RiverRockPhotos/E+ via Getty Images

A Quick Take On Ivanhoe Electric

Ivanhoe Electric (IE) has filed to raise $175 million in gross proceeds from the sale of its common stock in an IPO, according to an amended registration statement.

The company is a mining exploration and technology company in the United States and overseas.

Given the uncertainties of the metals markets pricing in a rising interest rate environment and the firm’s high and increasing operating losses combined with a pricey IPO valuation, I’m on Hold for the IPO.

Ivanhoe Electric Overview

Vancouver, Canada-based Ivanhoe was founded to explore and mine various metals critical to the electrification industries and applications.

Management is headed by Chairman and CEO Robert Friedland, who has been with the firm since July 2020 and has more than 25 years experience in international finance and minerals exploration and co-founded Ivanhoe Capital and has been chairman of Energy Capital Group.

The company’s primary offerings include:

-

Mineral exploration – copper, gold, silver

-

Typhoon – geophysical exploration technologies

-

VRB Energy – large scale energy storage systems

Ivanhoe has booked fair market value investment of $158.8 million in equity and convertible debt as of March 31, 2022 from investors including I-Pulse, Century Vision Holdings, Fidelity Contrafund and others.

Ivanhoe – Project Acquisition

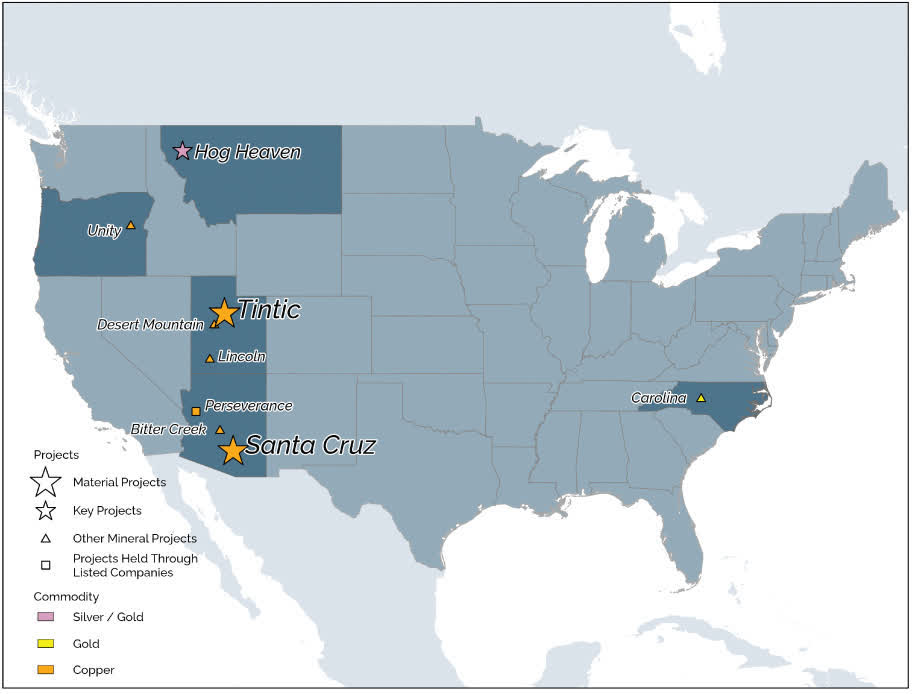

The firm’s current U.S. mineral projects are shown on the map below:

U.S Projects Map (SEC EDGAR)

IE believes it’s strategically important for the U.S. to develop its own resources to a greater degree to reduce its reliance on foreign sources of critical minerals and increase its supply chain resilience.

General & Administrative expenses as a percentage of total revenue have fluctuated as revenues have increased, as the figures below indicate:

|

General & Administrative |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Three Mos. Ended March 31, 2022 |

77.3% |

|

2021 |

438.6% |

|

2020 |

251.5% |

(Source)

The General & Administrative efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of General & Administrative spend, rose to 1.0x in the most recent reporting period, as shown in the table below:

|

General & Administrative |

Efficiency Rate |

|

Period |

Multiple |

|

Three Mos. Ended March 31, 2022 |

1.0 |

|

2021 |

0.0 |

(Source)

Ivanhoe’s Market & Competition

According to a 2021 market research report by the US Geological Survey, the U.S. mining industry produced an estimated $82.3 billion worth of minerals in 2020.

This represented about a $1.5 billion drop from 2019’s total of $83.7 billion

The U.S. continued to rely on foreign suppliers for many types of raw and processed materials, with imports accounting for more than 50% of U.S. consumption of various nonfuel minerals.

Also, the U.S. relied solely on imported minerals for 17 mineral commodities out of the 46 minerals it consumed.

Major competitive or other industry participants include:

-

Freeport-McMoRan

-

Alcoa

-

Newmont Mining

-

Southern Copper

-

Peabody Energy

-

Others

Ivanhoe Electric Financial Performance

The company’s recent financial results can be summarized as follows:

-

Growing topline revenue from a small base

-

Increasing gross profit and gross margin

-

Growing operating losses (annualized)

-

Higher cash used in operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Three Mos. Ended March 31, 2022 |

$ 6,762,000 |

333.7% |

|

2021 |

$ 4,652,000 |

0.4% |

|

2020 |

$ 4,633,000 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Three Mos. Ended March 31, 2022 |

$ 6,710,000 |

440.3% |

|

2021 |

$ 3,132,000 |

10.0% |

|

2020 |

$ 2,848,000 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

Three Mos. Ended March 31, 2022 |

99.23% |

|

|

2021 |

67.33% |

|

|

2020 |

61.47% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Three Mos. Ended March 31, 2022 |

$ (17,206,000) |

-254.5% |

|

2021 |

$ (60,749,000) |

-1305.9% |

|

2020 |

$ (26,601,000) |

-574.2% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

Three Mos. Ended March 31, 2022 |

$ (17,674,000) |

-261.4% |

|

2021 |

$ (59,320,000) |

-877.3% |

|

2020 |

$ (25,234,000) |

-373.2% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Three Mos. Ended March 31, 2022 |

$ (14,619,000) |

|

|

2021 |

$ (47,832,000) |

|

|

2020 |

$ (22,984,000) |

|

(Source)

As of March 31, 2022, Ivanhoe had $29.8 million in cash and $130.5 million in total liabilities.

Free cash flow during the twelve months ended March 31, 2022, was negative ($57.3 million).

Ivanhoe’s IPO Details

IE intends to sell 14.4 million shares of common stock at a proposed midpoint price of $12.13 per share for gross proceeds of approximately $175 million, not including the sale of customary underwriter options.

No existing or potentially new shareholders have indicated an interest to purchase shares at the IPO price.

The company will seek a dual listing of its stock, on the NYSE American Exchange and the Toronto Stock Exchange.

Assuming a successful IPO at the midpoint of the proposed price range, the company’s enterprise value at IPO (excluding underwriter options) would approximate $879 million.

The float to outstanding shares ratio (excluding underwriter options) will be approximately 15.5%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

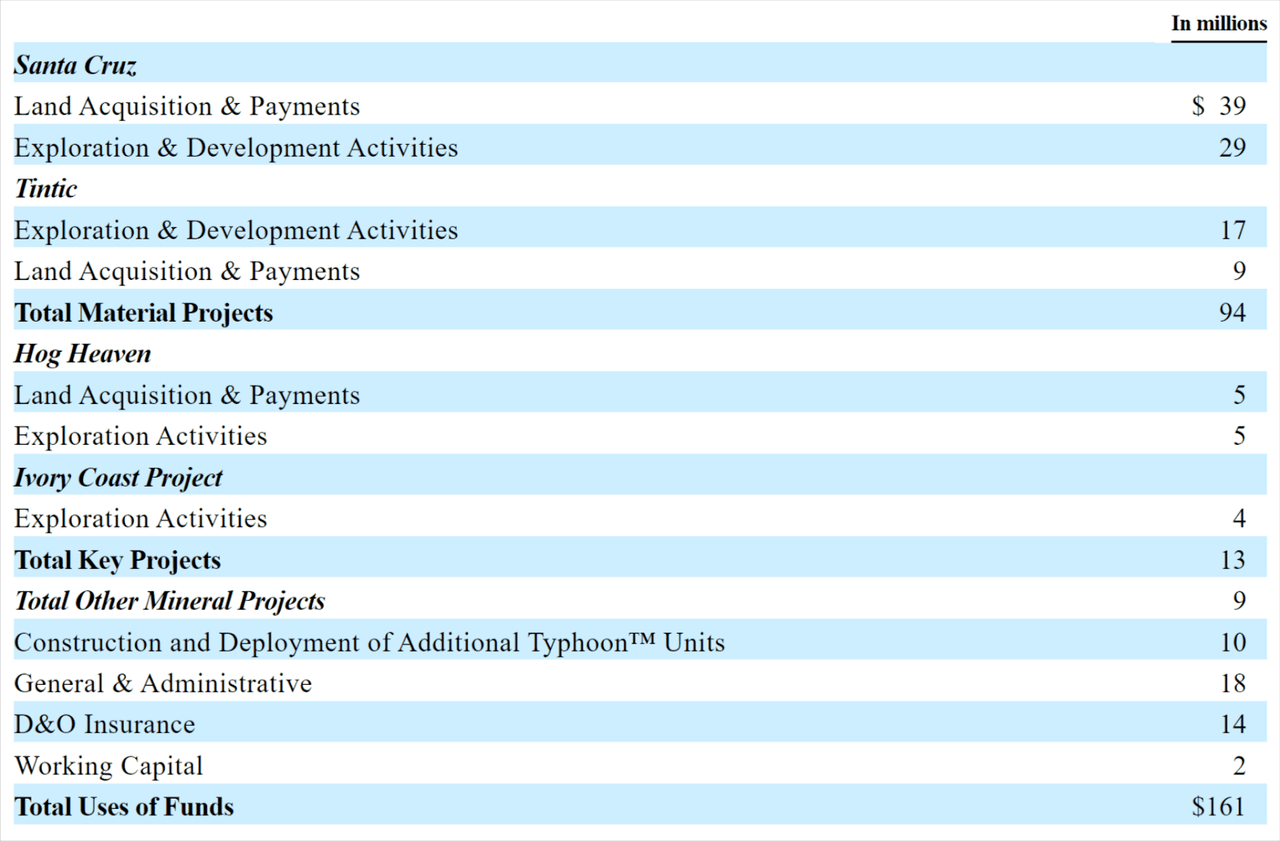

Per the firm’s most recent regulatory filing, it plans to use the net proceeds as follows:

Proposed Use Of Proceeds (SEC EDGAR)

(Source)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, two of the firm’s subsidiaries are involved in legal proceedings, but management believes that “none of the litigation in which we are currently involved, or have been involved since the beginning of our most recently completed fiscal year, individually or in the aggregate, is material to our combined carve-out financial condition, cash flows or results of operations.”

The listed bookrunners of the IPO include BMO Capital Markets, Jefferies, JPMorgan and other investment banks.

Valuation Metrics For Ivanhoe

Below is a table of the firm’s relevant capitalization and valuation metrics at IPO, excluding the effects of underwriter options:

|

Measure [TTM] |

Amount |

|

Market Capitalization at IPO |

$1,122,877,747 |

|

Enterprise Value |

$869,920,747 |

|

Price / Sales |

113.94 |

|

EV / Revenue |

88.27 |

|

EV / EBITDA |

-12.58 |

|

Earnings Per Share |

-$0.74 |

|

Operating Margin |

-701.80% |

|

Net Margin |

-714.66% |

|

Float To Outstanding Shares Ratio |

15.54% |

|

Proposed IPO Midpoint Price per Share |

$12.13 |

|

Net Free Cash Flow |

-$57,335,000 |

|

Free Cash Flow Yield Per Share |

-5.11% |

|

Debt / EBITDA Multiple |

-0.35 |

|

Revenue Growth Rate |

333.74% |

(Source)

Commentary About Ivanhoe’s IPO

Ivanhoe is seeking public capital market investment to continue and expand its exploration and production efforts primarily in the U.S. as it seeks to grow domestic production of minerals.

Its Typhoon technology has been deployed worldwide by both the firm and third parties in various major mineral deposit locations.

The company’s financials have produced increasing topline revenue, higher gross profit and gross margin but increased operating loss run rate and growing cash used in operations.

Free cash flow for the twelve months ended March 31, 2022, was negative ($57.3 million).

General & Administrative expenses as a percentage of total revenue have varied as revenue has increased; its General & Administrative efficiency multiple rose to 1.0x in the most recent reporting period.

The firm currently plans to pay no dividends on its shares and anticipates that it will use any earnings to reinvest back into the business and its growth initiatives.

The market opportunity for mining minerals in the United States is large but highly competitive. The U.S. imports a large percentage of its mineral requirements, so the need for domestic sources of production is significant.

BMO Capital Markets is the lead underwriter and there is no data on IPOs led by the firm over the last 12-month period.

The primary risk to the company’s outlook is the unpredictable market prices for various metals it intends to focus on.

As for valuation, management is asking investors to pay an Enterprise Value/Revenue multiple of 88x at IPO, so it appears the IPO is priced for a rapid increase in revenue in the short term.

While total revenue has grown markedly, the company is producing increasing operating losses, which is a distinct negative in the current market environment where firms requiring high capital investment are facing higher capital costs.

Given the uncertainties of the metals markets pricing in a rising interest rate environment and the firm’s high and increasing operating losses combined with a pricey IPO valuation, I’m on Hold for the IPO.

Expected IPO Pricing Date: June 23, 2022.

Be the first to comment