piranka

Thesis

In our previous article on Iron Mountain Incorporated (NYSE:IRM), we urged investors to be extremely cautious about adding at those overvalued levels. We also encouraged investors to consider cutting exposure (Sell rating), postulating that Iron Mountain’s forward growth cadence would not support its valuations back then.

Accordingly, Iron Mountain’s Investor Day (Project Matterhorn) in late September corroborated our thesis that its growth is expected to slow considerably through FY26. Coupled with an elevated level of capital spending that could hamper its AFFO per share growth momentum, the market needed to de-risk its execution risks.

As such, we are not stunned that the market sent IRM into a selling overdrive through its September lows, as it lost nearly 25% of its value within three weeks. Accordingly, the selling took out almost six months of gains, as the market woke investors up on their forward expectations about Iron Mountain.

Our analysis indicates that IRM is likely configured for a steeper fall as the market parses its ability to drive AFFO growth as its critical Global RIM segment is projected to slow further.

However, nothing falls in a straight line, as the current price action indicates that the market has been drawing in dip buyers since its late September lows. But, we discourage investors from adding at the current levels, as we postulate a near-term rally could ensue, drawing in more dip buyers before forcing a deeper selldown.

As such, we revise our rating on IRM from Sell to Hold for now and urge investors to consider cutting more exposure to sell at the next rally.

Project Matterhorn: Global RIM Revenue Would Slow Further

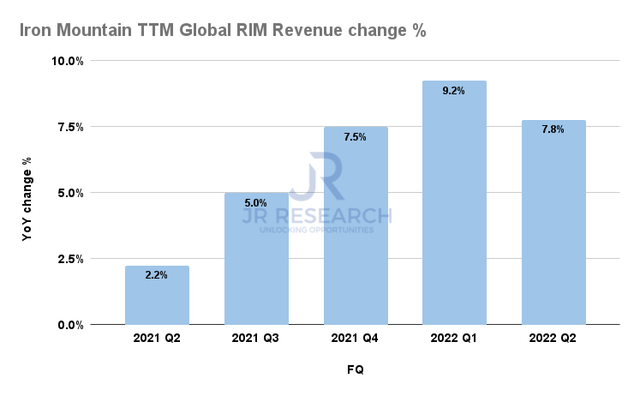

Iron Mountain TTM Global RIM revenue change % (Company filings)

As seen above, Iron Mountain’s Global RIM segment grew its revenue by 7.8% in FQ2 (on a TTM basis), down from Q1’s 9.2%. Global RIM remains IRM’s critical revenue driver (accounted for 83% of Q2 revenue), even though it has diversified into new growth areas.

However, management guided at its Project Matterhorn Investor Day that Global RIM’s revenue could slow further through FY26, with a revenue CAGR of 5% from FY21-26.

Management guided for corporate revenue CAGR of 10% from FY21-26. Therefore it suggests that IRM is seeing growth drivers from other segments to help lift its growth momentum, such as in its Data Center segment (FY21-26: 23% revenue CAGR) and Asset Lifecycle Management or ALM (FY21-26: 80% revenue CAGR).

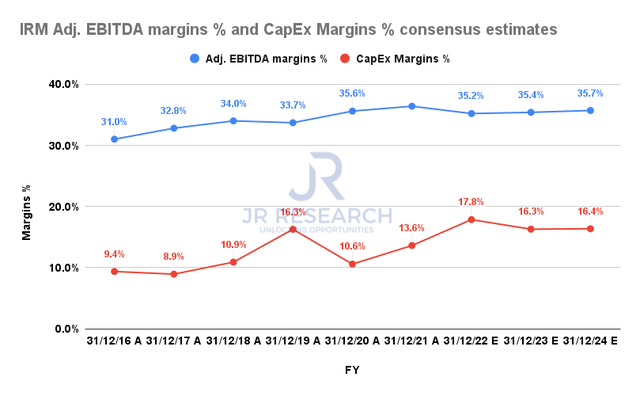

Iron Mountain Adjusted EBITDA margins % and CapEx margins % consensus estimates (S&P Cap IQ)

As such, the company needs to invest more aggressively in its data center segment to leverage its forward growth drivers. Therefore, it sees elevated CapEx spending through FY26 (at 16% of revenue), consistent with the revised consensus modeling.

Therefore, we believe the market needs to de-risk higher investment risks amid a much slower Global RIM growth cadence on its ability to continue driving AFFO growth.

Notably, the REIT maintained that its CapEx spending is expected to be funded internally. However, management had not ruled out possible equity financing, which could put further pressure on its AFFO per share growth. Hence, there are too many red flags for the market to ignore, as IRM was significantly overvalued in September.

IRM Remains Primed For A Steeper Fall

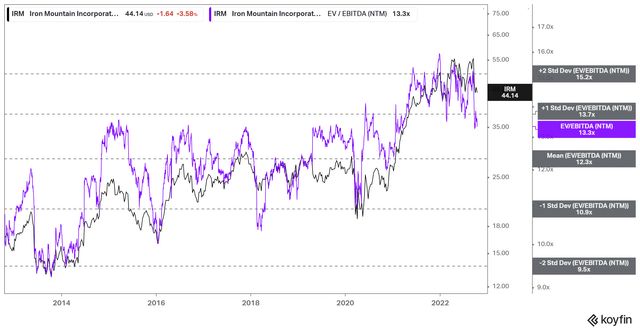

IRM NTM EBITDA multiples valuation trend (koyfin)

Despite its nearly 25% decline from its September highs, IRM’s NTM EBITDA multiples are still perched at the one standard deviation zone over its 10Y mean.

Furthermore, the market has demonstrated to bullish IRM investors that it’s not keen to re-rate IRM beyond its September highs. As such, we postulate that the reward-to-risk profile for IRM still points to the downside at these levels.

Is IRM Stock A Buy, Sell, Or Hold?

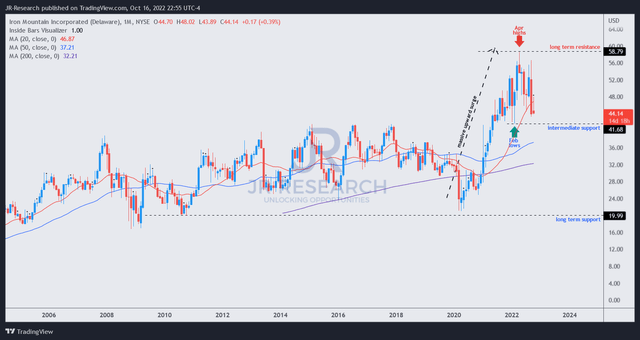

IRM price chart (monthly) (TradingView)

IRM investors benefited from the massive surge from its COVID lows toward its April 2022 highs. However, it also sent IRM into well-overvalued zones that are likely not sustainable as its growth slows, coupled with several red flags presented earlier.

However, nothing falls in a straight line, and we believe the market has been drawing in unsuspecting dip buyers at the current levels before staging a short-term rally to draw in even more buyers.

But, IRM remains well above its long-term moving average support levels. Furthermore, IRM’s price action suggests that a steeper fall is necessary to digest the rapid surge from its COVID lows and further de-risk its execution risks.

Hence, we see significant downside risks at the current levels and urge investors not to buy the dips. Investors looking to cut exposure should consider doing so at its next potential rally, as IRM is currently near- and medium-term oversold.

As such, we revise our rating on IRM from Sell to Hold.

Be the first to comment