David Becker/Getty Images News

Thesis

Alibaba (NYSE:BABA) continues to underperform on the key metrics of growth and profitability. However, the company is working to control costs amid an improving regulatory environment, so I believe that a turnaround in the coming years is more likely than not.

Introduction

I’ve written about Alibaba a couple of times in the past. I did a deep dive into China’s e-commerce industry, and then an article about Alibaba specifically. My last article was written in October 2021, when I argued that the risks facing Alibaba were overblown and that the company was too cheap. Since then, Alibaba has fallen another 20%.

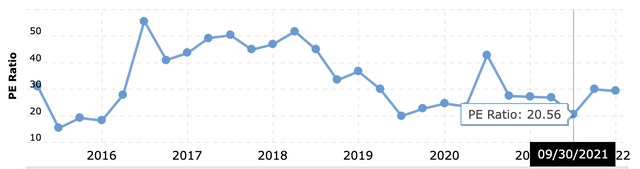

MacroTrends

Unfortunately for investors, despite Alibaba’s share price decreasing, it hasn’t actually gotten cheaper by the traditional P/E valuation metric. Alibaba fell below 20 P/E last October, but now trades above 30 P/E after reporting low EPS in Q4.

Despite quite a few downward EPS revisions lately, analysts still expect profitability to bounce back; Alibaba trades at a forward P/E of 16 according to Seeking Alpha. This is cheap relative to Alibaba’s five year sales CAGR of 40% and its historical average P/E near 30. So, if Alibaba delivers on analysts’ forward EPS estimates and maintains its current P/E, it could more than double in the next year.

Alibaba also retains a strong balance sheet, and returned about 4% of its market cap last year to shareholders through share repurchases. That’s a high “yield” for a company with double digit growth potential. They plan to continue these repurchases going forward.

Declining Profitability & Slowing Growth

The big question now is whether Alibaba can deliver on analysts’ forward revenue and EPS estimates. Although the company has grown revenue at a 40% CAGR over the last five years, its five year EPS CAGR is much lower at 6%. In the end, earnings determine the fair value of a mature company, so the slow rate of EPS growth is concerning. Revenue growth has also slowed substantially in recent quarters.

Alibaba’s worse-than-expected growth and profitability is often blamed on factors like the CCP’s regulatory crackdown, increasing competition, Covid lockdowns, and perhaps just poor management. There’s some truth to these narratives, especially as it relates to the fines the CCP charged Alibaba and the cancelled Ant Group IPO.

However, I believe that the impact of these issues on Alibaba’s long term potential is overblown. U.S. commerce giants like Amazon (AMZN), Target (TGT), and Walmart (WMT) have also struggled with growth and profitability recently amid a rapidly changing post-Covid environment, despite not dealing with a regulatory clampdown or flashy competition.

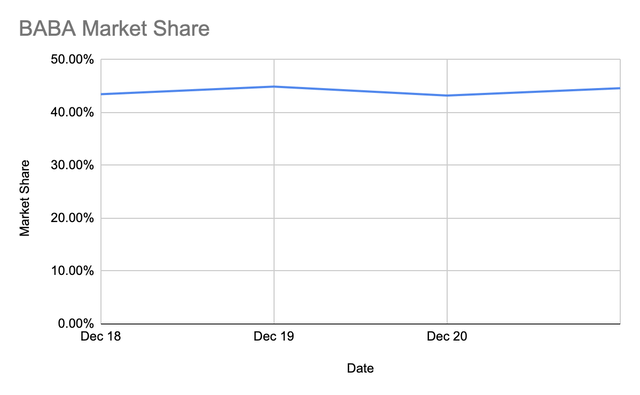

The Author

This chart I made roughly plots Alibaba’s market share as measured by its revenue relative to the combined revenue of competitors Alibaba, JD.com (JD), and Pinduoduo (PDD). We can see that despite concerns about competition, Alibaba’s market share has remained incredibly steady through the years. While competition has certainly hurt margins, at least Alibaba has slowly increased profitability over time; Alibaba’s main competitor, JD.com, has negative EPS growth over the last five years while Pinduoduo was unprofitable until last year.

Even as competition remains intense, Alibaba guided for improved future profitability in its recently reported Q4 thanks to cost cutting measures it’s currently implementing, although like many e-commerce companies they issued vague guidance. I’ll believe that Alibaba can improve its profitability when I see earnings that indicate as much, but I think that Alibaba’s cost-cutting strategy is a good one and that the best shareholder returns will come before it’s clear that Alibaba can be highly profitable.

Moving to another segment, Alibaba’s cloud business became profitable for the first time in Q4. However, that came against a steep deceleration to just 12% cloud growth, which Alibaba blamed on China’s Covid policies. U.S. cloud hyperscalers did quite well during Covid, so I wonder if something more is going on here. Because other cloud leaders like Tencent (OTCPK:TCEHY) and Baidu (BIDU) also reported slowdowns, I’m inclined to believe that it’s an issue with China’s overall cloud market rather than Alibaba specifically. Alibaba is the market leader in China’s cloud, but only has 7% share of the $1B 2025 China cloud revenue it projects. I think this projection is too optimistic after seeing how slow growth was this quarter, but it’s still one potential catalyst for Alibaba’s future growth.

Positive Catalysts

Another positive catalyst comes from Alibaba’s expansion into Southeast Asia. Alibaba’s Lazada continues to underperform Sea’s (SE) Shopee, with Lazada growing at 32% compared to Shopee’s 71%. However, I believe that the region’s fast growing e-commerce industry will remain without a wide moat leader until one competitor builds a dominant fulfillment network, similar to Amazon’s in North America and MercadoLibre’s (MELI) in Latin America. Alibaba’s deep pockets and fulfillment expertise give it a real chance to build the region’s leading fulfillment network. I’m long both Alibaba and Sea and don’t know who will win, but at least in Alibaba’s case it’s diversified enough that it doesn’t need to win in this region to deliver shareholder value.

Perhaps the most important positive catalyst recently was the news in April that Beijing is planning to “end its regulatory storm over big tech and give the sector a bigger role in boosting its slowing economy.” Although the news was reported by Alibaba-owned South China Morning Post and it’s difficult to trust statements made by the government, so far it appears that the article was accurate. There haven’t been any major negative developments from the CCP impacting Alibaba since then; there have even been rumors that Ant Group’s IPO will happen after all and Chinese regulators loosened their stance on video games. The reality is that in an increasingly digital economy, China will not achieve its growth targets without its big tech companies leading the way, and the CCP is smart enough to recognize this.

When this news was reported in April, I shared it with members of my marketplace service Tech Investing Edge and noted that the news could mark the bottom for Chinese stocks. Since then, Alibaba is up 19% even as U.S. equities have continued to sell off. Many investors have been burned trying to call a bottom on Alibaba and in the end I probably will be too, but for those who can hold for years, timing the exact bottom doesn’t matter.

I based my bottom call less on the news itself and more on a trend of relative strength in Chinese equities compared to U.S. equities. Although the current sentiment is that China is un-investable and its stocks will decline forever, had investors bought Alibaba at the start of the year instead of the S&P 500 they would be down 4% instead of 20%. Even when the aforementioned news came out in April, all of China’s big tech companies were already outperforming the Nasdaq year-to-date.

As I mentioned to members of my service at the time, if global equities had traded flat year to date instead of selling off, Chinese tech stocks would probably be up double digits and sentiment on them might be very different. If Chinese equities continue to outperform U.S. equities in the coming months and the CCP stays quiet, it’s inevitable that more investors will become interested in Alibaba again.

Conclusion

Alibaba is far from a perfect company, and their execution lately has been mediocre. They’ve gotten no help from their government either. However, their leading market position hasn’t changed, and there are many examples indicating that commerce and cloud leaders usually make good long term investments. Alibaba’s forward P/E today is quite cheap, and while it’s not guaranteed that the company will deliver on analysts’ forward EPS projections, the stock has a lot of upside if they can.

Be the first to comment