Isaac74/iStock via Getty Images

Rare Earths

Yes, we all know, rare earths are vital for the magnets that make the electric revolution work. Both in the motors for electric vehicles and also in the much larger magnets in windmills and so on. The world needs much, much, more of the specific lanthanides that make such magnets work – praseodymium, neodymium, terbium and dysprosium.

As I’ve pointed out more than once there’s a basic operational problem in the rare earths market. Rare earth concentrates are easy enough to find and or produce. Prices are in the low $single thousands per tonne for a concentrate of them as a result. The major cost in the industry is the separation of that concentrate of all of them into the individual rare earths. This costs around $20,000 a tonne. I’ve talked extensively about this problem when writing about Lynas, here. No point in repeating all of that, read there.

The end result of this particular technical problem is that the process loses money on the extraction of cerium and lanthanum, makes money on those four magnet metals, Pr, Nd, Tb and Dy. Whether the process as a whole makes money depends upon the market prices of those four plus the concentration of them in the, umm, concentrate. It’s entirely possible to have something which is – just as an example – 6 or 8% Pr/Nd and for it to be valueless. Those losses on refining out the Ce and La are greater than the revenue to be gained on the target materials.

Of course, this basic idea, that some deposits are economic to mine and others aren’t is not just common it’s the very basis of the mining industry itself. The rare earths difference is that it’s in that separation process, not the mining and production of the concentrate one, that this all becomes apparent.

This also seems to be why the very interesting Energy Fuels plan isn’t working out so well. They can indeed produce a concentrate but that concentrate doesn’t seem to be worth all that much.

This is the vital point to understand here. Producing a rare earths concentrate is easy enough. Separation is hard and costly. Which means that the content of the concentrate determines whether it’s economic or not. High La/Ce contents with low Pr/Nd aren’t economic.

The other thing about rare earths

Folks tend to miss how small a market this is. Until recently annual global demand and usage was perhaps 150k tonnes of all of them together. Valuation of the industry as a whole, turnover of perhaps $5 billion, in that sort of range. That’s at least the right order of magnitude – it’s certainly not $50 billion nor $500 million.

Yes, volumes desired are rising. This means there are many folks trying to enter the market. Separation plants are being built, mines planned.

But it’s also true that people are looking much more at alternative methods and sources of extraction. The industry as a whole is pretty new, post WWII. And China really has done most of it in recent decades meaning that little research was done on different production methods. People still think about going mining for the same minerals – bastnasite, xenotime and so on – in the same way and gaining the same sort of concentrate.

Except, of course, given the new interest some are looking at this all with a bit more of a squint. Are there other ways that we can produce a rare earth concentrate? I discussed this concerning Rainbow Rare Earths here. The answer is that yes, alternative sources of concentrate do seem to be entirely viable – in that case from the fertiliser industry.

The minor metals market problem

There’s a basic point stemming from the above that all too many don’t quite grasp about metals – especially the minor ones. There’s an awful lot of them out there because the Earth is a big place. When some new use arrives and demand therefore rises it is true that the current producers gain higher prices. But that then triggers a race to both exploit other deposits of the same old stuff and also to find new potential pathways of extraction.

We’re seeing this in lithium right now. The two traditional sources of spodumene and brines, new operations are being opened up of both of those. But we’re also seeing new techniques, from geothermal waters and also certain clay deposits. Back when germanium started to be used in fibreoptics there was a big expansion from the traditional lead and zinc ore sources into fly ash from coal plants. The soaring use of tantalum in the late 90s led to extraction from spodumene as well as the more traditional tantalite. And so on – a market expansion doesn’t just mean more mines and higher prices, it means intense exploration of alternative sources too.

This is also happening with rare earths.

Aclara Resources

A good example being what Aclara (OTCPK:ARAAF) (ARA:CA) is doing (there’s similar work being done by Ionic as well).

So, instead of looking at those traditional ores, is there any other form of geology that might be interesting? Yes – the ionic adsorption clays. Until recently it was generally thought that these were a specific feature of South China, where they are indeed exploited for the heavy rare earths. As it turns out this mineralization isn’t so rare. In fact, it’s a fairly common form of weathered granite in subtropical climates.

Aclara is working in Argentina and it’s possible to read more details here. They’re a recent IPO, appear fully funded and so on. They’re an offshoot of a sensible mining company, we’d back them in a technical sense. That is, they’re not fly by night fantasists, as some mining promoters are.

But it’s the economics of ionic clays that matter here. Firstly, the capital requirement to mine is much lower. It’s simply not necessary to mine at such scale as the more traditional hard rock mines, thereby reducing the entry cost. The actual process is much cheaper too – strip the overburden, wash the clay in an extractant, gain the rare earths in solution.

On the other hand, the rare earths content is much lower. So, if those were all then it would be much of a muchness really. What really changes the numbers though is this:

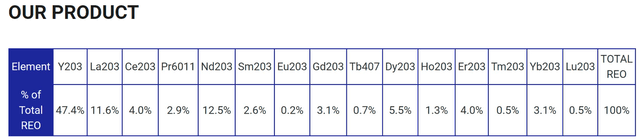

Aclara concentrate from Aclara Resources (Aclara Resources)

A standard concentrate from the traditional hard rock methods would be perhaps 50% or more La/Ce. As above, the cost to process that is $20k / tonne or so, the sale price after processing is $500 (not $500k, but $500) per tonne for the La/Ce portion. That’s a $19,500 per tonne loss on the La/Ce portion, something that then has to be made up by the revenues of the Pr/Nd/Tb/Dy.

So, concentrate from ionic clays already leaves much of the La/Ce in the gangue, thereby hugely reducing the costs of separation. Or, the other way around, vastly increasing the profitability of separating concentrates from this source.

A side issue here – the Y content can be extracted simply and easily. It is not necessary to send that through the traditional RE separator at that $20k per tonne cost, it’s a simple chemical strip from this concentrate.

Ionic clays as a concentrate source get around one of the biggest costs and problems in the whole process. Having to extract, at vast cost, that lanthanum and cerium from the concentrate. Materials that are worth around nothing currently (50 cents a kg is about right these days). Further, this problem is only going to get larger as rare earth production expands. In order to get that more Pr/Nd etc. then ever more La/Ce will have to be produced at that cost.

Unless, of course, the industry moves to this better form of concentrate.

Aclara Details

As I say, Aclara looks funded through to production as a result of the recent IPO. Production of concentrate that is. Their current accounts show mild expenditures on extending surveys plus the usual management overhead expenses. They’ve the proceeds of the IPO to be getting along with, most of which are currently in short term financial investments.

But it’s also true that they don’t need to come back to market again to go into production. These ionic clays are much cheaper in capital terms to exploit. Their c. $100 million total take will be enough to lead to production. That makes up for quite a lot of the lower RE content in the deposit.

My View

This isn’t an insistence that everyone should go buy Aclara nor any of the other ionic clay people. I do insist that it’s an important entrant into the marketplace through, something to be thought about.

In any volume (Ho and Lu etc. have value, but the markets are tiny and will likely remain so) the pay metals are the four magnetic ones. Pr, Nd, Tb, Dy. The traditional ores produce a concentrate which is heavy in La and Ce. The processing cost to reach the individual rare earths is circa $20 a kg concentrate. The sales prices of La and Ce are currently in the 50 cents to $1 a kg range. La and Ce are the majority (over 50% almost always) of the concentrates produced from the traditional ores.

Therefore, traditionally derived concentrates lose $19 and change per kg on 50% and more of the material processed, then make it up on the four magnetic metals in the basket. Now, if everyone faces this calculation then that’s not specifically a problem. But here we’ve these ionic clays. Which produce a concentrate which is much heavier in those heavy rare earths, much lighter in the two lights, La and Ce.

Both concentrates go through the same separation plants. Both face the same separation costs – around that $20 a kg. But, clearly, an La/Ce light concentrate is worth more. And will, presumably, outcompete La/Ce heavy concentrates over time.

These ionic clays, they are exploited in China and the usual assumption has been that they’re not really anywhere else. And yet that’s not true – there are such deposits all over the place, they’re common in subtropical weathering of certain granites.

Now, the market has changed, both La and Ce used to be worth rather more so the loss on separating them out was smaller. La, for example, had a big market in the glass for camera lenses. Sure, there are more lenses around now, all those phones, but they’re very much smaller, material consumption is much lower. It’s entirely possible that at some point the market will change again. Possibly some other fraction of the rare earth concentrate, that series of lanthanides, will become more valuable. This could change the calculations all over again.

But the specific desire for the heavies, the magnet materials, the near zero prices for lanthanum and cerium, have tipped – to my mind – the concentrate market heavily in favour of the ionic clay producers and away from the hard rock miners. I think we’re going to see a substantial change in the marketplace therefore.

The Investor View

There are a number of these ionic clay producers starting up outside China. Aclara is one of them and is my example here. Ionic Rare Earths (OTCPK:IXRRF) is another. I’ve heard of another, Serra Verde but know nothing about it.

It’s too early to say that this method, this sector, is definitively going to work out. But it’s something that those investing in this space definitely need to look at. Precisely because the pay part of the lanthanide basket is now so heavily weighted against La and Ce, in favour of the magnet metals, that means that the standard hard rock mining is less attractive compared to ionic clay. And the clay deposits aren’t as rare as was previously perhaps thought.

This also isn’t something that’s going to change the market this year nor next. But given the forward-looking nature of stock markets it deserves thinking about.

Rare earths aren’t rare, there are a number of possible sources for them. The change in the part of the basket that is valuable, that has a positive price after extraction costs, means the optimal source may well be changing.

This is worth considerable investigation by those interested.

Be the first to comment