Spencer Platt

Apple (NASDAQ:AAPL) has seen its upward trajectory come to a temporary pause as Wall Street analysts struggle to predict how macro-headwinds will impact the company’s results. While AAPL continues to deliver quarter after quarter filled with ample cash flow and share repurchases, investors can be forgiven for harboring doubts regarding the near term outlook for the company. While services revenues only make up around 20% of overall revenues, I see it eventually making up larger and larger proportions over the long term. That should lead to margin expansion, helping to add some justification to a not-so-obviously-cheap multiple. Even so, I continue to question whether that is enough to justify buying the stock at current prices.

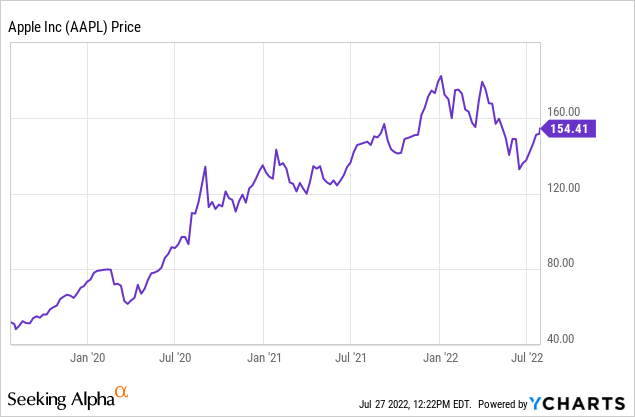

AAPL Stock Price

Amidst a vicious tech crash, AAPL stock has held up strongly.

I last covered AAPL on May 2nd when I discussed the stock’s defensive characteristics. Those characteristics are now being put to the test as the company needs to deal with the threat of inflation, supply chain disruptions, and lapping tough comparable quarters.

AAPL Stock Key Metrics

The latest quarter saw revenue growth slow down to 2%, bolstered by 12% growth in the services revenues. Due to higher headcount, operating income declined 4.1% to $23.1 billion. The net result was net income of $1.20 per share that was 7.7% lower than the prior year’s result of $1.30 per share. These results are not too surprising considering the multitude of headwinds, ranging from inflation, the Russia-Ukraine war, and possibly forgotten as of late – the impact of tough comps. Mac sales dropped double-digits which likely reflects the boost experienced during the pandemic.

The company ended the quarter with $179.3 billion of cash and investments versus $108.7 billion of debt. The company returned $28 billion to shareholders, continuing the policy of returning all free cash flow (and some more) to shareholders through dividends and share repurchases.

Why Was Apple’s Price Target Cut?

On July 20th, Morgan Stanley analyst Kate Huberty cut her price target for AAPL from $185 to $180 per share. While she continues to rate the stock overweight, she estimates that headwinds like the company’s exit from Russia and foreign exchange will lead to revenues declining 1.1% year over year. She expects that COVID-driven lockdowns in China will impact shipments in iPad and Mac segments. Those fears ended up being slightly overblown, but the steep slow down in growth is hardly a “beat.”

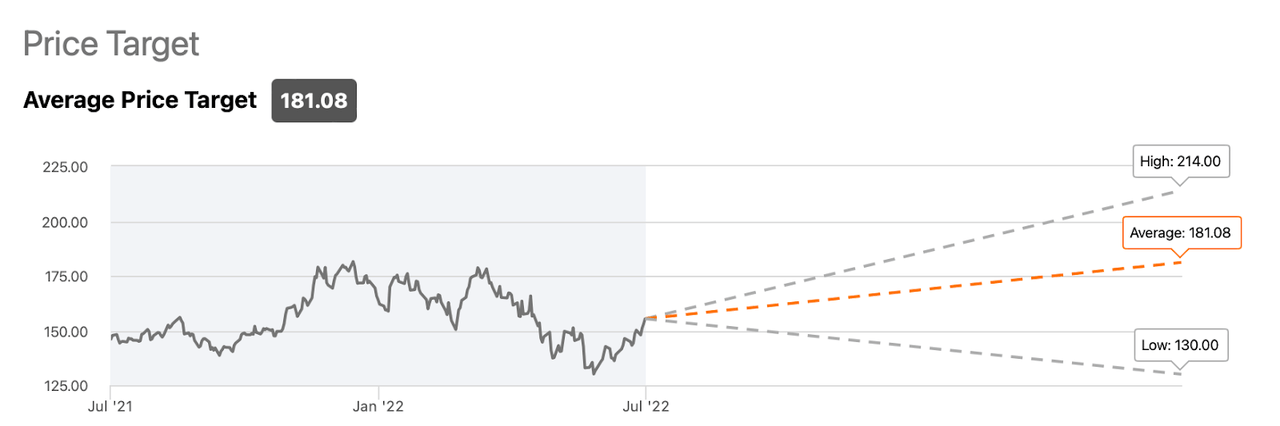

What Is AAPL Stock’s Price Target?

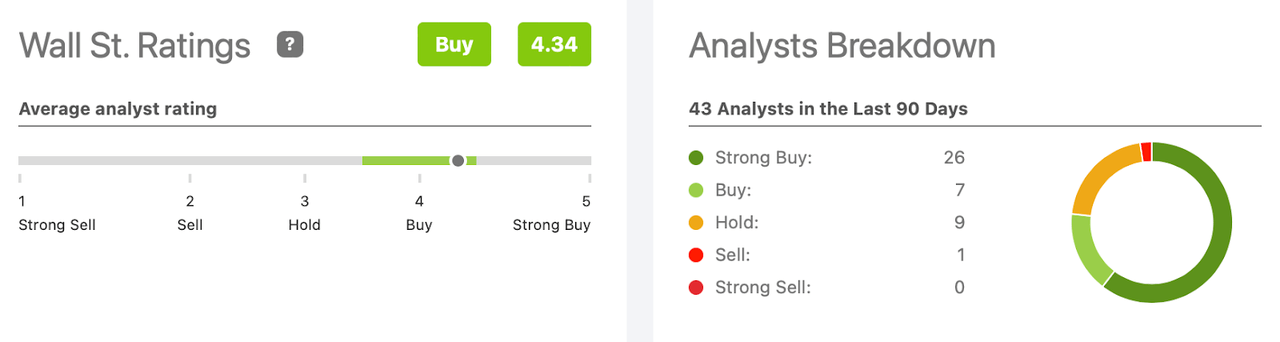

In spite of an ongoing generational crash in the tech sector, analysts have more or less remained very loyal to the stock.

Wall Street remains bullish on the company with a 4.34 out of 5 buy rating.

Seeking Alpha

The average price target of $181 per share reflects nearly 20% potential upside.

Seeking Alpha

For a company with such a strong balance sheet and cash generation, that kind of upside can be appealing to many investors.

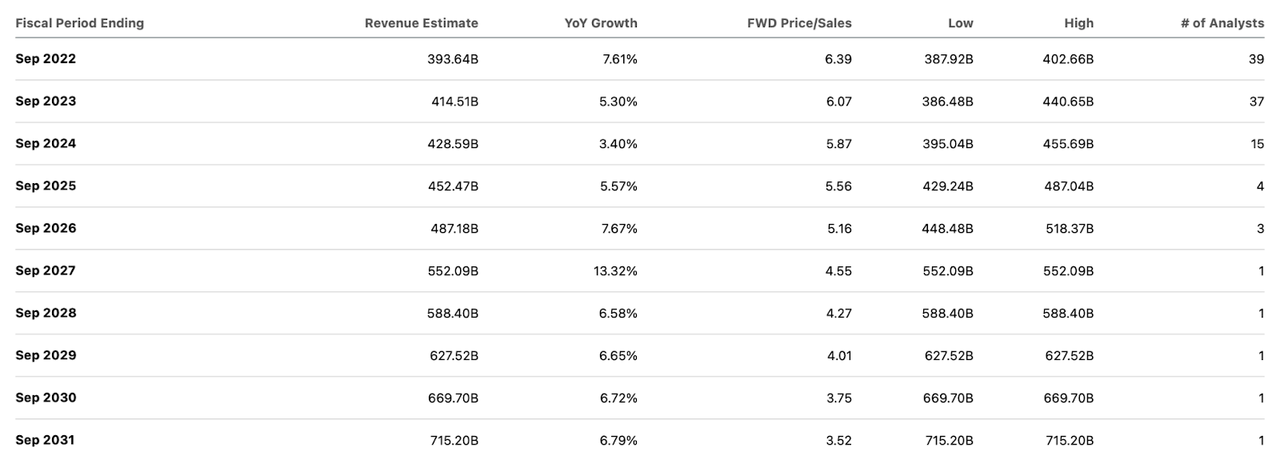

What Is Apple’s Long-Term Outlook?

AAPL is expected to sustain mid-single-digit revenue growth over the next decade.

Seeking Alpha

I suspect that this outlook may surprise some bullish investors on the stock. Let me explain why that outlook looks very reasonable. Services revenues continue to grow rapidly, but make up only around 20% of overall revenues. Meanwhile, product revenues have already slowed down in growth and I expect them to stagnate over the coming years as the pandemic may have pulled forward many years of growth. Yes, due to AAPL’s market position, services revenues may be able to grow at a 15% to 20% clip for a very, very long time. But even at the high end of that range, that segment alone will only lead to 4% overall revenue growth due to making up such a small amount of overall sales. Over time, services revenues will make up a greater and greater proportion of overall sales, but the law of large numbers suggests that by that time, services revenue growth should have slowed down considerably as well. That might explain why consensus estimates do not call for accelerated revenue growth in the back half of the decade.

Is AAPL Stock A Buy, Sell, or Hold?

At recent prices, AAPL is trading at around 25x forward earnings and 6.4x forward sales. Compared against a mid-single-digit revenue growth outlook, those multiples look aggressive. But one must factor in operating leverage, as services revenues carry a 70+% gross margin profile as compared to the mid-40’s overall gross margin of the past several quarters. AAPL generates an approximate 30% operating margin. Consensus estimates call for a 25% net margin this year. I could see that margin expanding to 40% over the long term. That means that the current 6.4x sales multiple equates to a 16x earnings multiple based on long term earnings power. Placed against a 5% to 6% revenue growth rate, that multiple still looks aggressive. The net cash position has declined to an insignificant percentage of the overall market cap, meaning that moving forward, AAPL will not benefit from the same aggressive share repurchase programs of the past. Given that the stock is already trading at 16x long term earnings power, I don’t see the urgency for multiple expansion, but acknowledge that the stock should continue to command a premium multiple as services revenues become even more significant. The stock might be able to deliver just slightly above market-beating returns from here based on the 4% earnings yield and mid-single-digit top-line growth rate. Wall Street appears to have fully embraced the relevance of services revenues (something that I have admittedly been too late to embrace myself) which should help support a premium multiple, but I’d argue that such an argument is better placed on other tech stocks amidst the tech crash. While I acknowledge the possibility for market-beating returns, I continue to rate the stock a hold as there is little margin of safety in the current stock price.

Be the first to comment