap, but this is the kind of company where operating leverage can cause the bottom line to grow at a rapid pace once the company decides to slow down investments in growth. I could see the stock eventually achieving 30% net margins – the stock trades at only 20x long term earnings power. Prior to Musk’s involvement, this stock has been a “show me” story, unable to achieve rich multiples in spite of what feels like an inevitable inflection point in monetization. Yet after Musk’s large buy-in, I could see the stock trading up to a 2x price to earnings growth ratio (‘PEG ratio’). TWTR has always seemed to trade based on the promise of future innovation – the presence of Musk makes such a possibility seem ever more likely, and that should be reflected in the valuation. Based on the 20% projected revenue growth rate, TWTR might trade at 12x sales, representing 100% upside over the next 12 months. Moreover, consensus estimates may prove conservative if the company finds a way to accelerate monetization of its platform. As a Twitter user myself, it feels like the company has not fully monetized its subscription capabilities, but that’s just anecdotal. The point is that even without any such innovation, the company can likely sustain at least 15% top line growth through adding new users, as the platform remains one of the most efficient aggregators of current news. There still remains the risk that Musk eventually liquidates his position without any real impact, but the company has a solid balance sheet and is generating cash. I note that TWTR is not obviously cheap relative to Meta (FB), especially on the basis of earnings, but on the flip side TWTR offers a differing social media strategy and its projected user growth suggests that it hasn’t faced the same issues facing FB. I nonetheless am optimistic that Musk can inspire some innovative changes in the company and the stock offers substantial upside in either case.

Be the first to comment