halbergman

Introduction

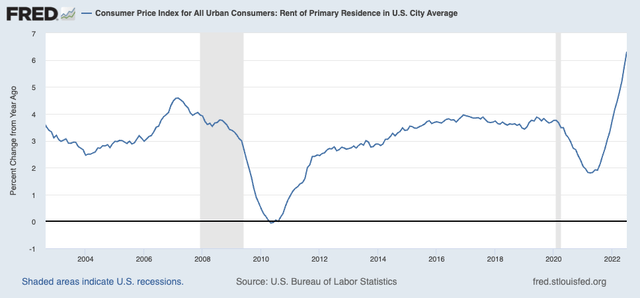

Multiple ways lead to Rome. That’s especially true when looking for ways to put money to work. Investors can buy stocks, physical real estate, gold, vintage cars, and even signed football jerseys. One of the best ways to achieve financial freedom is by buying real estate. There are countless success stories of investors who buy undervalued real estate, creating a lot of passive income for themselves. That’s a great strategy, but not everyone has the funds or time to do the same. I’m in that last category. That’s no problem thanks to REITs. In this article, I will discuss Invitation Homes (NYSE:NYSE:INVH), a company that allows investors to buy into a portfolio of more than 80,000 homes in great locations with above-average income tenants, a healthy balance sheet, and high dividend growth. It’s not a high-yielding stock with a yield of roughly 2.4%. Yet, dividend growth and capital gains are outperforming the “average” REIT.

Invitation Homes is a terrific pick for dividend-growth investors and everyone looking to buy quality real estate from the comfort of their own homes.

I put the stock on my watchlist to buy as soon as an opportunity presents itself.

Now, let me show you the details!

(Large) Investors Love Single Family Housing

But first, let’s look at the bigger picture.

The first pandemic year of 2020 was the start of a number of secular trends. Or at least it accelerated a number of trends. It accelerated environmental efforts under net zero, it changed global supply chains, and it also changed home buying behavior. While large institutional investors ignored the single-family home market (to a large extent) as they preferred large multifamily properties, they started buying “like crazy” after the pandemic as home buyers in general looked to buy assets outside of city centers.

In general, I think it’s fair to say that large investors prefer bulk investments. This includes multi-family housing, industrial properties, and niches like self-storage. Investors can buy a lot of (often low maintenance) assets by throwing a lot of money at projects, to put it bluntly.

This is now increasingly possible in the single-family housing sector. According to toptal.com:

The dramatic increase in computing power is enabling these new home-rental firms to scale and manage their portfolios more efficiently, not only enhancing the ability to analyze the market, speed up research, and make smart decisions more quickly, but also streamlining costs associated with property management. This convergence of market conditions and increased analytic power means these investors are likely here to stay.

In this article, I will explain that Invitation Homes has excelled at this, which (almost) allows it to treat single-family housing as a commodity.

With that said, last month, Redfin wrote a report covering investors in the housing market, which included a number of charts that I obviously need and want to include in this report.

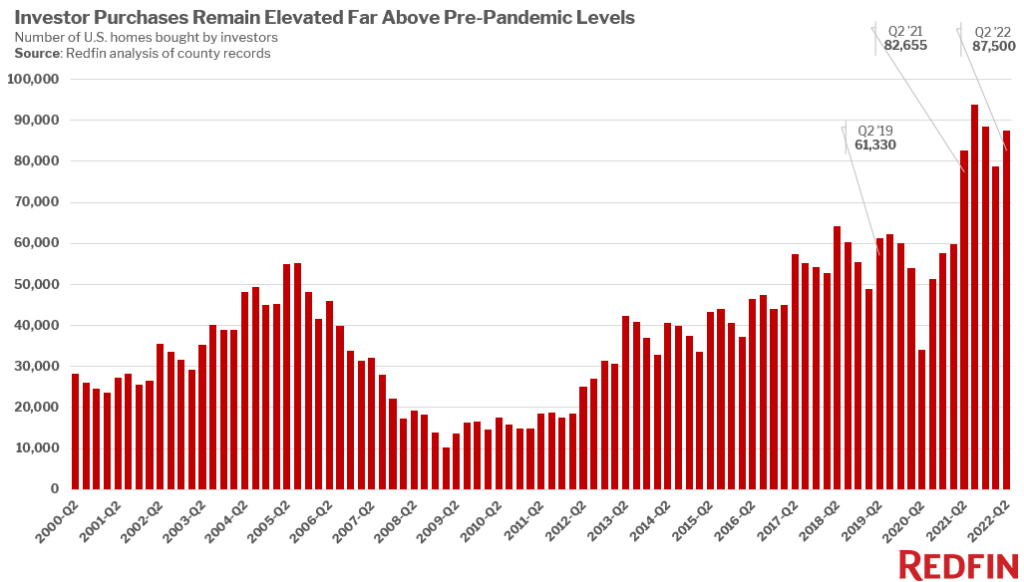

In the second quarter of this year, investors bought roughly 87,500 homes in the United States. That’s an 11% increase versus the first quarter and 5.9% higher compared to 2Q21.

Prior to the pandemic, investors bought close to 55,000 homes per quarter, which is close to pre-Great Financial Crisis levels. The pandemic accelerated demand, and it does not look like higher rates have scared investors away.

Redfin

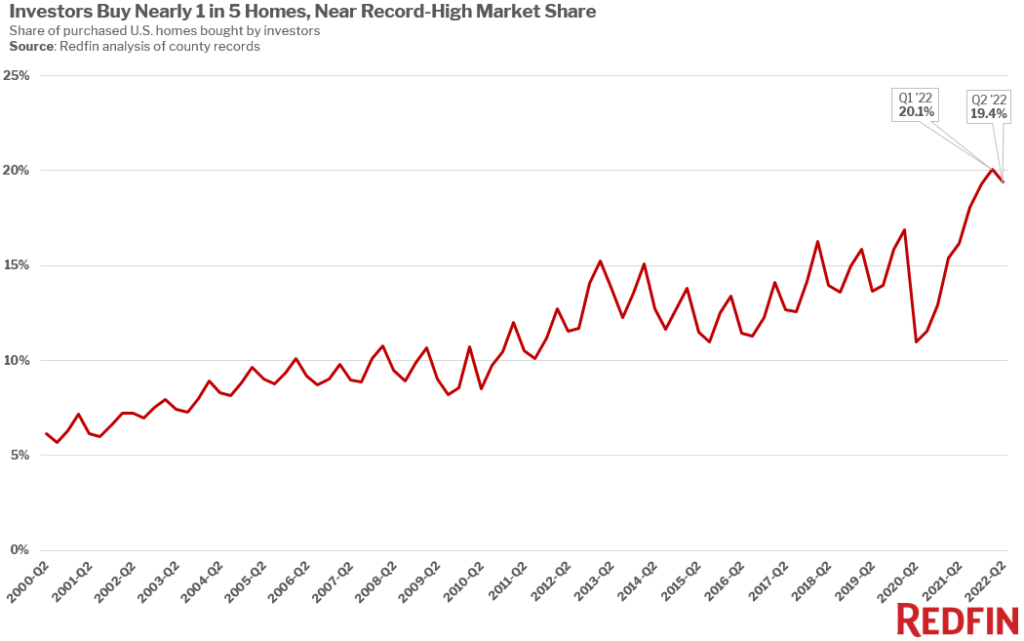

At current levels, investors are buying close to 1 in 5 homes, or 20%. That’s up from 15% prior to the pandemic and less than 10% prior to the housing crisis.

Redfin

The reason why investor buying isn’t fading as much is because of lower competition from non-investors. According to Redfin:

While investor purchases have leveled off, they haven’t slumped like home purchases in the broader market–a sign that the housing-market cooldown is a motivator for some investors. Many of them took advantage of the slowdown in the for-sale housing market when dwindling homebuyer competition presented opportunities to buy homes that can be turned into rentals. While rent growth has slowed, it’s still up 14% year over year as prohibitively high home prices keep rental demand afloat.

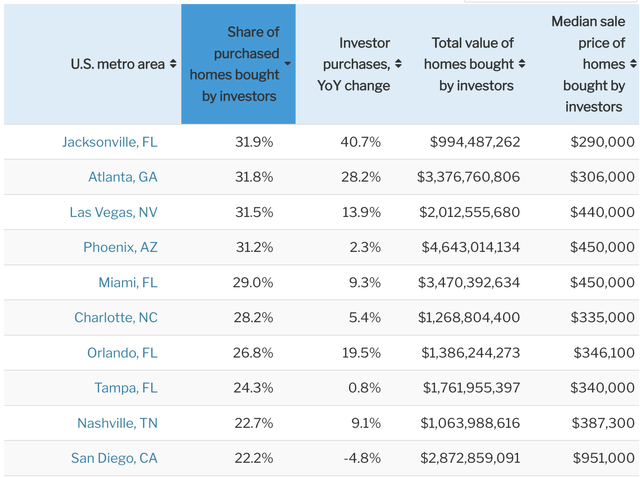

Moreover, despite increasing housing weakness like pressure on home sales volumes and pricing due to affordability issues and (related) higher rates, the hottest markets for investors are still seeing higher demand from investors. In the top 10 markets, just one market is seeking lower investor demand (San Diego, CA).

Related to housing market issues, Bloomberg reported that landlords are preparing their war chests to accelerate investments in a “cooling” housing market.

American Homes 4 Rent, the third-largest single-family landlord, is taking calls daily from a variety of potential sellers, including national builders, Chief Executive Officer David Singelyn said at an industry conference last week. He said builders are currently offering small concessions on deal terms even as they hold the line on price, but he expects that to change.

“We’re going to see those prices come down,” Singelyn said. The landlord is “sitting on a significant amount of investable cash and funds, and we can take advantage of those opportunities.”

Moreover, and with regard to Invitation Homes:

Even before the recent slowdown, the largest US homebuilders have turned to landlords as a way to diversify their sales efforts. Last year, Lennar Corp. teamed up with Centerbridge Partners and Allianz Real Estate to build and acquire more than $4 billion worth of rentals. PulteGroup Inc., meanwhile, agreed to develop 7,500 houses for rental giant Invitation Homes Inc.

This finally brings me to the REIT with the INVH ticker.

Why I Put Invitation Homes On My Watchlist

With a market cap of $24.6 billion, Invitation Homes is the third-largest residential REIT in the United States, with a gap of roughly $5.0 billion to number one.

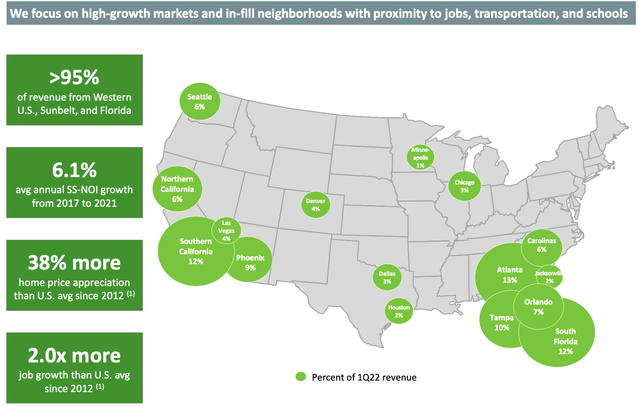

The company generates almost all of its revenue in the Western US, the Sunbelt, and the Sunshine State, Florida. In these areas, home price appreciation was 38% higher than the US average since the housing bottom of 2012. Job growth in these areas was 2.0x faster than the average, which I expect to continue given shifting economic dynamics.

In these markets, the company aims to apply a buying and maintenance model that allows for “bulk” buying while still creating a situation where entry barriers for competitors are high. According to the company:

We operate in markets with strong demand drivers, high barriers to entry, and high rent growth potential, primarily in the Western United States, Florida, and the Southeast United States. Through disciplined market and asset selection, as well as through strategic mergers and acquisitions, we designed our portfolio to capture the operating benefits of local density as well as economies of scale that we believe cannot be readily replicated.

Since its incorporation on October 4, 2016, the company has accumulated more than 80,000 homes, which includes the merger with SWH in 2017.

The company’s average tenant income is $130,000 per year with an income-to-rent ratio of 5.4x as of 1Q22. Not only that, but resident turnover is the lowest in the company’s history with the average tenure lasting 32 months.

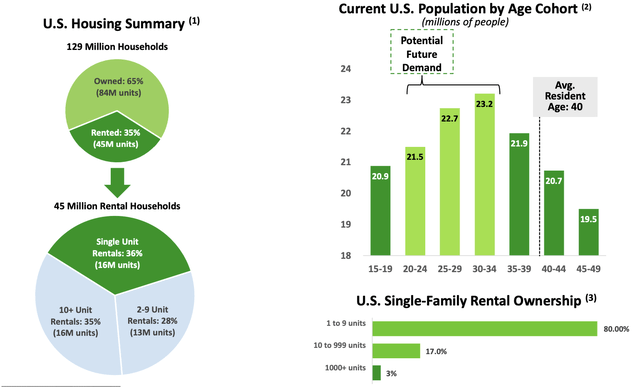

The average age of its residents is 40, which means new opportunities present themselves as the average millennial is now pushing 40. Generally speaking, this comes with changing housing demands as the company overview below shows.

That said, the company has a “highly scalable, vertically integrated, and resident-centric” property management service platform called ProCare, which is basically why the company can treat single-family housing as “bulk” real estate.

The company has a clear management structure with managers and associates responsible for certain parts of the company’s portfolio. The company also has an app for tenants to interact with the company and a system where it visits each home twice a year. If needed, this is combined with maintenance tasks to lower the number of trips to and from tenants.

On top of that, the company uses its national infrastructure to support local operations. This includes figuring out what the best practices are and applying these on a bigger scale.

This includes a next-gen acquisition strategy based on supply and demand forecasts and making the company’s scale work in its favor. This helps when competing with smaller bidders and companies/non-investors who cannot compete with the company’s efficiencies.

That’s why a lot of investors like INVH are so successful in acquiring quality assets. It’s an impossible model to compete with for investors who operate on a much smaller scale.

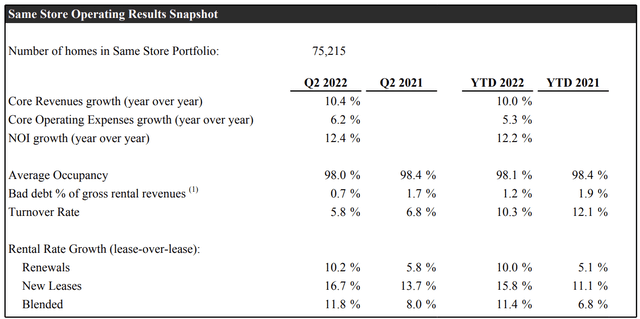

With that said, the company’s numbers continue to impress. In 2Q22, the company reported core revenue growth of 10.4% thanks to high rent growth of 10.2% (renewables) and 16.7% growth in new leases, which is a number that blew my mind, to be honest.

Despite these high numbers, the company continues to enjoy a 98.0% occupancy rate with bad debt falling to 0.7% of total revenues. The turnover rate also dropped by a full point over the past four quarters despite worsening housing dynamics – in general.

Moreover, the company collected 99% of its rent in 2Q22. 92% were collected in the month they were billed. 7% were late collections. Late collections are up from 3% pre-COVID, which isn’t a good sign. Yet, total collections are back to pre-pandemic levels. In 3Q21, the total rent collection was 97%.

What’s interesting is that the company helped more than 33,000 residents with the additional assistance of nearly $175 million, which includes providing extra time to pay rent.

The company continues to see strong application volume, in line with levels of the past two years. Especially Las Vegas, Phoenix, South Florida, Tampa, and Orlando continue to do well. That’s no surprise as I listed all of these regions in the first half of this article.

According to Chief Operating Officer Charles Young:

[…] new lease rate growth continuing to significantly exceed renewals, we remain – we maintain a sizable loss to lease that we estimate to be approximately 16% across the portfolio. Together with our historically low turnover, we believe we are well positioned for future rental growth.

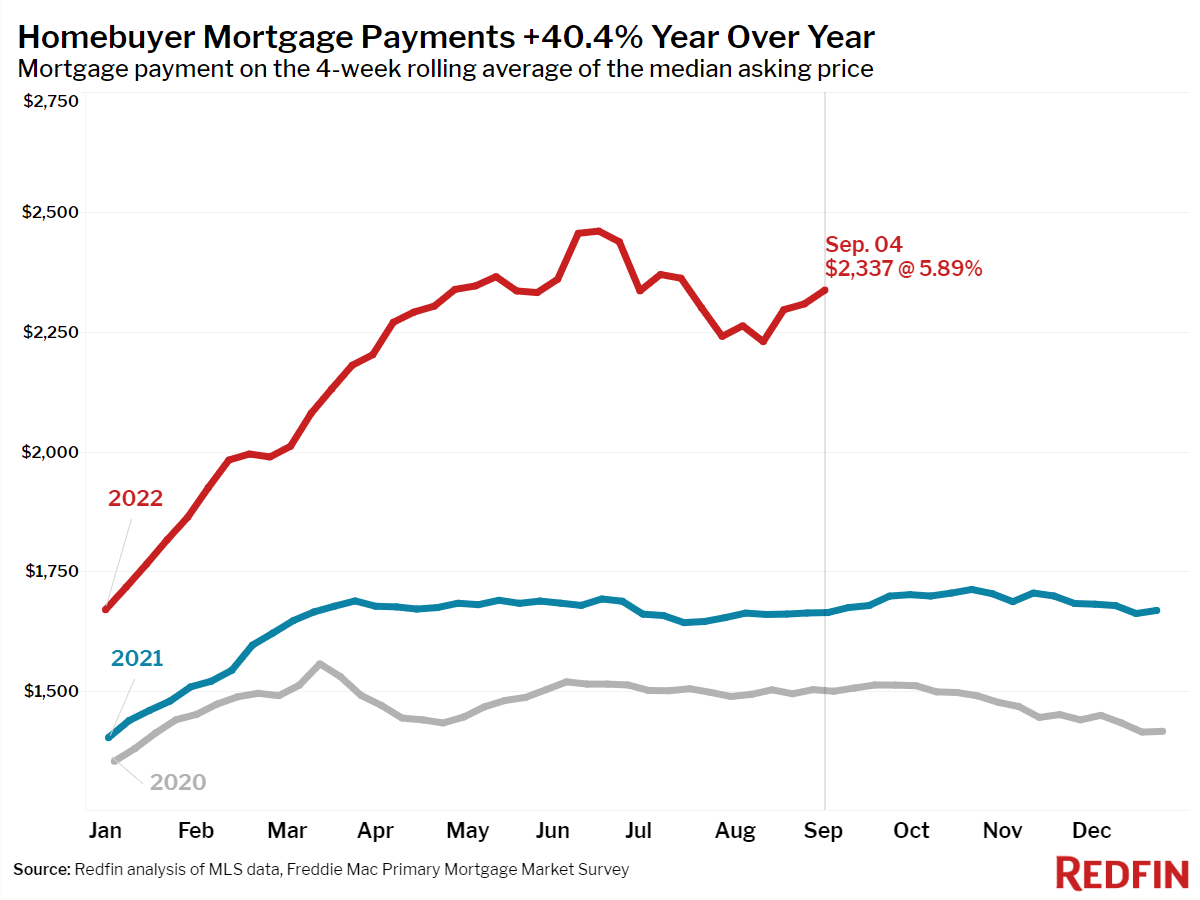

It also needs to be said that renting is increasingly affordable. At least relatively speaking due to rapidly rising mortgage rates. In early September, the average mortgage payment was $2,337 per month. Last year, it was less than $1,750.

Renting a home until the market cools off is the way to go for a lot of people, and I cannot disagree with that strategy.

Redfin

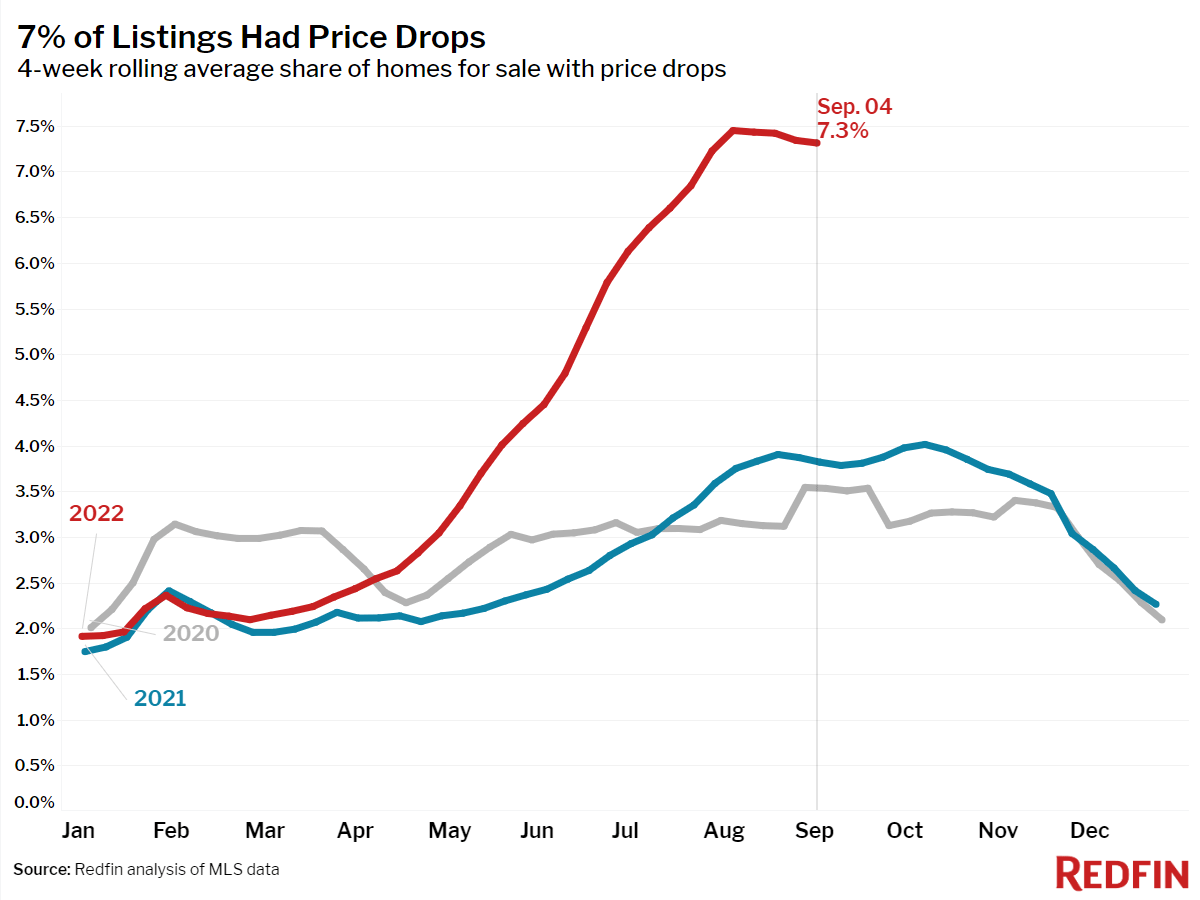

It’s also the reason why more than 7% of home listings had price drops.

Redfin

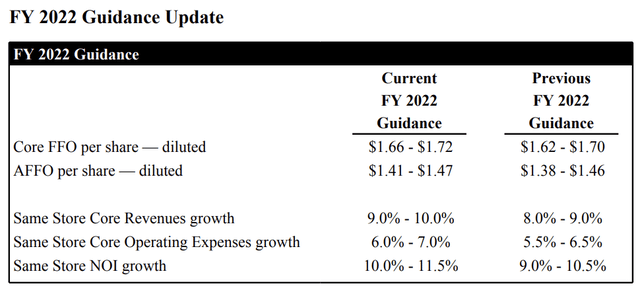

Thanks to its strong results, the company raised its full-year same-store core revenue growth expectations to the 9% to 10% range. The company now expects to end up with $1.66 to $1.72 in core FFO per share on a full-year basis.

This puts the valuation of the company somewhere between 23.3x and 24.2x core FFO.

That’s not cheap, yet I cannot possibly make the case that it’s overvalued for a company with double-digit growth and long-term secular tailwinds.

The Dividend & Balance Sheet

Especially given the threat of falling home prices and rising rates, a healthy balance sheet is key. Invitation Homes has $7.4 billion in total net debt. This is based on $7.8 billion worth of gross debt and more than $300 million in cash (among other minor items). Only a third of the company’s debt is secured debt with a weighted average interest rate of 4.0%. That’s a good deal.

Its unsecured debt is yielding 3.4%, on average, with 6.4 years until maturity.

While the company has a net leverage ratio of 5.9x, which isn’t very low, its debt rating is BBB (stable outlook), which makes sense given the company’s steadily growing income stream, low rates (high debt quality), and the long average yield until maturity.

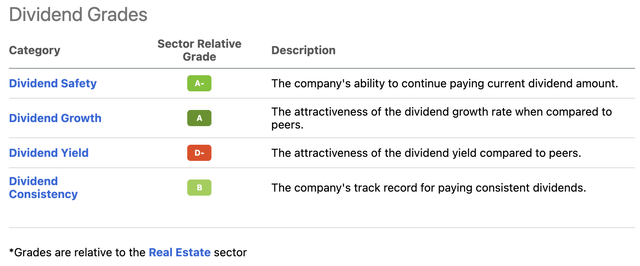

With that said, the only issue is that INVH is a somewhat low-yielding stock. At least compared to the real estate sector. Using the Seeking Alpha dividend scorecard, INVH is scoring very low on its yield, but high in all other categories.

The current quarterly dividend is $0.22 per share. That’s $0.88 per year per share or 2.2% of the current stock price.

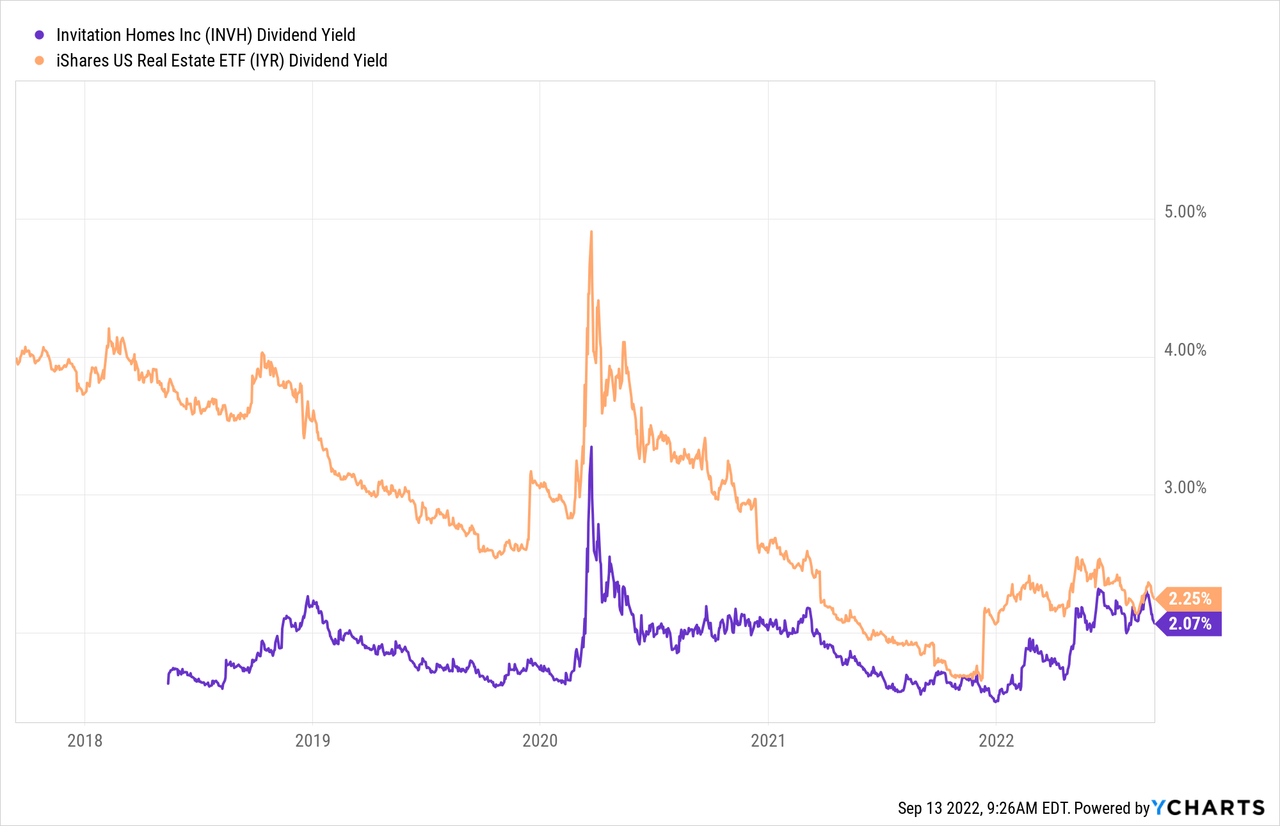

While the company scores poorly versus the sector median, it is yielding in line with the weighted iShares U.S. Real Estate ETF (IYR). Please note that the chart below has not been updated. The yield is 2.2% as I just calculated.

While the yield is “average” at best, high FFO growth is translating to high dividend growth and outperforming capital gains. Over the past three years, the average dividend growth rate was 18.4%.

The most recent hike was announced in February of this year. Back then, management hiked by 29.4%.

Moreover, the adjusted FFO payout ratio is 61%. This is roughly 11 points below the industry median.

The mix of strong fundamentally-backed growth, a below-average payout ratio, high dividend growth, and a decent valuation is leading to outperforming returns as the INVH/IYR ratio below shows, excluding dividends.

Takeaway

I put INVH on my watchlist for a number of reasons. It’s a fantastic way to buy residential real estate without having to do the work yourself. The company owns high-quality single-family homes in sought-after areas, its customers have above-average incomes and an average stay of almost 3 years.

The company runs a highly efficient business allowing it to buy prime real estate at good prices and maintain good relationships with tenants.

Balance sheet-wise, we’re dealing with a company that has accumulated quite some debt, yet the quality of its debt is high. The average maturity is long, rates are below average, and the credit score confirms all of this.

This helps the company to outperform its peers on a long-term basis along with an average dividend yield that is poised to grow in strong, double-digit territory for years to come.

While the valuation is fine, I’m looking for a bigger sell-off of 10-15% before adding this stock to my portfolio. As much as I like this company, housing is seeing some headwinds that could become stronger as the Fed raises its rates.

Other than that, I think we’re dealing with one of the best REITs on the market that is likely to deliver outperforming returns for many years (probably decades) to come.

(Dis)agree? Let me know in the comments!

Be the first to comment