David Becker

Elevator Pitch

I touched on a potential delisting for Alibaba Group Holding Limited (NYSE:BABA) [9988:HK] in my prior May 3, 2022, article for the company. In this latest article, I address the question of whether Alibaba is a good buy and hold stock in light of BABA’s recent business and regulatory developments.

Regulatory uncertainty and business growth challenges make Alibaba a trading play or a buy and sell stock, rather than one that investors can be confident in buying and holding for the long run.

The right time to buy Alibaba’s shares is when its current valuations have not fully reflected expectations of a near-term recovery in the company’s financial performance. This isn’t the case now, as BABA’s current undemanding forward P/E valuations are aligned with its weak business outlook in the short term. As such, I have a Neutral view of Alibaba, and I will wait patiently for a better entry opportunity in the form of either even cheaper valuations or signs of an improvement in its business outlook.

How Has Alibaba Been Performing?

Both short-term share price corrections and long-term structural stock price under-performance offer opportunities for investors with a long-term investment horizon and a buy-and-hold investment mentality. In that respect, Alibaba does earn its place on the initial watchlist of buy-and-hold investors by virtue of its share price performance.

BABA’s One-Year Share Price Chart

Alibaba’s Five-Year Stock Price Performance

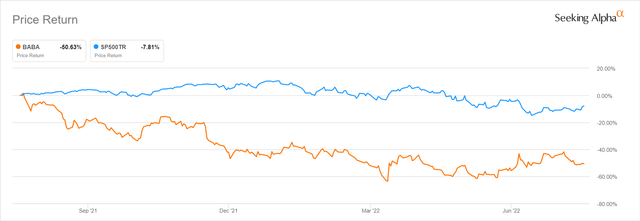

In the past one year, BABA’s share price has halved, as compared to a -7.8% pullback for the S&P 500. In the last five years, Alibaba’s stock price has decreased by -31.6%, in contrast with the +75.3% rise for the S&P 500 over the same period.

In summary, Alibaba’s stock price performance has been poor in both absolute and relative terms for the past one-year and five-year periods, which would have definitely captured the attention of many investors.

Is Alibaba Stock Fairly Valued?

Alibaba’s stock is fairly valued in my opinion.

Alibaba’s Peer Valuation Comparison

| Stock | Consensus Forward Next Twelve Months’ Normalized P/E Multiple | Consensus Forward Next Twelve Months’ EV/EBIT Multiple | Consensus Forward Next Twelve Months’ Enterprise Value-to-Revenue Multiple | Consensus Forward Three-Year Revenue CAGR | Consensus Forward Three-Year Normalized EPS CAGR |

| Alibaba Group | 14.1 | 19.0 | 1.9 | +10.9% | +8.4% |

| Tencent Holdings Limited (OTCPK:TCEHY) (OTCPK:TCTZF) [700:HK] | 22.9 | 17.7 | 4.9 | +10.3% | +10.2% |

| Pinduoduo Inc. (PDD) | 25.1 | 18.7 | 3.3 | +19.4% | +35.5% |

| JD.com, Inc (JD) [9618:HK] | 30.7 | 48.7 | 0.5 | +15.9% | +30.7% |

| Meituan (OTCPK:MPNGF) [3690:HK] | N.A. as the company is expected to be loss-making | N.A. as the company is expected to be loss-making | 4.2 | +25.8% | N.A. as the company is loss-making in the most recent fiscal year |

Source: S&P Capital IQ

BABA currently trades at the lowest forward P/E multiple and the second lowest forward Enterprise Value-to-Revenue multiple among its peers. But this appears to be justified, considering that Alibaba’s expected three-year forward normalized EPS CAGR is the lowest in the peer group. Moreover, BABA’s valuations are comparable with Tencent and Pinduoduo based on the forward EV/EBIT valuation metric, although the latter two companies boast superior bottom line growth expectations.

I come to the conclusion that BABA is at a reasonably fair valuation now, after comparing the stock’s key valuation and financial metrics against that of its peers.

BABA Stock Key Metrics

The near-term financial outlook for BABA is poor, judging by the revisions to the company’s key consensus financial metrics in recent months.

Alibaba’s sell-side consensus revenue and normalized earnings per share or EPS estimates for Q1 FY 2023 (YE March 31) have been reduced by -10.6% and -20.6%, respectively in the last three months, according to data provided by Seeking Alpha. During this period, 10 sell-side analysts cut their top line projections for BABA in the upcoming quarter, while seven analysts lowered their Q1 FY 2023 bottom line forecasts for Alibaba as per Seeking Alpha data.

Specifically, the consensus forecasts imply that BABA will reverse from a +8.9% YoY revenue growth in the final quarter of fiscal 2022 to deliver a top line contraction of -0.7% in YoY terms for the first quarter of fiscal 2023. The market consensus also expects Alibaba’s YoY EPS decline to worsen from -23.0% in Q4 FY 2022 to -36.2% in Q1 FY 2023.

Alibaba noted at its Q4 FY 2022 investor call on May 26, 2022, that “it’s prudent at this time, not to give financial guidance that is typically provided at the start of the fiscal year (FY 2023).” BABA stressed that at the call that “since mid-March 2022, we have seen significant impacts to our domestic businesses from COVID-19 restrictions in China.” Considering the company’s management comments, it is easy to understand why Alibaba’s upcoming Q1 FY 2023 results are expected to be uninspiring.

Is BABA A Good Buy And Hold Stock?

In my view, a good buy and hold stock is an undervalued company which boasts a high degree of predictability with respect to its long-term business outlook. In an earlier section of the article, I highlighted that Alibaba is fairly valued rather than undervalued. In this section, I detail the business challenges and regulatory issues for BABA that make it hard for investors to recognize the stock as a good buy and hold pick.

In terms of challenges on the business front, Alibaba’s core China e-commerce business growth has been slowing in recent times due to a large base (it is already China’s largest e-commerce company) and stiffer competition (superior growth outlook for rival PDD as seen with consensus numbers). This evidenced by the relatively low consensus forward three-year revenue growth estimate as highlighted in a previous section of this article. Looking ahead, BABA is pinning its hopes on increased lower-tier city penetration for its e-commerce business, and the scaling up of its cloud business to drive its future growth.

I don’t have a favorable view of BABA’s plans to grow its presence in the grocery product category and lower-tier Chinese cities with Taocaicai and Taote (formerly known as Taobao Deals). In its 2021 Investor Day presentation, Alibaba referred to Taote as a new marketplace focused on “value-for-money products (sourced) from manufacturers”, and it mentioned Taocaicai as providing a “next-day self-pickup fulfillment network” for groceries.

But I think Alibaba won’t be that successful with these new growth initiatives. The community group buying space, which Taocaicai is competing in, suffers from intense competition, and the competitive intensity is validated by the fact that even a leader in this business such as Meituan struggles to achieve profitability for this segment. Earlier, there were local Chinese media reports published in March 2022 which claimed that Alibaba was planning to cut jobs in the community group buying business. Separately, Alibaba’s Taote is a late-mover as compared to peers like Pinduoduo which have already established a strong foothold in lower-tier cities in China. There is no assurance that Taote will be able to grab share away from PDD and other rivals.

Alibaba’s cloud business is seen to be another key growth engine for the company, but Alibaba Cloud could possibly face headwinds in the near future based on recent news flow. A recent July 14, 2022, Wall Street Journal article noted that “executives from Alibaba Group Holding Ltd.’s cloud division have been called in for talks by Shanghai authorities in connection with the theft of a vast police database.” In the WSJ article, it is noted that some “cybersecurity companies” claim that “Alibaba’s cloud platform that hosted Shanghai’s police database used outdated systems that didn’t offer ability to set a password.”

At the time of writing, there hasn’t been any official response from the company with regards to this matter. If the news on Alibaba Cloud’s involvement in the Shanghai data theft turns out to be true, there will be financial penalties for the company at the very least. In the worst case, there might be restrictions put in place for Alibaba Cloud that could prevent the business from offering its services to clients.

Notably, I also previously discussed about the risk of “private companies” in China being “eventually mandated to migrate their data to cloud platforms run by the state in the future due to cybersecurity concerns” in my September 28, 2021, article for Kingsoft Cloud (KC). As such, it is possible that the future growth outlook for private cloud operators like Alibaba Cloud might be less rosy than what the market expects.

With respect to regulatory factors, recent events suggest that the regulatory crackdown on Chinese technology companies hasn’t come to a close yet.

Alibaba’s stock price dropped by -9% from $120.90 as of July 8, 2022, to $109.57 as of July 11, 2022. BABA’s shares had responded negatively to being news of the company being “fined by regulators in Beijing for improperly reporting details of some of its past acquisitions”, as indicated in a Seeking Alpha News article published on the same day. Alibaba’s share price continued to be weak in the past two weeks or so, closing even lower at $103.96 as of July 20, 2022.

Another indicator that Chinese technology giants are still on the radar of regulators is that Tencent didn’t have any new games approved for release in the recent two rounds of game approvals in China as per a July 13, 2022, Seeking Alpha News article. It is noteworthy that another major player in China’s games market, NetEase (NTES) didn’t secure any game approvals as well, similar to Tencent. It will be reasonable to conclude that the Chinese regulators are favoring new game applications from smaller gaming companies (as opposed to larger companies and market leaders), which is consistent with their stance of curbing monopolistic behavior in China’s technology sector.

In a nutshell, BABA is not a good buy and hold stock, as there is substantial uncertainty with regards to the company’s long-term outlook as a result of business challenges (in terms of reigniting growth) and regulatory headwinds (regulators appears to still have their eyes on the major Chinese tech players).

Is BABA Stock A Buy, Sell, Or Hold?

BABA stock is deserving of a Hold or Neutral investment rating.

Alibaba isn’t a buy and hold investment, as the company might not be able to return to a faster pace of growth as it did in the past based on a review of the prospects of Taote, Taocaicai and Alibaba Cloud. Moreover, the Chinese authorities seem to be still targeting the Chinese tech giants on various regulatory issues.

As a buy and sell name or trading stock, the risk-reward for BABA isn’t attractive. While Alibaba’s valuations aren’t particularly expensive, they are reasonable based on the company’s short-term financial outlook. Therefore, I am Neutral, rather than Bullish or Bearish, on BABA now.

Be the first to comment