Jon Farmer

Is this a good time to be looking for Tech-related dividends? With the -28% slide in the NASDAQ so far in 2022, it may require a lot of intestinal fortitude on your part to wade into those churning waters. On the other hand, you may be able to find a few tech diamonds with a high yield.

Iron Mountain Incorporated (NYSE:IRM), known as the world’s largest records storage company, is a real estate investment trust (“REIT”) which has been adding more Tech to its offerings over the past few years, via its expansion into Data Centers and document digitization services.

Profile:

As stated on the IRM site:

Iron Mountain Inc., founded in 1951, is the global leader for storage and information management services. Trusted by more than 225,000 organizations around the world, and with a real estate network of more than 85 million square feet across more than 1,400 facilities in over 50 countries, Iron Mountain stores and protects billions of valued assets, including critical business information, highly sensitive data, and cultural and historical artifacts.

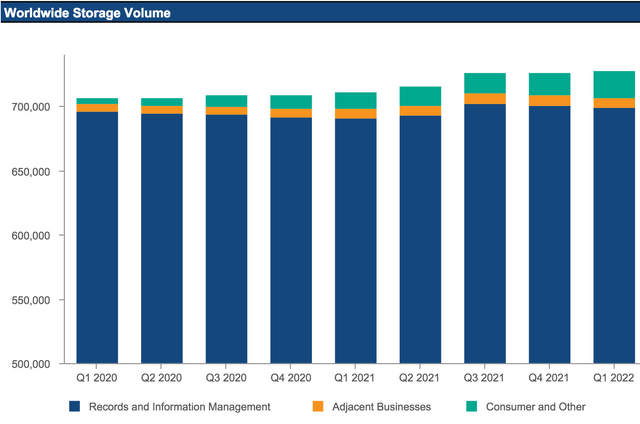

Bears have tried to make a case for years that digitization would erode and damage IRM’s business. In terms of storage volume, that doesn’t seem to be the case. One key fact gives IRM’s world-leading storage business big support – government and business entities are required to maintain records for many years. This has led to IRM having ~950 of the Fortune 1000 as its customers for decades.

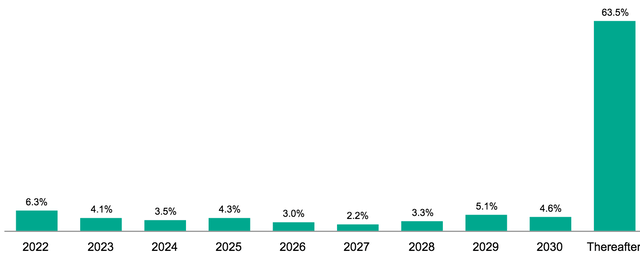

Management’s diversification into digital businesses, such as data centers and document digitization, has also helped IRM to continue to thrive. Part of the strength of IRM’s business model is that it has long term leases with its customers, which currently average 11.9 years:

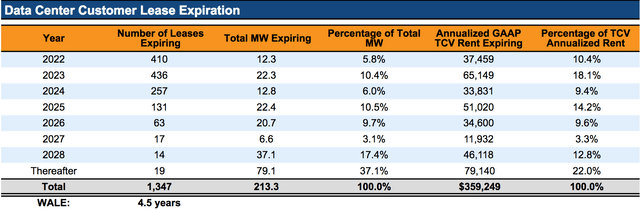

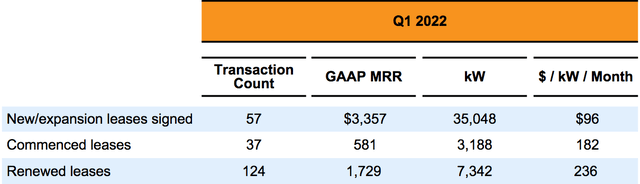

Its data center leases average 4.5 years:

Earnings:

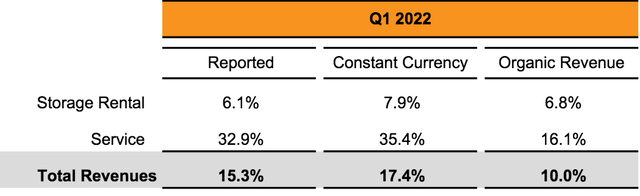

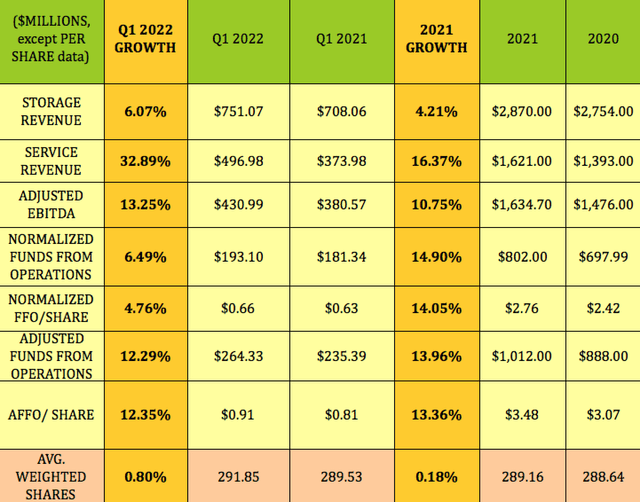

Q1 2022 continued the success of full year 2021, with overall Revenue growing 15%. While Storage remains IRM’s biggest revenue generator, Service had 33% growth in Q1 2022, and was 36% of IRM’s revenue in 2021, vs. 33.5% in 2020.

Storage had 6.8% organic growth in Q1 ’22, while Service had 16.1% organic growth:

The Data Center business had its best ever quarter, leasing 35 megawatts, via 124 leases. Management also signed a 72MW near build to suit lease in Virginia in April ’22.

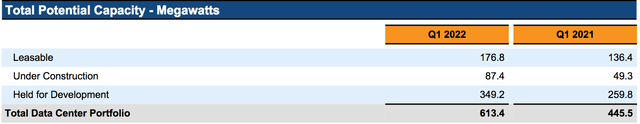

Management has continued to ramp up IRM’s data center capacity, which grew 38% y-o-y in Q1 ’22, to 613MW:

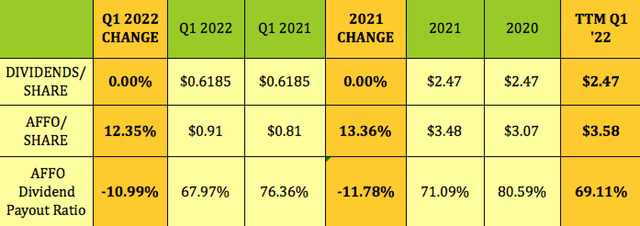

Q1 ’22 EBITDA rose 13%, while AFFO rose ~12%, and Normalized FFO rose 6.5%. The share count grew less than 1%:

2022 Guidance:

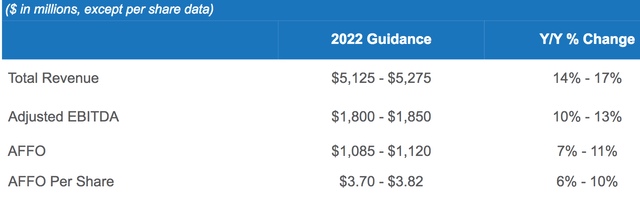

Management has guided to double-digit Revenue and EBITDA growth for 2022, with mid-point 9% AFFO growth:

Dividends:

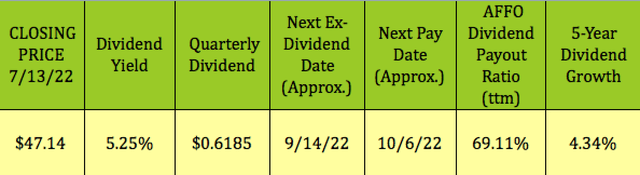

Management has maintained the current $.6185 quarterly dividend since Q4 ’19, hence the 4.3% 5-year dividend growth average. IRM should go ex-dividend next on ~9/14/22, with a ~10/6/22 pay date.

The AFFO/Dividend Payout ratio improved by 11% in Q1 ’22, dropping to 67.97%, vs. 76.26% in Q1 ’21, continuing the improvement seen in 2021. The trailing payout ratio is 69.11%. IRM is approaching management’s target for a low to mid-60’s % payout ratio, after which they foresee increased dividends.

Profitability & Leverage:

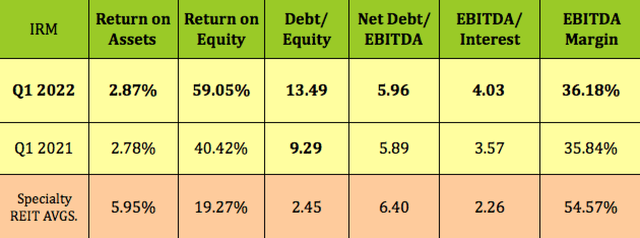

While ROA was up slightly, ROE jumped to 59% in Q1 ’22, much higher than specialty REIT averages. However, take these Specialty REIT averages with a large grain of salt, since this sub-sector is a mix of disparate industries, running from cell towers to lumber to prisons to casinos, etc.

Debt increased in order to finance the January 2022 acquisition of ITRenew, a global leader in mission critical data center life-cycle management solutions. With the transaction, IRM acquired 80% of the outstanding shares of ITRenew on a cash- and debt-free basis for approximately $725M in cash, with the remaining 20% acquired within three years of close for a minimum enterprise value of $925M.

Management has a long-term target leverage ratio of 4.5X – 5.5X.

Debt & Liquidity:

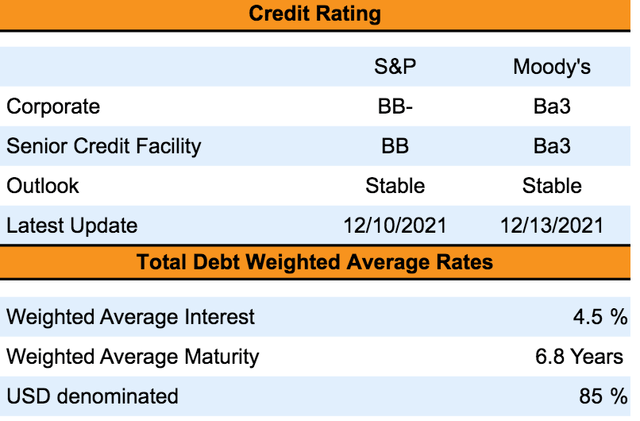

IRM’s corporate debt is rated BB- stable by S&P, and Ba3 stable by Moody’s.

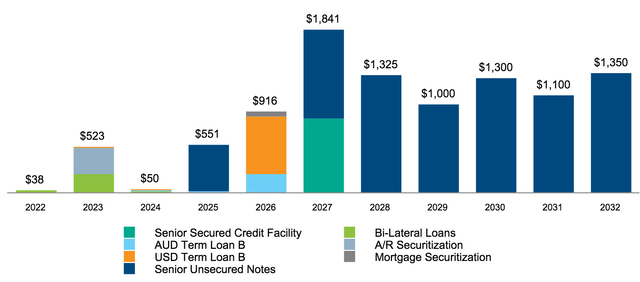

IRM has $523M in debt maturing in 2023, with its next sizable maturity of $551M coming due in 2025. 81% of IRM’s debt is at fixed rates, with a 4.5% weighted average interest rate.

As of 3/31/22, IRM had liquidity of $1.8B, comprised of $195M in cash, and ~$1.6B in available credit.

Valuations:

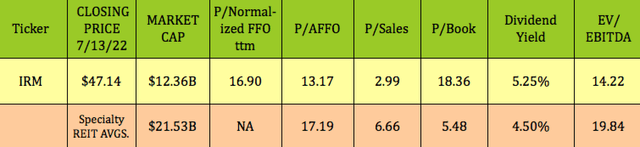

Since IRM has a unique business mix, peer comps aren’t available, but here’s a table of comps vs. the Specialty REIT sub-industry, which shows IRM as cheaper on a P/AFFO, P/Sales, and EV/EBITDA basis, and more expensive on a P/Book basis, with a higher dividend yield.

Analysts’ Upgrades & Price Targets:

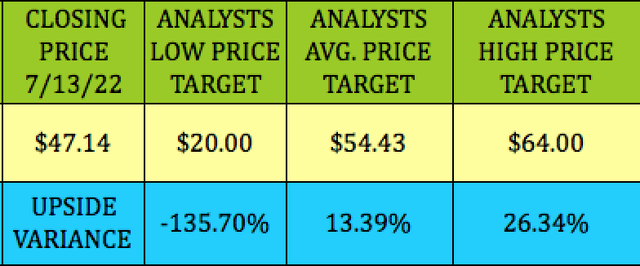

In late June ’22, Barclays initiated coverage of IRM, with an Overweight rating, and a $58.00 price target. At its 7/13/22 $47.14 closing price, IRM was ~13% below analysts’ $54.43 average price target, and 26% below the $64.00 highest price target. That $20.00 low target is most likely quite old – we couldn’t find it in any listings.

Performance:

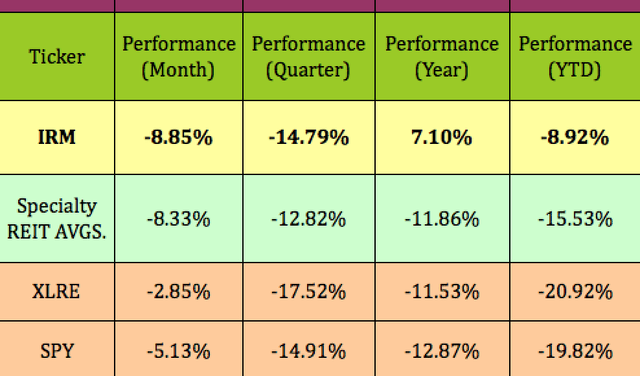

IRM has outperformed the Specialty REIT industry, the broad REIT industry, and the S&P 500 by wide margins over the past year, and so far in 2022:

Parting Thoughts:

Owning a piece of a business with a decent moat can be quite rewarding – data and paper storage/management won’t be going away anytime soon. We rate IRM a long term BUY, based upon its strong earnings record, its 2022 guidance, and the strong possibility of future dividend increases.

If you’re interested in other high yield vehicles, we cover them every weekend in our articles.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Be the first to comment