GarySandyWales/E+ via Getty Images

Investment Thesis

Invitae Corp (NYSE:NVTA) is a business that offers, in its own words:

Offers high-quality, comprehensive, affordable genetic testing across multiple clinical areas, including hereditary cancer, cardiology, neurology, pediatrics, personalized oncology, metabolic conditions and rare diseases. (Source: 10-K submission 2021).

Invitae has grown revenues in every year since 2013, from just $1.6m in that year, to $444m in 2021 – which represented a 63% year-on-year increase.

That is the good news – the bad is that Invitae’s share price, which had grown from $4.70 in early 2018, to $50 in January 2021, now trades at a value of $2.80 – down 94% in a little over 18 months.

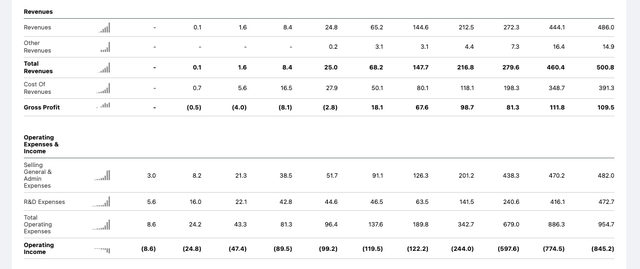

The underlying issue is easy to point to – as revenues grew, losses mounted, as illustrated by the table below.

Invitae income statement 2012 – present day. (Seeking Alpha)

Source: Seeking Alpha.

Invitae may have delivered revenues of $272m in 2020, up 28%, but operating losses increased by 145%, to $598m. Revenues may have increased again in 2021, to $444m, but net losses increased by a further 30%, to $775m.

Clearly, such a pattern is unsustainable, and Invitae has begun to take action. Kenneth Knight, who joined the company as Chief Operating Officer (“COO”) in 2020 from Amazon – where he was Vice President of Transportation Services – was appointed CEO in July, replacing Sean George, Ph.D. who was in the role for five years, and now joins the Board of Directors.

Knight’s first task is to oversee a major “Strategic Business Realignment”, designed to deliver $326m in non-GAAP annualised cost savings by 2023, which will involve ditching non-core operations and refocusing on “the portfolio of businesses that generate sustainable margins and deliver returns to fuel future investment”, Invitae’s words. ~1,000 employees at the company will also be sacrificed.

When reporting Q2’22 earnings – with top line revenues of $136.6m, up 17.5% year-on-year – Invitae declared a net loss for the quarter of an astonishing $2.5bn, which included, according to a press release:

A complete writedown of goodwill of $2.3 billion, which was a result of a significant, sustained decline in the stock price and related market capitalization and a lower than expected financial performance.

Invitae also reported a cash position of $737m, and guided for FY22 revenues to be up by a low double digit percentage amount year-on-year – somewhere around the $500-$600m mark, perhaps – and for cash burn to be $600-$650m, including $75m set aside for “realignment activities and severance”.

When details of the Q2’22 earnings and restructuring plans were announced around 9th August, Invitae’s share price briefly traded as high as $9 per share, before quickly sinking back <$3.

It certainly seems as though the market had placed far too much trust in Invitae’s ability to grow revenues, and not paid enough attention to its spiraling costs, and increasing debt – total liabilities currently stand at $1.9bn, including $1.46bn of convertible notes, a large tranche of which falls due in 2024.

With Invitae’s current market cap valuation being $652m, the question for investors to answer is whether the restructuring plan can work, and in the remainder of this post I will attempt to provide some additional colour on that by discussing Invitae’s business plan, the details of the restructuring plan, markets and competition, and financial considerations.

First of all, let’s begin with a key and fundamental question.

Is There A (Large Enough) Market For Invitae’s Products?

Growth without profit can sometimes be justified if the market opportunity is large enough – think of a company such as DexCom (DXCM), for example, which supplies glucose monitoring devices to diabetics, and swallowed a $186m loss in 2018, in order to ramp up manufacturing and reach more customers.

That strategy has proven successful – DexCom is profitable and growing sales – but with >1m Type 1 diabetics and 21m Type diabetics in the US alone, the market opportunity was secure provided the product was good enough.

In Invitae’s case, the genetic testing market is estimated to be similar in size to the glucose monitoring market – both are apparently valued at ~$15bn, and expected to reach ~$30bn in size by 2030. Similar to DexCom and its continuous glucose monitoring devices (“CGMs”), patients who wish to use a genetic testing service must ask their physician to make the application on their behalf.

Invitae says (in its Q2’22 10Q submission) that the company was founded on four key principles, as follows:

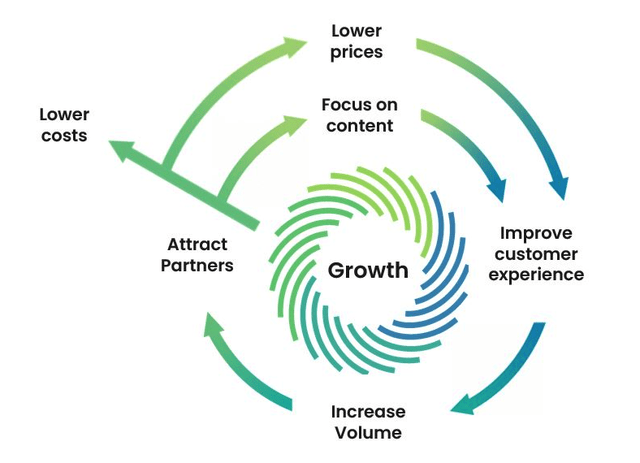

The following diagram put together by the company demonstrates how it expects to grow in its markets.

Invitae strategy for growth. (Invitae 10Q Q222)

Source: company 10Q submission Q222.

Competition is fairly intense in Invitae’s markets however – the company lists its competition in its annual report as follows:

Ambry Genetics, a subsidiary of Konica Minolta Inc.; Athena Diagnostics and Blueprint Genetics, subsidiaries of Quest Diagnostics Incorporated; Baylor-Miraca Genetics Laboratories; Caris Life Sciences, Inc.; Centogene AG; Color Genomics, Inc.; Connective Tissue Gene Test LLC, a subsidiary of Health Network Laboratories, L.P.; Cooper Surgical, Inc.; Emory Genetics Laboratory, a subsidiary of Eurofins Scientific; Foundation Medicine, a subsidiary of Roche Holding AG; Fulgent Genetics, Inc.; Guardant Health, Inc.; Integrated Genetics, Sequenom Inc., Correlagen Diagnostics, Inc., and MNG Laboratories, subsidiaries of Laboratory Corporation of America Holdings; Myriad Genetics, Inc.; Natera, Inc.; Perkin Elmer, Inc.; and Sema4 Genomics; as well as other commercial and academic labs.

In addition, there are a large number of new entrants into the market for genetic information ranging from informatics and analysis pipeline developers to focused, integrated providers of genetic tools and services for health and wellness, including Illumina, Inc. which is also one of our suppliers.

Compare that to DexCom, for example, which has only two competitors of note – Abbott Laboratories (ABT), and Medtronic (MDT). Invitae’s range from startups to major pharmaceuticals, and to make matters worse, use cases around genetic testing are still not entirely clear. The industry arguably trades more on its potential than its fundamentals.

To use the DexCom example once again, users of DexCom products can measure a positive outcome by a reduction in the number of hypo-glycemic and hyper-glycemic incidents, and the added convenience of not having to use fingerpricking devices. What does success look like for a Invitae customer?

On its Q2’22 earnings call Invitae CEO Knight cited the example of the National Comprehensive Cancer Network (“NCCN”) releasing new guidelines on colorectal cancer (“CRC”), endorsing universal germline genetic testing for all patients. Knight insisted that this decision was influenced by studies conducted by Invitae, and would lead to a doubling of the germline genetic testing population for CRC. Next, the company plans to target breast, prostate and lung cancer – far larger markets.

Knight added that germline and somatic information – also supplied by Invitae – yields “earlier diagnosis, more actionable results, ongoing monitoring and potentially better outcomes”, and that this is being continually proven in studies. Another attractive use case, is patient specific ctDNA detection for which can help patients detect biomarkers or understand if a treatment is working or not.

Invitae has also developed a patient chat tool, known as Gia, to provide data collection services and translate them into actionable insights. Via a partnership with Worldwide Clinical Trials Incorporated the two companies have collected data from over two million patients. This type of data driven service may have a big role to play in Invitae’s business model going forward, although in the near term, it may not have the impact the company hopes. The reason for this, as with the failure of telemedicine to catch on, is that patients are not receptive to it.

Ultimately, I would conclude that there is a large enough market for a company like Invitae to be successful, even amongst so many other companies developing similar product suites. Much depends on which companies Invitae may be able to form relationships with – Illumina for example, is a genetic sequencing giant that can afford to bide its time and wait for its products to mature and become better suited to its target market, and Invitae needs to find more partners with deep pockets.

That’s clear because in 2021, for example, Invitae spent ~$1.4bn to earn $444m, yet despite its success with the CRC testing win, it’s hard to think of an Invitae product that is unique, or indispensable. That needs to change, and quickly.

Can Invitae Handle Its Debt Obligations?

One of the problems Invitae has is that it is going to have to find ways to make its products more relevant and essential whilst slashing its R&D budget at the same time owing to the debt obligations the company must meet in 2024. CEO Knight mounted a defence of the company’s strategy on the Q2’22 earnings call:

There’s going to be material impact to our R&D as a result of this now. At the same time, we were — we feel we were really intentional and pretty darn smart about how we went about this. We looked at the business opportunity, the ability to serve our patients and clients, and we try to do this holistically. It wasn’t just a kind of we didn’t just make it up at the last minute. We really worked on this thoughtfully over a period of weeks, months. And we feel really good about the fact that we targeted the right businesses for us to exit.

Nevertheless, settling debt takes priority, as Knight admitted in his introductory comments:

One of management’s top priorities includes finding the right option for our debt obligations due in 2024, and we continue to be in discussion with various parties looking for the most optimal solution.

It seems that Invitae has $350m of convertible notes maturing in September 2024, as well as a $135m term loan, and there does not appear to be a plan in place yet for the company to meet these obligations – it is difficult to see how management repays those notes if cash is requested, given it is not generating cash, but losing it, and at a rate of ~$600m per annum.

It’s tempting to wonder if a sale of the business would be the most favourable exit strategy, since the opportunity to buy Invitae at the present time may not be attractive to many companies. There is no flagship product that puts Invitae at a strong competitive advantage in its markets, it seems, although perhaps the suite of oncology tests would appeal, plus an acquirer would also have to take on the company’s debt.

What Does The Future Hold For NVTA?

Reviewing Invitae’s business, products, and financial situation, the first question that strikes me personally is how the market ever got to a valuation of ~$13bn for this company?

In fairness, net losses in 2019 were “only” $212m and the company only began to lose nearly 2x as much as it earned in 2020 and 2021. Perhaps there was a surge of enthusiasm for the company’s products during the pandemic, when the market viewed genetic testing as a key element of the fight against the pandemic. Perhaps investors were simply prepared to wait for the genetic use cases in oncology and other indications to emerge, as they surely would, given the power of the technology and its implications.

Either way, Invitae may have received more support than it fully deserved, or borrowed more than was strictly necessary to grow the business. Looking back, SG&A spending increased from $201m in 2019, to $438m in 2020, whilst top line revenues only increased by $60m – where did the money go?

CEO Knight has promised that, after a likely down year in 2023, when revenues are expected to dip, the company can target top line growth of 15-25%, based on opportunities primarily in Women’s Health, Data Capture, and Oncology.

That forecast is significantly lower than the 40% growth once spoken of, and I would also see it as a concerning sign that apparently, CEO Knight admitted on the earnings call, the oncology division was struggling for growth in Q222, since that is the one established and attractive market that Invitae is currently operating in.

In theory, if Invitae shaves $326m off its operating expenses by the end of 2023, and increases its revenues in 2024 say by ~$100m, to somewhere in the region of $625-$650m the company’s net losses in that year could shrink to, for argument’s sake, $200m-$300m. With cash likely to have evaporated by then, however, and the convertible and term loan falling due, Invitae would still be in a perilous situation, even in this relatively optimistic scenario.

There doesn’t seem to be an obvious route away from danger for the company at the present time, but there does at least appear to be a management team in place capable of making some tough decisions, and stemming the tide of losses. Can management go on and complete a business turnaround?

If that were to happen then Invitae’s best hope appears to be its oncology testing kits, since this is the main revenue generator – Women’s Health accounted for just $27m of revenues in Q2’22 -and perhaps a surge in interest in genetic testing brought about by advances in e.g. precision oncology – an increasingly important field of treatment.

Even so, with so many other companies active in this space, and with barriers to market entry apparently not prohibitive, it would take a leap of faith to buy Invitae at the present time. It appears to be more the case that Invitae was significantly overvalued one year ago, than undervalued today. I will give Invitae stock a “HOLD” recommendation at this time, as I feel it may take 2-3 years for a picture to emerge of how the new management team is performing.

Be the first to comment