nikkytok/iStock via Getty Images

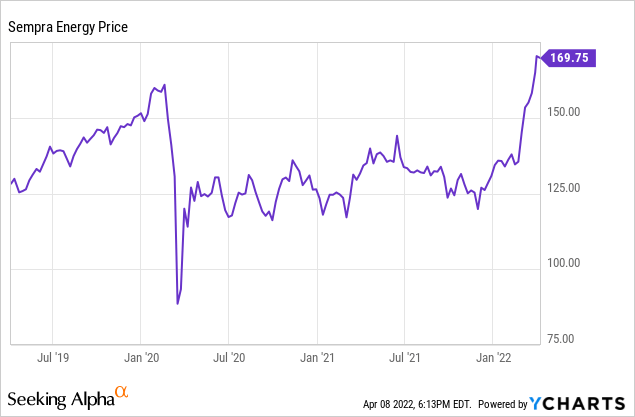

Sempra (NYSE:SRE), an energy infrastructure company, has experienced a 35% stock price increase since my most recent report in November 2021. It continues building a high-growth electric transmission and distribution business in Texas (Oncor), continues to meet its gas and electric service obligations in southern California, exports and sells gas in Mexico, and fulfills an even-more-vital role in exporting significant volumes of liquefied natural gas (LNG).

Investors have identified Sempra’s LNG upside, hence the stock price rise. However, because its existing units were built, as most LNG facilities, are on the basis of long-term contracts, the company will not see a large immediate upside from the current high spot prices for LNG.

Although California operations expose Sempra to above-average regulatory risk, and Mexican operations to political risk similar to that experienced in the US generally and California particularly, this is diversified by operations in business-friendlier Texas, especially the much-needed Gulf Coast LNG exports.

With its price run-up and a 2.7% dividend yet excellent operations, I am downranking Sempra from buy to hold. I will keep my existing shares and look for a more favorable entry point.

LNG Key

The interest in Sempra’s Cameron LNG operations has been much heightened by the shortage of natural gas in Europe due first to Russian under-deliveries and then a quick but massive pivot away-to the extent possible-from Russian gas imports that form up to 50% of German gas supplies and 40% of the European Union’s supplies, following Russia’s invasion of Ukraine.

The resulting extreme shortage led to key Asian and European spot LNG prices of more than $50/MMBTU at times, and currently $33-$34/MMBTU, several multiples of comparable prices a year ago of $7/MMBTU. Of the 11.3 BCF/D of total US LNG capacity, Sempra’s Cameron facility operates three trains with a total nameplate capacity of 1.8 BCF/D. The company has take-or-pay contracts with A-rated counterparties for about twenty years of remaining term for Cameron Trains 1-3.

In conjunction with other owners, the company is proposing Cameron Phase 2, which would comprise building a larger fourth train with a capacity of about 900 MMCF/D, coupled with debottlenecking (increasing the capacity of) the first three trains. The other companies involved are affiliates of TotalEnergies (TTE), Mitsui (OTCPK:MITSY), and Japan LNG. The latter is a company jointly owned by Mitsubishi and Nippon Yusen Kabushiki Kaisha (NYK).

As an example of the interest in US LNG exports, earlier this week, officials from Latvia, Estonia, Germany, France, Bulgaria, Hungary and the UK met with natural gas (producer) energy executives in Texas. While purchases were discussed, one executive noted that new LNG capacity takes years to build and after 2022 the US won’t have much new capacity until 2025.

Nonetheless, Sempra and other US LNG companies plan to help fulfill the new US agreement to supply additional LNG to Europe in 2022 and beyond.

2021 Results and Guidance

In 2021, Sempra earned GAAP net income of $1.25 billion, or $4.01/diluted share, compared to $3.76 billion or $12.88/diluted share in 2020. Adjusted net income for 2021 was $2.64 billion, or $8.43/diluted share. The primary difference between the GAAP and adjusted 2021 net income totals is the addback of $1.15 billion for Aliso Canyon litigation.

Trailing twelve-months operating cash flow was $3.84 billion, while levered free cash flow was -$315 million.

Sempra organizes its operating segments into three broad areas:

*Sempra California, comprising San Diego Gas & Electric (SDG&E) and Southern California Gas (SoCalGas),

*Sempra Texas, which is Oncor Electric Delivery, and

*Sempra Infrastructure, which has three core business groups: LNG and net-zero solutions, energy networks, and clean power.

Operating segment earnings for 2021 were:

SDG&E: $819 million

SoCalGas: -$427 million (includes Aliso Canyon charge)

Sempra Texas/Oncor: $616 million

Sempra Infrastructure: $682 million.

The company is guiding to 2022 and 2023 EPS of $8.10-$8.70/share and $8.60-$9.20/share, respectively. It expects a 2022-2026 EPS growth rate of 6-8%/year.

Sempra’s 2022-2026 capital plan is a company-record $36 billion. It forecasts its US utility rate base bill grow from $41 billion to $62 billion by 2026.

Electricity and Gas Demand and Macro Factors

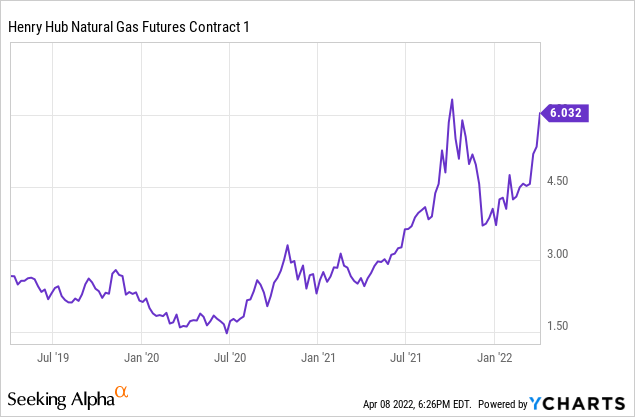

The NYMEX price of natural gas at Henry Hub for May 2022 delivery closed at $6.32/MMBTU on April 8, 2022.

The spot price of gas for physical delivery at the Waha hub in west Texas for April 8, 2022, was $5.66/MMBTU; the price of physical delivery at Henry Hub was $6.03/MMBTU.

Permian natural gas (the Waha hub) is important to Sempra in six ways: a) export to Mexico; b) growth in electricity demand from electrifying operations in the vast Permian field; c) source of natural gas for direct sale by SoCalGas and San Diego Gas & Electric; d) source of natural gas for electricity generation by San Diego Gas & Electric; e) tradeable for source gas to the Cameron, Louisiana LNG plant; and f) fuel for electricity generation that Oncor/Sempra then sells in west Texas.

Thus, despite high prices, sourcing natural gas from the Permian benefits Sempra because:

*some of it is associated gas (must be produced to produce oil),

*the Permian is a big gas supplier, second only to Appalachia,

*the focus on reducing emissions and flaring means even more infrastructure devoted to natural gas capture.

Other Growth Prospects

Electricity demand ties directly to the economic health and activity of the region served. Geographical diversification between Southern California and Texas provides Sempra both a large base and significant growth opportunities.

In his book, A Question of Power, energy expert Robert Bryce discusses other sectors for electricity growth in addition to baseline population and economic growth: electric vehicles, cannabis farming, large data centers, and cryptocurrency mining.

While part of the increase in Texas electricity use is due to Permian field electrification as well as to population increases, Electric Reliability Council of Texas (ERCOT) executive Brad Jones and director Bill Flores explain that crypto miners also find lower-cost Texas electricity to be attractive. The interest is mutual since crypto miners are typically interruptible users. As well, there are numerous businesses relocating to or expanding in Texas, readily symbolized by an event like Elon Musk’s Cyber Rodeo.

Regulation

Sempra has oversight from and reporting responsibilities to public utility commissions in every state in which its regulated utilities operate: California policy and regulation is particularly strict, with a preference for non-hydrocarbon energy sources. In rate cases Sempra answers to and is subject to input from a wide variety of customer-stakeholders.

However, only San Diego Gas & Electric and Southern California Gas are regulated by the California Public Utility Commission.

Sempra Texas (Oncor) is regulated by the Public Utilities Commission of Texas. Activities in Mexico are subject to Mexican regulation.

Liquefied natural gas projects must receive permit approval from the US Department of Energy and the Federal Energy Regulatory Commission.

Dow Jones Utility Index and Competitors

Sempra is headquartered in San Diego, California. Its utilities have no exact competitors-utilities are given a monopoly on their service areas in exchange for heavy regulation-but the company can be compared to other companies in the 15-stock Dow Jones Utilities Average Index (DJU).

In LNG operations on the US Gulf Coast, Sempra’s major U.S. competitor is Cheniere, available to investors as either through partnership units, (CQP) or as common stock (LNG). However, several other liquefied natural gas projects and companies in the US and abroad can also serve Europe and Asia.

Governance

At April 1, 2022 Institutional Shareholder Services ranked Sempra’s overall governance as a 6, with sub-scores of audit (5), board (5), shareholder rights (4), and compensation (9). In this measurement, a score of 1 represents lower governance risk and a score of 10 represents higher governance risk.

Sempra’s ESG rating as of February 2022 was a total risk score of 25 (41st percentile). Component parts are environmental risk 12.1, social 7.1, and governance 5.5.Controversy level is 3 on a scale of 0-5, with 5 as the worst.

At March 15, 2022, shorts were 1.3% of floated shares.

Insider ownership of stock is negligible.

Sempra’s beta is 0.65: its stock moves directionally with the overall market but not as sharply.

At December 30, 2021, Sempra’s five largest institutional stockholders, some of which represent index fund investments that match the overall market, were Blackrock (9.4%), Vanguard (8.7%), T. Rowe Price (6.1%), Capital International Investors (6.1%), and State Street (5.6%).

Blackrock, Vanguard, and State Street are signatories to the Glasgow Financial Alliance for Net Zero, a group that manages $57 trillion in assets worldwide and which advocates limiting hydrocarbon investment.

Stock and Financial Highlights

The company’s market capitalization is $40.1 billion at an April 8, 2022, stock closing price of $169.79 per share. This level was at the top of the 52-week range of $119.56-$170.76.

With a trailing twelve months’ earnings per share (EPS) of $4.01, SRE’s price/earnings ratio is 42. The company is guiding to 2022 EPS of $8.10-$8.70 for a forward P/E of 20.

Return on assets is 2.5% and return on equity is 5.6%.

An annual dividend of $4.58/share equates to a 2.7% yield.

At December 31, 2021, Sempra had $44.6 billion in liabilities and $72.0 billion in assets resulting in a liability-to-asset ratio of 62%. Liabilities included $10.0 billion in current liabilities ($3.4 billion in short-term debt), $21.1 billion in long-term debt and finance leases, and $13.5 billion in deferred credits and other liabilities.

The mean rating from eleven analysts is 1.8 or “buy” leaning toward “strong buy.”

Notes on Valuation

The company’s market value per share is well above book value per share of $79.15, indicating positive market sentiment.

The ratio of enterprise value to EBITDA is 16.7: the stock is not a bargain by this measure.

Positive and Negative Risks

Inflation will increase all of Sempra’s costs, including its financing costs, a factor given its liability-to-asset ratio of 62% and $24.5 billion in debt and finance leases. Natural gas prices are already higher. There is no guarantee that Sempra can recover higher costs.

Inflation generally and increases in consumers’ costs for gas and electricity in any region may reduce demand growth.

California drought, wildfires, and electrical power outages, planned and unplanned, remain an issue, as does the anti-hydrocarbon bent of California (and US) regulators and bankers.

Recommendations for Sempra

Dividend-hunters may find Sempra’s 2.7% yield of less interest than other opportunities, especially given the stringent and hydrocarbon-negative California regulatory environment. However, this well-run company’s growing markets in Texas, Mexico, and LNG exports provide expansive, diversified profitability, and Sempra sources natural gas from the second-most-affordable area of the country. (Appalachia is the most affordable.)

With a future price-earnings ratio of 20, potential investors may want to wait for a lower price entry point and/or additional progress on Texas electricity growth and LNG export build-outs.

Again, I plan to continue holding Sempra stock while looking for more favorable entry timing for additional purchases.

Source: sempra.com

Be the first to comment