wildpixel/iStock via Getty Images Iovance

“The intelligent investor is a realist who sells to optimists and buys from pessimists” – Benjamin Graham (Warren Buffett’s mentor)

In biotech investing, a delay in a regulatory filing usually causes a stock to drop precipitously. Nevertheless, you should not be afraid of such temporary hiccups and consequently sell your shares prematurely. Prior to accepting an application, the FDA sometimes simply requests additional potency assay or other data for extreme thoroughness sake. As the company works with the agency to send the requested information, the issues would be resolved. Hence, your stock would regain trading momentum to surpass its former high.

That being said, Iovance Biotherapeutics (NASDAQ:IOVA) encountered an issue with its potency assay for the lead drug, lifileucel. After months of uncertainty, Iovance has now resolved the aforesaid debacle. More importantly, the path toward approval is seemingly clear. Therefore, the stock has rallied by over 31% in the previous month. Nevertheless, I believe there are substantial upsides. Usually, buying the stock at this transitioning point also leads to robust profits. In this research, I’ll feature a fundamental analysis of Iovance and provide my expectation on this stellar growth equity.

About The Company

As usual, I’ll present a brief corporate overview for new investors. If you are familiar with the firm, I suggest that you skip to the subsequent section. I noted in the prior article,

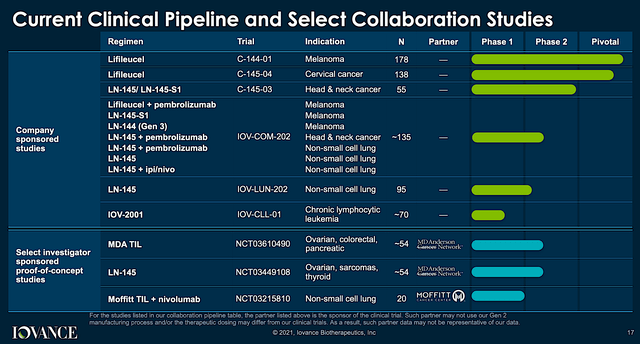

Operating out of San Carlos, California, Iovance is focused on the innovation and commercialization of stellar medicine to deliver hopes in seemingly hopeless cancers. As a therapeutic pioneer, Iovance harnesses the power of Tumor-Infiltrating Lymphocytes (“TILs”) to expand its pipeline of “smart medicines.” As you will see, leveraging TILs is an ingenious way to ramping up key immune cells in your body to decimate cancers. Interestingly, this novel treatment is applicable to a variety of solid tumors, including melanoma, cervical, head and neck, and non-small cell lung cancers (NSCLC).

Potential Assay Concerns Cleared

As you know, the overhanging issue for Iovance was the potency assay issue. Coupled with the biotech bear market, it created such an uncertainty that caused the shares to tumble roughly 50%. Due to the ambiguity regarding the assay, some investors believed that the TIL data is too good to be true. Perhaps, the potency assay delegitimizes the strong data. That aside, the potency assay debacle prevents Iovance from filing a Biologic License Application (i.e., BLA) for Lifi.

Now, the good news came to shareholders and patients on April 05, as the company announced that the FDA has provided feedback on the additional data submitted. Specifically, the agency delivered positive responses for both Iovance’s potency assay matrix and its proprietary cell co-culture assay. That being said, the overhanging cloud of doubts is now cleared.

Upcoming BLA of Lifi Monotherapy for Metastatic Melanoma

Facing tailwinds from the FDA, Iovance is poised to have a pre-BLA meeting with the FDA in July. And, you can expect the firm to file a BLA a month later (i.e., in August). Commenting on the regulatory victory, the President and CEO (Frederick Vogt, Ph.D., J.D.) remarked,

The favorable feedback received from the FDA on our potency assays and assay matrix brings Iovance a step closer to our submission of a BLA for Lifi in metastatic melanoma. We look forward to bringing Lifi to the market quickly to offer melanoma patients a new option following anti-PD-1 therapy.

Based on the anticipated filing in August, you can expect an FDA decision sometime in 2Q 2023. Of note, that’s my projected timeline if there is no additional hiccups like a potential COVID delay. Given that the regulatory decision is crucial to the success of Lifi, you should forecast its chances of approval.

Leveraging my Integrated System of forecasting, I ascribed a 65% (i.e., more than favorable) chance of approval. I based my rationale on prior data releases, my decades of forecasting experience, and my intuition. Simply put, you’re most likely to see Lifi approve sometime next year.

Lifi Combo For Metastatic Melanoma

As a shareholder, it’s great for you that Iovance is maximizing the value of Lifi. In other words, the company is starting a Phase 3 trial of Lifi in combo with an immune-checkpoint inhibitor (i.e., ICI) dubbed pembrolizumab (Keytruda) for metastatic melanoma toward year-end. As a general rule-of-thumb, combination therapy delivers much stronger efficacy than one drug alone. And, that’s due to the potential synergy as well as multi-target attacking.

Nevertheless, the downside to combo drugs is that the adverse effects can be too strong. Despite potential tolerability issues, combination therapy is the cornerstone of prudent cancer management. After all, hitting cancer at multiple spots would knock it out and thereby limiting the time these rogue cells have to escape immune detection. That is to say, it improves efficacy and prevents relapses.

As a ramification, you can expect (for patients who had not been treated with an ICI) that the Lifi/Keytruda combo would deliver much better results than either Keytruda or Lifi alone. Here’s your proof in the pudding. In the IOV-COM-202 study, Cohort 1A demonstrated a remarkable 67% overall response rate (i.e., ORR). That is to say, eight out of twelve patients had a confirmed ORR. Due to this robust response and the dire need for novel treatments, the FDA granted this combo the Fast Track Designation to expedite the review/approval process.

Seeing that Iovance is assessing Lifi monotherapy and combo for various indications, you can appreciate that Iovance is using a “basket approach.” Simply put, the company is maximizing the chances that at least one of a few molecules would become a blockbuster.

Competitor Landscape

Regarding competition, Iovance’s TIL squared up against conventional chemoradiation therapies. There are also novel therapies in development like IL2 agonists that seek to boost the immune system. Nevertheless, the failure of Nektar Therapeutics (NKTR) indicates that TILs are superior to IL2 drugs. More importantly, there are other exotic cancer drugs like CAR-T, CAR-Macrophage, and CAR-NK. On this note, CAR-T is an extremely powerful medicine for cancer with exceptional efficacy and acceptable safety. Despite the presence of CAR-T/NK/Macrophage and competing drugs, there is plenty of room in this space for many innovators.

Financial Assessment

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll analyze the 4Q 2021 earnings report for the period that concluded on March 31.

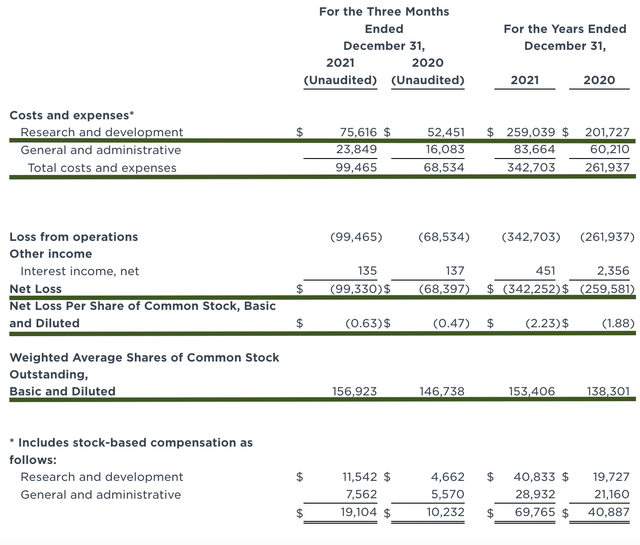

Like other developmental-stage biotechs, Iovance has yet to generate revenue. That makes sense because they are still developing their drugs rather than having marketed medicines. Therefore, you should focus on other metrics. That being said, the research and development (R&D) registered at $75.6M compared to $52.4M for the same quarter a year prior. I view the 44.2% R&D increase positively because the capital invested today can turn into blockbuster profits tomorrow. After all, you have to plant a tree to enjoy its fruits.

Additionally, there were $99.3M ($0.63 per share) net loss versus $68.3M ($0.47 per share) decline for the same comparison. On a per-share basis, the bottom line depreciated by 34.0%. Now, this is not a reason to be alarmed. Iovance simply invested more money into R&D which cuts into the bottom line.

About the balance sheet, there were $602.1M in cash. Against the $99.4M quarterly OpEx, there should be adequate capital to fund operations into 2Q 2023. Simply put, the cash position is robust relative to the spending rate. While on the balance sheet, you should check to see if Iovance is a “serial diluter.” After all, a company that is serially diluted will render your investment essentially worthless. Given that the shares outstanding increased from 146.7M to 156.9M, my math reveals a 6.9% annual dilution. At this rate, Iovance easily cleared my 30% cut-off for a profitable investment.

Valuation Analysis

It’s important that you appraise Iovance to determine how much your shares are truly worth. Before running our figure, I liked to share with you the following:

Wall Street analysts typically employ a valuation method coined Discount Cash Flows (i.e., DCF). This valuation model follows a simple plug-and-chug approach. That aside, there are other valuation techniques such as price/sales and price/earnings. Now, there is no such thing as a right or wrong approach. The most important thing is to make sure you use the right technique for the appropriate type of stocks.

Given that developmental-stage biotech has yet to generate any revenues, I steer away from using DCF because it is most applicable for blue-chip equities. For developmental biotech, I leverage the combinations of both qualitative and quantitative variables. That is to say, I take into account the quality of the drug, comparative market analysis, chances of clinical trial success, and potential market penetration. For a medical diagnostic device, I focus on market penetration and sales. Qualitatively, I rely heavily on my intuition and forecasting experience over the decades.

|

Molecules and franchises |

Market potential and penetration |

Net earnings based on a 25% margin |

PT based on 156.9M shares outstanding and 10 P/E |

“PT of the part” after appropriate discount |

|

Lifi franchise for various cancers (ovarian, NSCLC, melanoma, head/neck, cervical, solid tumors). |

$5B (estimated from the $581.25B global cancer market by 2030) | $1.25B | $79.66 | $63.72 (20% discount because already pending for approval with additional Phase 3 baking) |

| Younger assets for various cancers | Will wait for more mature until valuing | N/A | N/A | N/A |

|

The Sum of The Parts |

$63.72 |

Figure 4: Valuation analysis (Source: Dr. Tran BioSci)

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the biggest concern for Iovance is if Lifi monotherapy would gain FDA approval for metastatic cancer next year.

That aside, there is also a risk that other TIL franchises (especially Lifi) would not generate positive data. For that, I ascribed a 35% risk because I believe in a more than favorable (i.e., 65%) chance of positive data release. With Dr. Maria Fardis’s departure, there might be other issues deeper than the surface that investors do not know.

Final Remarks

In all, I recommend Iovance Biotherapeutics a buy with the 4.5 out of 5 stars. On a one- to three-year horizon, I expect the new $63.72 (raised from $60) price target (i.e., PT) to be reached. Iovance Biotherapeutics is a growth stock that delivered extremely robust data. It’s so strong that it made some investors think their TIL drugs are “too good to be true.” As the potency assay is resolved and the path toward BLA filing is proven, you can bet that the company has a very special class of therapeutic. Going forward, you can anticipate TILs to continue posting remarkable data outcomes. Moreover, the first TIL (i.e., Lifi) is most likely to gain approval for metastatic melanoma. With the overhanging clouds now cleared, the stock is overdue for a larger rally.

Be the first to comment